Due to rising environmental awareness and the need for environmentally friendly transportation options, the electric vehicle (EV) industry has experienced an extraordinary rise in popularity in recent years. Investors actively seek ways to profit from the EV revolution as the globe transitions to a greener future. They are also looking for the next major player to revolutionize the market. In this article, we delve into the captivating realm of electric vehicles and unveil a stock that has garnered significant attention as the leading EV investment opportunity.

Furthermore, we will explore the bigger picture of the market for electric vehicles, looking at the current trends, obstacles, and possibilities that influence the sector—starting by introducing a financial analyst and investor known for his expertise in the stock market and investment strategies who has boosted these types of investments.

His name is Enrique Abeyta.

And he’s proof that the American dream is alive and well.

Enrique Abeyta’s Background

Born into extreme poverty, he spent his childhood bouncing between cheap motels and run-down apartments.

His father was an alcoholic truck driver and hairdresser, his mother a political exile from Uruguay.

But even though the odds were stacked against him, Abeyta was a gifted student… ranked second highest in his graduating class… and won an internship in the office of Senator John McCain.

He went to the University of Pennsylvania’s Wharton School, the oldest and most prestigious business school in America.

Abeyta’s fellow alumni include Warren Buffett… Elon Musk… former President Donald Trump… Peter Lynch… and current and former CEOs of Apple, Alphabet, Pfizer, and Johnson & Johnson.

At Wharton, he learned how to invest… rose to be the editor-in-chief of The Red and Blue, a conservative newspaper… and once again graduated near the top of his class.

Abeyta moved to New York, where he worked as a banker at Lehman Brothers.

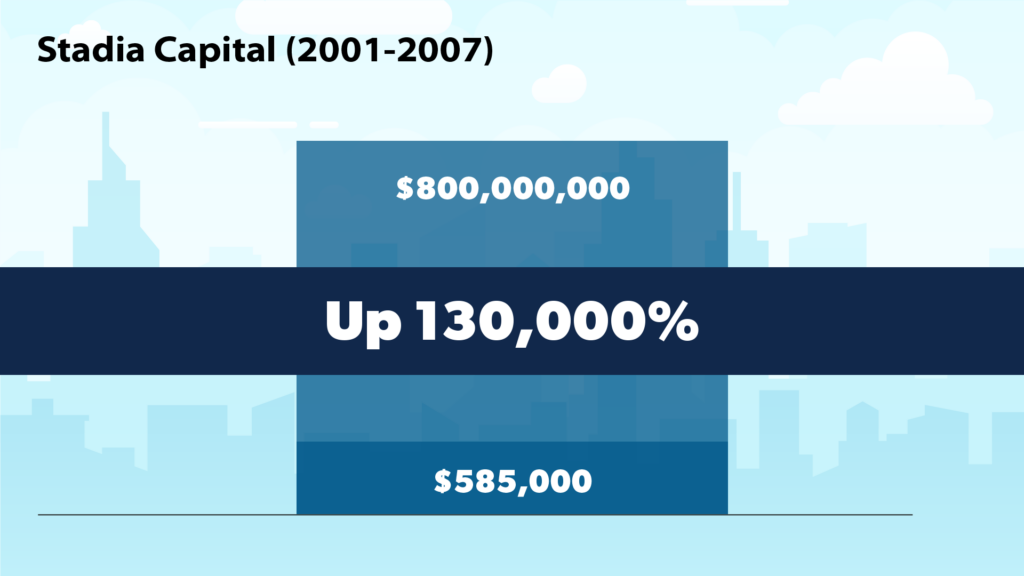

In 2001, he launched his first hedge fund… grew its assets from $585,000 to $800 million, a 130,000% increase… and beat the market nearly 17 times over.

Throughout his career, Enrique Abeyta’s raised over $2 billion in investment capital from over 100 institutional, pension, family office and high-net worth investors.

He’s made his clients double, triple, and even 8 times their money.

- 102% in 19 months

- 103% in 26 months

- 112% in 25 months

- 168% in 22 months

- 230% in 23 months

- 240% in 24 months

- 788% in 10 months

And he’s been profiled by The Wall Street Journal, CNBC, Barron’s, Institutional Investor, Forbes, Business Insider, and Bloomberg.

But Abeyta’s never forgotten where he came from.

After he made his first two million, he wrote his mother a check for 750 grand – and told her she never had to work again.

He proudly supports our troops and has helped numerous vets find success on Wall Street.

And he turned down a seven-figure job offer to return with his family to his hometown in Arizona – and to be a good father to his three young children.

Today, Enrique Abeyta writes for one of the top financial research firms in the world… and he’s pounding the table on a $12 stock that he believes EVERYONE should own.

This company is an automaker that’s at the center of the global shift to electric vehicles (or EVs).

It’s just launched a vehicle that the Wall Street Journal calls “an American manufacturing triumph.”

And Enrique Abeyta believes this vehicle will outsell anything released by Tesla, Rivian, or any other trending EV start-up.

But if you want the chance to make money from this launch, you must take action before Thursday, February 2.

And now, for the first time, Abeyta will blow the lid off this little-known investment story and detail his #1 EV stock for 2023.

Stay tuned…

Enrique Abeyta and EV Stocks

Hi, I’m Enrique Abeyta. And I’m going to tell you about the biggest economic story that the mainstream press is completely missing.

Despite all the round-the-clock news coverage of red-hot inflation, the war in Ukraine, and the stock market bloodbath…

Most people have no idea this is happening.

As we speak, the world’s smartest money is currently gearing up for what could be the most lucrative sea change in 109 years.

Nearly every bank, brokerage, endowment, insurer, and hedge fund on the face of the planet is pouring a total of $520 BILLION into what I call the “Master Reset” of the automobile industry.

And if you ride their coattails, you could turn a small stake into a MASSIVE return over the long term.

After all, we’re talking about a $3.8 trillion market that’ll be rebuilt virtually from scratch…

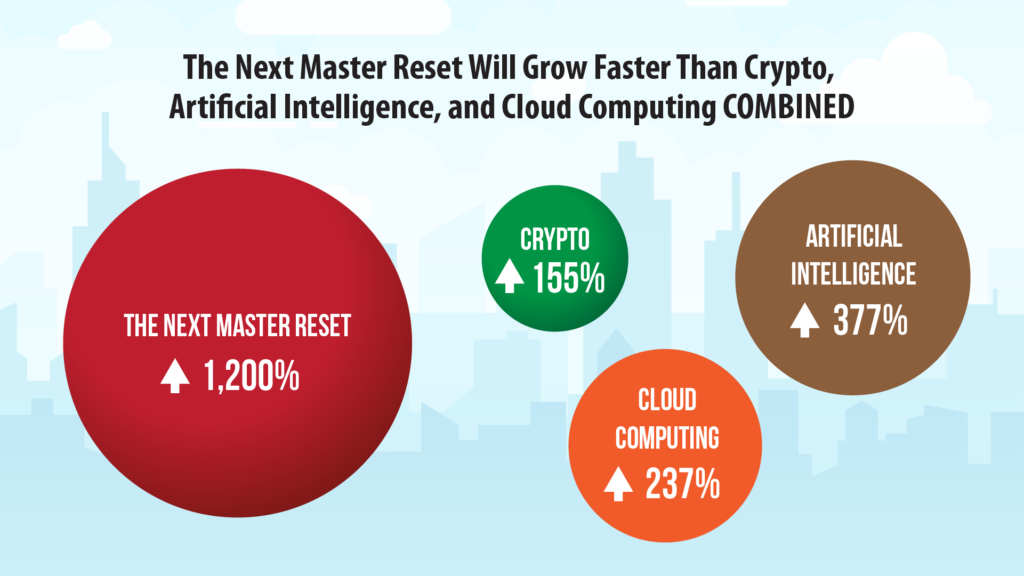

And grow faster than crypto, artificial intelligence, and cloud computing COMBINED.

Cal-Berkeley professor and Secretary of Labor finalist Harley Shaiken says…

And former Nissan Executive Andy Palmer says…

EV Stocks List

I’m talking about the industry-wide move to electric vehicles (EVs)…

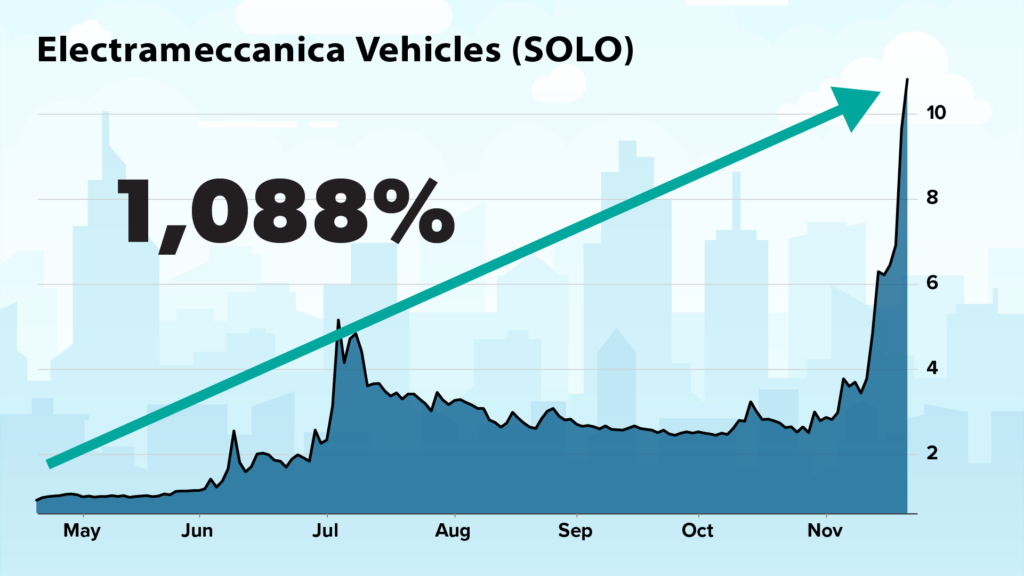

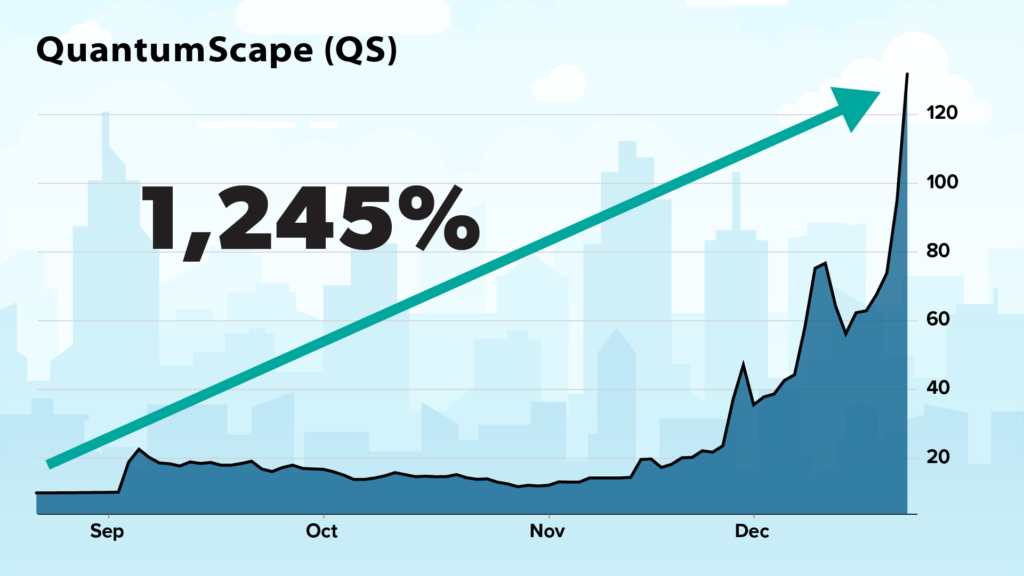

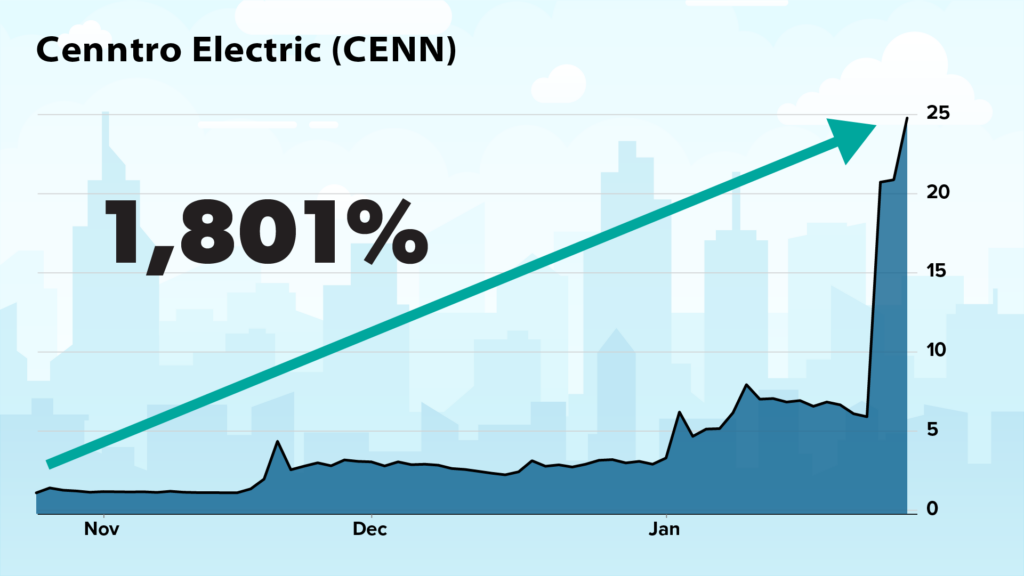

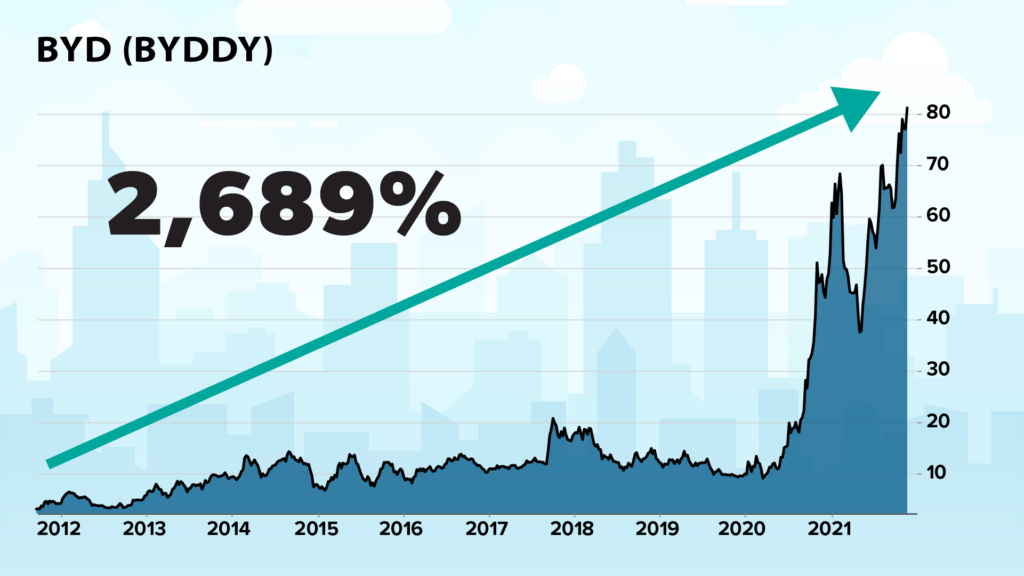

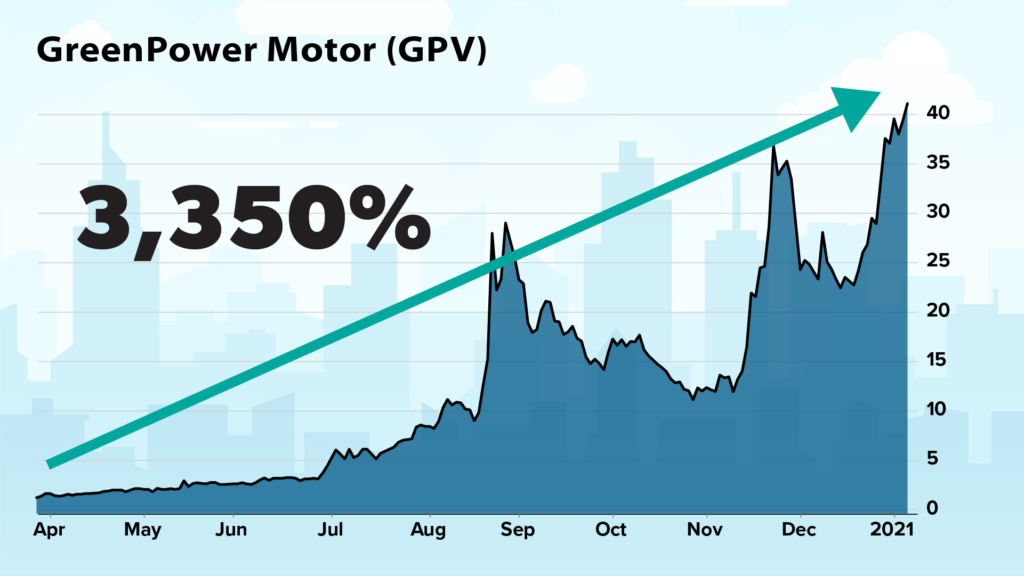

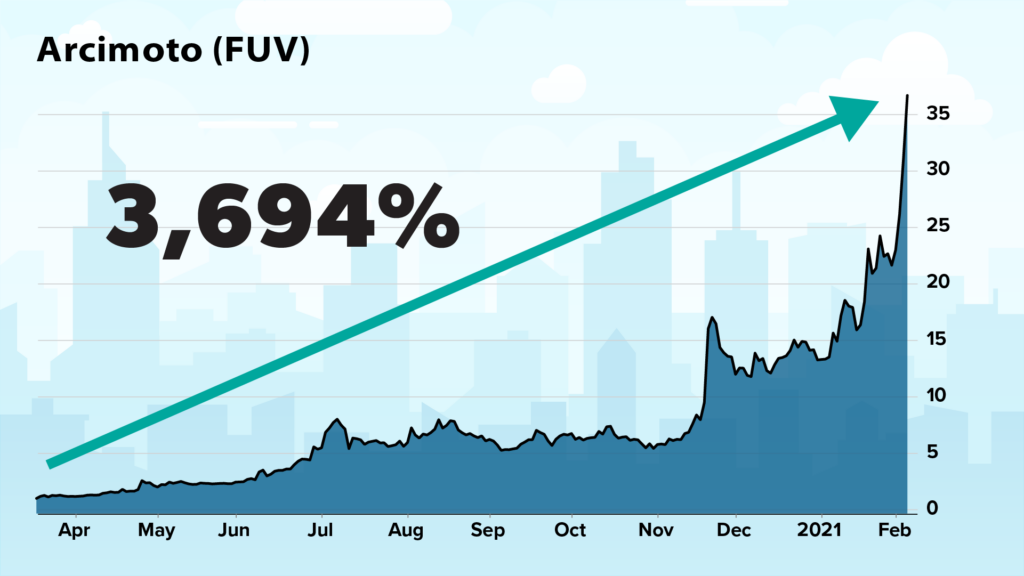

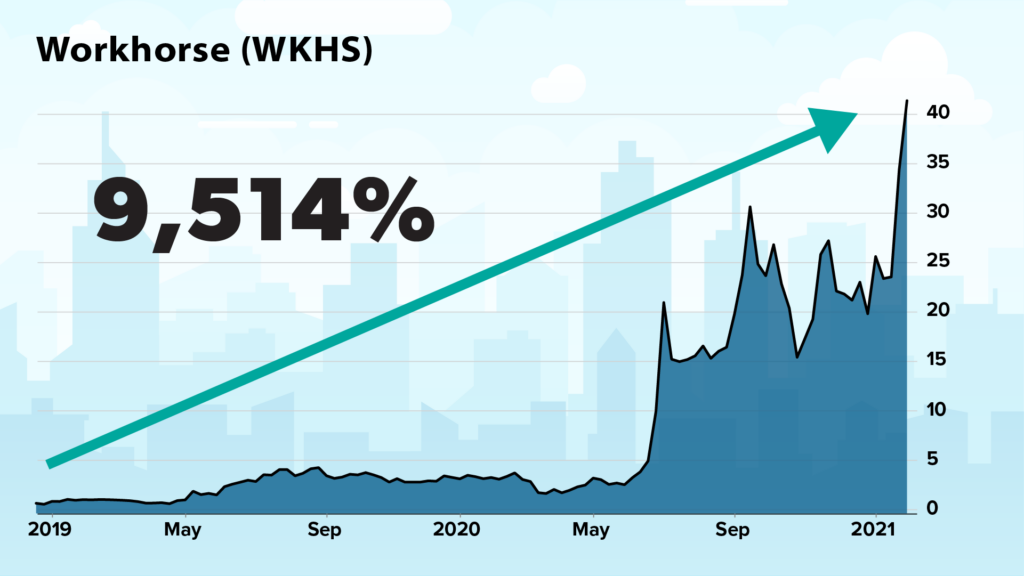

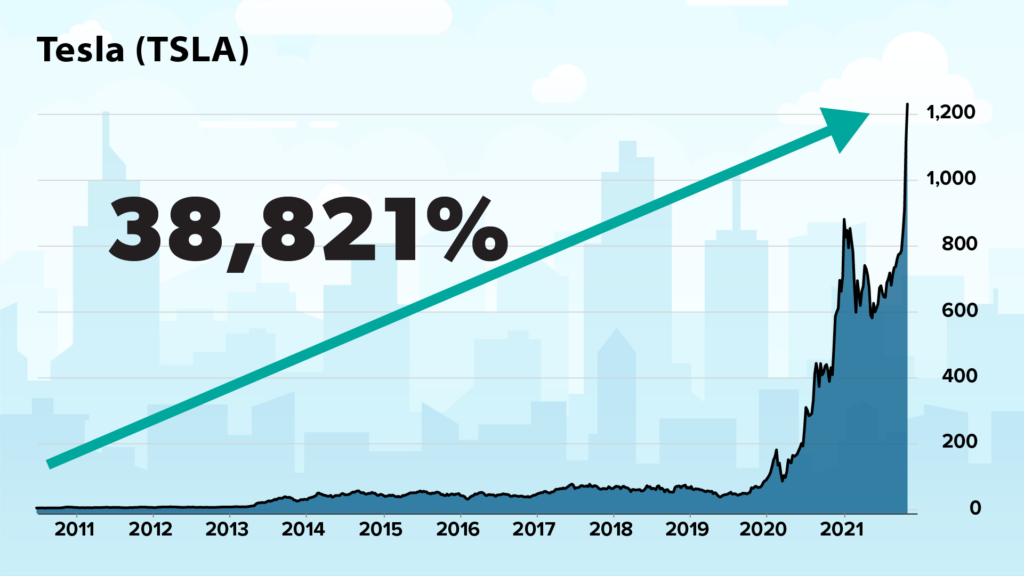

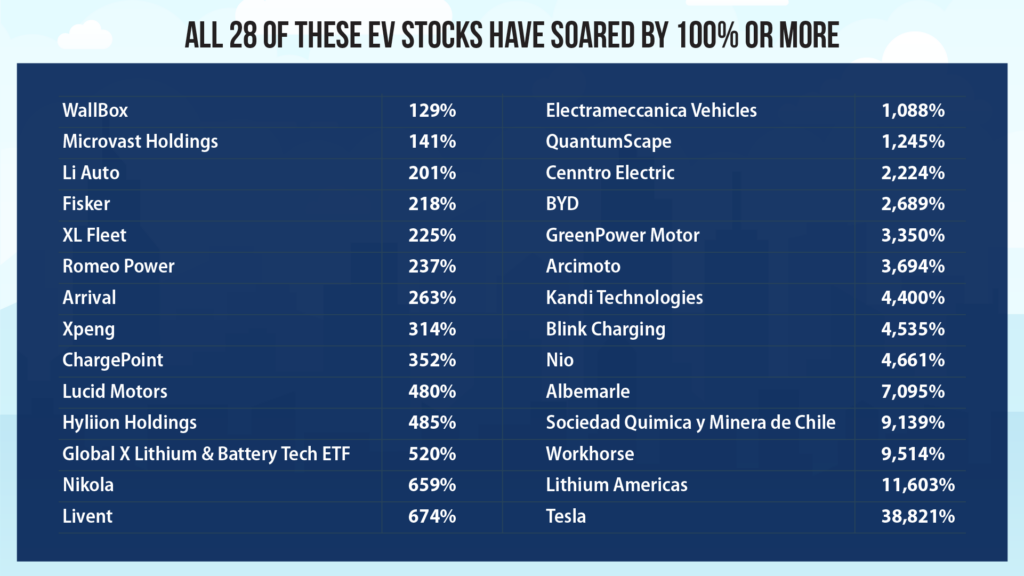

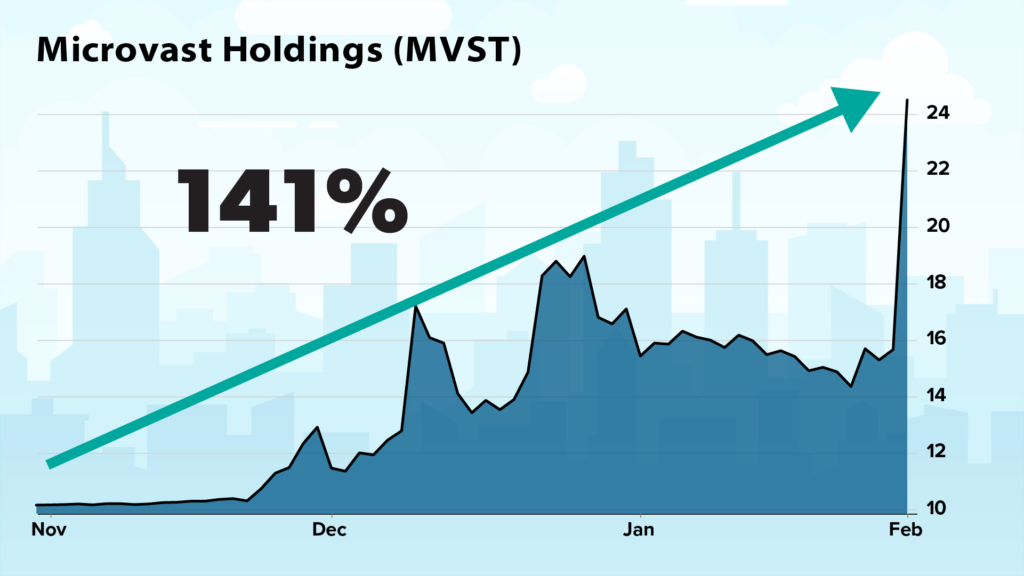

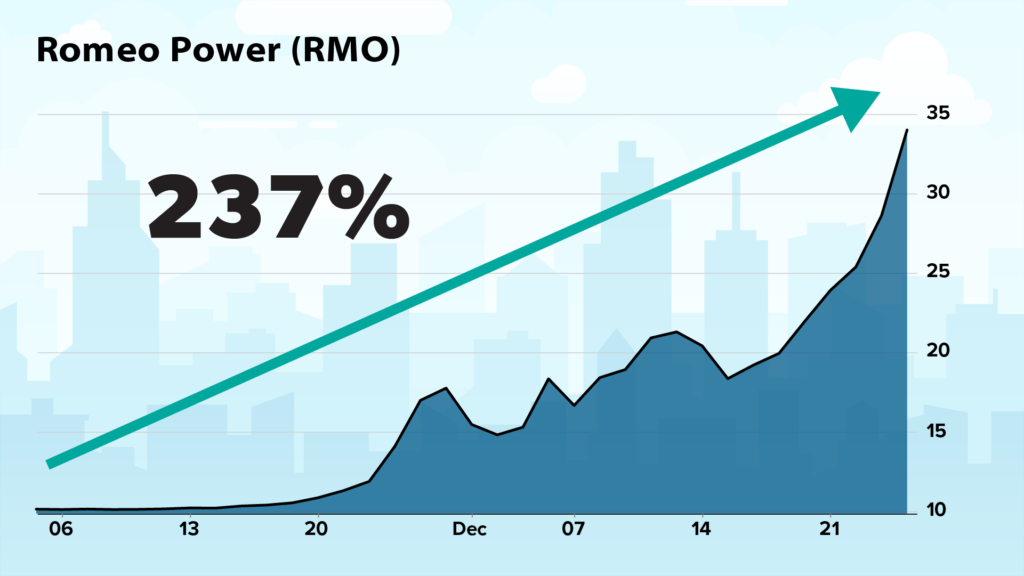

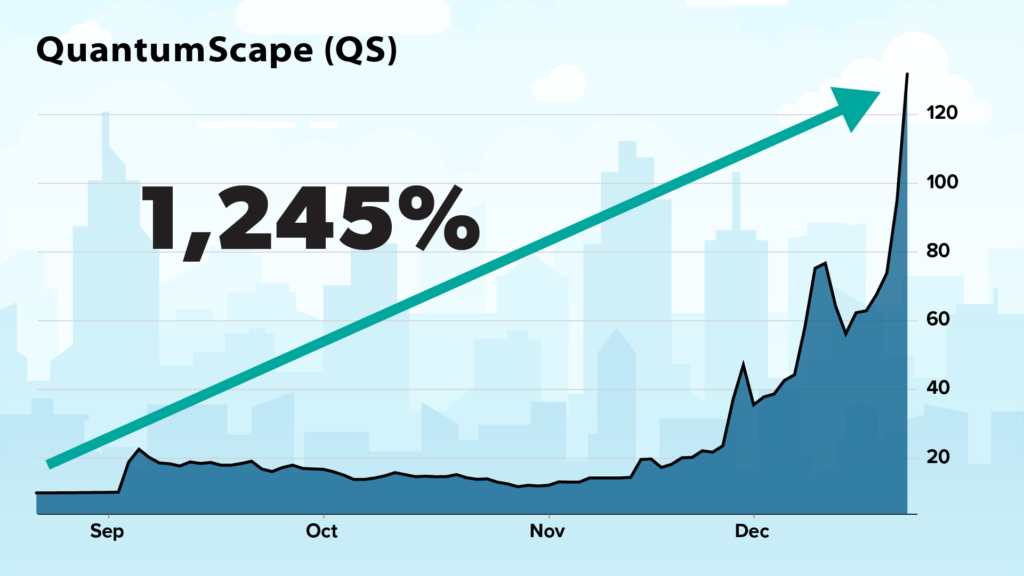

The charts you see here are all the best examples of EV stocks that could’ve handed you ten times your money… thirty times your money… and even higher.

But if you think the train has left the station, that couldn’t be further from the truth.

I predict that a combination of…

- An opportunity to put as much as $38,129 in your pocket…

- A new technology that could enable you to earn $5,000 a year without working or investing…

- Another tech that’s set to make charging an electric car as quick and convenient as filling up a gas tank…

- And a steep markdown in EV prices…

Will make consumers “go electric” far faster than most people expect.

My proprietary research – which is based on a survey of more than 1,100 automotive executives across 31 countries – indicates that…

EV Stocks: Enrique Abeyta’s Prediction

The EV market is set to grow by an average of 133% every year.

Now here’s the part of this story that most people are completely in the dark about…

You see, if you listen to the mainstream press, you’d think Tesla, Rivian, or some “breakthrough” battery maker will dominate this market.

But I predict that one unexpected automaker will outsell all of them.

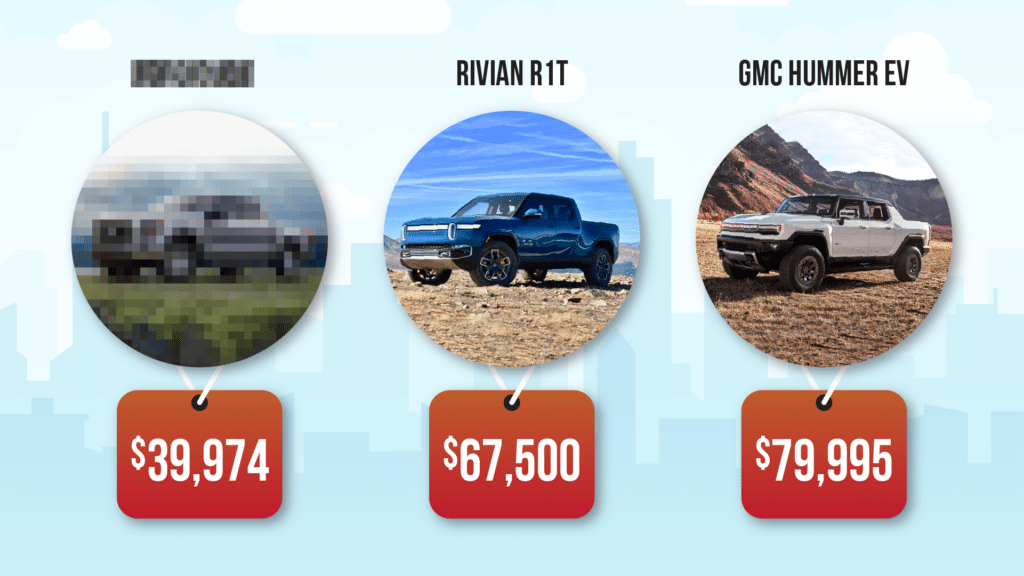

My #1 EV stock for 2023 just launched a new vehicle that’s up to 50% cheaper than the competition.

It’s the first electric version of a line of vehicles that singlehandedly makes more money than McDonald’s, Nike, Coca-Cola, and Starbucks.

If any EV can take this movement mainstream, it’s this one.

And the top brass at this firm knows it.

Its executive chairman recently bought $13 million worth of shares…

This is a company that I believe EVERYONE should own.

And at just $12 a share, it’s also a stock that everyone can afford.

But here’s the main reason I’m pounding the table on this stock…

I believe it’s about to make a HISTORIC business move that could take its shares even higher.

It involves Wall Street’s favorite seven-letter word.

It’s a word that billionaire hedge fund manager Joel Greenblatt says can “make you a lot of money.”

And that Peter Lynch – one of the greatest investors of all time – says “often results in astoundingly lucrative investments.”

And if you hear me out, I’ll both blow the lid off this major move – and give you the full scoop on my #1 EV stock for 2023.

You’ll want to move on this special situation quickly.

That’s because if you don’t position yourself for this set-up by February 2, you run the risk of missing out on this once-in-a-decade opportunity.

In My Entire 25-Year Wall Street Career, I’ve Never Seen Anything Like This…

That said, I can understand if you’re hesitant to buy stocks right now.

Inflation is at a 40-year high.

The Fed is hiking interest rates and slashing its balance sheet by as much as $95 billion a month.

And the Dow is down nearly five thousand points since the start of the year.

But here’s the thing…

The last time market fears were this wild, I showed my readers the chance to make a TON of money.

It was March 2020.

And I got in front of a camera with Wall Street legend Whitney Tilson and called it “the best investing opportunity of the past decade.”

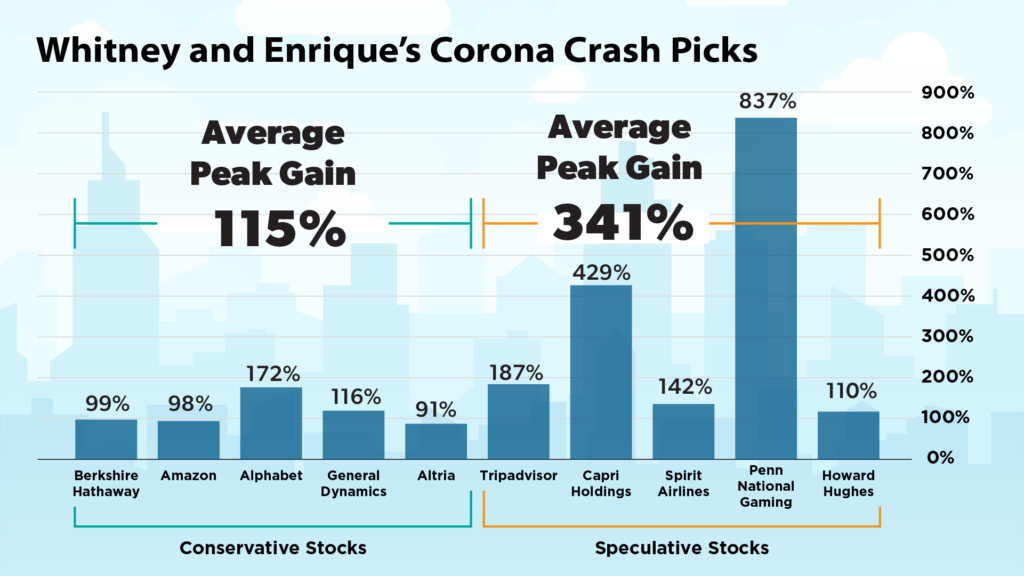

We recommended two baskets of stocks, one conservative and one speculative.

Now, get this… The conservative stocks soared by an average peak of 115%.

The speculative picks went up by an average peak of 341%.

And our biggest winner – Penn National Gaming – jumped by as much as 837%.

And even with the recent market rout, all but one of these positions are still in the green.

What’s more, many of them remain up by 100% or more.

But as amazing as that opportunity was, I don’t think it holds a candle to this set-up in the EV space.

That’s because “Master Resets” are once-in-a-decade economic events that give investors the chance to generate extraordinary returns.

So if you regret missing out on the Covid-19 market rebound, you’ll doubly regret missing out on this.

I’ll give you all the details on the $12 stock at the heart of this game-changer – and why you need to swing into action by February 2.

How A Few Self-Taught Tech Wizards

Triggered an Ultra-Lucrative “Master Reset”

But before you do anything, you need to understand “Master Resets.”

That’s when a new technology or product comes along that changes the face of an industry in one fell swoop.

Consider the computer business…

For the better part of the 21st century, this industry was dominated by IBM and a group of companies commonly known as the “Seven Dwarfs”: Burroughs, Control Data, General Electric, Honeywell, NCR, RCA, and UNIVAC.

These companies made mainframe computers.

They were as big as a room… could only be operated by trained technicians… and cost $4.6 million a pop.

Only deep-pocketed corporations, universities, and research centers could afford them.

But in the 1970s, a group of self-taught tech enthusiasts entered the picture.

They used cutting-edge microprocessor technology to build computers that could sit on your desk… required no extensive training to operate… and were 99.9% cheaper than the mainframe computers of the time.

Investors who realized this innovation had triggered a Master Reset made off like bandits.

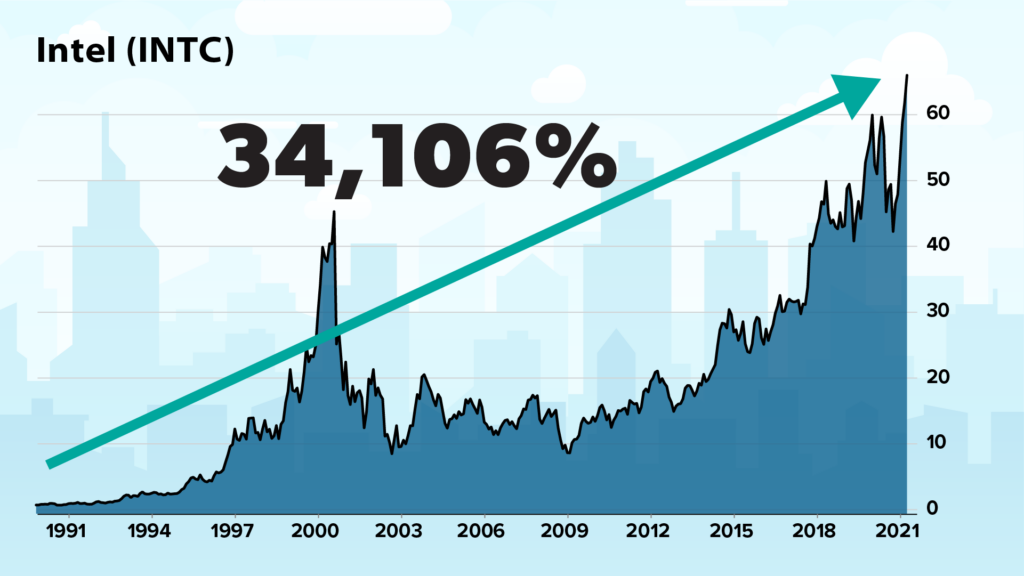

Intel – the manufacturer of those microprocessors – soared by as much as 34,106%…

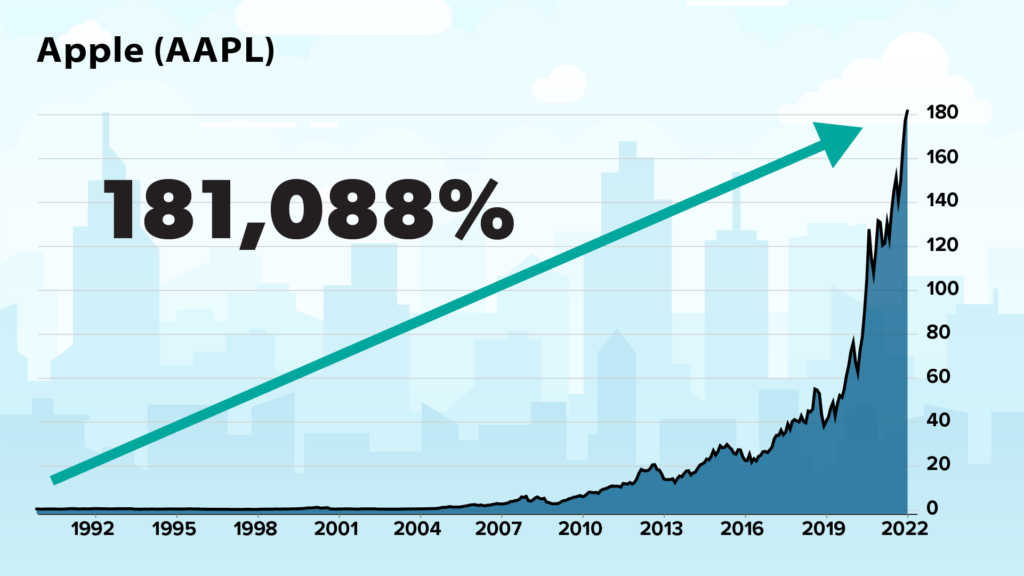

Apple – the maker of the first pre-assembled personal computers – rose by as much as 181,088%.

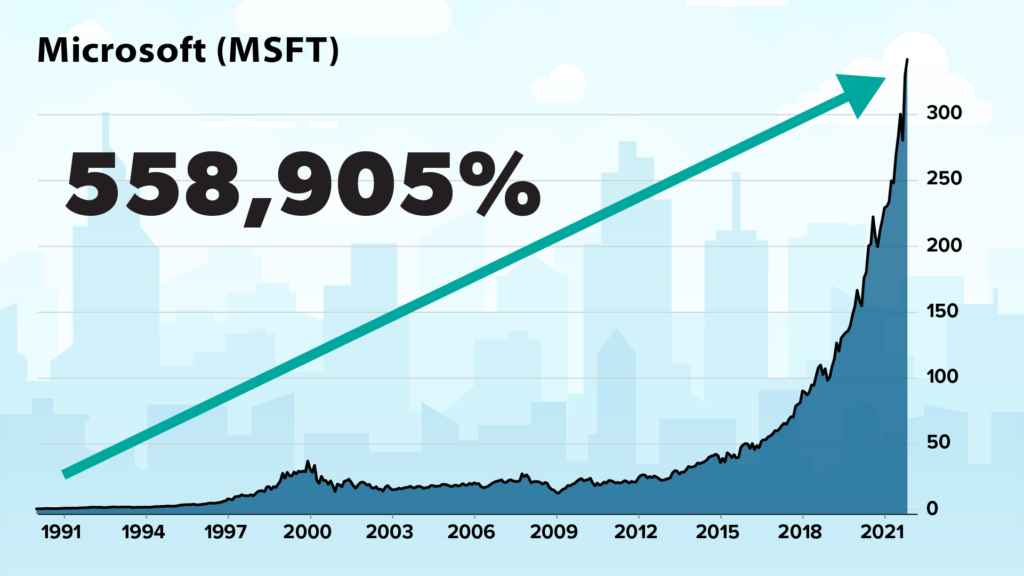

And Microsoft – the developer of the most popular operating system for PCs – climbed up to 558,905%.

But investors who dismissed PCs as fads fared horribly.

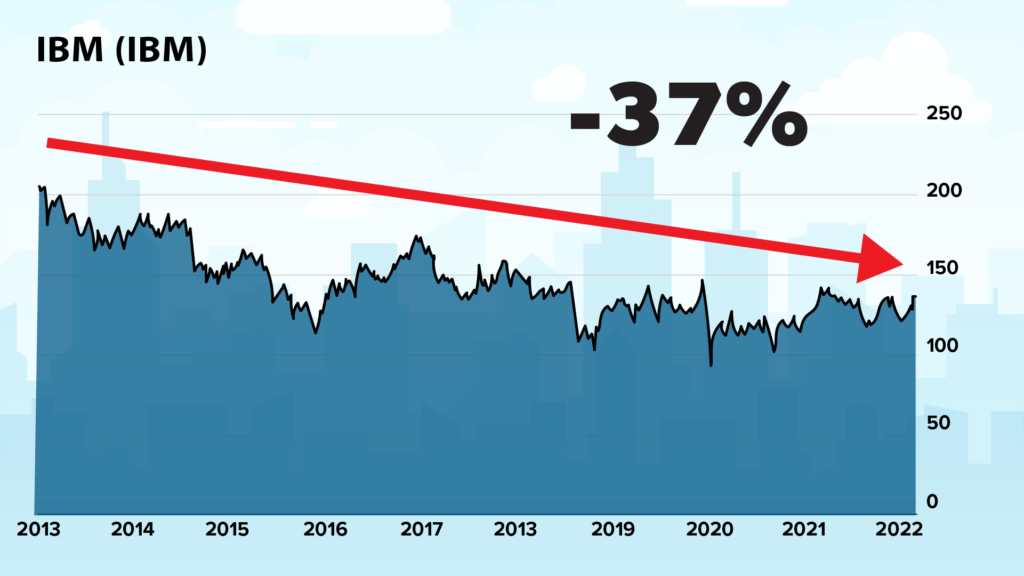

IBM – which once commanded 70% of the market – is down 37% from its 2013 peak.

And the so-called Seven Dwarfs have done even worse.

One analyst compared holding Control Data to “watching paint dry.”

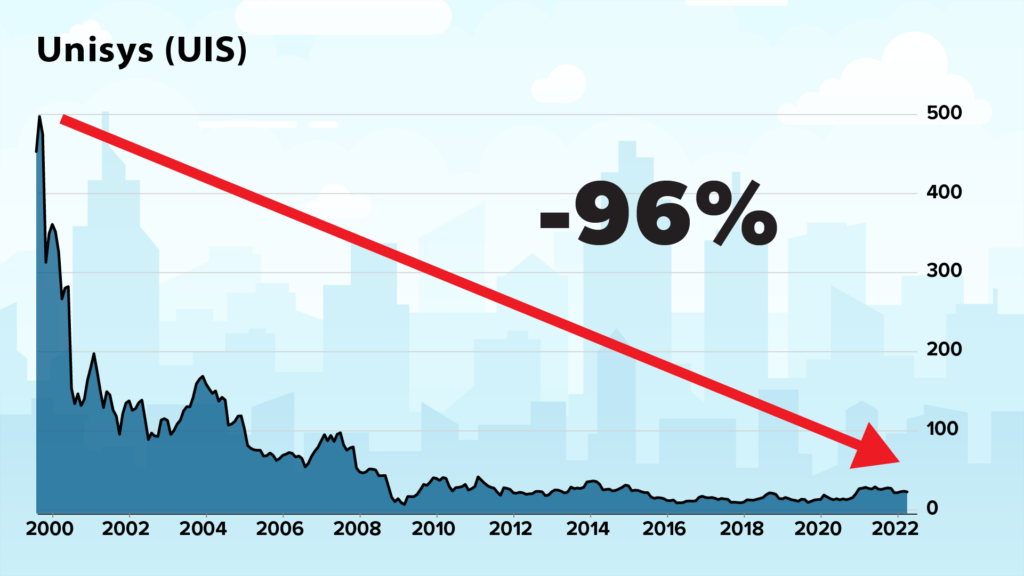

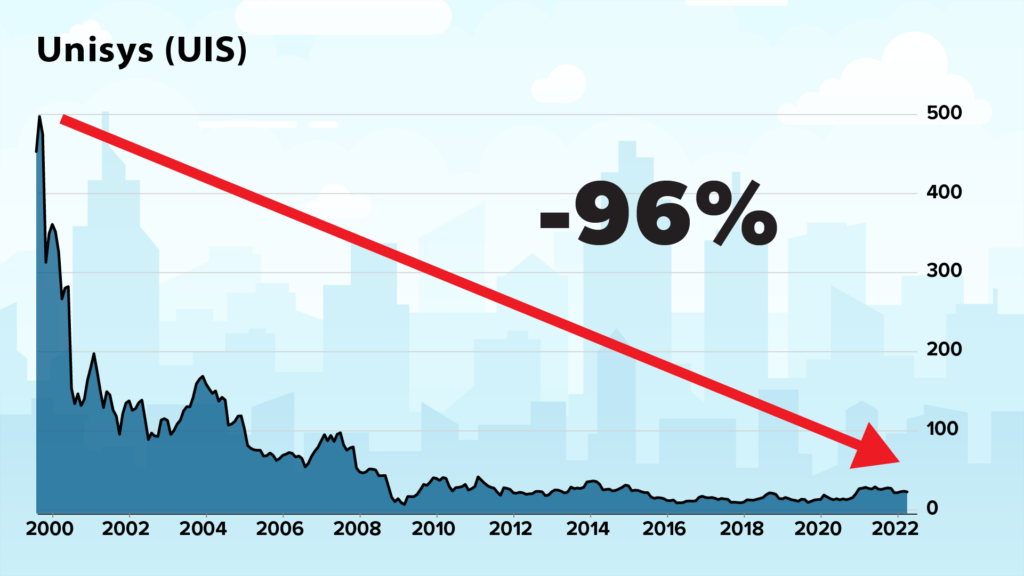

And Unisys – a merger of UNIVAC and Burroughs – is down 96% from its dot-com bubble peak.

Had you invested in Unisys, every $10,000 invested would be worth just $400 today.

When Jeff Bezos Triggered Retail’s Master

Reset, Some Folks Made Millions and Others

Lost EVERYTHING

That’s because when Master Resets happen, some fortunes are minted – and some are ERASED.

Just look at retail.

By the end of the 20th century, a group of department stores had DOMINATED this sector.

They succeeded with one simple business strategy: accept lower margins in exchange for higher volume.

This model was highly lucrative for DECADES – until 1995, when a Wall Street quant named Jeff Bezos discovered a way to take everything that worked about this model… and make it even better.

Bezos saw that by selling products online and taking storefronts out of the equation, he could achieve both high volume and high margins.

Hardly anyone realized it at the time, but Bezos had just set off retail’s Master Reset.

And the savvy few who recognized the Amazon founder’s achievement could’ve built extraordinary wealth.

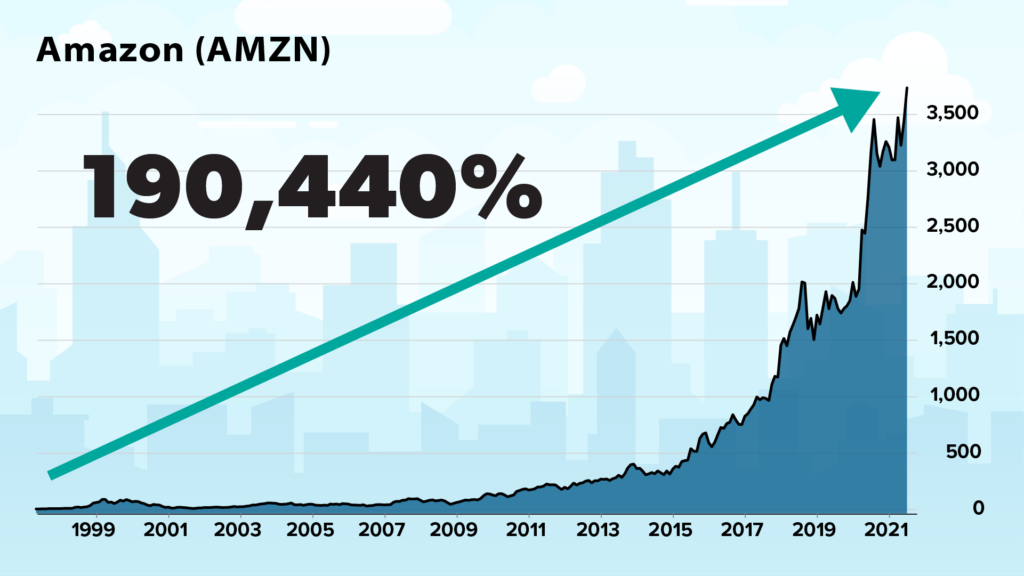

Amazon soared by as much as 190,440%…

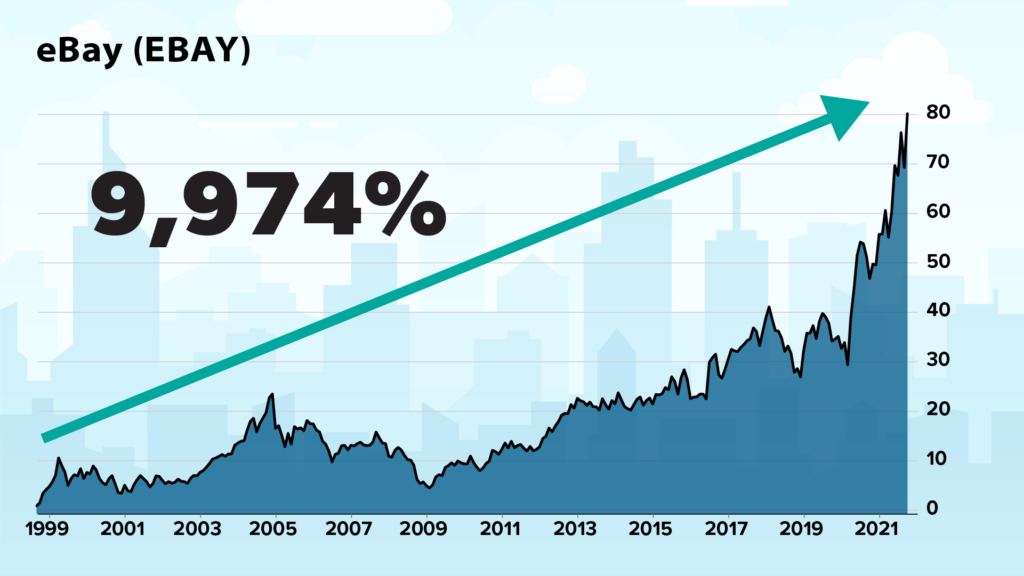

And its fellow e-commerce pioneer eBay surged up to 9,974%.

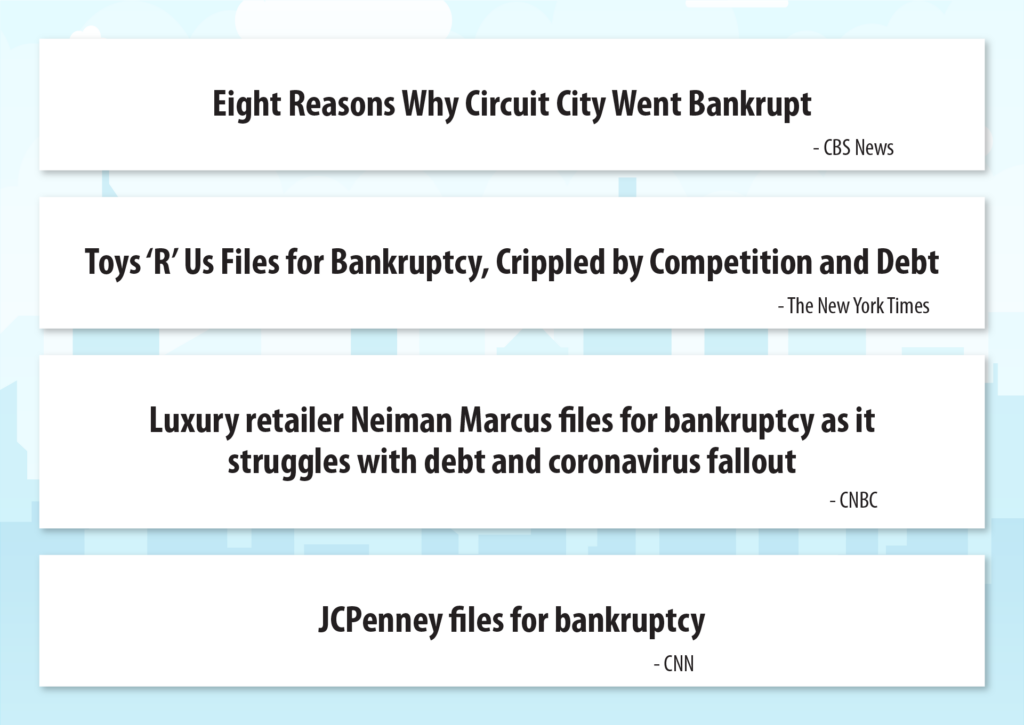

On the other hand, investors who bet on brick-and-mortar retailers got wiped out.

When Sears filed for bankruptcy in 2018, shares plummeted by 87%.

Circuit City, Toys “R” Us, Neiman Marcus, and JCPenney have all gone bankrupt too.

You see, there are two sides to every Master Reset…

The winners that seal one’s financial freedom – and the losers that take away your freedom when they go down.

AT&T Is Still Recovering from Telecom’s

Master Reset

Just look at the telecom industry.

For more than 100 years, landlines were the only game in town – and AT&T had a monopoly on them.

But in the early 1980s, two things happened that set telecom’s Master Reset in motion.

First, the U.S. government forced AT&T to split up into eight different companies, dissolving its stranglehold on the industry.

Then, the Federal Communications Commission (the FCC) started distributing spectrum licenses to run the cellphone systems in 30 major American cities.

Anybody could apply for these licenses. All you needed was money… an entrepreneurial spirit… and a TON of gumption.

This system paved the way for a group of scrappy upstarts to gain market share as the cellular revolution took shape.

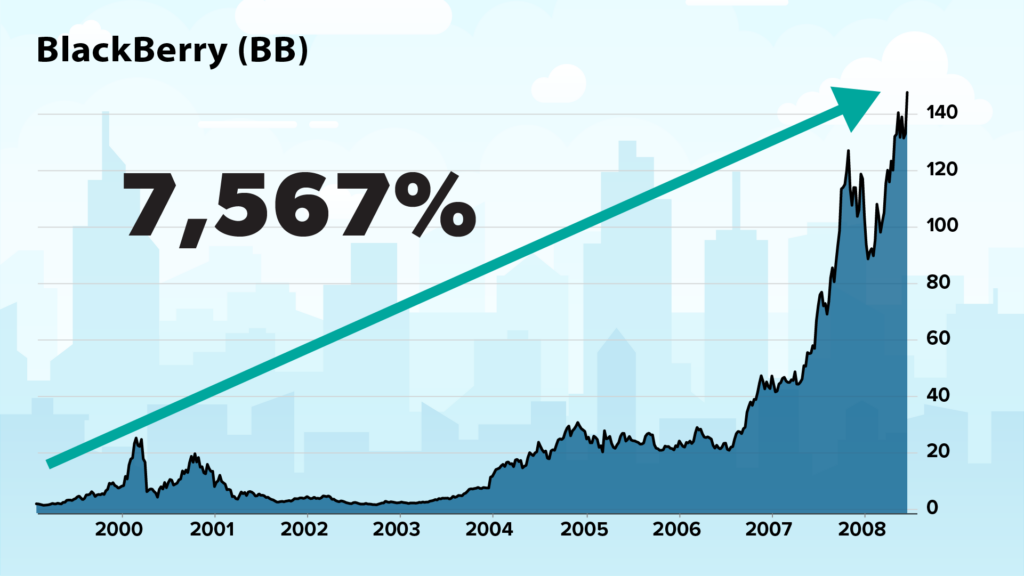

Mobile phone maker BlackBerry surged by as much as 7,567%…

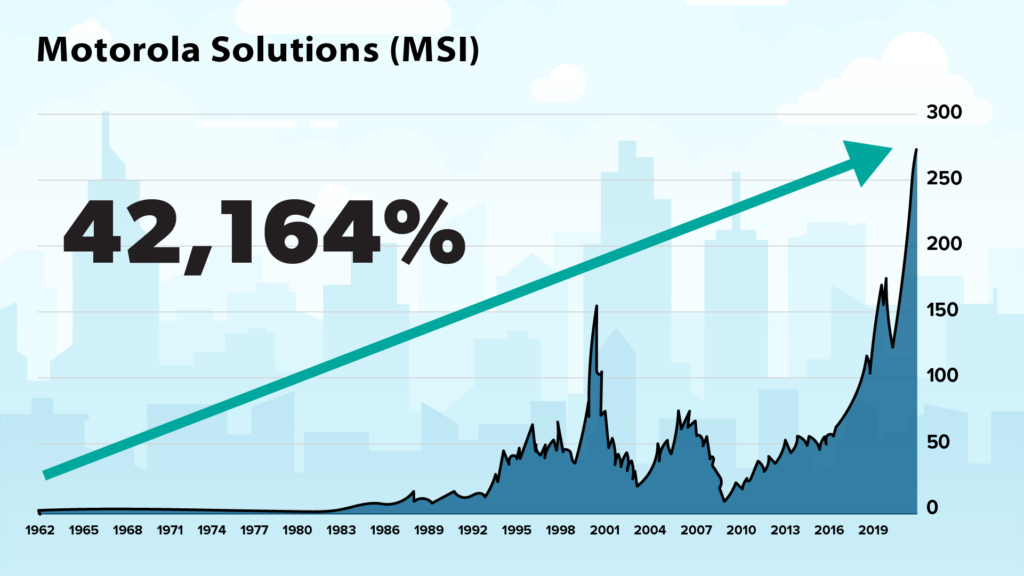

Motorola – maker of the legendary DynaTAC cellphone – went up to 42,164%.

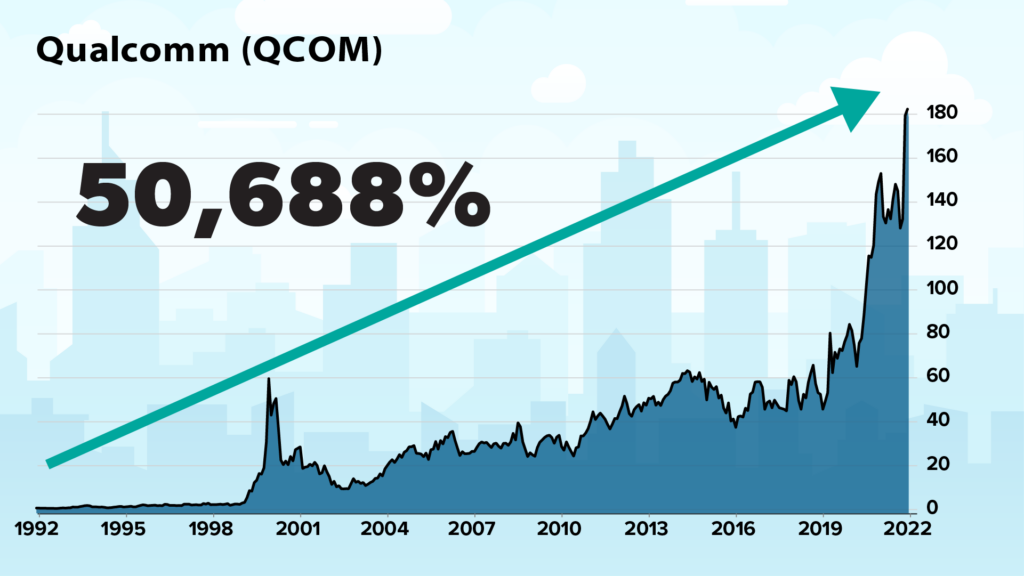

And cellular chipmaker Qualcomm rose by as much as 50,688%.

By getting in on these companies before their industries underwent a Master Reset, you could’ve booked MASSIVE gains.

Of course, the key is to get into the right stock… Not every one of them will be a success story.

There are bound to be some that just don’t pass muster. The point here is to highlight the potential.

And you know who didn’t see cellphones’ disruptive potential? AT&T.

In fact, in 1980, AT&T commissioned a study that claimed there would be only 900,000 U.S. mobile phone users by the year 2000.

They couldn’t have been further off. By 2000, 100 MILLION Americans owned cellphones.

That’s more than 100 times the number AT&T predicted.

And folks who trusted AT&T and put their money on the telecom giant went on to sorely regret it.

The stock’s been cut in half since its 1999 peak.

If you had bought at the top and staked $10,000, you’d have lost more than $5,000 by now.

If you don’t want that to happen to you, you must read this in full.

The Auto Industry’s Master Reset

Could Be the Biggest Reset Yet

And I believe the Master Reset it’s about to undergo will make the revolutions in personal computing, retail, and telecom look TINY.

We’re talking about a complete overhaul.

Assembly lines will be stripped out of factories and replaced with completely autonomous ones…

And entire plants will become immediately obsolete and shuttered on the spot…

Volkswagen’s CEO Scott Keogh describes it as “one of the biggest industrial transformations probably in the history of capitalism.”

That’s because the auto industry’s Master Reset is set to…

- Put as much as $38,129 back in consumers’ pockets…

- Give drivers the chance to make up to $5,000 a year by doing virtually NOTHING…

- Provide as much as 10 days of backup power during natural disasters…

- And give investors dozens of chances to multiply their money many times over.

And listen, if that last point gives you pause, just feast your eyes on all these winners.

2,689%… 4,661%… 9,514%… 11,603%… 38,821%… These trough-to-peak returns are jaw-dropping.

I’ve identified no less than 28 examples of companies powering this Master Reset that’ve surged by 100% or more…

Half of which have gone up by 1,000% or more over the years.

What’s more, the biggest gains could still lie ahead.

According to the New York Times,

“demand for electric cars is so strong that manufacturers are requiring buyers to put down deposits months in advance.”

The Guardian recently reported that “electric vehicles are close to the ‘tipping point’ of rapid mass adoption.”

Now, here’s the part that should make you want to jump out of your seat and log in to your brokerage account…

That tipping point may have just been reached.

Bloomberg recently performed an analysis of EV adoption rates around the world.

They found that once EVs make up 5% of all new car sales, you see adoption take off at lightning speed.

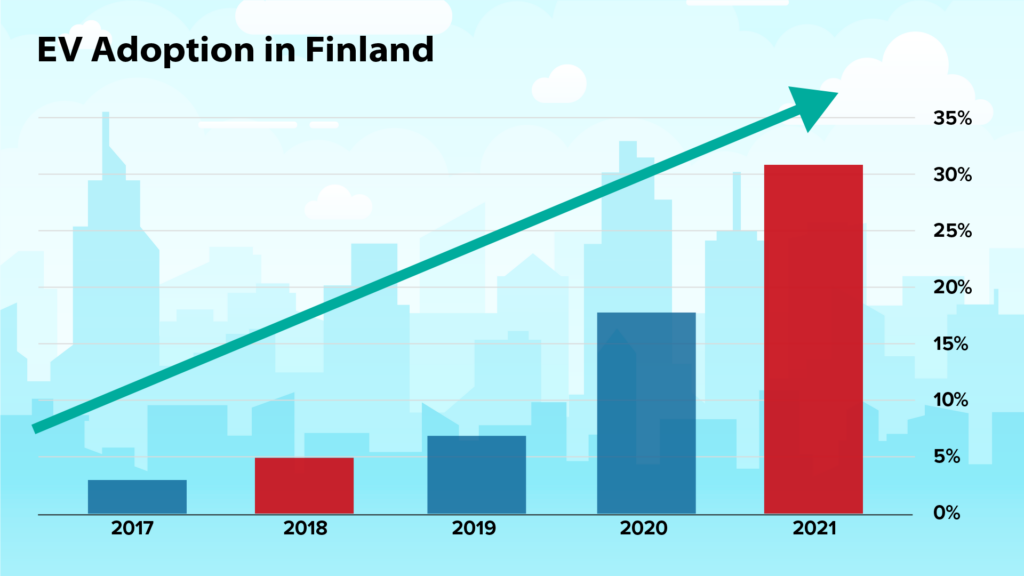

Just look at what happened in Finland when it crossed the 5% mark in 2018. Just three years later, EVs commanded 31% market share.

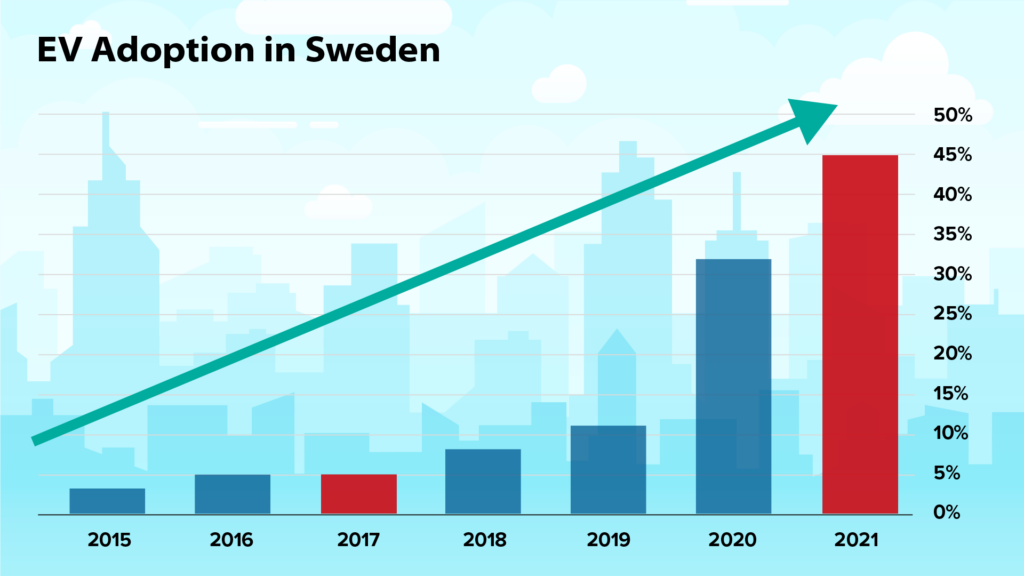

Or look at Sweden. It crossed the 5% mark in 2017. Today, nearly half of all new cars sold in Sweden are electric.

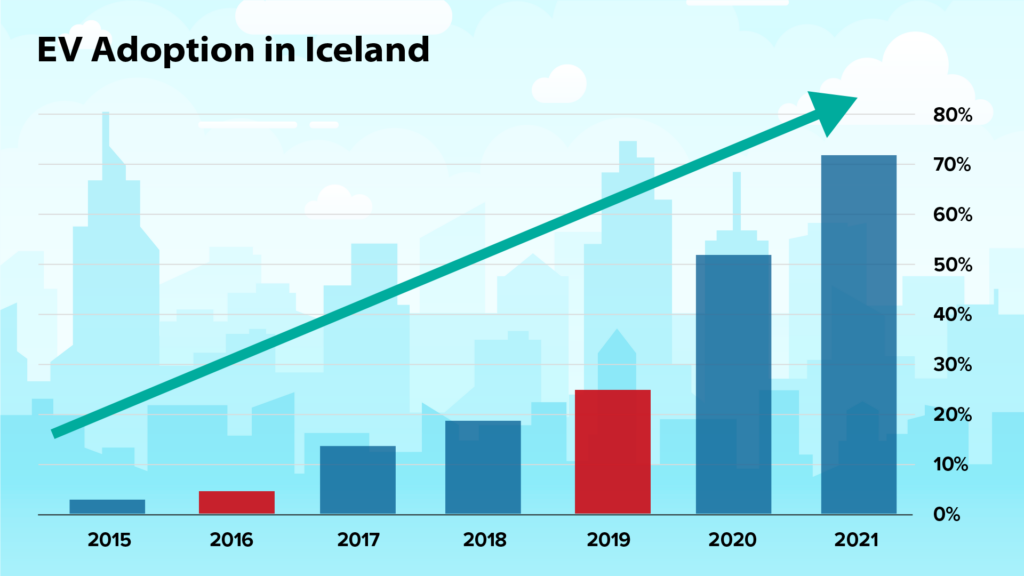

Iceland crossed the 5% mark in 2016. By 2019, EVs controlled nearly 25% of the market. Two years later, 72%!

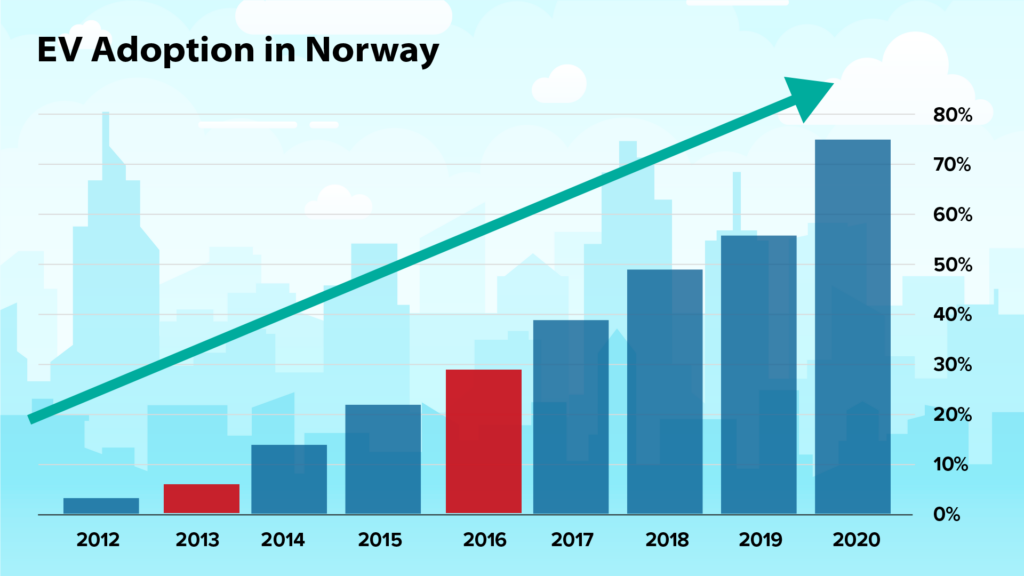

Norway passed the 5% mark back in 2013. Three years later, it passed the 26% mark. Now 86% of new cars rolling out of dealerships are electric.

Now get this. The U.S. just crossed 5%. That means EVs could control 25% of the domestic auto market by 2025… and 75% by 2029.

That’s FAR ahead of most major forecasts. And it’s not just the U.S…

South Korea, New Zealand, Germany, Italy and France have ALL recently crossed the 5% mark. And Canada, Australia and Spain are set to hit it this year.

This signals that EVs are not just a gimmick or a fad – they’re ushering in a true Master Res et of the auto industry.

And I believe ONE automaker will lead this Master Reset – and give folks the chance to turn a small stake into a huge return.

It just launched a vehicle that could easily become the bestselling EV of all time. Heck, it could make the Tesla Model 3 look like the Ford Pinto!

In a moment, I’ll give you the details on this $12 stock, so you can secure a spot on this potential rocket ride… which is set to take off as soon as February 2.

The Auto Industry’s Master Reset

But first, to give you an idea of just how big EVs could become, take a look at the brands below…

- Jaguar

- Alfa Romeo

- Lotus

- Bentley

- Cadillac

- Lexus

- Mercedes-Benz

- Mini

- Rolls-Royce

- Volvo

- Audi

- Chevrolet

- GMC

- Buick

Every single one of these major auto brands will soon be 100% electric.

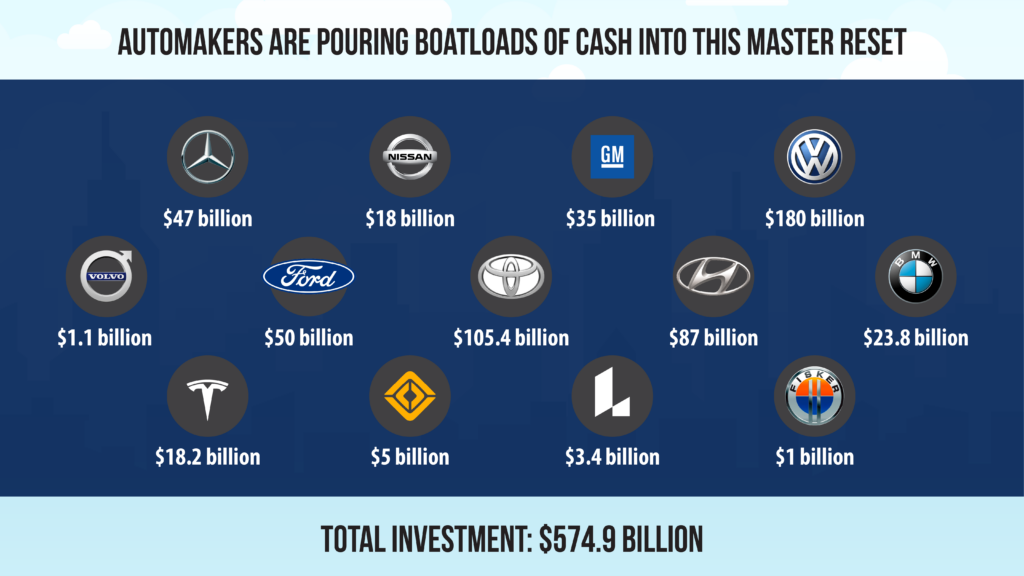

The big-name automakers behind these brands are backing up the truck in a major way.

Mercedes has put down $47 billion. It’s introducing 10 new EVs in this year alone.

General Motors is pushing $35 billion to the center of the table. It’s received more than 65,000 reservations for its electric GMC Hummer pickups and SUVs.

And Volkswagen’s earmarked a staggering $180 billion for EVs. VW plans to deliver a million electric cars annually and build six giga factories across Europe to cover battery demand.

All told, automakers are investing $575 billion to make sure they don’t get left behind by this Master Reset.

Why are companies that once scoffed at EVs suddenly pouring boatloads of cash into them?

I’ll tell you one thing: It’s not because they want to save the environment.

It’s because the outsized benefits of owning an EV will soon become impossible to ignore…

So much so that no consumer with even a scrap of common sense will choose gas over electric.

Let me to break them down for you…

EV Benefit #1: They’ll Save You up to $38,129

in Fuel, Maintenance, and Repair Costs Over the Life

of the Vehicle

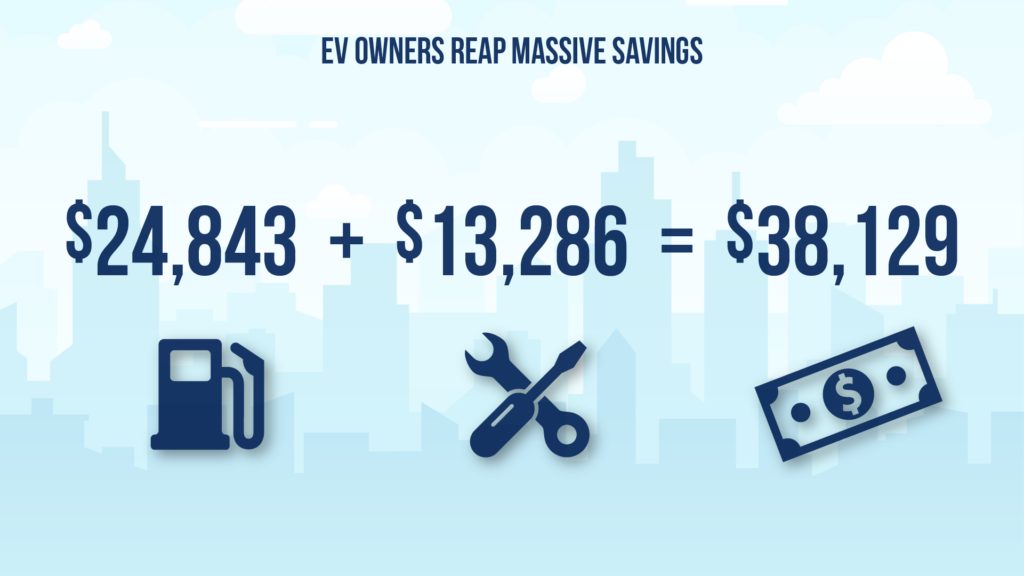

Consumer Reports recently found that EV owners save as much as $15,000 on fueling costs over the life of their vehicle.

Keep in mind, this model assumes a $3-a-gallon gas price.

At current prices, certain EV drivers will enjoy fuel savings of $24,843.

Meanwhile, higher gas prices mean that motorists who stick with gas-powered vehicles will incur $2,000 in additional costs this year alone.

That’s according to Yardeni Research, one of the top economic thinktanks in the world.

But listen, fuel savings are just the tip of the iceberg. Maintenance savings are a massive factor as well.

Consider… the drivetrain on a regular car contains more than 2,000 moving parts.

An EV has just 20.

Spark plugs, catalytic converters, ignition coils, oxygen sensors: all the parts that make your mechanic jump for joy when they break… they’re nowhere to be found in an EV.

That’s why I urge people to think twice before they invest into formerly “recession-proof” auto parts suppliers like O’Reilly Automotive and Advance Auto Parts.

AAA reports that EV owners save $949 per year in maintenance costs.

Over the life of the vehicle, they’ll save $13,286.

Combine that with the fuel savings, and you’ll get as much as $38,129 back in your pocket just for driving an EV.

EV Benefit #2: They Double as Backup Power

Generators for Up to 10 Days

Remember the Texas Freeze of 2021?

That February, a statewide power outage cost Texas $130 billion… left more than 10 million people without power for days… and caused at least 246 deaths.

But that tragedy was just a piece of a bigger problem.

You see, most power lines were built in the 1950s and 60s – with a 50-year life expectancy.

That’s why annual outages have DOUBLED since 2015… and they’ll only happen more and more as time goes on.

According to the Department of Energy, these outages cost the economy $150 billion a year.

But upgrading the power grid would cost a whopping $2.5 TRILLION.

I wouldn’t count on that happening any time soon.

However, if you own an EV, you may never have to worry about outages again.

That’s because some EVs are set up for “bidirectional charging.”

That means that not only can they use electricity to charge their batteries… they can also send electricity from a charged battery to a house.

This game-changer could save billions of dollars… tens of thousands of homes… and even lives.

And utility companies and automakers alike are diving in with both feet.

PG&E and General Motors just partnered up to test EVs as on-demand power sources in California.

But my #1 EV stock for 2023 is way ahead of them.

This company – which again trades for only $12 a share – just launched a vehicle that can provide full power to your home for three days.

Dial back your energy usage, and it could power your home for 10 days.

EV Benefit #3: You Could Earn $5,000 A Year

Without Working or Investing

Now, let’s say your car is fully charged, and the power’s on in your home…

In this case, you can use your EV battery to make money – without lifting a finger.

Using Vehicle-to-Grid (V2G) technology, you can send electricity to the power grid.

All you have to do is plug your EV into your home, and once the battery is fully charged, it’ll automatically start selling excess electricity to the grid.

By selling during peak hours, you could make upwards of $5,000 a year.

Over the life of the vehicle, that comes out to $75,000 in risk-free passive income.

And listen, this isn’t science fiction.

There are more than 80 V2G trials taking place around the world.

Marie H. – a participant in one of these trials – said she was able to both make money and cut her electricity bill in half.

BMW is testing V2G in its new EVs.

The Nissan Leaf is already equipped with this tech.

And Volkswagen plans to offer V2G capability for its EVs this year.

So when you buy your first EV, don’t forget to ask if it’s set up for V2G. It could hand you YEARS of income – with all the safety of a 10-year treasury note.

EV Benefit #4: They Could Soon Cost the

Same as Gas-Powered Vehicles

Since Robert Anderson invented the first EV around 1832, one obstacle has stood in the way of mass adoption: PRICE.

The EVs of the early 20th century cost upwards of $4,000. Only the rich could afford them.

Then, in 1908, Henry Ford launched the gas-powered Model T. The base model cost just $825, or about $26,000 in today’s dollars.

Inside the next two decades, Ford brought the price down to $370 – and EVs basically disappeared.

But now, nearly 100 years later, a price shift is taking place.

You see, the reason EVs are relatively expensive is because of their lithium-ion batteries. They make up about half the cost of electric cars.

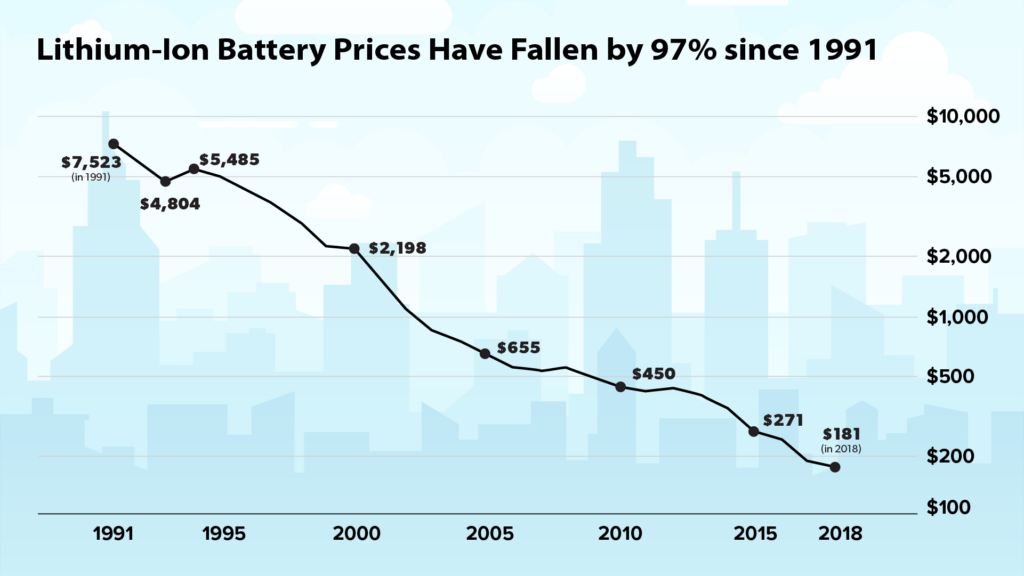

And the price of these batteries has dropped by 97% since 1991.

What’s more, they’re only getting cheaper.

Car and Driver reports that falling battery prices “could make an EV car cheaper than a gas car to buy” by 2023.

But batteries aren’t the only reason EVs are rapidly becoming more affordable.

It’s also thanks to “Wright’s Law.”

Theodore Wright was an aeronautical engineer who discovered that every time airplane production doubled, the labor requirement was reduced by 10-15%.

In other words…

The more we make of something, the better we get at making it and the cheaper it gets to make.

So if you’ve ever wondered why PCs, TVs and kitchen appliances have become so affordable over the years, it’s because of Wright’s Law.

And with the EV market set to grow by 133% on average every year, Wright’s Law indicates that EVs will just get cheaper and cheaper.

EV Benefit #5: You Could Soon Be Able to

Recharge Your EV In Less Than Five Minutes

Another big roadblock to EV adoption is charging time.

It currently takes anywhere from 30 minutes to 12 hours to recharge an EV.

If you try to charge an EV any faster than that, it will cause the lithium batteries to overheat and then degrade over time.

However, a team of engineers over at Purdue University has just invented a solution to this problem.

Purdue, by the way, is known as “the cradle of astronauts.”

Nearly a third of all U.S. spaceflights have a Purdue grad on board.

In addition, their engineers were the minds behind the Golden Gate Bridge and the Hoover Dam.

But this new charging cable they’ve devised could go down in history as their crowning achievement.

It harnesses an alternative cooling method to deliver a fully charged battery in less than five minutes.

That’s roughly the same amount of time it takes to pump your gas!

And here’s the icing on the cake…

This research was funded by my #1 EV stock for 2023.

That means they’ll get first dibs on this breakthrough tech when it’s ready for commercial use.

EV Benefit #6: You’ll Love Driving Them

But if saving you $38,129…

Giving you backup power for up to 10 days…

Enabling you to earn $5,000 a year by doing nothing…

Recharging in under five minutes…

And costing less than a gas-powered vehicle isn’t enough…

EVs are simply a lot of fun to drive.

Even the most basic models have tons of torque and can do 0-60 mph in less than four seconds.

Since they don’t have transmissions or engines that constantly vibrate, they offer an incredibly smooth ride.

And because they don’t require mechanical valves, gears, or fans, they’re whisper-quiet.

The only problem is that EVs are in such high demand, dealers can’t hold on to them for test drives.

One New York Times reporter had to drive around for an hour before he found a model in stock.

But that’s all about to change. No less than 18 new electric models will arrive in dealerships this year.

Mark my words…

Once folks take these cars out for a spin, they’ll fall in love – and do everything in their power to get their hands on one.

EV Investors Could’ve Captured Gains as High

as 3,694%… 4,661%… and 38,821%

But here’s the thing…

Even though I believe the EV revolution will be great for motorists worldwide…

Investors will reap the biggest rewards from this movement.

Every single segment of this red-hot market has dished out explosive gains.

From trough to peak, battery makers like Microvast, Romeo Power and QuantumScape have soared 141%, 237%, and 1,245%…

Charging station manufacturers like ChargePoint and Blink have surged 352% and 4,535%…

Chinese carmakers like BYD, Kandi Technologies and NIO have gone up 2,689%, 4,400%, and 4,661%…

Startups like Lucid Motors, ElectraMeccanica and Arcimoto have seen gains of 480%, 1,088%, and 3,694%…

And, of course, Tesla has rocketed 38,821% higher.

But there’s one category of this sector that I believe will reap the lion’s share of profits…

And it’s the one that consumers and companies are most excited to see come to fruition.

Consumers have amassed more than 1.6 million reservations worth over $105 billion.

Amazon, FedEx, UPS, Walmart, Merchants Fleet and even the U.S. Postal Service have pledged to put more than 581,000 of these vehicles on the road.

And again, they’re not doing this because they want to save the planet.

They’re doing this because they stand to save more than $21 billion.

This Segment of the EV Market is Projected to Grow by 1,594%

I’m talking about electric trucks. A market projected to grow by 1,594% by 2026.

Electric truck makers like Nikola and Workhorse have gone up 659% and 9,514%.

And Rivian – perhaps the most popular company in this category – had the biggest IPO of 2021.

But I believe one company will outsell them all…

It just electrified a line of pickups that generate more than $40 billion in a good year.

That’s more sales than McDonald’s, Nike, Coca-Cola and Starbucks.

And it’s about to get even bigger.

Its new electric model has received nearly 200,000 reservations – forcing the automaker behind it to quadruple its production to meet demand.

It’s easy to see why demand is booming.

This pickup’s twin electric motors pack 563 horsepower and 775 pound feet of torque – nearly doubling the stats on the gas model.

It can tow up to 10,000 pounds and has a 2,000-pound maximum payload.

It survived an extreme heat test at 118 degrees Fahrenheit – and DOMINATED the coldest February day in Boulder in 123 years.

And not only is this truck as much as 50% cheaper than the other electric trucks on the market…

A Washington D.C. thinktank found that it’s 17% cheaper than even its gas-powered equivalent.

This truck will take electric vehicles mainstream in a major way – and the smart money knows it.

More than half of its shares are owned by institutional investors.

Bank of America has $1.1 billion worth.

State Street has backed up the truck to the tune of $3.4 billion.

Blackrock’s shares are valued at $5.6 billion.

And Vanguard holds $6.2 billion in stock.

What’s more, its Executive Chairman – just bought $4.5 million worth of shares.

That’s on top of the $8.5 million in shares he snapped up last December.

Here’s a man who knows more about its business than anyone else on the planet – and he’s buying up all the shares he can get!

But it isn’t just the launch of this electric pickup that has investors excited.

I believe this automaker’s about to announce a business move that’ll unlock a TON of shareholder value.

According to my analysis, I’m speculating that it will spin off its EV division and turn it into its own independent company.

Now, nothing is certain, but if you really know stocks, you know that spinoffs are like manna from heaven to investors.

Billionaire hedge funder Joel Greenblatt says, “You can make a pile of money investing in spinoffs.”

Peter Lynch – one of the most successful investors of all time – has found that “spinoffs often result in astoundingly lucrative investments.”

And Charlie Munger – Warren Buffett’s right-hand man – believes that “an investment operation that focuses on spinoffs would do exceedingly well.”

The market data backs Munger up.

A McKinsey study analyzed spinoffs over 36 years. It determined “that excess returns are positive over almost all holding periods.”

They’ve generated some of the biggest gains in stock market history.

PayPal (a spinoff of eBay) flew up 907%…

NCR (a spinoff of AT&T) surged 1,110%…

Autoliv (a spinoff of Electrolux) jumped 1,908%…

Expedia (a spinoff of IAC) went up 2,583%…

Agilent Technologies (a spinoff of Hewlett-Packard) soared 2,608%…

And LendingTree (another spinoff of IAC) went up 29,755%.

But here’s my favorite thing about spinoffs… If you own shares of the parent company, you could automatically get tax-free shares of its spinoff for FREE.

So if you buy this automaker today, you’ll get the chance to own both a great, dividend-paying company with massive margins, tons of cash and industry-leading brand loyalty…

And a red-hot startup that could command a sky-high valuation as a pure EV play.

In other words, buying this stock right now is an incredibly low-risk way to invest in the auto industry’s Master Reset that’s just now hitting a tipping point.

And if you get in before February 2 – its next scheduled earnings announcement – you could get shares for a HUGE discount.

Bonus Dossier #1: “My #1 EV Stock for 2023”

I put everything you need to know about this stock in my new investment dossier, “My #1 EV Stock for 2023”.

This dossier will tell you…

- Why this automaker could easily triple your money

- How to buy it in any brokerage account

- How to determine the perfect position size

- And a full rundown of its fundamentals

And if you act quickly, you can get in at $12, right alongside the big trading houses who are currently loading up on shares.

The way I see it, you have two options now…

It’s not a tough decision.

When you have the chance to change the course of your financial future, you have to take it.

Look, I’ve shown my readers across my services multiple chances to make as much as five times… nine times… and even fifteen times their money.

I’ve Given My Readers the Chance to Grow Their Wealth Many Times Over…

For example, I once recommended a space exploration stock called Virgin Galactic.

It’s a huge player in the booming space tourism industry. It’s already locked in $230 million in flight reservations.

When I first start researching the idea, I found out that one of my hedge fund friends was among its largest shareholders.

We wound up talking about the company for TWO HOURS. He put me in touch with Virgin Galactic’s CEO.

After I did my own due diligence, I pulled the trigger and recommended the stock to my readers.

If they sold at its peak, they had the chance to collect a 482% gain.

A few months later, during the depths of the Covid-19 market crash, I recommended a company called Penn National Gaming.

Penn’s a casino operator that recently made a big investment in the sports betting boom.

Sports betting is expected to become a $23 billion market by 2026.

But Wall Street claimed the stock “was no longer a value opportunity” and advised investors “to take some money off the table.”

But when I analyzed Penn, I realized that its share price didn’t reflect two hidden assets: real estate on the Las Vegas strip and a video game terminal business.

Penn became one of the biggest winners of the Covid-19 market recovery, surging 837% in less than a year.

I love taking advantage of market sell-offs like this. For instance, in October 2021, I recommended a special trade on Qualcomm, the global wireless technology leader.

The stock had fallen 11% since September, due to supply chain issues.

But while I was conducting my research, I found that Qualcomm has beaten earnings expectations, often by a large margin, over the past 16 quarters. A proven history of outperformance.

But we didn’t have to wait for Qualcomm’s next earnings announcement. The stock went on an absolute tear.

And our special trade recommendation soared 1,418% in just over a month.

That turns $5,000 into $79,000.

Can you imagine the kind of freedom a return like that would give you?

That’s the type of potential I see in my #1 EV stock for 2023.

I can send you the dossier detailing this $12 stock at the end of this presentation.

I strongly urge you to buy it before Thursday, February 2.

But keep in mind…

The EV boom is bigger than any one stock. We’re talking about an entire INDUSTRY getting reset.

Bonus Dossier #2: “The EV Investment Bible

That’s why I just put the finishing touches on a dossier that’ll give you a high-level overview of this millionaire-minting shift.

It’s called “The EV Investment Bible”. Consider it your one-stop shop for EV financial research.

Look, if you think investing in EVs is about picking the right start-up, this is the eye-opener you need.

I’ll go over all the different types of EV stocks… from battery makers to charging station manufacturers and beyond… and break down the pros and cons of each category.

You’ll find out why Tesla’s 50% U.S. market share could be cut in half (or more!) as competition in this space heats up.

You’ll see why batteries are becoming increasingly cheaper along with details on a firm that just made a 1.2-million-mile battery.

You’ll learn more about vehicle-to-grid technology – the EV innovation that could hand you $5,000 a year just for leaving your car in your driveway – and the company that’s patented this technology.

But most importantly, you’ll get my “EV Watchlist,” a basket of four MUST-BUY companies on the frontlines of the auto industry’s Master Reset.

I’ve gone over these stocks with a fine-tooth comb. They all have massive market share… are virtually unknown to the average investor… and provide CRITICAL resources for the big EV rollout.

If you want to make serious money from this Master Reset, these stocks BELONG in your portfolio.

You can see that I’ve designed this dossier to cover ALL your bases.

Bonus Dossier #3: “Seven EV Deathtraps”

That said, with any Master Reset, it’s not enough to simply know the stocks to buy.

You also need to know which stocks aren’t worth your time or money.

For every Amazon, there are a hundred Sears.

So I’ve just put together a list of companies that should be avoided at all costs.

I call it “Seven EV Deathtraps.”

You might be surprised by a few of the names on here.

One of them has attracted a “crowd of retail investors,” according to Bloomberg.

Today, it’s down almost 80% from all-time highs, and I believe it’ll keep on plummeting.

Another is a popular Chinese EV maker that faces a serious risk of getting banned from the New York Stock Exchange.

The SEC just put it on a list of companies that could get delisted if they fail to turn over audit results.

Bottom line: if you have any of these EV deathtraps in your portfolio, all I can say is WATCH OUT.

In a moment, I’ll show you how to claim this dossier and steer clear of these ticking time bombs FOR FREE.

Let me explain…

I Turned Down a Seven-Figure Salary to

Speak with You Today…

My name, again, is Enrique Abeyta. Now, it might surprise you to hear this…

But even though I received an Ivy League education… enjoyed a 25-year Wall Street career… and have managed billions of dollars for the world’s elite…

I didn’t grow up with a silver spoon in my mouth. Not even close.

I spent my childhood bouncing between cheap motels and run-down apartments.

But even though the odds were stacked against me in every possible way…

Hard work and perseverance turned me into a multimillionaire.

In fact, I keep a deposit slip of the first million in my bank account.

But through it all, I never forgot where I came from.

After I made my first couple mil, I wrote my mother a check for 750 grand – and told her she never had to work again.

I have a lot of military in my family – and I’ve helped about a dozen vets find success on Wall Street.

And after spending nearly three decades in the financial district, I got sick of helping the rich get richer.

I turned down a seven-figure job offer… moved my family back home to Arizona… and started working for a firm with one simple mission: to provide everyday folks with hedge-fund-grade research.

It’s called Empire Financial Research…

And unlike the analysis provided by the big investment banks, our research is independent.

That means we don’t accept kickbacks or commissions in return for recommending certain stocks.

If we recommend a stock, it’s because we truly believe in it.

And if we believe in it, you can bet we’ve studied it from every possible angle.

I Work Side by Side with One of the Greatest Investors Alive

I’m proud to say that my partner in this business is one of the greatest investors alive…

A Wall Street legend who’s given talks at Google, Harvard, Columbia and Wharton, he’s famous for starting a hedge fund firm with only $1 million and building it into a collection of funds with over $200 million under management.

He predicted the dotcom crash in 2000… the housing crisis in 2008… and the collapse of bitcoin in 2017.

In fact, his gift for calling major shifts in the stock market has led CNBC to dub him “the Prophet.”

His name is Whitney Tilson.

And if that name sounds familiar, it could be because he’s been profiled by 60 Minutes, the Wall Street Journal, the New York Times, Kiplinger, Forbes and dozens more.

Or it could be because he got in early on some of the biggest stock runs of all time.

He bought Amazon in 1999. Since then, it’s rocketed up to 7,433% higher.

He bought Netflix in 2012. It’s gone up by as much as 8,791%.

And he bought Apple in 2000. It’s soared up to 51,771%.

Imagine… $1,000 in Apple alone could’ve turned into more than half a million bucks.

Now typically to get access to Whitney and me, you’d have to pay me the “2% of assets and 20% of profits” fees we charged at our hedge funds.

Today, you can get me and my team’s best money-making ideas for a pittance – it’s the best bargain on or off Wall Street.

But before I break down this deal for you, let me tell you about one final EV investment I think you should make immediately.

BONUS #4: “The Best Way to Own White Gold”

Now, if you know anything about EVs, you know they’re powered by lithium, the EV market’s “white gold.”

In fact, the EV market makes up almost 80% of lithium-ion battery demand.

As global EV sales have surged from 130,000 in 2012 to 6.6 million today, lithium stocks have rocketed higher too.

Albemarle has shot up by 7,095%.

Sociedad Quimica y Minera has gone up 9,139%.

And Lithium Americas has soared 11,603%.

Lithium is just going up from here. It’s a simple matter of supply and demand.

According to the International Energy Agency, the number of EVs on the road will hit 145 million by 2030.

Not only is that up 21-FOLD from today… these vehicles will require nearly 1.6 MILLION tons of lithium.

And I’ve zeroed in on an easy-to-follow, “one-click” way to play the surge in lithium demand.

It’s a way to essentially own the entire lithium market with one trade.

I’ve put all my research on it into a dossier titled, “The Best Way to Own White Gold”.

Bottom-line: if you want the chance to make big money from EVs, you need to have these dossiers. Just to recap, they’re…

- My #1 EV Stock for 2023

- The EV Investment Bible

- Seven EV Deathtraps

- The Best Way to Own White Gold

These dossiers are the first research you’ll see from me when you start a no-risk, trial subscription to my flagship financial newsletter, Empire Stock Investor.

On the first Wednesday of every month, we’ll send you our latest report and newest money-making recommendation.

We’ll also show you exactly how to allocate a portfolio across our recommendations to maximize your potential gains, just like I did for my hedge fund clients. This way, you’ll never find yourself wondering what you should do with new stocks I recommend.

In 2020, the average annualized gain for Empire Stock Investor was 55.7%.

This return measures the results achieved by all of our recommendations, scaled to a one-year period.

Of course, all investments carry risk. And you should obviously never invest more than you can afford to lose.

But when the upside is this high, I believe it’s worth it to take a flyer.

Just look at these messages from people who say they’ve made BIG money by following our recommendations.

Thank you for your service and your kind words, Andrew.

Here’s another one…

This last one’s from a fellow named Richard M. who’s a testament to the fact that it’s never too late to pick up a profitable new habit.

80 years old and he just started active trading!

The truth is… I put a high level of energy into everything I do. It doesn’t matter if it’s my investment career or my personal life.

Yes, I wake up at 5 a.m. every morning, turn on CNBC, turn on Bloomberg, track the market and keep pushing until 10 or 11 at night.

But I’ve also run seven marathons, including five of the six world majors.

I work hard, and I don’t take any shortcuts. And I’ll do everything in my power to make this service work for you.

I hope you’re the next one to tell me your success story.

Empire Stock Investor Offerings

So if you take advantage of this offer and get started with Empire Stock Investor today, I’ll send you all you need to hit the ground running.

- INVESTMENT DOSSIER: My #1 EV Stock for 2023

- INVESTMENT DOSSIER: The EV Investment Bible

- INVESTMENT DOSSIER: Seven EV Deathtraps

- INVESTMENT DOSSIER: The Best Way to Own White Gold

- The next 12 months of Empire Stock Investor – we’ll send you a new report on a new investment idea and any changes to our model portfolio, on the first Wednesday of every month (12 issues in all).

- Whitney Tilson’s Empire Financial Daily and Whitney Tilson’s Daily .. every day the markets are open. In these must-read daily emails, Whitney and his team address the most important issues affecting you and your money.

- Plus full access to all of our archived research reports and recommendations, including a very valuable report called The Perfect Portfolio, and another detailed analysis called: The Industries Most Affected by the Driverless Car Revolution.

So how much does it all cost?

Well, that might be the best part.

Frankly, I could sell this package for thousands – if not tens of thousands – of dollars.

But I’m on a different type of mission today.

I know there are a lot of people out there – normal people like my dad who drove a truck and dreamed of owning a few of his own someday – who don’t know what to do with their money right now.

Should they sell all their stocks?

Buy more?

And what should they buy?

Many of our members are regular folks who are just learning about the markets …

At the same time, we have a few billionaire investors like Bill Ackman and Seth Klarman who subscribe to our research.

But regardless of your investing experience… the key is to take control of your financial situation and grow that money now.

I have no doubt that Empire Stock Investor will help you succeed in that goal.

And today, you can get full access to this monthly newsletter, where Whitney and I offer investment ideas and update you on any adjustments we make to the model portfolio…

My four investment dossiers on the EV boom…

And Whitney’s daily letter where he shares investment ideas from his giant network of contacts in the investing community…

For just $49.

The regular retail rate for my work is $199 per year – and some of my readers pay as much as $5,000 per year – but you can save 75% off the regular rate by taking advantage of this special trial subscription offer.

I promise you – this is by far the best deal in the investment world today.

For about the price of an inexpensive dinner for two – you can position yourself to radically transform your retirement finances over the next few years.

Even better: This trial subscription is 100% risk-free.

After reviewing everything I’ll send you, if you decide in the next 30 days, for any reason, that my research isn’t right for you, no problem.

Simply give our member services team a call and they’ll promptly refund 100% of your money.

In other words, you have absolutely nothing to lose and a great deal to gain when you take me up on this generous offer today.

It’s Decision Time

Remember, the auto industry is on the verge of a Master Reset.

The EV market is projected to grow by an average of 133% every year.

Along the way, many people stand to get rich.

That’s why all the big tech companies are piling in.

Amazon has ordered 100,000 electric vans. Soon there won’t be a single combustion vehicle in its delivery fleet.

Apple is accelerating the development of its own fully autonomous EV.

Apple’s chief supplier Foxconn just laid down $8 billion to build a factory to make battery cells and other EV parts.

Sony, search engine giant Baidu, and smartphone maker Xiaomi are diving in feet-first too.

Every single one of these companies owes its exponential growth to pinpointing and capitalizing on paradigm-shifting technologies.

And that’s exactly what EVs are.

BBC calls this shift “the biggest revolution in motoring since Henry Ford’s first production line started turning back in 1913.”

EV stocks have exploded 4,535%… 9,514%… and 38,821% higher.

And the biggest gains could still be to come. Think about it…

Wall Street’s big trading houses have poured $520 billion into this movement.

Would they be investing all this money if they didn’t think EVs were the future?

Of course not!

This is your big chance to get ahead of the next major investment trend…

And buy the $12 stock at the center of it all.

It’s just launched a vehicle that could become the bestselling EV of all time.

It’s the first electric version of a line that singlehandedly makes more money than McDonald’s, Nike, Coca-Cola, and Starbucks.

The Wall Street Journal calls it “an American manufacturing triumph.”

And it could be on the verge of making a business move that Peter Lynch – one of the greatest investors of all time – says “often results in astoundingly lucrative investments.”

Buying this stock could be the great success story of your life.

And if you don’t get in before February 2, you may never know.

To gain access to everything I’ve described here in a matter of minutes, simply click the “Order Now” button below.

This will take you to a secure Order Form, where you can review everything here before submitting your order.

Thank you for your time. And congratulations, I look forward to welcoming you to Empire Stock Investor.

Regards,

Enrique Abeyta

October 2022