WARNING: The “Experts” Who Failed to Predict the DOT-COM Crash… the Housing Bust… the Panic of 2008… and the 2020 Crash are now Saying “Stocks Will Recover Soon”…

Once Again, They’re Dead Wrong and Following Their Advice Could Cost You Dearly

Dear Reader,

If you’re over the age of 50 and your retirement plans depend on your portfolio recovering in the next few years…

I have something you need to hear.

The destruction you’ve seen in stocks, bonds, and the housing markets so far could just be the tip of the iceberg.

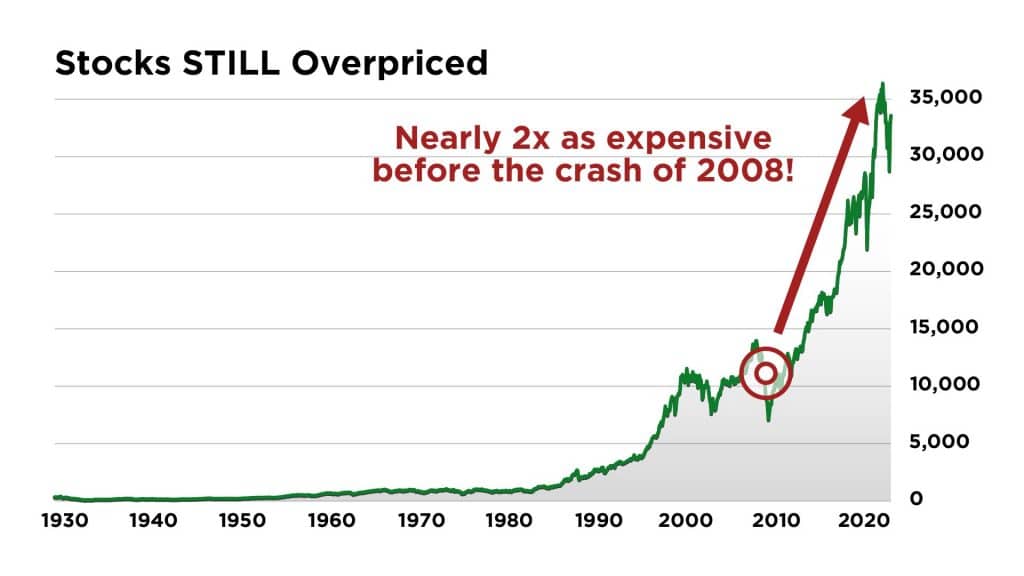

Today stocks are STILL nearly twice as expensive as they were before the crash in 2008…

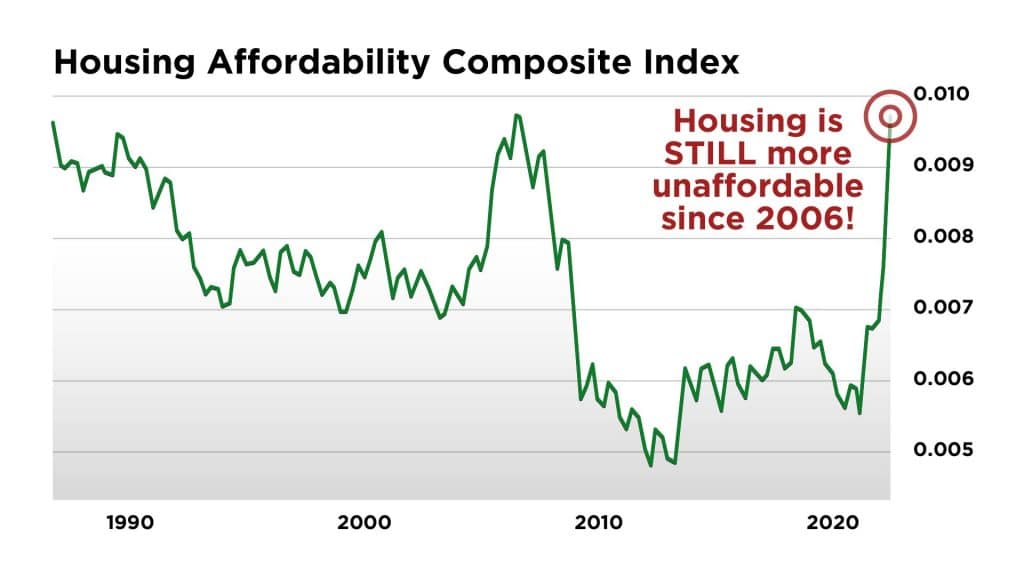

Housing is STILL more unaffordable than any other time since 2006…

Some used cars are STILL selling for more than new vehicles right off the lot…

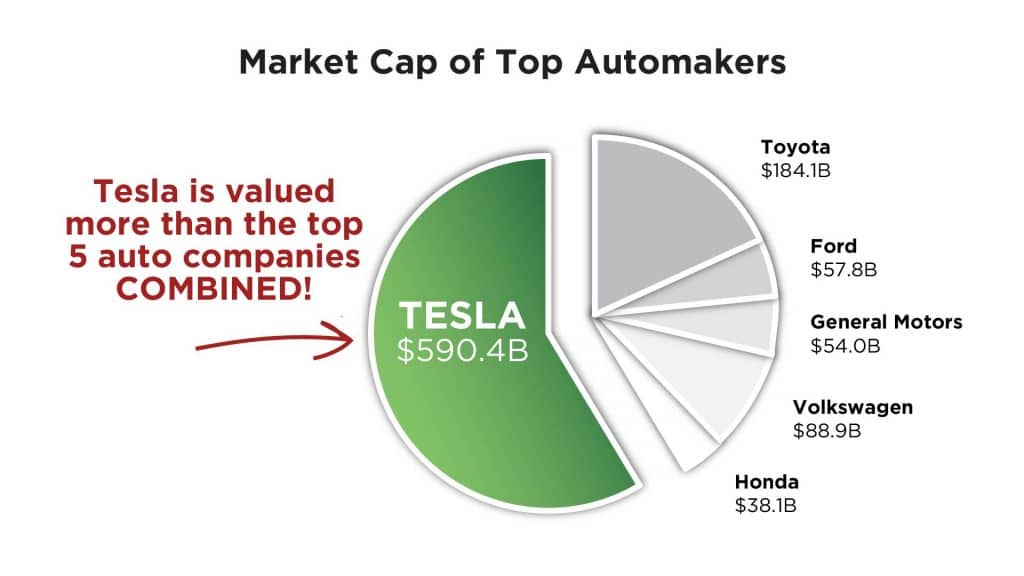

And some companies, like electric vehicle maker Tesla, which manufactured less than a million vehicles last year…

Is still more highly valued than Ford, GM, Toyota, VW, and Honda combined.

Despite these companies manufacturing 25 TIMES more vehicles last year.

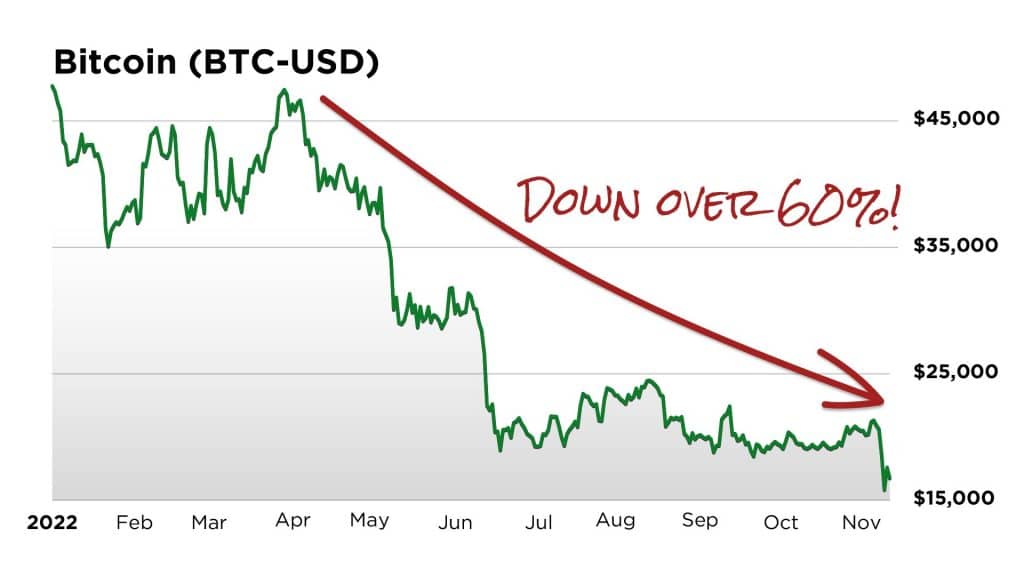

Even assets like Bitcoin are now down well over 60% from their highs.

And supposedly “risk-free” government bonds around the world are collapsing…

So, if the fact that EVERYTHING going down makes you feel like this market crash is different… if it feels like there are no more safe havens for your money… but conventional wisdom tells you to wait things out…

Listen, you are not alone.

Some of the smartest people I know… millionaires who are incredibly successful in their various fields… are all following the same logic…

These same smart and wealthy friends of mine continue to “buy the dip,” assuming the market will turn higher in the months ahead. They believe stocks are “cheap” right now.

I’m here to tell you that is a BIG mistake.

So, whether you’ve sold your stocks and are wondering if it’s time to buy back in…

Or if you’ve held onto your portfolio and are waiting to recoup your losses…

I’m telling you that – either way – you are waiting for a day that may NEVER come.

Please, please pay close attention to what I am about to say. This could be your last warning… your final chance…

I believe stocks will NOT recover this time, at least not in the way you’ve likely come to expect.

Not in your lifetime.

My research indicates…

The losses you’ve experienced in stocks so far aren’t over. Not even close.

While most folks pray for a repeat of the 2020 recovery… I think we will instead witness an event that will send The Dow falling to 10,000… 5,000 – maybe even lower… as the biggest asset bubble in history continues to unwind.

Right now, we’re entering a period I refer to as a “Dead-Zone”… Stocks go nowhere for months… then some bit of optimistic news sends them a few points higher… Only to watch the stocks in your portfolio hit even lower lows.

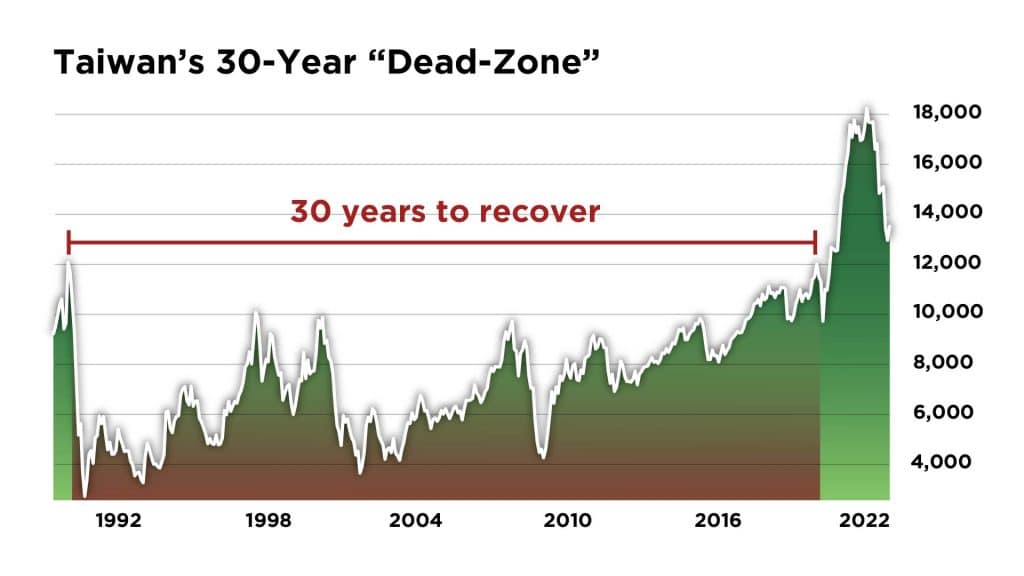

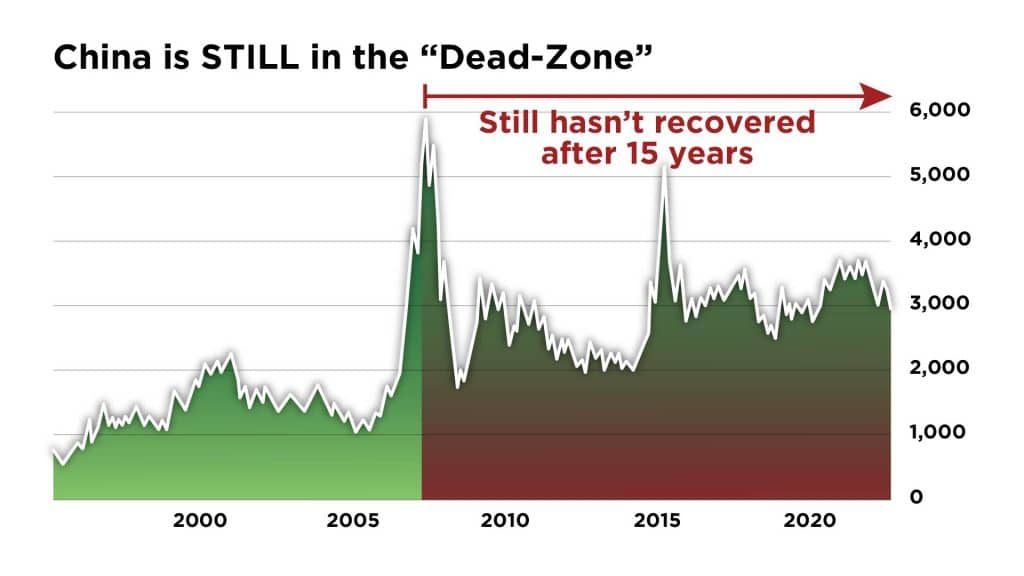

And as I’ll show you now, this is a situation history tells us could last 5, 10, even 20 or 30 years until stocks hit new highs again.

You may disagree with my prediction. Or believe this sort of outcome is impossible. Afterall, “buy the dip” has been the best advice you could follow over the past 40 years, right?

But as you’ll see, this kind of “dead-zone” we’re entering now has happened before. And not just once. It’s happened dozens of times… in many countries around the globe.

Now for reasons I’ll share in a minute, I believe it’s happening again, right here in America.

I want to show you all the research and data that has led me to this conclusion. I’ll also outline the four steps you should take immediately to prepare… You don’t have to take every step I’m recommending right now. But please… at least take the first step… and see if I’m right in the months to come, and then you can follow the rest of my recommendations.

In short, it’s never been more critical than right now to know exactly what to sell and where you can still put your savings to earn a decent rate of return.

That’s the purpose of my message today.

Again, if I’m right and you don’t recognize what’s about to happen in America, you will probably regret it for the rest of your life.

How do I know that?

Because what’s happening now has happened over and over again before…

The “Everything Bubble” has Popped – We’re Now at the Start of a Massive Stock Market “Dead-Zone”

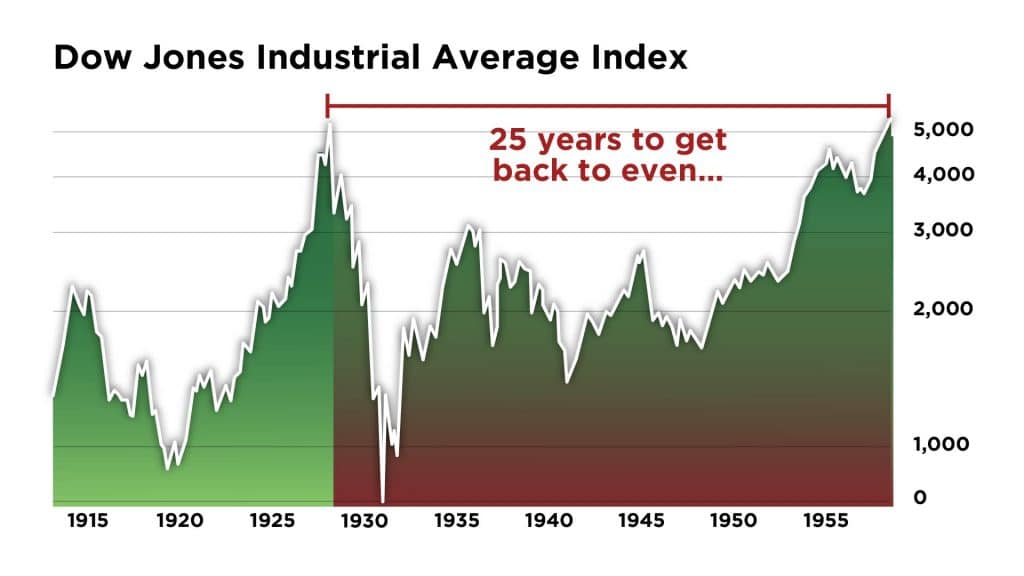

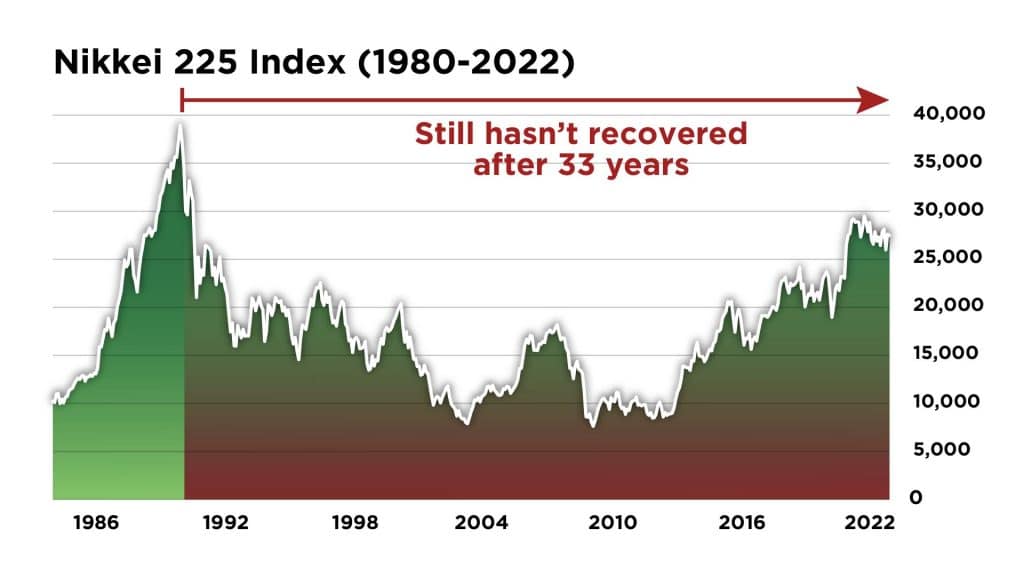

Take a look at this chart:

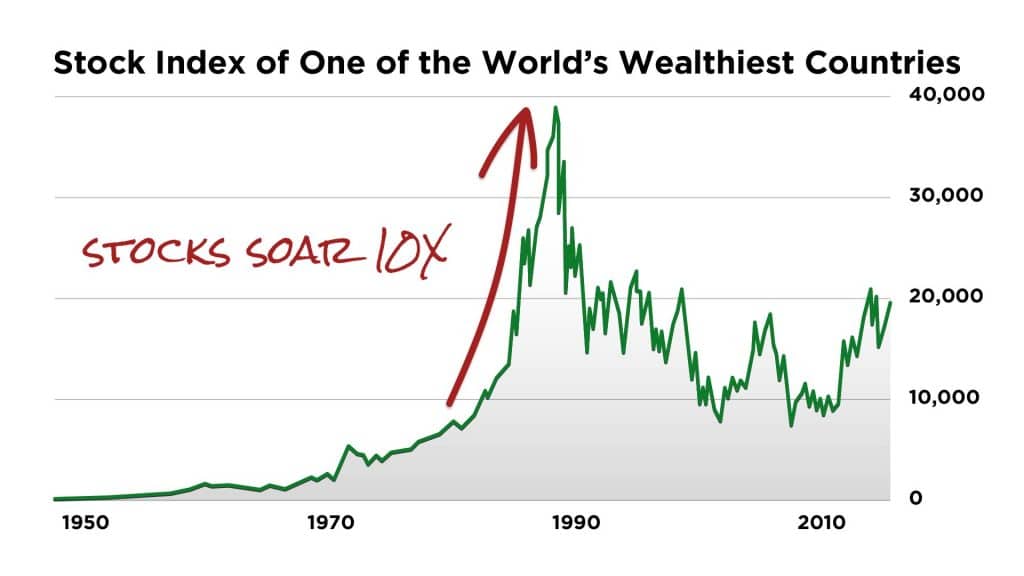

It’s the stock index of one of the wealthiest nations in the world.

As you can see, it entered a furious bull market in the mid 1980s…

And investors who rode it higher had the chance to make a killing.

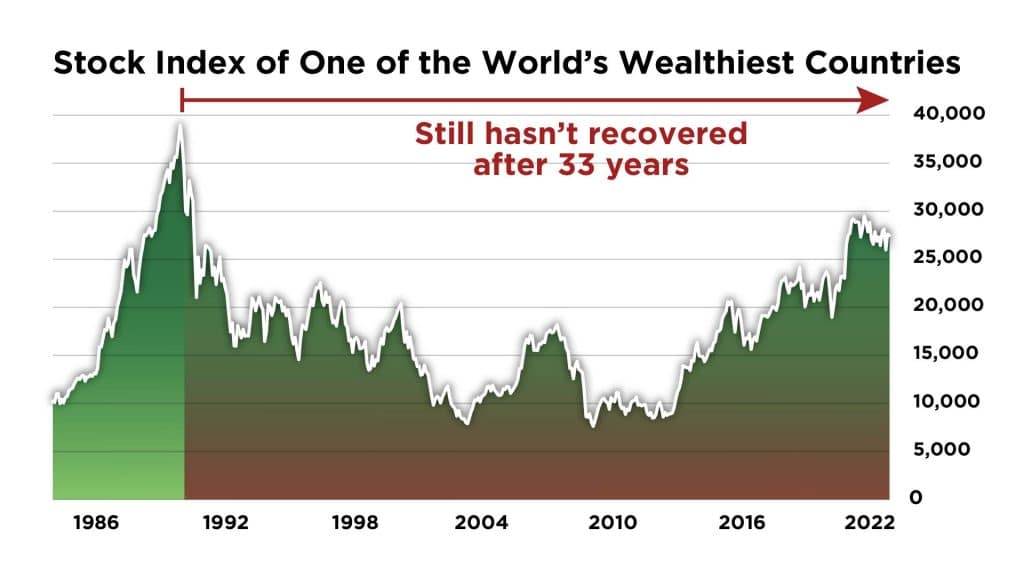

But here’s what you’ll never see on CNBC… let’s zoom out…

Even today, 33 years after that bubble burst, it still has NEVER recovered.

This type of scenario… where it takes a decade or several decades for a market to get back to “break even” is what I refer to as a “Dead-Zone” in stocks.

Now, if you’re a student of history, you may have guessed that the example I just shared is Japan.

And you might think, “sure, but that could never happen in America today.”

You can take that chance and just hope for the best. But as I’ll show you in a moment, this exact sort of multi-decade “Dead-Zone” HAS happened in America before.

And if you are over the age of 50, I’d be willing to bet that a 10-year (or longer) market “Dead-Zone” isn’t something you’ve considered in your retirement planning.

That’s why I put this message together today.

Most Americans are totally unprepared for a multi-year bear market, let alone a market “Dead-Zone” that could last a decade… or two… or three or longer.

But that’s exactly what we could be at entering right now.

You might think Japan is a special case, but the same exact thing happened right here in America 100 years ago.

Back then, the United States’ economy was booming. They called it “The Roaring 1920s.”

Of course, you are probably familiar with the Great Depression that followed.

But most people don’t realize – after the market crashed – the same pattern played out.

After the bubble burst… it took 25 years to recover. And the average buy-and-hold investor never got back to “even.”

It’s incredible that people don’t talk about this more…

So, remember…

When the mainstream media tell you “stocks always recover,” what they really mean is “so far, the U.S. stock market has always recovered… eventually.”

And remember that “eventually” could mean a market “Dead-Zone” of 10… 20… even 25 years or more.

My point is: if you are OK waiting 10 years or more for your portfolio to recover, then you can close this message, and stop listening to me right now.

On the other hand, if you can’t wait a decade or more… you’ll be relieved to hear that there was a perfect place to put your money during these multi-decade dead-zones. In just a bit I’ll show you the power of this incredible asset, and how you might want to put some of your money here again today (it’s one of the few investments that is up this year, while the stock market is way down).

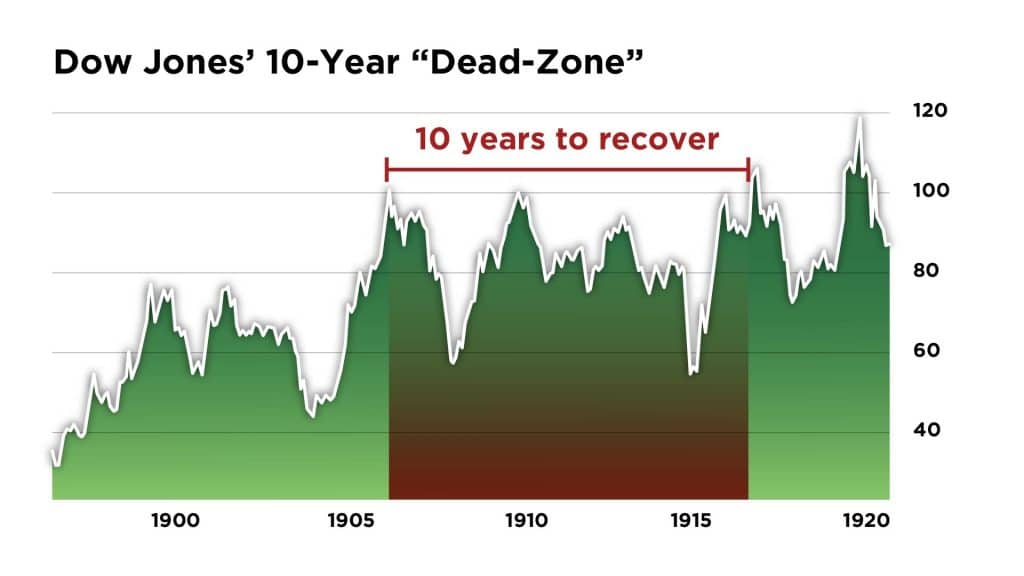

Because I’ve studied how this “Dead-Zone” pattern has unfolded over and over again to just about nearly EVERY major bubble in history.

It happened again, here in America after the DOW’s 1966 crash…

In inflation adjusted terms, buy and hold investors didn’t “break even” until 1995.

It happened after the Panic of 1907…

And it has happened in countries all over the world too.

Like Taiwan…

Spain…

In China…

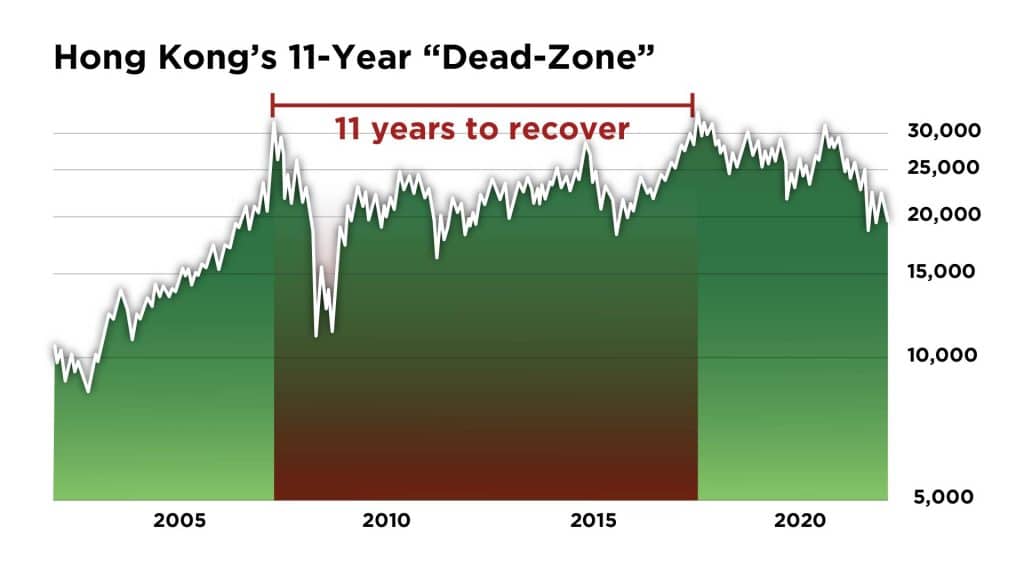

In Hong Kong…

And in Germany…

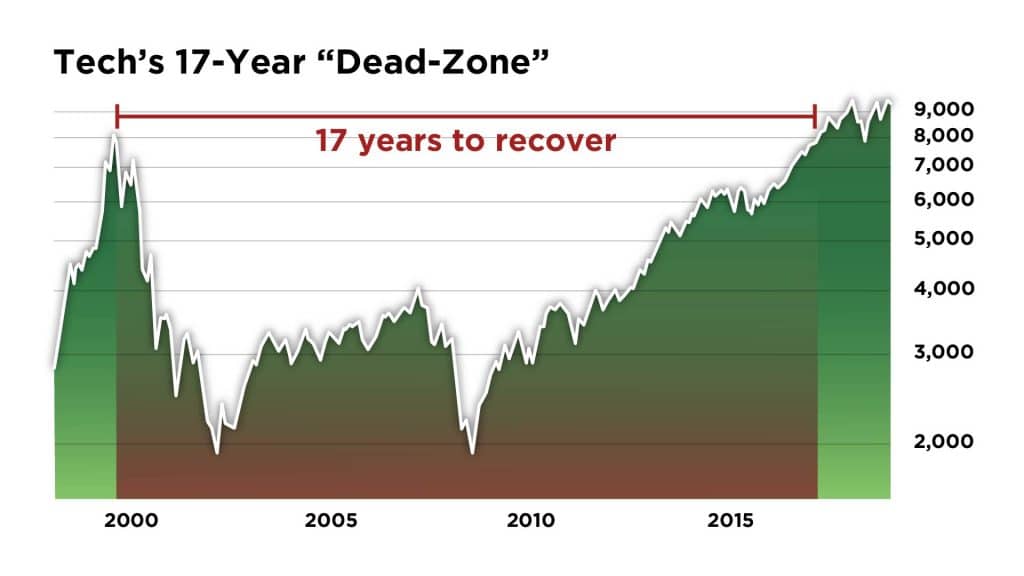

We’ve even seen dead-zones in specific sectors.

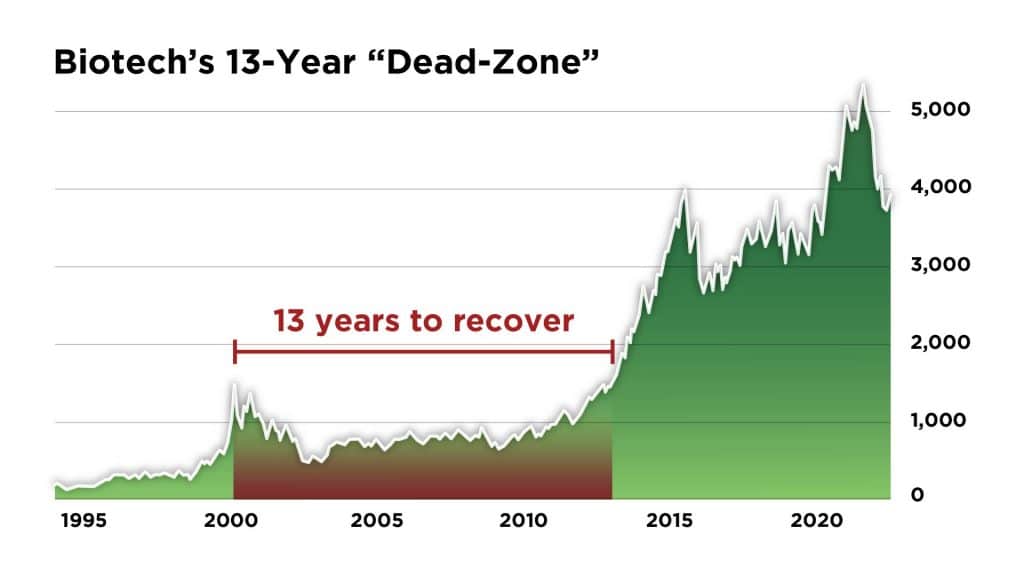

Like biotech stocks…

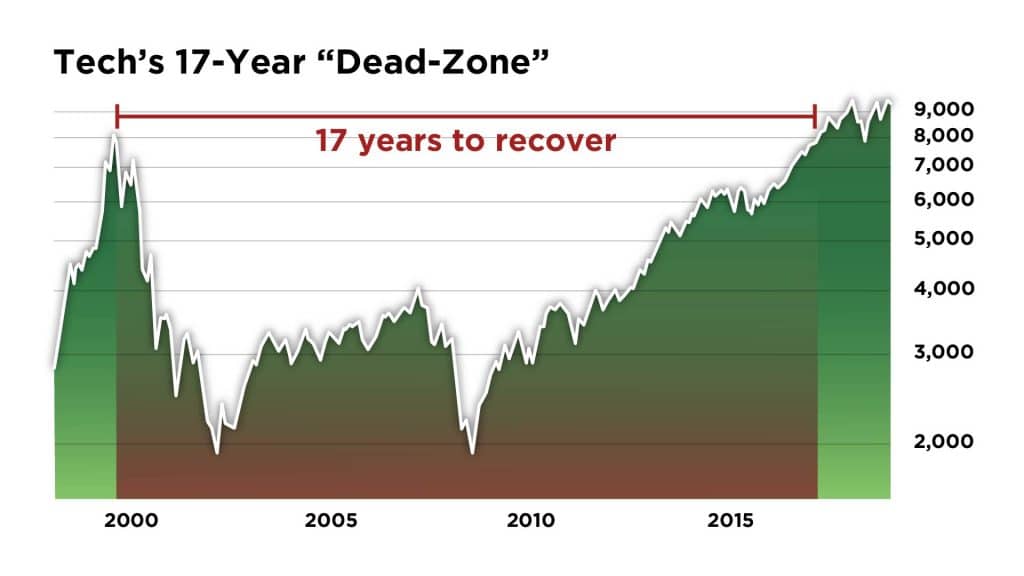

And tech stocks after the dot-com bubble…

The number of “dead-zones” we’ve had is incredible, I know, but if you would like to fact check any of our data, please visit our details & disclosures page, linked at the bottom of this transcript.

So, if you’ve been thinking of buying the dip…

Or if you’ve been telling yourself, “I’ll sell as soon as my account gets back to break-even…”

THIS is your warning call…

It is time to move your money into investments that could go up even if the rest of the market ultimately declines another 50% or more.

Because even in multi-decade “dead-zones” like we are entering right now… There are proven investments that could make you a fortune as stocks head lower and sideways for years.

But if you want to capture the biggest gains… the kind that could turn every $100 invested into $500… $1,000 or more, you’re going to have to do something completely different. Don’t worry, it’s not complicated. You don’t have to open up any new accounts or tie your money up in illiquid assets or private deals, or anything like that.

You just have to understand and take advantage of the dramatic SHIFT that’s occurred.

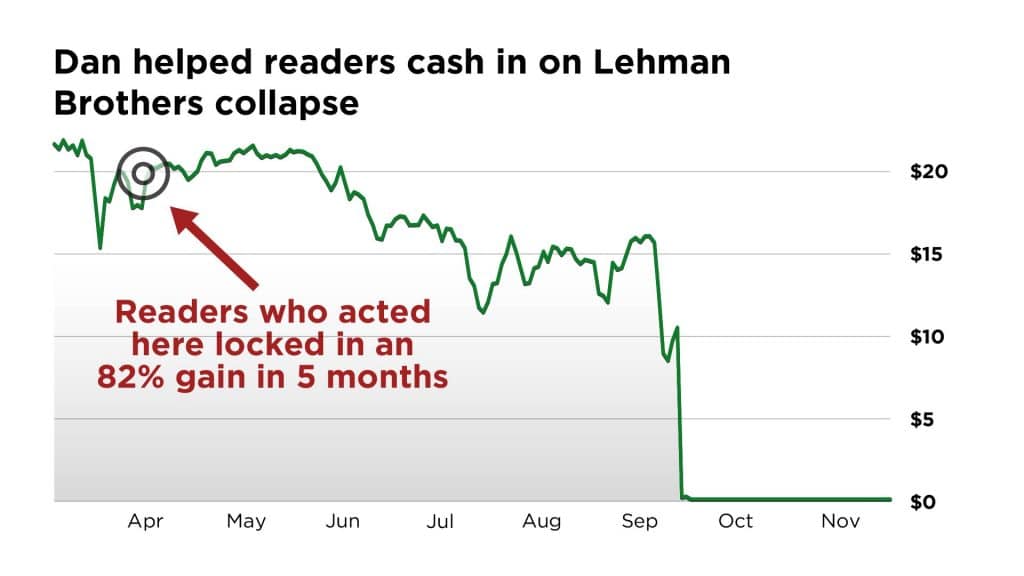

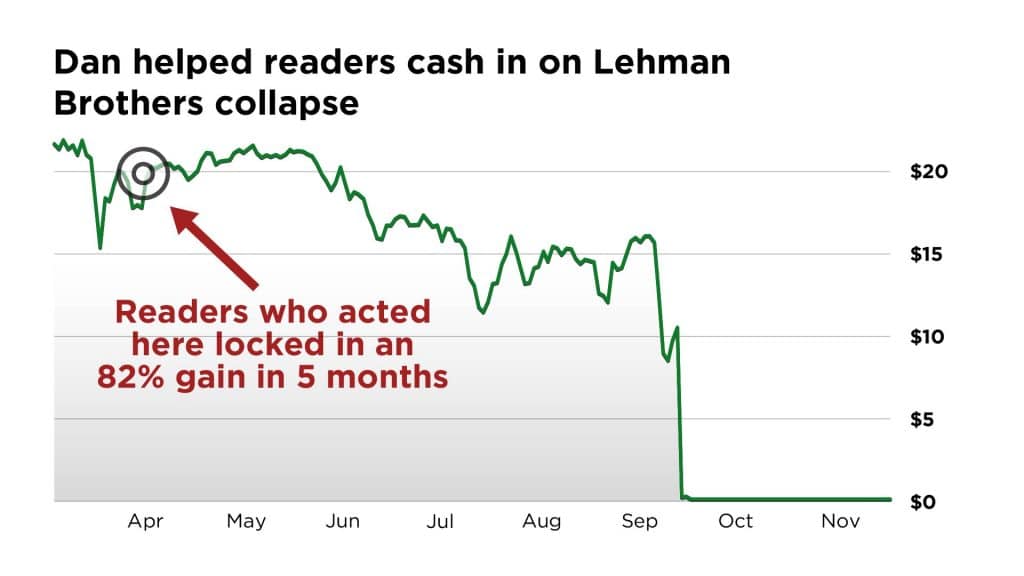

I helped folks like you do the exact same thing back in April of 2008.

I didn’t only warn them a financial crisis would occur…

I ALSO told them to short Lehman Brothers five months before it went bankrupt, for a near-perfect 82% return in just five months.

Only today, I think we are looking at a far, far bigger threat to stocks, the economy, and your wealth.

And now, I want to share exactly what you can still do…

First, Let Me Introduce Myself

Hi. My name is Dan Ferris. I don’t spend my time making predictions on television. You wouldn’t catch me on FoxBusiness or CNBC… but I bet I know more about market history than most of those folks combined. I have an entire section of my financial library dedicated to the subject.

I normally only share my insights with a small group of followers who’ve tracked me down on their own.

But I recorded this video because I believe we are approaching a moment of financial catastrophe unlike anything we’ve seen in 50 years… possibly since the Great Depression.

While I don’t like stepping into the spotlight…

Because I’ve been willing to make big, public calls like the one I’m sharing with you today, I’ve been profiled in Barron’s and Bloomberg…

And attracted the attention of multimillionaires and world-renowned fund managers who have read my work. (One manages a billion-dollar fund that did seven times better than the S&P 500 between 2000 and 2018.)

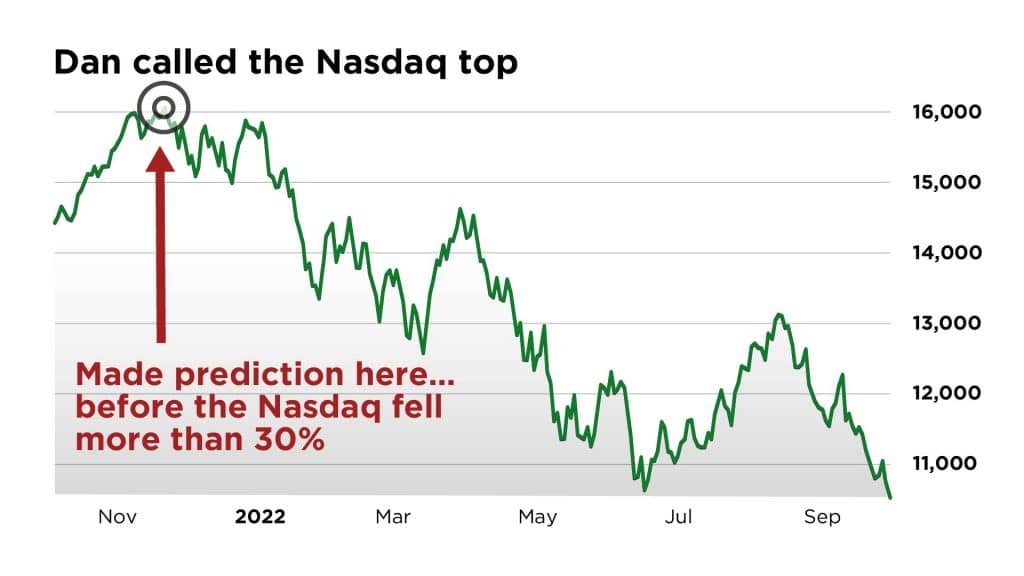

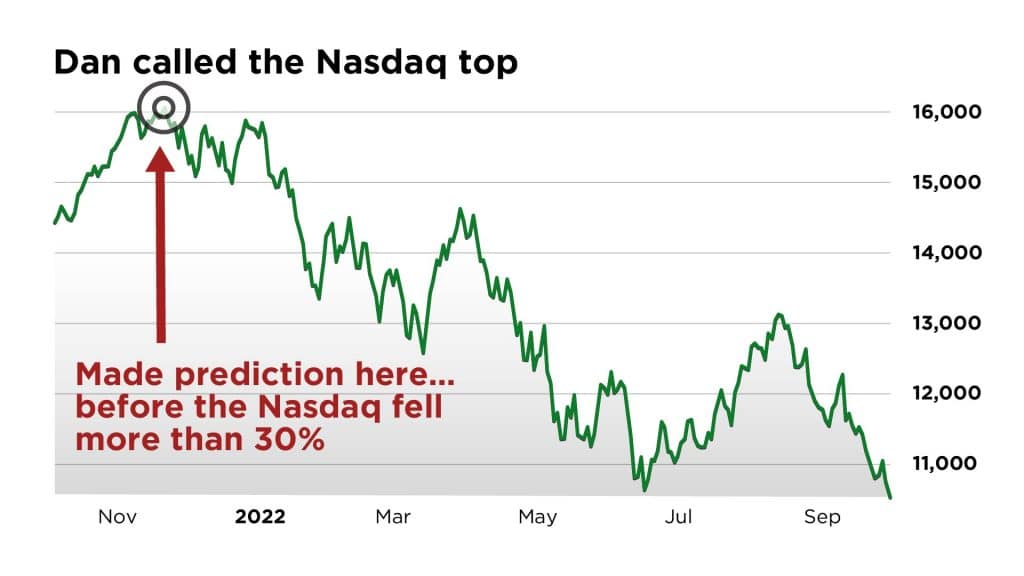

Like when I made a message on November 19, 2021 to warn that the Nasdaq had peaked – to the day!

And that’s exactly what I’m here to share with you today…

Today, I think we are in the middle of the biggest bubble in history… what I call the “everything bubble.”

And I’m here to warn you that the losses we’ve seen since the market peaked are just the beginning.

What we are going to experience over the next few years could be worse than the Great Depression, the Dot-Com crash, and the Financial Crisis combined.

Over the next few minutes I’m going to give you a preview of what could be ahead for you and your money if you don’t make some smart moves soon…

And you’ll soon see that listening to the “experts” who tell you “just hold on, stocks always recover,” could set you up for disaster in the coming months.

But I know by now you must be wondering…

If these stock market “dead-zones” have occurred in America and all over the world dozens of times… and if major developed economies like Japan are still stuck in a dead-zones that have lasted more than 30 years…?

Why does NO ONE talk about it?

You Won’t See This Story in the Mainstream Media… At Least, Not Yet

Well, there’s two very good reasons you won’t see any of the talking heads in the media talking about this phenomenon.

For one, if CNBC and FoxBusiness began talking about the reality that stocks could go nowhere for years, let alone a decade or two, it would cause a mass panic.

Can you imagine how many Americans would rush to sell their stocks upon hearing this?

It would be like the biggest bank run in history, as Americans pulled trillions of dollars from their brokerage accounts.

And no matter how bad the problem is already, I can guarantee you, a run on brokerage firms of this scale would make the situation far, far worse.

Stocks would drop like a hammer. Trading would be halted. Americans would worry their life savings are about to disappear.

It would be a complete disaster.

Our country can survive a long period where stocks go nowhere. But a run on America’s retirement accounts and 401ks could tear apart our economy and our financial system practically overnight.

The second reason is that the newspapers you read and the channels you watch for your financial news only make money if you are tuning in.

Consider, if you knew that the market would head nowhere for years and years to come, would you really have any use for the mainstream financial media?

Probably not to the extent you do today…

And think about it…

The CEOs who go on the air… the brokerage houses that pay for commercials… the anchors who run the shows… they don’t make money by making bets on the market.

They make money when you listen to favorable coverage and push up the price of their stock… they make fees when you buy or sell stocks in your brokerage account… they make advertising dollars when you tune in to hear what they have to say.

This is why you are constantly bombarded with contradictory messages of fear and greed.

When the market is up, they try to attract your attention with messages of fear that the market will sink. And when the market is down, like it is today, they will tell you it is time to “buy the dip” while stocks are “cheap”…

And that’s exactly what has dominated financial news recently…

What all these folks fail to point out and understand is that the bull market we just went through was not “normal.” It was not natural. It was a once-in-a-lifetime bubble in nearly every asset on the planet.

And a bubble this big, and this historic, does not end with just a 20% slide.

Major asset bubbles end when nobody is invested anymore… and when what little money is left is being frantically pulled out of the market because it is all people have left.

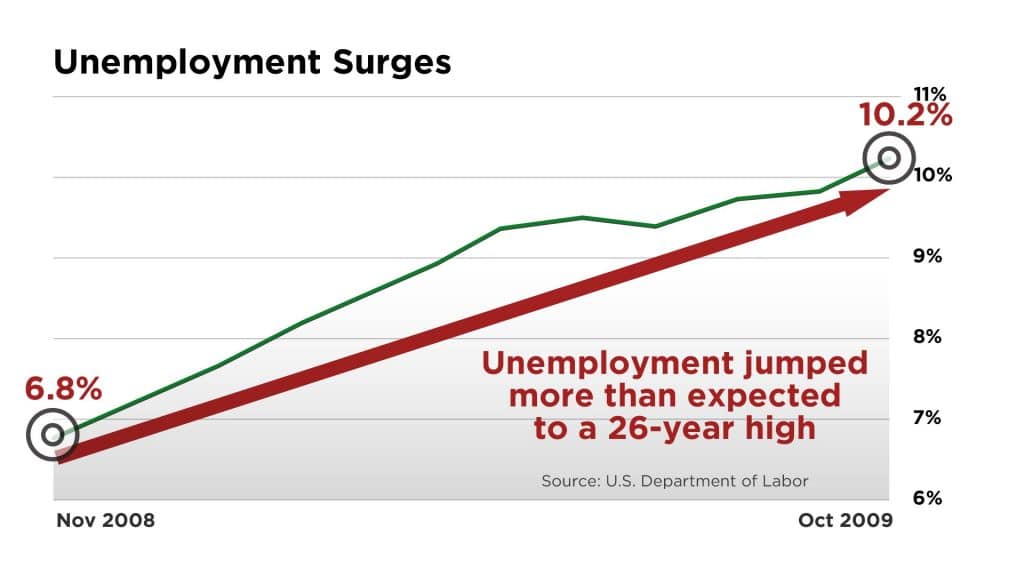

If you want to remember what a REAL stock market bottom feels like, think back to 2009…

Unemployment hit the highest levels in 26 years.

Every night on the news you may have seen people walking through Manhattan with boxes…

Housing developments were left abandoned…

I’m sure you remember what that time felt like… to sum it up in a single word, Americans felt hopeless.

It wasn’t unusual to see repossession vans emptying the contents of a homes in nice, gated communities.

Even “wealthy” students were being pulled out of private colleges left and right.

Everyone you talked to was suddenly “downsizing” and moving into more “efficient” homes…

Retirements were postponed or canceled.

But that simply isn’t the situation in the financial markets today…

Right now, I believe we are just on the other side of the peak of the greatest market bubble in history. And we’ve only begun to get a taste of the pain ahead for the financial markets.

This fact is no secret among serious financial minds. I’m talking about famous investors and economists who have spent their careers studying periods just like we are in today.

Like Jeremy Grantham, who predicted the 1989 Japanese bubble, the 2000 dot-com bubble, and the 2007 housing bubble. He recently warned, “Only a few market events in an investor’s career really matter, and among the most important of all are superbubbles.” He says “This is very rare. The same happened in 1929. It happened in 1972 before the very big decline then. It happened in 2000 before the tech wipe-out.”

And Michael Burry, who became famous for predicting and betting against the housing collapse in 2008, recently called it the “greatest speculative bubble of all time in all things,” that “could be worse than 2008…”

In fact, his success at the time made him so famous for his ability to nail market bubbles that they made an award-winning film about him called The Big Short.

And he’s telling investors, “… We have not hit bottom yet.”

If you only get your financial news from newspapers, magazines, and television, you are never going to hear this story…

At least, not until it will be too late to do much about it.

But it is no secret.

You’ve Been Warned About This Outcome for 15 Years

Our leaders at the highest levels of both our government and financial system have been discussing this as a likely scenario for years.

In fact, during the financial crisis in 2008, the idea was so frightening, it was a determining factor in the government’s course of action during the crisis.

At the time, President Obama went live on TV to explain that failure to act could lead to the same kind “of dead-zone” that began in Japan after 1989.

“As a consequence they suffered what was called the ‘lost decade,’ where essentially for the entire ’90s, they did not see any significant economic growth… So what I’m trying to underscore is… that this is not your ordinary, run-of-the-mill recession.”

In short, our president, after likely listening to the advice of all the most important economists and investors in the world, feared one thing the most… what at that point had been occurring in Japan for 20 years.

That’s because America found itself in almost the exact same scenario as Japan in 1989.

And it is also why the president of the Federal Reserve Bank of St. Louis James Bullard wrote at the time, “The United States is closer to a Japanese-style outcome today than at any time in recent history.”

You see, the root of Japan’s crisis can be traced back to a new economic system introduced in the 1950s based on “over-lending” capital that banks didn’t have.

Between 1955 and 1989 the stock market soared more than 20-fold.

And land values in Japan’s six largest cities grew 15,000%.

The lands of the Imperial Palace in Tokyo became valued higher than the entire state of California.

At the peak properties in Tokyo were fetching $139,000 per square foot.

And then, in 1989, the bubble in Japanese stocks and real estate began a long and slow crash… one that it still has not recovered from over 30 years later.

And that probably would have happened to the United States in 2008…

Except for one thing…

More Bad Debt

In 2008, interest rates were high by recent standards… at 6%.

Instead of allowing badly indebted banks and corporations to go bankrupt…

The Federal Reserve had room to artificially suppress interest rates and allow all the bad debt to be kicked down the road.

The real problem though, is that it kept them there ever since… which did two things…

But the good times enjoyed over the last 15 years haven’t come without a great cost…

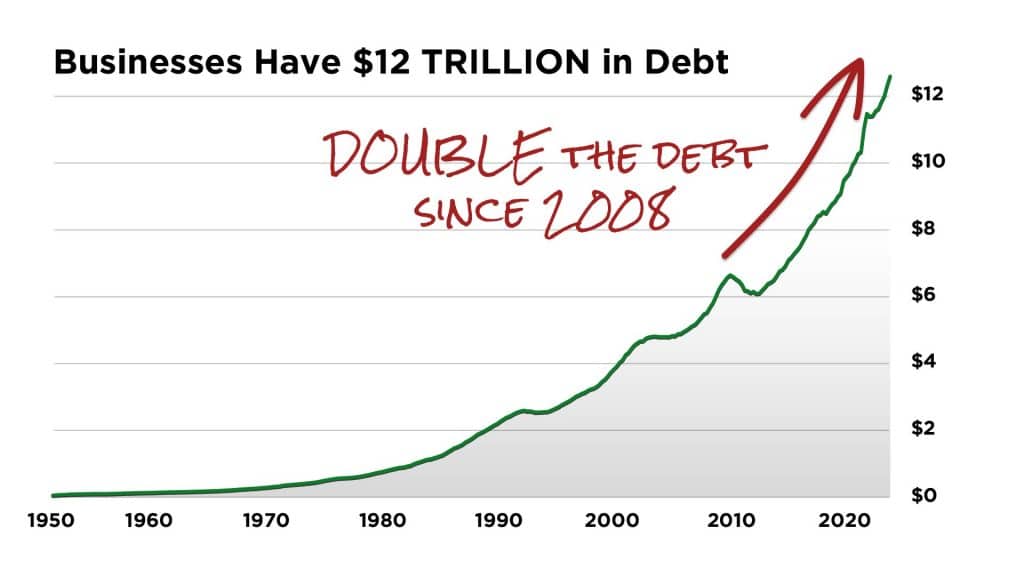

In fact, businesses borrowed so much that today they have $12 trillion in debt – DOUBLE the debt they had in 2008.

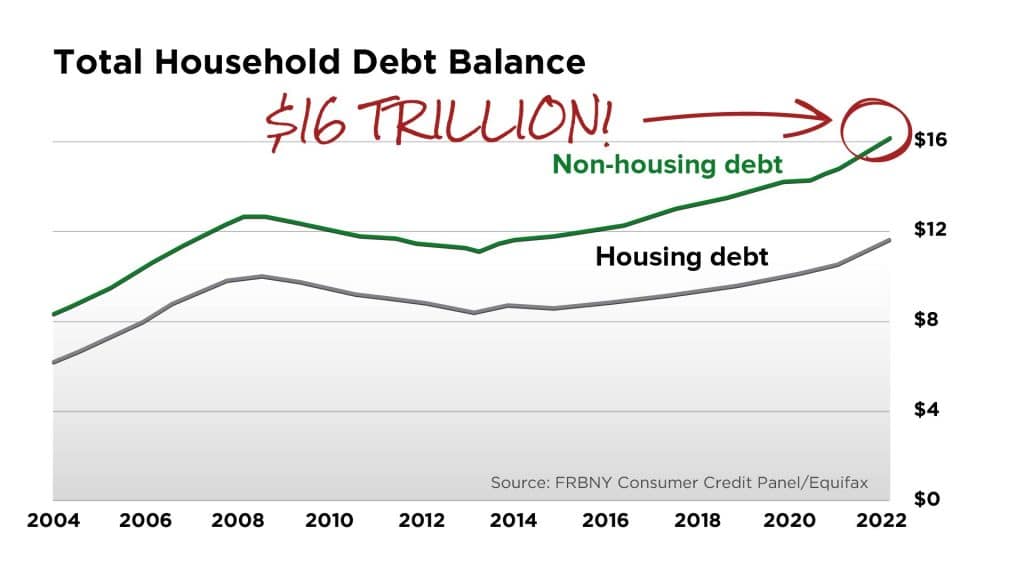

Likewise, households have accumulated an all-time high of over $16 trillion in debt…

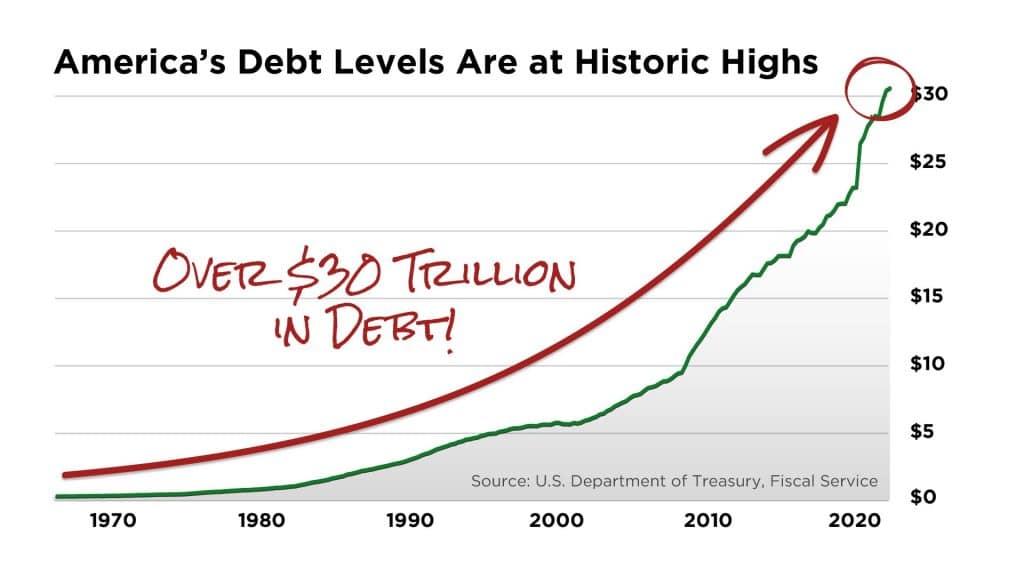

And worst of all, the US government borrowed trillions more – tripling government debt since 2008 to a total of over $30 trillion today…

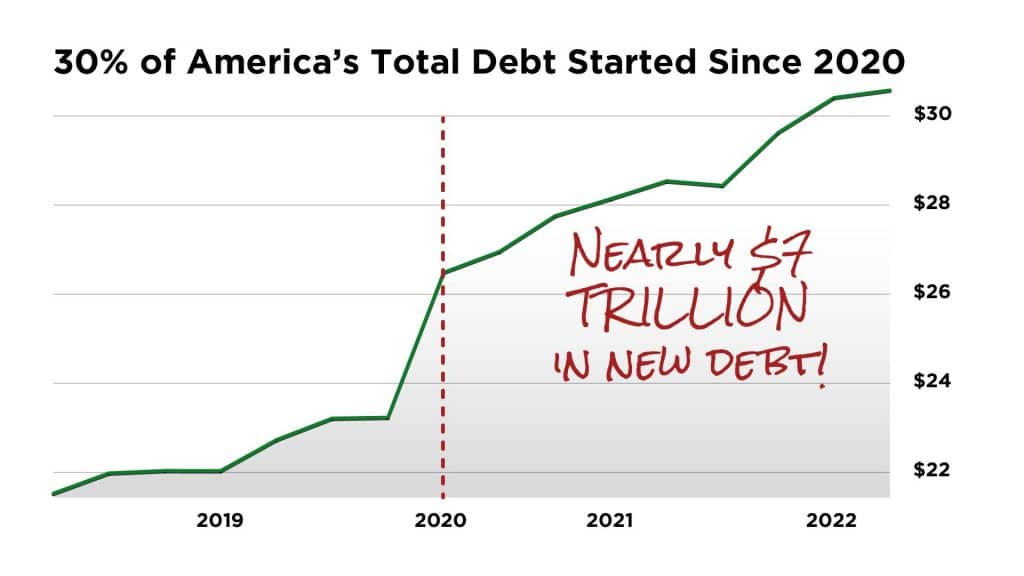

Shockingly, nearly $7 trillion in new debt – nearly 30% of the total – has been created since the beginning of 2020 alone.

And that brings us to the present moment…

The Federal Reserve kept interest rates were so low for so long that it has created the highest inflationary event in more than 40 years…

And today they are trying to fight inflation with the only weapon left in their arsenal.

Higher interest rates.

The exact same move that Japan’s Central Bank made in 1989 that quickly burst the bubble in Japanese stocks and real estate.

Following History’s “Dead-Zone” Blueprint

Are you beginning to see why our country’s situation today is so similar to Japan back in 1989?

As I said, the situation we are in is no secret among folks who study the kind of historic bubbles we’ve been living through.

For example, Michael Boskin, a professor at Stanford University, and former Chair of the President’s Council of Economic Advisers, says:

“While the United States certainly can, and I hope will, avoid [what]has befallen Japan… it pains me to say that I am not optimistic we will do so.”

And Desmond Lachman, a Resident Fellow at the American Enterprise Institute says,

“In much the same way as the bursting of its property and equity bubble in the early 1990s cost Japan a lost economic decade, the bursting of the U.S. everything bubble must be expected to usher in a prolonged period of disappointing economic growth… unusually large budget deficits, the proliferation of zombie companies, and yet another round of Fed quantitative easing.”

This is why I’ve spent so much time trying to get this warning to you today…

We’ve embarked on a series of aggressive rate hikes that could ultimately spell disaster for American investors.

The same thing happened here in the United States back in 1965…

Following WWII, returning G.I.s came home flush with cash and created the mother of all booms.

The Dow more than quadrupled following the war from under 2,000 to over 9,000 at its peak in 1966.

But then, in 1965 the Federal Reserve began to hike interest rates to get them back to normal prewar levels.

Unemployment numbers were low and the economy was booming.

And nobody was prepared for what came next…

Adjusted for inflation buy and hold investors of the day didn’t “break even” in inflation adjusted terms until 1995.

That’s 30 years of no returns!

Consider, if I am right, and we are at the very beginning of a similar “dead-zone”…

Stocks could be the highest today than they will ever be again in your lifetime if you are over 50 years old!

I don’t mention that to scare you…

I’m telling you this because I know most people don’t study debt bubbles and market “dead-zones.” And I want people to fully understand what the next few years could look like for your investments.

We’ve all become accustomed to faster and faster recoveries in recent years…

The COVID-19 scare caused the fastest crash and quickest recovery in history.

This is what investors have come to expect… that a “buy the dip” approach will always be rewarded…

But I believe following that logic today could be the biggest financial mistake you ever make.

Blue chips Won’t Save You

You see, even “big, safe, and boring” blue chip stocks won’t protect you.

After the bubble in U.S. stocks burst in 1966… even the “best” and supposedly “safest” stocks in America collapsed…

The share price of essentially the hottest tech company in the world at the time, IBM, fell 57% and did not get back to even for nine years…

I’ve heard lots of people talk today about buying Disney lately, because it’s fallen about so much… but I doubt Disney’s fall is done. During the market “dead-zone” that began in 1966, the stock fell 83% in less than two years.

Other iconic businesses collapsed as well – Coca-Cola fell nearly 70% and General Electric fell nearly 60% and both took nine years just to get back to even.

Likewise, if you believe the biggest winners of the last decade like Amazon, Facebook, and Google will protect you…

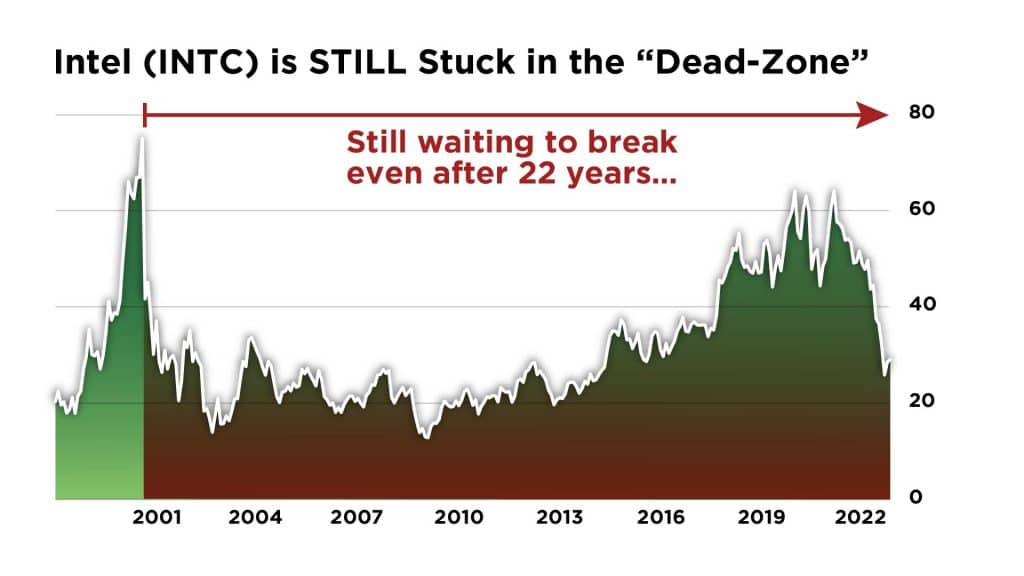

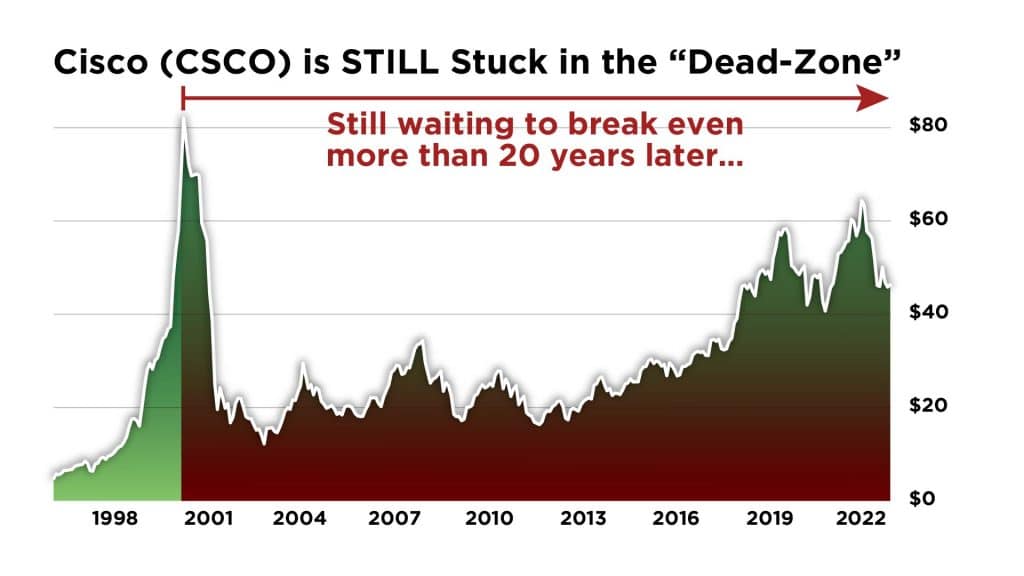

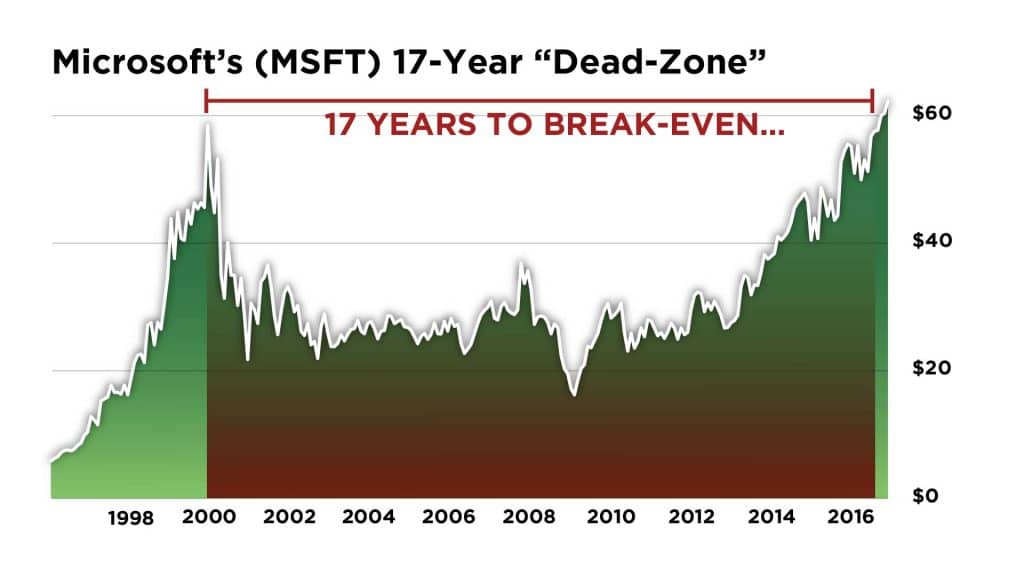

Remember, that’s exactly what everybody thought when they bought Intel, Cisco, and Microsoft in 1999.

And spoiler: they still haven’t broken even yet on Intel…

Or Cisco 20 years later…

And it took until 2016 to break even on Microsoft.

Think about that…

Microsoft is one of the greatest, cash-gushing, dividend growers on the planet – and you’re underwater on it for 17 years!

I repeat: it doesn’t matter if your portfolio is full of some of the greatest and most successful enterprises in human history. These companies are all in the same giant bubble as every other asset on the planet.

Amazon trades for more than nine times all the profit it has ever made since its 1994 founding.

And yes, they’re safer than most other stocks most of the time, but absolutely everybody thinks they’re safe. When everybody thinks something about the stock market, that usually means it’s about to be proven wrong.

The real point is that blue chip stocks are riskier than folks believe today. That’s bad. It’s not like they’re small, risky stocks that everybody knows are risky. These are stocks everybody thinks are safe…

For example, Facebook is the most successful human enterprise in history. It has 2 billion users. It’s bigger than capitalism, communism, Catholicism, Islam, China, India… you name it. Nothing is as successful as Facebook.

But that hasn’t stopped it from falling by half since the peak.

And it won’t stop it from falling another 50% or more either.

That’s why it is so important that you closely examine every investment you own today.

In 1989, of the world’s top 50 companies by market capitalization, 32 were Japanese…

By 2018, only one such company (Toyota) remains in the top 50.

So please, please, don’t fall into the trap of thinking that the best investments of the last 10 years will look anything like the best investments of the next 10 years.

Instead, let me show you exactly what changes you need to make to preserve your money, and potentially grow it many times over, over the next few years…

Which Investments Could Perform Best?

The Answer Might Surprise You

I’ve spent years studying the fall out of Japan’s 1989 bubble… and covering the insane speculative bubbles like we’ve seen in America in recent years.

And I’ve spent hundreds of hours tracking down and speaking with some of the most important investors alive to better understand how to invest in a market like the one we are experiencing today.

For example, I’ve spent more than a thousand hours interviewing, one-on-one, many of the most important financial minds in the world today… like

Larry Lindsay, who served as a member of the Federal Reserve Board of Governors and is the former director of the National Economic Council. He probably understands the causes behind today’s bubbles better than anyone else.

Tobias Carlisle, the head of the Acquirers Fund, who has probably spent more time studying the kind of investments that worked best during Japan’s lost decades than anyone else.

Jaime Rogozinski, the founder of Wallstreet Bets, and the father of the meme stock movement.

Marty Fridson, AKA the “dean of high yield debt.” Marty worked as the director of high yield strategy at Merrill Lynch for over a decade and is widely known as one of the smartest bond analysts in the world.

Former Congressman Dr. Ron Paul, who has been the biggest public critic of the Federal Reserve’s unprecedented money printing in America for several decades.

Rick Rule, the former president and CEO of Sprott US Holdings, one of the largest commodity investors in the world. Rick knows more about profiting from gold and gold miners than anyone else I’ve ever met.

Harris Kupperman, the president of Praetorian Capital Management who made a small fortune shorting the dot-com bubble in 2000, and who returned more than 100% to his investors in 2020 and 2021 by betting on manias he sometimes described as “Ponzi schemes.”

Morgan Housel, a partner at Collaborative Fund and the author of the Psychology of Money. Morgan has become famous for good reason. Understanding human psychology will be probably more important than anything else when it comes to making money over the next 10 years.

Mark Spiegel the portfolio manager of Stanphyl Capital Partners, whose hedge fund was up 37% in the first six months of 2022 while the rest of the market was down 20%.

And dozens and dozens of other investors I don’t have time to list.

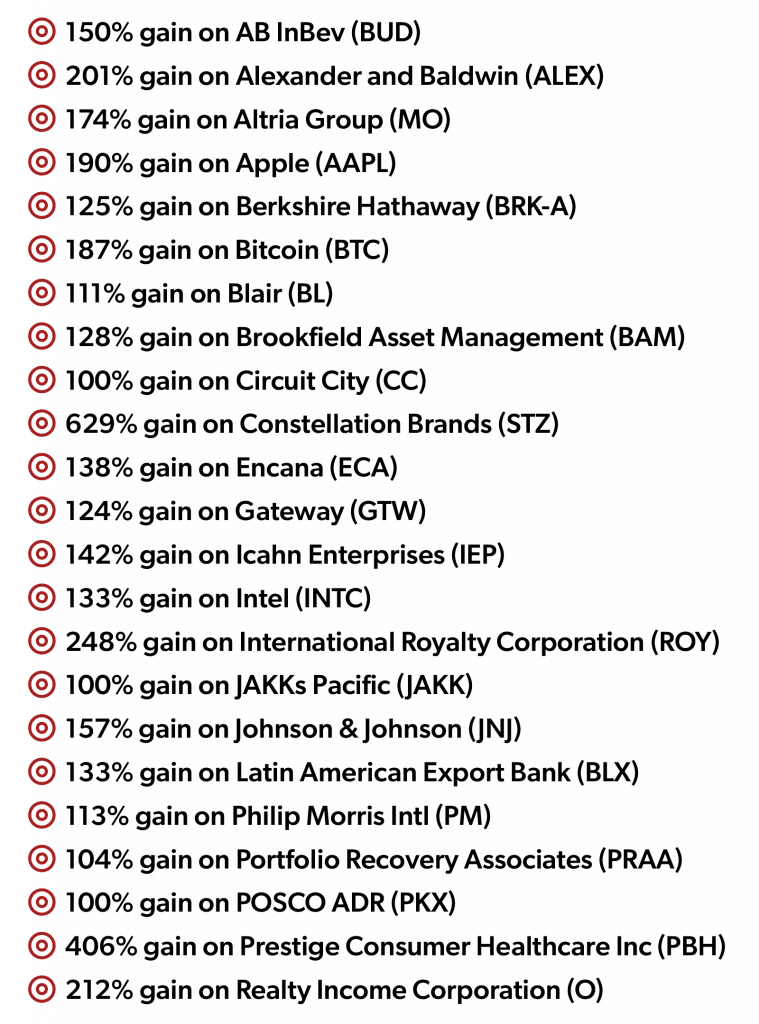

This network of some of the most influential financial minds in the world has helped me uncover 24 opportunities to see triple-digit gains in the past few years.

And it helped me warn those same followers about some of the biggest risks in the market…

I already mentioned when I warned my followers a financial crisis would occur in April of 2008 and told them to short Lehman Brothers five months before it went bankrupt, for a near-perfect 82% return in just five months.

I also mentioned how I warned them the Nasdaq had reached a peak in 2021 to the day.

But my vast network of contacts also helped me warn my followers to sell risky stocks and raise plenty of cash before a 21% market decline in 2011… and again in 2015, when the market notched its first negative return since the financial crisis.

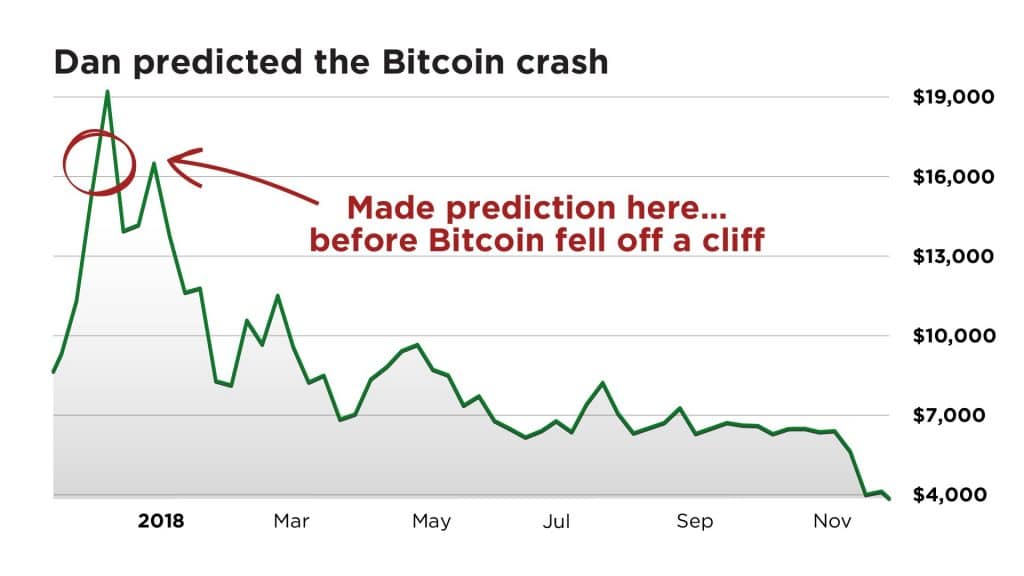

And in December 2017, it helped me warn that Bitcoin could quickly fall by as much as 90%. In fact, it plummeted by 80% over the next year.

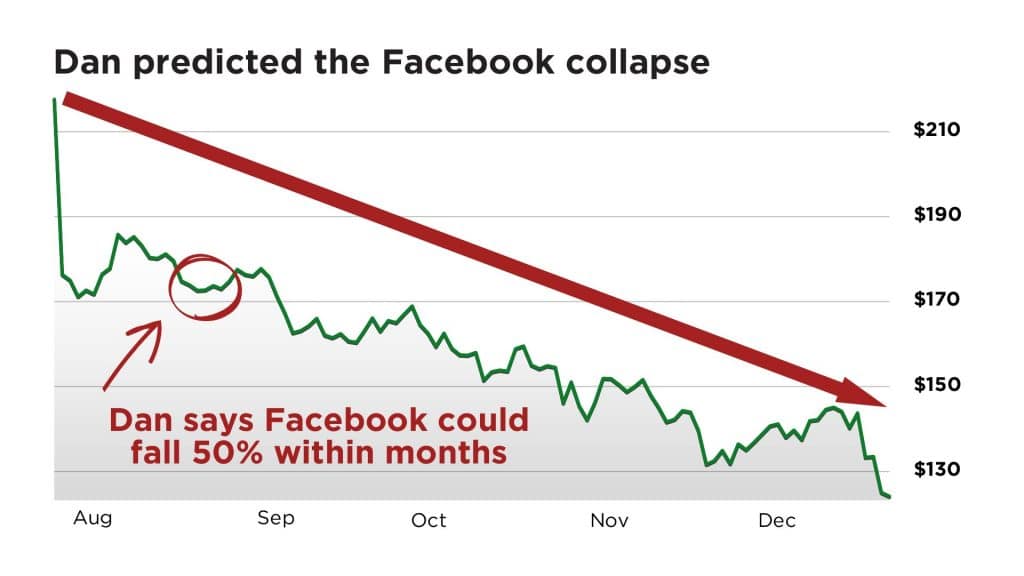

Then the next year, I helped them avoid catastrophe again – warning that Facebook could fall by 50% in a matter of months. It went on to fall by 43% from July to December.

Now that might make it sound like I spend most of my time predicting calamities, but I reference my past calls simply because I want you to take the warning I’m sharing with you today very, very seriously.

For example, while I warned my subscribers to get out of Bitcoin in 2017 before it crashed over 90%… I also turned around in February of 2020 and told them it was time to buy it. It then soared 1,100% in just 12 months.

My point is that in every crisis there is always opportunity.

So, after talking to dozens of experts and studying dozens of market bubbles around the globe, I’ve put together a complete blueprint for exactly what you need to do to not only protect the value of your investments, but also grow them tremendously in the years to come.

Now, based on everything I’ve shared with you today, you might think that the best course of action is to simply sell your stocks right now and go to cash.

And if you do that, that’s at least better than watching your portfolios fall by another 50%-plus.

But inflation alone is going to eat close to 10% of the value of your savings every year with that strategy.

So, allow me to show you exactly what I recommend you do instead…

Step #1: Sell These Stocks Immediately

Twenty years ago, I was hired as the first equity analyst at a small boutique financial research firm called Stansberry Research. Back then there was just a few of us working on ancient laptops in a drafty old house in Baltimore trying to publish the same kind of information for readers that we’d want our own parents to follow with their money.

In the two decades since, we’ve grown into one of America’s leading independent financial research firms, with more subscribers than many of the nation’s leading newspapers.

We’ve become so successful because we don’t accept money from advertisers, kickbacks from companies, and we only make money if our customers like our work so much that they decide to pay for it.

In other words, we designed a financial publishing model that aligned directly with the interests of our readers. If they don’t do well, neither do we.

One of the benefits of this success is that it has allowed us to build an in-house research team with multiple accountants, a financial lawyer, a PhD in finance, former hedge-fund and mutual-fund managers, and dozens of other senior and junior analysts.

I can promise you nobody has done more work than us understanding the dangers that lie waiting for unsuspecting Americans in a multi-decade “dead-zone” for stocks.

And we’ve completed the ultimate guide to understanding EVERYTHING you do NOT want to own as the market continues to make a major shift from growth to stagnation over the coming months and year.

It’s called: Avoid at All Costs – These Stocks Will Never Trade This High Again in Your Lifetime.

We’ll show you the 12 most dangerous companies in America today. There’s a good chance you own one of these stocks.

We’ll show you which investment sectors to avoid. We’ll show the kind of investments we expect to fall the furthest as this all plays out – including investments totally outside the stock market that many Americans currently own. We’ll show you exactly what to look for in your retirement account (like a 401k) to make sure you aren’t at risk.

If you do nothing else, please heed these warnings.

Because believe it or not… these sort of things can play out even faster than I expect.

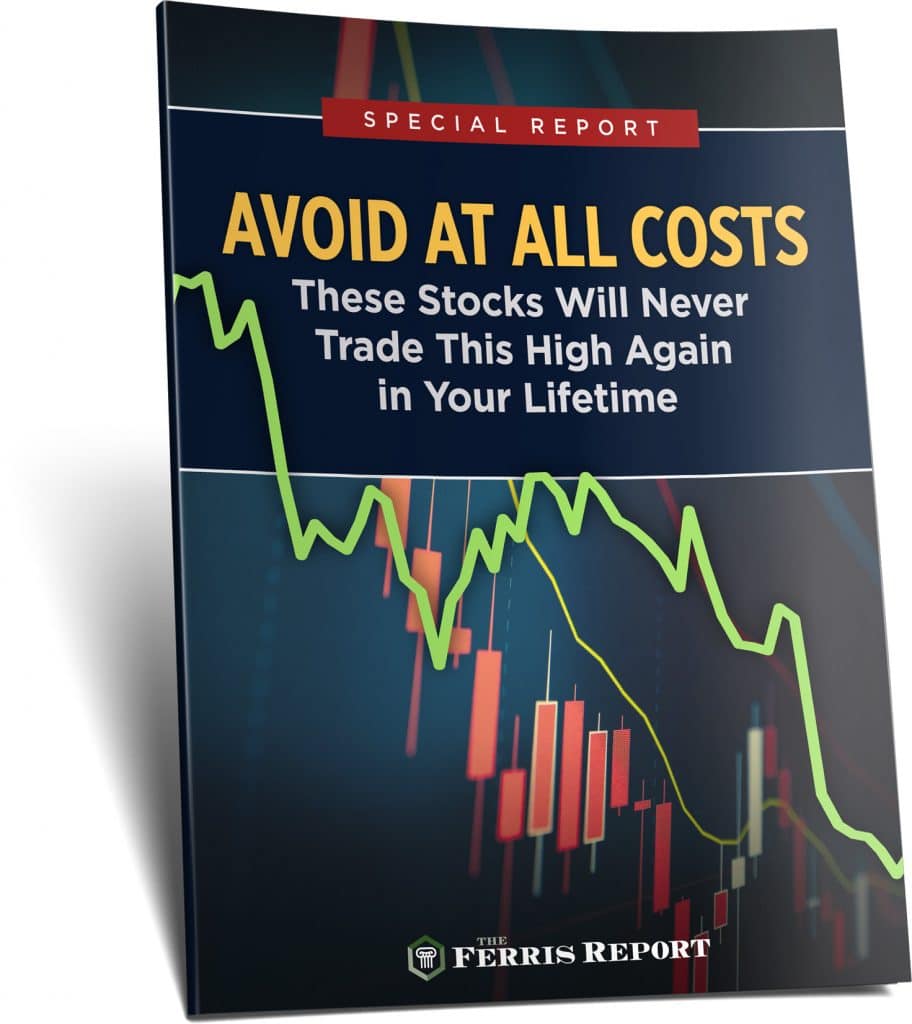

For example, three years ago I warned my readers that Peloton, the company that makes the popular at-home exercise bike, wouldn’t exist within five years.

Then as the pandemic raged, and speculators bid up the prices of stay-at-home stocks to frankly stupid prices…

The stock soared from under $25 before the pandemic to over $160 at its peak – a more than 500% gain in less than a year.

But it was clear to me that this business had no competitive advantage. Eventually folks would go back to the gym and – like every popular at-home exercise machine of the last few decades – Peloton bikes would end up collecting dust.

Well not long ago, the CEO of Peloton, Barry McCarthy, told the Wall Street Journal that the company has about six months left to grow its business dramatically – or the company won’t be able to survive on its own.

I’m sure I don’t need to convince you how difficult it would be to grow this company any larger than it was at the peak of home fitness shopping in late 2020.

But even though this was one of the most popular stocks in America two years ago – today it is down 95% from its peak.

And I think anyone who “buys the dip” today could be in for another 95% loss in the next six months.

So, making sure you aren’t invested in the wrong stocks is the first step. We’re already beginning to see a lot more stories like Peloton hit the financial news.

Everything you need to know is in our Avoid at All Costs report.

Now…

Every market-rattling event such as this creates not only losses, but big winners too.

Maybe this strikes you as self-serving or conniving.

If so, I’m sorry, I can’t help you. You’re welcome to lose as much money as you want.

Not me. And not my subscribers either. That’s why we’ve developed a series of simple steps to help you make a lot of money even if we don’t see most stocks trade this high ever again in our lifetimes…

Step #2: PROTECT AND MULTIPLY YOUR WEALTH – MOVE YOUR MONEY TO THESE INVESTMENTS

Once you’ve made sure you aren’t holding any of the dangerous stocks and other investments I just mentioned…

The next thing you need to understand is what investments are likely to preserve and grow the value of your money in the coming years.

Of course, I don’t recommend you put all your money in one place. No serious investor would ever tell you to do that.

Instead, as I’ll show you, there are several investment themes you are going to need to take advantage of.

Value Partners Group, an asset management firm with nearly $7 billion assets under management, has studied the performance of value investing in Japan’s stock market during the two decades following the 1989 crash…

And according to their research, there’s one specific type of stock that could’ve made 4x your money following the crash while Japan’s stock market dropped 62.21% over the same period.

However, one segment within that group of stocks did even better…

By narrowing the group down further to one key metric, you could have actually turned $1 into $17.17, a 1,617% gain over the period – that’s more than four times better than value stocks as a whole!

The same group of stocks could have made you huge gains during the other multi-decade dead-zones that occurred in America too, like following the crash in 1929… 1966… and the dot-com crash.

It probably won’t surprise you to know that many of the wealthiest guys in America are now in on the exact same type of investment I’m going to show you how to use.

I’m talking about guys like Ray Dalio, Stanley Druckenmiller, Dan Loeb, Ken Fischer, Seth Klarman, and George Soros.

I’ve seen this group of stocks soar more than 500% in just a few years. I think you could conservatively make that much going forward. But I think you’ll do even better when we help you narrow your focus to just a handful of the best stocks in the group, which we expect to soar higher than anything else.

I’ve put everything you need to know to get started, including the names and ticker symbols of the stocks I think will soar higher than any others over the next few years in a brand-new report called…

The Best of the Best – The ONLY Stocks That Can Safely 8X Your Money During America’s “Dead-Zone.”

These stocks are already up nearly 100% since the government began its unprecedented money printing in response to the pandemic. But they have much, much further to go. You want to get in now.

Step #3: Get Some Money OUTSIDE the U.S. Dollar

I’ve already explained how much damage the government has caused thanks to ultra-low interest rates and trillions of dollars in additional stimulus over just the past few years.

The biggest result of the central bank’s irresponsibility has been rampant inflation like we have experienced here in the United States since the 1970s.

During the 1970s, the price of silver went up 2,400% and the price of gold went up 2,300%.

I think it makes sense for every American to go out and buy gold and silver bullion and to keep it in a safe place.

But I want to show you something totally different, which I’m almost positive you’ve never considered.

It will cost you just a few hundred or few thousand bucks to get stated… but when gold and silver prices move… you can expect to see your investment move four or five times more.

I believe you could realistically make gains of 1,000% or more over a period of several years.

But you must keep in mind: This is a pure and absolute speculation. You will almost certainly have a few losses along the way. But it’s very low risk because you should be making a very small bet.

And if it hits as I expect, the gains will be game changing… you could make 10 times your money or more.

I’ve put the full details in a new report titled, Trade Your Dollars for Potential 1,000% Gains Thanks to Gold and Silver.

But be smart. If you can’t afford to speculate, if you can’t afford any losses, stick with the other stuff I’m going to show you how to do.

Like this…

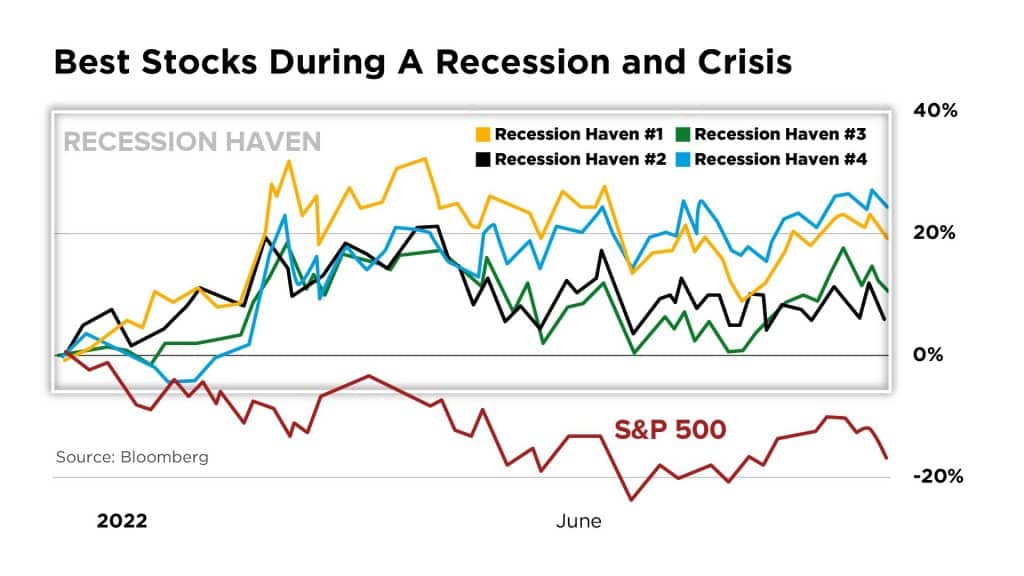

Step #4: These Stocks are MORE Than Just a Recession Haven

There’s one more report I want to send you…

It’s a thorough analysis my team and I just put together, called: The Recession Haven That Could 7X Your Money in 10 Years.

And it’s perfectly suited for you if you want to keep money in the stock market with less risk.

You see, while inflation squeezes consumers and the economy continues a long period of sluggish growth, companies that the government will increasingly depend on as the world grows more volatile will be great places to protect and grow your money.

These are some of the most financially stable companies in the world, and they will be hurt much less than everything else during this crisis.

You can safely put your money in these companies today, and probably never look at them again for the next five years.

And by the way, these stocks are all showing double-digit gains this year while the rest of the market is down around 20%! They also outperformed the S&P 500 since 2001 by nearly 60% with no signs of slowing down.

Demand for their products is skyrocketing with backlogs swelling to historic levels.

I can’t say any more about any of these ideas right here.

But if you want to take advantage of these opportunities right away, it’s easy to do.

As I mentioned, I started working at Stansberry Research nearly 20 years ago as the company’s first stock analyst. Worldwide, we employ over 200 people with just one goal: To run a profitable business that helps folks make the best possible decisions with their hard-earned money.

Since we started this business nearly two decades ago, we have shown a lot of people the opportunity to make a lot of money.

I know…

You hear lots of people say that. They talk about their winners of 100%, 200%, 500%, or more.

But you and I both know… that’s all B.S.

The next time someone claims such a thing, ask to see their complete record. I think our firm is the only one in the entire industry that publishes a full track record, every single year.

I wonder why?

What really counts is helping folks transform their financial lives over a period of several years.

Here’s just a tiny fraction of the notes I’ve personally received in the past few years from my followers…

“You have helped me put six grandkids through collage with no debt. One through law school, one in medical school, and one who has given me two great grandchildren.” – Mark M.

“I went from $ 3000 in Apple to $ 200K over 8 years.!!” – Jim S.

“[Your recommendations] have done quite well, with gains of 50% to 250%, and have actually fared much better than my other investments during this recent economic turmoil.” – Bernie M.

The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Now look, I can’t promise you’ll make a large fortune following our research. And there’s actually a good chance our work is not right for you. All investments involve risk, and past performance does not indicate future returns. Folks who don’t understand that should not be reading my research, period.

Also, we frequently offend folks with our views on personal responsibility and government incompetence.

What I can tell you is that:

- We’ve had incredible success over nearly two decades helping people radically change their financial lives.

- Our work is ridiculously inexpensive compared to its value.

- You can try it risk free, because I simply don’t want your money if you’re not happy with our work.

But listen, before you decide whether or not to find out more about the coming multi-decade “Dead-Zone” in stocks… and before you decide you want to re-order your financial affairs a bit… I’d like for you to simply pause for a minute.

Don’t listen to what I’m saying.

Don’t pay any attention to the facts and historical examples in this presentation. Don’t think about the facts or figures.

Just think for yourself.

Think about how many things you’ve seen in our country that simply don’t make sense.

Digital images selling for millions of dollars… used cars selling for more than the price at the dealership… companies with no profits worth billions of dollars… houses doubling and tripling in value in just a few years.

Canceled student debt… calls for reparations and trillions of dollars in new government spending with no end in sight.

Inflation, we are told, is “transitory” but never seems to go away… stagnating wages… and billionaires who grow richer by the day while most others get left behind.

If any of this seems normal to you… put this presentation aside.

But I’m sure if you’d think for just a minute, you’ll realize you’ve been wondering about all of this stuff for years.

Something in our country just hasn’t been right. Hardly anyone is proud to live within their means. Or can be trusted.

Haven’t you wondered if there was something behind the growing desperation you sense among your friends and neighbors… something to explain what’s been going on?

There is.

The historic amounts of debt and new money our country has created out of thin air has done all sorts of funny things to the economy, and I believe the situation has finally hit a tipping point.

That’s probably why famed American investor and hedge-fund manager Stanley Druckenmiller has been warning that “There’s a high probability in my mind that the market, at best, is going to be kind of flat for 10 years.”

And it is likely why Ray Dalio, the founder of the most successful hedge fund in history simply says, “The biggest market crash of our generation is coming.”

Remember: the destruction you’ve seen in financial markets so far could be just the tip of the iceberg.

The mother of all crises has been brewing for more than 20 years.

The government made borrowing money almost free. So, it should be no surprise that instead of getting out of debt, Americans – particularly the poor – have piled on huge new debts.

Corporations have too. And of course, the government is now more in debt than anyone else.

There are huge losses coming. Economists know it. Most of the senior leaders in Washington know it too.

Is it really going to be a surprise after what we’ve seen over the last 10 years that we are now in for a decade or more of a market “reset” where stocks go lower or nowhere at all?

Only if you’ve completely ignored everything going on around you in the financial and political world for the past 10 years.

Get the facts for yourself. Learn what you need to do.

Normally a year of my research costs $199, which I think is more than fair.

But because I want to introduce you to my work today, I’m offering you a 75% discount immediately.

Today, a one-time fee of as little as $49 entitles you to an entire year of my work with everything I’ve described here. Including…

My Monthly Analysis called: The Ferris Report – delivered on the fourth Wednesday of each month, around 5pm Eastern Time.

- Research Report: Avoid at All Costs – These Stocks Will Never Trade This High Again in Your Lifetime.

- Research Report: The Best of the Best – The ONLY Stocks That Can Safely 8X Your Money During America’s “Dead-Zone.”

- Research Report: Trade Your Dollars for Potential 1,000% Gains Thanks to Gold and Silver.

- Research Report: The Recession Haven That Could 7X Your Money in 10 Years.

PLUS: you’ll get our daily update, called The Digest, around 6 p.m. each day. There is so much to stay on top of in the financial markets today. Things are breaking apart faster and faster every week. But I’ll keep you posted on everything you need to know.

You’ll also have subscribers-only access to nearly my full library of financial ideas, secrets, and strategies that could change your life.

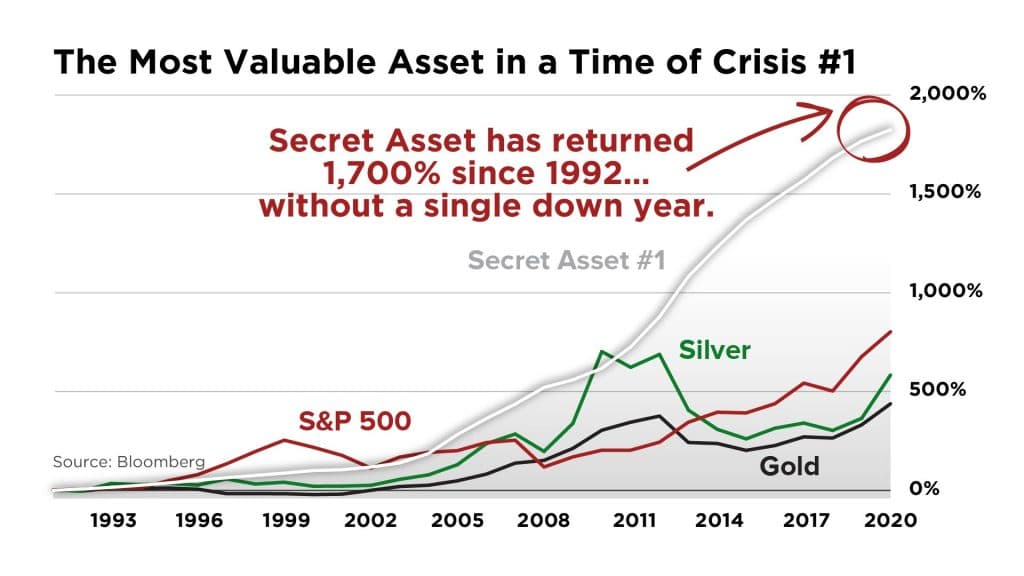

For example, right now it’s critical that you know about two assets that go up the most (with the least amount of risk) in times like this. Be sure to also read: The World’s Two Most Valuable Assets in a Time of Crisis.

The first is up 1,700% over the long term, without a single down year in decades.

And the second has safely delivered income of around 12%-14% per year for the last 30 years without fail.

Everything you need to know is in these Research Reports, which you’ll gain access to in a matter of minutes.

And like I said: if you’re not happy with my work for any reason, just let us know within 30 days of placing your order, and we’ll part as friends. You’ll receive a full refund, so there’s really no risk to taking this offer. But so much to gain.

100% Satisfaction Guarantee

Take the next 30 days and review everything we send you…

Including all of Dan’s new special reports, his actionable recommendations, his entire model portfolio… plus all your free bonuses.

If your subscription isnt everything you expected, simply contact us within the first 30 days and we will issue a full 100% money-back refund, no questions asked.

Dan Ferris

The Ferris Report Editor

To get started, click the “Get Started” button below.

This will take you to a Secure Form… where you can review everything once more, before submitting your order.

Please, please, take everything I’ve shown you today seriously.

Remember, the moves you make with your money in the coming days could be the most important of your life.

Dan Ferris

December 2022