Whitney Tilson, nicknamed “The Prophet” by CNBC, is a well-known figure in the investment community. He’s built a successful career by making bold predictions, offering expert stock picks, and helping others profit significantly. In addition, he is an accomplished entrepreneur, business owner, writer, and philanthropist.

Tilson’s sharp business acumen earned him widespread acclaim throughout his career. Several media outlets featured him, including CNBC, SmartMoney Magazine, Bloomberg TV, Fox Business Network, and Kiplinger’s. In addition, major publications like the Wall Street Journal and the Washington Post profiled him.

Tilson has personally met with former Presidents Clinton and Obama, participated in several Berkshire Hathaway meetings hosted by Warren Buffett, and delivered speeches at business schools such as Harvard, Columbia, and Wharton.

With such an impressive track record, it’s natural to wonder about Whitney Tilson’s net worth and how he achieved it.

While exact figures are not publicly available, there’s a general consensus online about his net worth. So before giving the figure away, let’s say it’s significant and a testament to his career.

A deeper dive into Tilson explains why and how he acquired this fortune.

The Early Years

Whitney Tilson, born in 1966 in New Haven, CT, graduated magna cum laude with a bachelor’s degree in Government from Harvard College. He later received an MBA with High Distinction from Harvard Business School in 1994. In addition, he was elected a Baker Scholar for finishing in the top 5% of his class.

Before beginning his MBA program, Tilson was a founding member of Teach for America. After completing his MBA, he worked with Harvard professor Michael E. Porter for five years, analyzing the competitiveness of inner cities and inner-city-based companies. Together, they founded the Initiative for a Competitive Inner City, where Tilson served as Executive Director.

He also created ICV Partners, a private equity fund focused on minority-owned and inner-city businesses. He raised nearly $500 million in funds.

Investment Success

In 1999, Whitney Tilson took a significant step forward in his investment career and founded Tilson Capital Partners, which he later rebranded as Kase Capital Management. This move marked a pivotal moment for Tilson and propelled him to become one of his generation’s most successful investors.

With an old-school, value-focused approach, Whitney Tilson started Kase Capital Management. Taking a long-term investment approach, he selected stocks based on solid fundamentals and discounted market value relative to their intrinsic value.

*Check out TIlson’s latest prediction on the 3 technologies set to change the world*

Following this philosophy, Tilson started three value-oriented hedge funds and two mutual funds. Over the first 11 years of Kase’s operations, his funds’ assets under management grew from $1 million to $200 million. In addition, Tilson’s hedge funds outperformed the broader market, delivering gains of 184% compared to 3%.

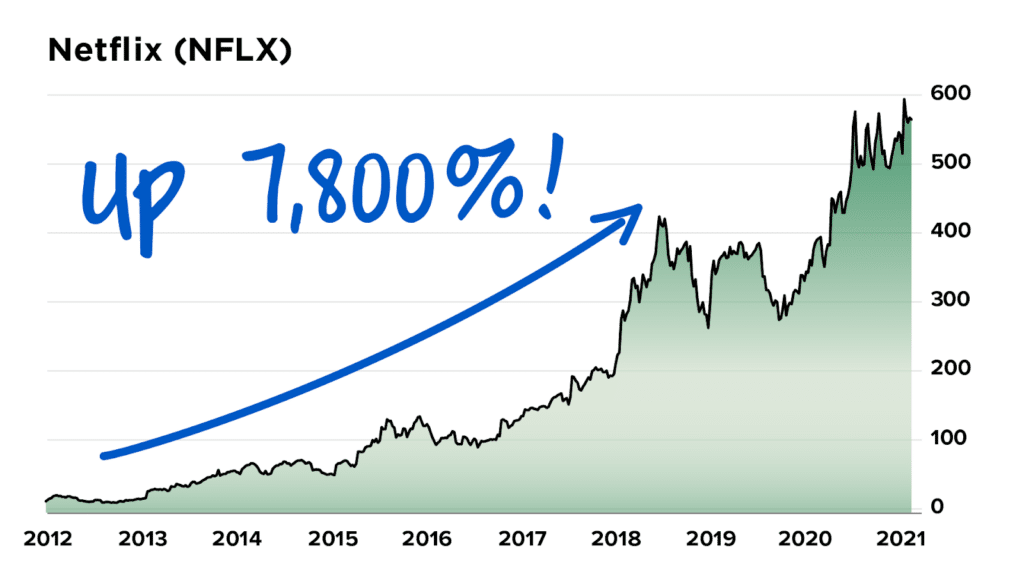

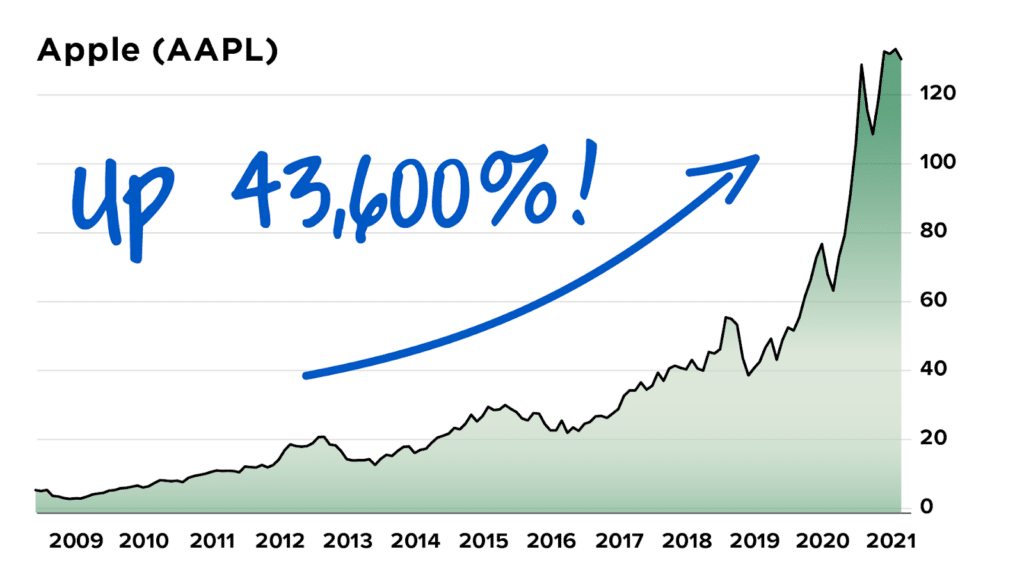

During this period, Tilson made several shrewd investment decisions, including investing in AOL at $4 a share, shorting Enron, and recommending Netflix on national television when it was just $7.78 a share (in less than a decade, it was worth 4200% more). He also bought Apple at a split-adjusted $0.35 (it’s up more than 40,000% since then) and invested in Amazon at $48 (last checked, it was up more than 7,700%). Additionally, he accurately predicted the decline of 88 different stocks, including three bankruptcies.

During his tenure at Kase, Tilson gained national attention for two 60 Minutes segments. One segment, which won an Emmy, predicted the 2008 housing crisis. The other exposed Lumber Liquidators before its stock tumbled 80% in 2015.

Although Kase Capital Management closed in 2017 after a few down years, Tilson continued to charge forward as a writer and entrepreneur. Moreover, the booming stock predictions would also eventually return.

Entrepreneur and Author

Whitney Tilson is not only a successful investor but also an accomplished writer and entrepreneur.

In addition to contributing to prominent publications like Forbes, the Financial Times, The Motley Fool, and TheStreet.com, Tilson has written and co-written three books:

- More Mortgage Meltdown: 6 Ways to Profit in These Bad Times

- The Art of Value Investing: Essential Strategies for Market-Beating Returns

- The Art of Playing Defense

Additionally, Whitney Tilson has actively participated in various entrepreneurial ventures over the years.

In 2014, he founded the Kase Learning platform, providing online courses and seminars for investors. Tilson also co-founded the Value Investing Congress, a biannual investment conference held in New York City and Las Vegas.

Most recently, Tilson’s 2019 launch of Empire Financial Research played a vital role in re-establishing his reputation as a prominent figure in the investment community and contributed significantly to his high net worth.

More On Empire Financial Research

Whitney Tilson, leveraging his friendship with Porter Stansberry of Stansberry Research, founded Empire Financial Research after briefly leading Kase Learning.

Empire Financial Research is a website and newsletter service that provides investors worldwide with in-depth research, analysis, commentary, and advice on overlooked investment opportunities. Whitney Tilson continues to run the platform and offer exclusive insights previously only available to Wall Street insiders. He draws on his decades of expertise and commitment to value investing to give investors a unique perspective.

Within the Empire Financial Research platform, Tilson launched Empire Investment Report and Empire Stock Investor, which have contributed to the website’s reputation as one of the industry’s most respected financial newsletter platforms. Notably, Bill Ackman, Joel Greenblatt, David Einhorn, Seth Klarman, and Leon Cooperman are subscribers.

*You can subscribe to his report and hear his latest stock picks for an exclusive 75% OFF the usual price with our discount link.*Similar to his performance during the first 11 years of Kase Capital, Tilson has made bold calls through Empire Financial Research, achieving impressive returns:

- 268% in 13 months on Smith & Wesson (245% annualized)

- 156% in 10 months on Penn National (189% annualized)

- 49% in four months on Crocs (153% annualized)

- 68% in eight months on Tripadvisor (105% annualized)

- 50% in seven months on AerCap (88% annualized)

- 37% in 15 months on Rosetta Stone (31% annualized)

Tilson’s foresight was also displayed during the coronavirus crash, as he declared on March 25, 2020: “This is the absolute best time to be an investor in more than a decade.”

As we all know, the market enjoyed impressive returns in the following year and a half, even when things seemed as bleak as they did.

What Is Whitney Tilson’s Net Worth?

According to various sources readily available online, there’s a general consensus that Whitney Tilson has amassed a net worth of approximately $50 million. Tilson’s astute investment strategies and entrepreneurial acumen are responsible for this.

As a well-known value investor, Tilson’s stock-picking prowess and ability to identify lucrative opportunities in the market have enabled him to achieve substantial returns for himself and his investors. Over the years, he has demonstrated a keen eye for spotting undervalued stocks, including early investments in game-changing companies.

Beyond his success as an investor, Tilson’s entrepreneurial spirit has also contributed to his net worth, and continues to do so.

With a wealth of knowledge and experience, Tilson can be a valuable resource for anyone looking to build their net worth just like he did.

If you’re curious about how Whitney Tilson accumulated this net worth and how he can help build yours, see his latest EOD stock pick to learn more.