America’s Nightmare Winter is Coming.

Will You Be Ready?

He went to law school at Georgetown with Fed chief Jerome Powell in the 1970s…

Then built the largest publishing empire of its kind, with more subscribers than the Washington Post and The Wall Street Journal combined.

Along the way he’s written three New York Times bestselling books.

As perhaps the most anti-social ‘rich guy’ in America, he rarely makes public appearances, instead retreating to his 100,000-plus acres in South America… his two centuries-old chateaux in France… or his cottage in Ireland.

But despite his wealth, this humble entrepreneur who’s regarded as one of the most important innovators of the Internet revolution, still buys $30 Walmart jeans, drives a Ford F-150 pickup, and chases cattle on horseback.

He’s built two of his many homes with his own hands – an adobe structure of mud and stone built using Roman-era building techniques in Argentina. The other, a solar house built of ferro-cement in the States.

And today, this ultra-wealthy and successful man is going public with what he says is: his Fourth and Final Prediction of his 50-plus year career.

Each of his other three big predictions have come true, and today from his 200-year-old house in Ireland – you’ll hear…

Subscribe to our YouTube channel for more expert stock-picking tips.

How two unstoppable and inevitable trends are on a collision course in America, like two runaway freight trains.

And how this collision will cause the biggest disruption to our society, our financial markets, and our way of life in more than 50 years…

Leading to an event he calls: “AMERICA’S NIGHTMARE WINTER.”

Get the facts you won’t hear anywhere else.

Learn what this means for you, your family, and your money, from one of the most successful men in America over the past 50 years.

Everything you need to know starts now…

Hello, my name is Bill Bonner.

I’ve recorded this video message from my cottage near the town of Youghal, about 150 miles southwest of Dublin.

Vikings invaded here in the 8th Century. Normans invaded in the 12th century.

More recently, Sir Walter Raleigh was granted 42,000 acres by Queen Elizabeth I… lots of fertile land along Ireland’s River Blackwater.

I mention Sir Walter Raleigh because I believe what happened to him many years ago might happen here, too, to millions of Americans.

You see, back then, Raleigh was on top of the world.

He’d accomplished little in life, yet managed to curry favor with the Queen, and was soon in possession of about 0.2% of the entire country, including castles, farms, abbeys, estates, and more.

But his good fortune did not last.

Before long, locals revolted, the economics of his estate collapsed, and Sir Walter Raleigh, a notoriously extravagant spender, was forced to sell his Irish holdings for a pittance… just 1,500 pounds.

It’s perhaps one of the worst deals in British or Irish history. That land is likely now worth many millions.

Raleigh’s son was so distraught, he tried to recoup the losses, but got nothing.

And I believe something similar is about to happen to millions of unsuspecting Americans…

Our good fortune of the past 50 years is about to take a major turn, as two inevitable trends careen toward each other, like runaway freight trains on the same track.

This collision will bring about some of the most difficult years in American history.

And so… after a 50-year career spent building one of the largest financial research firms of its kind…

After launching offices in Poland, Spain, London, China, Russia, India, and more than a half dozen other countries…

After watching my companies reach a market valuation of more than $3 billion…

After earning more money than my wife and I… our kids and grandkids can ever spend in several lifetimes…

And after taking the federal government to court on behalf of America’s future generations…

I believe it falls on someone like me to warn you… clearly… and without distraction.

I can do this now because I’m too rich to care about money… and too old to care about what anyone says about me.

You see… I’ve made three similar macroeconomic predictions in my 50-year career.

All three proved to be right, though I was mocked each time.

I expect my fourth and final prediction to be no different.

Most will pay no attention. Even fewer will take the basic steps I recommend to protect themselves. And that’s fine. I have no interest in telling anyone what to do.

But I know for a small group, this warning could be life changing.

As I’m about to show you, we are in for a very strange period in American history. Two extremely powerful and unstoppable trends, which seem unrelated on the surface, will soon bring shock and awe to every American doorstep.

Eventually, you’ll see this story in The Wall Street Journal and The Washington Post. The blame and finger pointing will reach a fever pitch. But hopefully, you’ll have already made a few key decisions.

And so here, I’ll give you my warning in its simplest form…

Someday in the future… perhaps on a particularly cold night…

… America’s entire energy system will collapse.

Fuel won’t get delivered. Rolling blackouts will sweep the land. Pipes will freeze. Food in the freezer will go bad. You may shiver in the dark… praying for a little power – for weeks.

You’ll be one of the lucky ones. Others – with less margin of error – may fare worse.

Experts tell us if diesel fuel is cut off, it would take only three days before supermarket shelves are bare.

In the 72 hours following an energy cut off, almost all businesses would run out of supplies and shut down. And if this continued… in a matter of weeks, civilization as we know it would come to an end.

Covid could look like a cakewalk compared to what lies ahead.

We live in an extremely fragile world today.

Everything moves by container ship and truck… and almost every ship and truck run on diesel. So when the diesel fuel stops coming, ships stop sailing, trucks stop rolling, goods stop arriving – food, medicine, building materials… everything.

When that happens, people die.

You won’t see this reported many places, but the cracks in the system are already appearing…

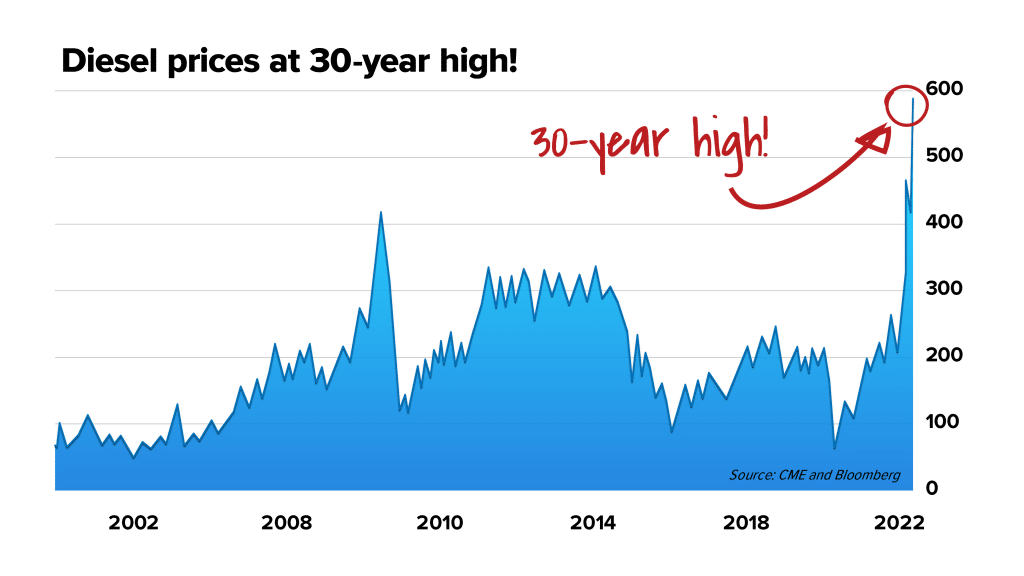

Recently, east coast diesel inventories plunged to the lowest seasonal level in 30 years. And diesel prices nationwide have hit record highs.

Desperation is starting to set in.

Thieves recently stole $1,700 worth of diesel in Indiana.

Most Americans don’t that realize diesel fuel is the workhorse of the economy. It’s used everywhere to keep trucks, tractors, ships, freight trains, and factories moving.

And that’s just the beginning…

In the midst of all this… the electric grid won’t be able to light up like it used to.

It will depend more on solar panels and windmills. But in a long spell of darkness and cold, ‘renewable’ power sources are worthless. The remaining fossil fuel power plants won’t be enough to pick up the slack.

Some areas will get power. Others won’t. Millions will suffer.

The financial markets, of course, will be thrown into a frenzy.

I believe prices for some assets will soar higher than anyone can imagine. Gas prices could touch $50 a gallon. I predict oil will hit $500 per barrel before this cycle is over.

For other assets, there will be almost no bid whatsoever.

So, millions will find themselves in the same situation as Sir Walter Raleigh, many years ago here in Ireland–forced to sell once-valuable assets at a pittance.

Around my office, we call this inevitable scenario: “America’s Nightmare Winter.”

And there’s so much more to it, which I’ll get to in a second.

My guess is this all sounds impossible to you. An exaggeration at best. Maybe you think I’m trying to scare you.

But at its core, this story is only partly about fuel and energy sources.

The collapse of America’s power grid is just one of the consequences of the two runaway freight trains barreling toward each other on a collision path in our country today.

And ironically, as I’ll detail, my warning is nothing compared to the scare tactics being employed by today’s politicians, major media, and universities, who have put us on this dangerous path.

But I’m getting ahead of myself.

So let me back up.

Before I can show you what’s coming next and the four steps my team and I recommend you take as soon as possible, I want to explain the two runaway freight trains now barreling toward each other…

My 4th and Final Warning

Like a lot of Americans my age, I was lucky. I got into the financial industry at the start of the biggest boom ever. All you had to do was buy stocks in 1980 – after Paul Volcker tamed inflation – and sit tight.

“Buy the dip” was the best advice of the past 40 years.

That’s why most people believe this 40-plus year trend can only continue.

But I strongly disagree.

I want to show you why we are living in a very dangerous moment right now. And why it’s more critical than ever that you and your money are in the right place at the right time.

That’s the secret.

For me. And for you. Not being smart. Or doing anything clever or complicated. You just have to make sure you and your money are in the right place at the right time.

That’s exactly what I’m going to show you how to do today .

Along the way I think you’ll learn secrets about our country you’ve not heard anywhere else. Like why I believe Warren Buffett just made one of his biggest bets ever in preparation for “America’s Nightmare Winter.”

And why the head of America’s biggest private equity firm (Blackstone) says we’re about to have “social unrest” and a “new regime.”

In the coming minutes, I’ll show you how America’s elite – the whole elite… Republican as well as Democrat… the people who control the government, the Fed, the media, Wall Street, and the universities – are corrupt and incompetent and have put us on this path.

What I see on the horizon could be the worst crisis ever in the U.S… a combination of two disastrous policies… which I believe could likely be followed by riots and ultimately some form of revolution.

Now look, I’m not trying to influence U.S. policy or sue anyone again. I’m just ‘connecting the dots’ as I’ve done throughout my career…

My First 3 Big Predictions That All Came True…

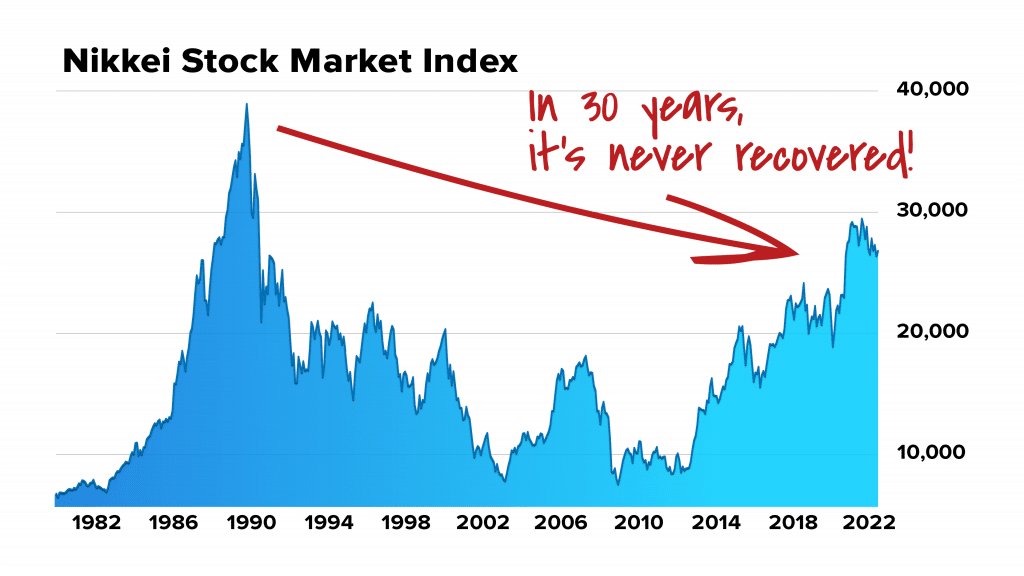

My first big call was back in the 1980s, when I warned folks of the imminent Japanese stock crash.

Back then, Japan was on top of the world.

Nine of the world’s 10 biggest banks were in Japan back then. Half the world’s stock market capitalization traded in Tokyo.

Even crazier, the Tokyo Imperial Palace (just 1.15 sq kilometers) was estimated to be worth more than all of California!

But then came a major collapse, just as I predicted.

By 2004, prime commercial real estate fell by about 99%… and residential real estate collapsed about 90%.

As hard as it is to believe, Japanese stocks have still never recovered, 33 years later. Today they’re about a third below their 1980’s highs.

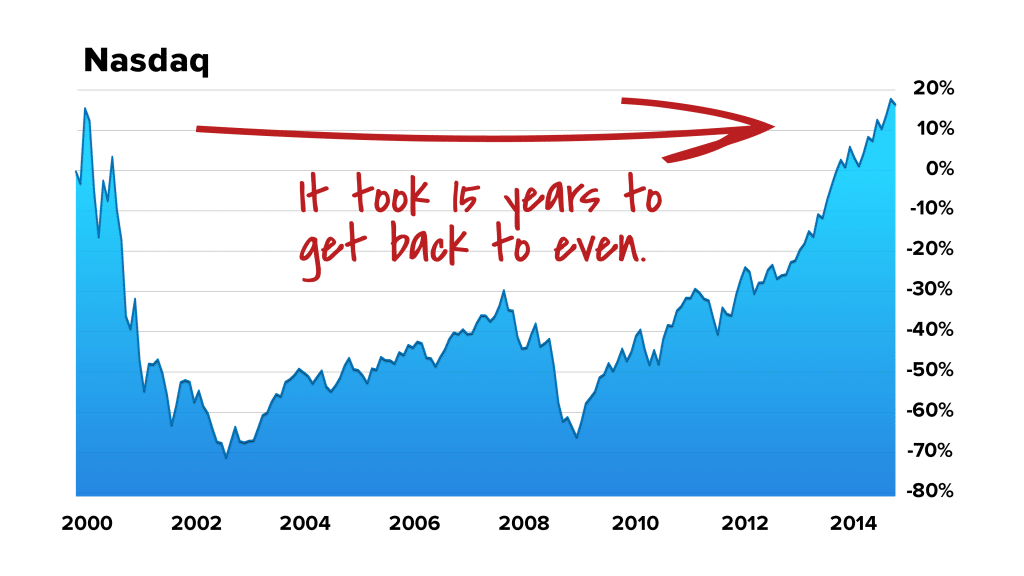

My next big warning concerned the “dot.com” Internet companies of the late 1990s. Again, I was right on the mark.

In fact, there was probably no one in America who wrote more about the dot-com fallacy than me during that era. I covered it almost daily for several years, in what many say was the first commercially successful and profitable Internet blog.

Again, there was a massive collapse.

The Nasdaq fell about 80%. It took 15 years to get back to even.

Then came my third warning in 2005-2007, when I saw a massive bubble in mortgage finance and real estate.

In my New York Times bestselling book Empire of Debt, (written with co-author Addison Wiggin) I predicted a long slump, “that will take down house prices and the stock market, but leave the dollar and bonds with little damage.”

That crash began in 2007… and just as I predicted, the dollar and bonds did fine, while stocks dropped 50% and as many as 10 million people ultimately lost their homes.

In each of these cases, I issued big, public warnings, just like I am doing today.

Still, most people ignored me – many even mocked me. I hope you don’t make that mistake, because…

My Fourth and Final Warning differs from the others I’ve made.

My other big warnings to date really only affected investors (and homeowners, in the case of the mortgage crisis).

The looming crisis I want to tell you about today, however, will affect everyone. And in ways that will be difficult for you to avoid.

So, let’s start with something no one else will dare tell you today…

How a government mandate and policies now pushed by the mainstream media, universities, celebrities, and Fortune 500 companies, will ultimately prove to be one of the most destructive decisions in human history…

Why is the Government Trying

So Hard to Scare You?

Governments do dumb things on a regular basis.

But it’s not often a government rejects its most important source of wealth and security…

And tries to replace it with something that could bankrupt the nation, and cause suffering for millions.

But that’s exactly what the U.S. government is doing right now, along with the mainstream media, universities, and quite a few Fortune 500 companies as well.

The policy all these folks are pushing?

The mandated transformation of our economy (at any cost)… to end fossil fuel use, to take carbon emissions to zero, and to establish renewable energy for all future economic activity.

This is the first runaway freight train barreling forward along America’s tracks.

Now look… I get it… everyone wants a better environment and less pollution. Everyone.

And someday… battery technology, wind power, and solar will probably become efficient enough to make up a meaningful portion of the electric grid – but not today.

And not anytime soon – not in the next 20 or 30 years… at least.

And that’s not my analysis…

The U.S. Energy Information Agency says wind and solar combined last year made up just 12% of the power grid today. Even dirty coal made up almost twice as much (22%).

And looking at the next few decades, the U.S. Energy Information Administration says by 2050… renewables will make up only 38% of the U.S. grid.

But the facts don’t matter…

So, politicians are shutting down oil and natural gas production, while spending obscene amounts promoting “green energy.”

Oil wells are capped. Generators decommissioned. Storage tanks abandoned. New investment has almost completely come to a halt. Discoveries have fallen to a 75-year low. Banks will no longer lend to oil and gas companies because it’s bad for their image. Today in America’s northeast region there are just seven refineries that process diesel fuel. There used to be 27.

The CEO of Chevron says there will never be another refinery built in America thanks to the state of policies around the world toward fossil fuels.

In short: the government punishes and discourages producers of ‘old energy’ while rewarding and subsidizing Wall Street and ‘renewable’ sources.

Take the state of New York for example…

As one resident told the Wall Street Journal:

“Large portions of New York sit atop massive but untapped sources of natural gas. The Utica Shale… contains an estimated 38 trillion cubic feet of natural gas, 940 million barrels of oil and 208 million barrels of natural-gas liquids…”

But New Yorkers can’t touch these resources, even though natural gas is the main reason we’ve been able to reduce carbon output for electricity in recent years (natural gas is about half as pollutive as coal).

Andrew Cuomo banned all hydraulic fracking.

He shut down interstate gas pipelines and closed the Indian Point nuclear plant. So now New Yorkers must import more natural gas… and at much higher prices.

They’ve even proposed banning natural gas hookups for new homes.

So instead of working to unleash the state’s energy resources, they are doing the opposite – fighting for new costly and unrealistic energy mandates.

And mark my words: this premature mandated switch to “clean energy” is going to be a disaster, causing economic hardship, poverty, and a widening of the wealth gap.

It’s the first big step, leading to: “America’s Nightmare Winter.”

Because the same thing that’s happening in New York is happening elsewhere and on the Federal level too…

On his first day in office, President Biden canceled the Keystone Pipeline.

A week later, he announced executive orders freezing new oil and gas leases on public lands and offshore waters, plus no CO2 emissions from electricity by 2035, and an all-electric vehicle fleet.

Of course, soon the administration had to ramp up energy imports from Russia by 24%.

And so, while everyone blames the energy crisis on Vladimir Putin and America’s “evil” energy companies, the truth is, it’s mostly the result of disastrous policies.

And this is only going to get much worse.

Remember my conservative prediction: before this cycle is over, gas will hit $50 a gallon… oil will hit $500 per barrel.

And here’s the thing…

No one likes to talk about what this mandated transition to “clean energy” will cost – so let me show you ghastly figures…

I’ve never seen this reported anywhere in the mainstream press, but look at the analysis done by Bjorn Lomborg.

He’s an environmentalist and visiting fellow at Stanford. Time Magazine calls him one of the world’s 100 most influential people. And he’s repeatedly named one of Foreign Policy’s Top 100 Global Thinkers.

Here’s what Lomborg says…

$5 Trillion… Per Year?

New Zealand was the first country to promise a carbon neutral economy.

In 2007, the Prime Minister said her small nation (with roughly the population as South Carolina) would be carbon neutral by 2020.

The elites loved it. The UN called her a “Champion of the Earth.”

Well… long story short, New Zealand not only failed to achieve the vision, but also failed to reduce any emissions whatsoever.

So, what did the government do next?

They doubled down on this terrible idea and promised carbon neutrality by 2050.

The one good thing about New Zealand’s efforts is that they are the only country we know of that’s actually looked at legitimate cost estimates for going carbon neutral.

And what is the price tag, exactly?

Well, New Zealand’s leading independent economic think tank says getting halfway to the target – cutting 50% of New Zealand’s emissions by 2050 – would cost at least $19 billion annually.

Lomborg says that’s about what the country spends on education and health care.

But keep in mind: cutting the first half of carbon emissions is the easy part… the low hanging fruit. It gets a lot harder and a lot more expensive to cut the second half.

Getting all the way to zero carbon emissions would likely cost $61 billion annually… more than New Zealand spends on social security, welfare, health, education, police, courts, defense, environment, and every other part of government… combined.

Lomborg says gas taxes would need to hit $8.33 per gallon every year for the next 30 years. That’s just the taxes, not including the fuel costs.

And it’s worth pointing out that Lomborg’s estimates were made BEFORE energy prices skyrocketed 200% in the past roughly 20 months.

OK…

But at least if New Zealand pulls this off, it will help the world deal with climate change, right?

The answer is yes… but barely.

Lomborg says if we assume New Zealand will actually deliver and stick to its promise for the rest of the century, the total amount of greenhouse gas reduction will deliver a temperature reduction of 0.004°F in year 2100.

In other words, the country will go bankrupt… and it won’t make a lick of difference for the planet.

All of this is scary to think about… but here’s the really terrifying part…

If we take New Zealand’s cost model and apply it to the U.S… Lomborg says it implies a cost of at least $5 trillion for America in today’s money.

Not just once, but every single year!

That’s more than the Federal government estimates it will collect in total revenue in 2022.

Still… the U.S. government plows ahead… along with the mainstream media… the celebrities… the school systems… and more.

Need more evidence this is a disastrous plan?

Look at Germany’s green energy scheme, called Energiewende [pronounced: En-er-gee-venda] (meaning “energy transition”), which started in 2010.

Today Germany has among the highest energy costs in the world.

And fossil fuel use has declined only 1% since the massively expensive program was started, according to Lomborg’s analysis.

How bad will it get for Germany?

Well, a report just out says producer prices in Germany are up a whopping 33.5% from last year. Yes, 33.5% in a single year.

It’s destroying the German economy.

Electricity costs are up 87% compared to a year ago… and natural gas prices are up 154%.

That’s a lot of numbers, I know… and if you want to see the sources for these figures and all the data presented here, see our details & disclosures page, linked to at the bottom of this page.

The point I’m trying to make here is simple …

It’s not that we all don’t want a cleaner, healthier environment.

We all want green energy to work. And eventually… in 50 years or so, it probably will.

But today the reality is these green energy technologies are simply not ready to provide the bulk of our power, no matter what we’re willing to pay.

Green energy mandates will cost trillions of dollars, and in their current form will do almost nothing to prevent global warming.

But America’s Elite Caste… the politicians, mainstream media, celebrities, and universities… continue to tell us that we have only until 2030 to solve the problem of climate change.

And yes, I refer to this group as a “Caste.”

They are the nearly permanent members of the ruling class.

Dwight Eisenhower warned about them in his farewell address in 1961. He said they would have ‘unwarranted influence’ on America and acquire a vast amount of ‘misplaced power.’

Eisenhower was right then. And since then, it’s only gotten worse. Today it’s D.C. insiders. It’s academics and Wall Street types at the Federal Reserve. It’s celebrities from Hollywood. And it’s the media – especially the mainstream media.

Today the Elite Caste tells us we must make this shift to green energy immediately, and no matter what the cost. “This is what science says!” they scream.

But the Elite Caste has been trying to scare us for decades…

Back in the 1970s, Stanford ecologist Paul Ehrlich said overpopulation would destroy the world.

On CBS national news he said: “Sometime in the next fifteen years, the end will come. And by ‘the end’ I mean an utter breakdown of the capacity of the planet to support humanity.”

Guess what? 50 years later there were more than three times as many people on the planet compared to when Ehrlich made the dire prediction.

In the early 1980s, the UN predicted planetary “devastation as complete, as irreversible as any nuclear holocaust” by the year 2000, due to climate change, ozone-layer depletion, and acid rain.

Then in 2006, Al Gore estimated that unless drastic measures to reduce greenhouse gases were taken within 10 years, the world would reach a point of no return.

And while Gore’s bombastic predictions failed to materialize, he became the world’s leading celebrity environmentalist. And his net worth went from less than $2 million to more than $200 million.

That’s one of the things I learned over my 50-year career… to find out why so many people are pushing such a flawed agenda, you’ve got to follow the money.

I’ll show you in a minute why the same is true today… and where the big money is really going. While the overall stock market has collapsed, some people are getting rich – I’ll show you how.

In fact, I’ll show you where America’s best investor, Warren Buffett, is making one of the biggest investments of his career. You can get in on this trade too. I’ll show you how in just a second.

But first… let me get to the second runaway freight train headed our way… which will inevitably lead to “America’s Nightmare Winter”…

Our mandated switch to “green energy” is a huge problem… but this second problem might be even bigger…

Why I Sued the Federal Government

Many years ago, I worked in Washington at a group called The National Taxpayers Union. Our mission was to save the taxpayers money by cutting government waste.

It soon became obvious that Congress really sought more waste, not less. Because a ‘wasted’ dollar went into someone’s pocket – right where they wanted it.

So, then we tried to limit taxes. We were more successful there. Congressmen didn’t like to have to explain to voters why they raised taxes.

But then Congress got smart. They started borrowing… big time. That way they could spend more money without raising taxes.

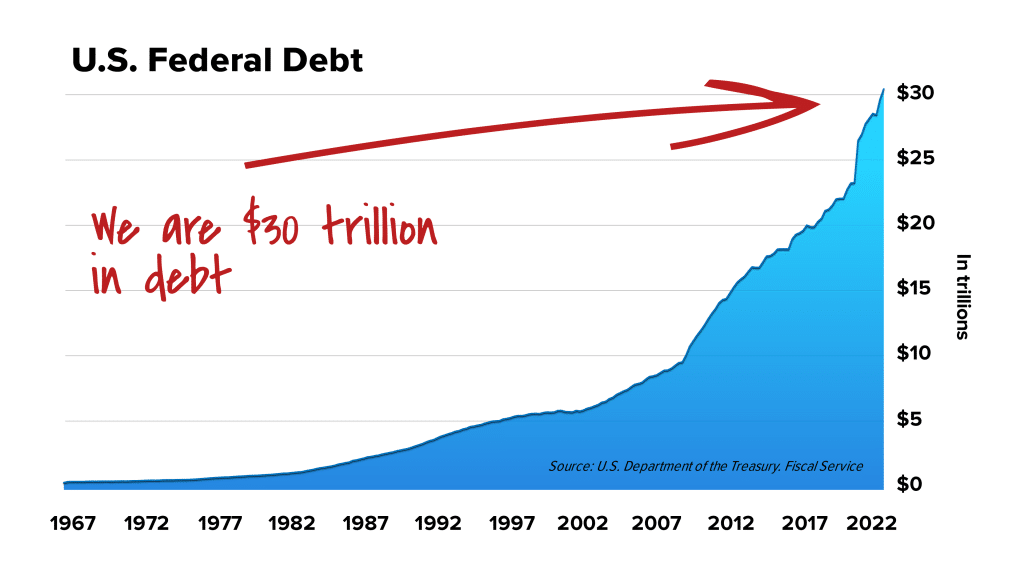

So next I led a lawsuit against the U.S. government. You won’t be surprised to hear how it turned out. We lost. And since then, the U.S. federal debt exploded 60 times… from $500 billion in the mid-1970s to over $30 trillion today.

After I left Washington, I spent my career building up my worldwide business. But when I came back to the U.S., it felt strange to me. It was as if the country had changed in a profound way I couldn’t describe.

The country I knew no longer exists. And there’s no going back.

One of the places I spend a lot of time today is northern Argentina. More than 15 years ago, my wife and bought a ranch there, about 9,000 feet up, in the foothills of the Andes.

I was able to buy a massive property in Argentina for about one-tenth of what it would cost in the United States. This property is one of the most beautiful places on earth… as you can see in these photos…

But sadly for everyone trying to make a living here… it’s also one of the most dysfunctional.

This dysfunction is what allowed me to buy my property, literally, with a suitcase full of cash, because financial institutions and the local money could no longer be trusted.

And here’s the interesting part:

There’s nothing wrong with Argentina or its people. The problem is politics, which turned Argentina from one of the richest countries in the world to one of the most corrupt and poverty-stricken.

And now, I see those exact same politics taking root in America too.

This is the second runaway freight train I’ve been telling you about…

So let me say it as plainly and simply as I can:

It doesn’t matter what tricks the White House, the U.S. Treasury, or the Federal Reserve are using… or how they spin it…

America is about to experience one of the greatest inflationary periods in world history.

And this inflation, which the entire world can now plainly see, will soon get much, much worse…

It will push millions of Americans down… out of the middle class… out of private retirement… out of private health care… and out of a decent life based on independence and privacy… into a collectivist nightmare.

It won’t be long before millions of Americans will be trapped by their own collapsing currency and deeply indebted government.

And this destruction of the currency, coupled with the rejection of the real source of our own wealth (our massive and cheap energy reserves)… will result in what I call: “America’s Nightmare Winter.”

Unfortunately, this all leads not just to high prices…but potentially to starvation and perhaps even some form of revolution.

Here’s why.

For starters, tractors run on diesel. And at $40 a gallon it will cost $20,000 just to fill a standard 500-gallon farm fuel tank.

Plus, farmers already face shortages of parts, fertilizers, seeds, and chemicals. Especially fertilizer. Billions of people are alive today only because we’re able to use natural gas to make ammonia by heating up nitrogen and hydrogen.

In fact, the BBC says almost half the world’s population would not be alive today without this process.

So, imagine you’re a farmer…

You’re about 60 years old (the average age for a U.S. farmer today)… and getting tired. You can’t hire anyone to help… no one wants to do the work no matter what you’re willing to pay!

On top of that, you’re facing $40-a-gallon fuel… and problems getting fertilizer and chemicals…

And you’re thinking maybe this is a good time to retire.

Then who grows the corn? The fields grow up in weeds, not wheat.

And what about all the trucks… the processors… packagers… distributors… retailers – they, too, need fuel… and supplies. And what if they’re not available when you need them?

You saw what the Covid shutdowns did to the economy.

Now, try to imagine what 50% inflation and electric blackouts coupled with huge ‘supply chain disruptions’ in the energy sector will do.

What farmer… what producer… what businessman… wants to put his seed in the ground when he has no idea what price he might get for the crop?

Inflation makes a hash of all business calculations.

And so in America, when you go to the store, you might find a box of Wheaties for $15… but the store is out of milk. And the canned goods are hit or miss… half the shelves are empty.

Oh, you’ll probably still be able to get something to eat. But it might not be what you want… and it might be very expensive.

And keep in mind: Behind nearly every revolution in world history you’ll find soaring food costs.

I’ve seen how this all plays out firsthand… I’ve lived it…

Locked Down in Argentina

Here’s another thing no politician or anyone in the Elite Caste will bother telling you right now…

Despite what you see with your own eyes, prices for all our goods and services… prices for real estate… for oil and gas… are NOT going up the way you think they are.

You see, what’s happening in America today is very similar to what happened in Argentina…

The truth is, prices are NOT going up – it’s the value of your money that’s going down.

Economic historian Adam Ferguson explains this phenomenon in his book, When Money Dies:

“It was the natural reaction of most Germans, or Austrians, or Hungarians—indeed, as for any victims of inflation—to assume not so much that their money was falling in value as that the goods which it bought were becoming more expensive in absolute terms.”

This U.S. government has destroyed the U.S. currency – beyond any state of repair or recovery. There is simply no turning back.

This is what happens when you print more money over an 18-month period than we’ve printed in the previous 200 years of our country’s existence.

This is what happens when you print a trillion new dollars into existence in just two days in March of 2020… yes, that’s really what the government did. Time Magazine wrote about it, although you barely heard a whisper about it anywhere else.

This is what happens when the Fed prints more than 5 trillion new dollars into existence since late 2019.

This list of money handouts just goes on and on and on… and politicians are talking about ramping it up even more today!

Gavin Newsom, governor of California, for example, recently proposed sending all state car owners $400 checks to offset higher gas prices.

Others receiving checks will include: renters, folks who pay utility bills, nursing staff, parents who pay for childcare, and more… oh and also free public transportation for everybody!

If you think California prices are high now, wait ‘till Newsom’s $18.1 billion “inflation relief” package hits the streets.

But this is the new way forward in America…

We’ll fight inflation by flooding the system with even more money.

The one thing you MUST remember if you live in America and hope to survive the coming years is this…

Inflation and currency devaluation is not just a threat… it’s the government policy from this point forward.

In the coming years, everything you do will be governed… everything will be controlled more and more by the state and their handouts.

More welfare and eventually Universal Basic Income. Medicare for all. “Free” college. More debt… and more debt forgiveness for a hand-selected group of individuals and corporations. Biden’s recent student debt forgiveness package is just a small taste of what’s to come.

We’ll see “income security” handouts. Price controls. Much higher taxes. More and more Americans not actually working, just like in Argentina.

Already, the government’s share of economy has gone from 22% before lockdown to upper 30% today. Soon, I believe it will be 50% or more.

As we move forward, shortages for everything will only escalate. More government weakens everything and pushes us more into debt. We are now rapidly accelerating into this new phase.

Of course, politicians love it.

They’ll have more say and more power.

Meanwhile, we’ll all be drowning in a monetary system that only empowers bankers, speculators, and a government leviathan that can’t survive without more debt and inflation.

Here’s something else to watch for: I think we’ll soon have enormous bailouts of state pension funds across America – which are woefully underfunded.

We’ll likely need at least $3 trillion to pay off state retirees.

And meanwhile, the government will continue to do everything they can to lock you into our collapsing currency… just like all governments do when they destroy their money.

- During Germany’s and Austria’s historical inflations, for example, there were laws against hoarding commodities like food and fuel… and laws forbidding ownership of foreign currencies.

- Today, Argentines are only allowed to purchase the equivalent of $200 in foreign currency per month. This locks all citizens into the plummeting peso.

Argentina also enforces a 35% “Solidarity Tax” on foreign purchases.

I know of folks in Argentina who saved everything for their Paris honeymoon, their life’s dream. But a week after their wedding day, the government announced the Solidarity Tax, and they had to call the whole trip off – the 35% tax put it all beyond their reach.

Mark my words, this is what America’s future looks like. Have you heard of FACTA, for example?

Most Americans haven’t, but it’s a policy our government quietly passed not long ago, which forces foreign banks to automatically turn money over to the U.S. government when Americans diversify out of the U.S. dollar.

From here on out, everything is going to get much more restrictive.

Billionaire Ray Dalio says the government will soon outlaw Bitcoin.

I don’t know if he’s right, but nothing is beyond the government’s reach. Just remember this: desperate governments do desperate things.

Even the extremely conservative billionaire Warren Buffett has said, “They [the government] will come after corporations. They will come after individuals… They’re going to have to raise a lot of money.”

(By the way, I’ve got a fantastic strategy for how you can legally get serious money beyond the government’s reach… I’ve done this with large amounts of my family’s fortune… more in a minute.)

But here’s the thing…

The worst part of a currency collapse isn’t the rising prices… or the shortages… or restrictions on what you can and can’t do with your money.

The worst part is that when you destroy the money, you infect and corrupt everything.

As my colleague Jim Grant says, inflation is NOT about the increasing money supply growth… it is essentially, “The fiscal breakdown of the state.”

As a German woman told Nobel and Pulitzer Prize-winning writer Pearl Buck about her country’s famous early 20th century inflationary collapse:

‘We used to say, “The dollar is going up again,” while in reality the dollar remained stable but our mark was falling… It all seemed just madness, and it made the people mad.’

The fiscal breakdown of the state ultimately leads to the breakdown of society.

You can see this madness in Argentina every single day…

Recently, a truck carrying cows to the slaughterhouse was stopped by a mob in Buenos Aires. They were so desperate they slaughtered a cow right there on the street and cooked it over an open fire.

Argentina’s 50% inflation has destroyed the economy. Today, private jobs are disappearing, while 55% of all registered workers are now employed by the government. Shortages and corruption run wild.

The same trends are developing in America… and America is definitely going a little mad too…

Some U.S. states are threatening to break away. The rich are fleeing. The wealth gap is soaring. People are driving more recklessly than ever… and drinking more alcohol than ever before too, according to The New York Times.

Altercations on airplanes are at all-time highs. Murder rates are sky-high. Violent crime is soaring. Students are more disruptive than ever. Hate crimes have hit a 12-year high according to the FBI.

And so, make no mistake…

These inflationary changes are now unstoppable… and could potentially destroy everything that remains uniquely American in our country.

I think “America’s Nightmare Winter” is now inevitable.

And here’s exactly what I believe it will look like…

Welcome to “America’s Nightmare Winter”…

Mandating the end of fossil fuels… and printing ‘paper’ money to pay for it is like lighting a stick of dynamite at both ends.

On one end, you cut off the supply of the most important components of modern economies – energy and raw materials.

On the other, you greatly increase the supply of paper money… which always leads to inflation, war, depression, military takeovers, and social upheaval.

Essentially, we are rejecting the real source of our own wealth (abundant and inexpensive fossil fuels)… and trying to replace it with inflationary money-printing.

These are America’s two runaway freight trains, barreling toward one another on a collision course.

Before this cycle is over, oil will go to $500 a barrel. That’s in part because of more inflation and more money printing (the dollar could fall by another 50% from here), and in part because the government has essentially ended new oil and natural gas exploration.

In the short term, we’re going to see rolling electricity blackouts and shortages.

Fuel won’t get delivered. And while some areas will get power, others won’t. Millions will suffer. These blackouts will cover much of the country. Food in the freezer will go bad.

In short… America’s entire energy system will suffer one collapse after the next.

And over the longer term, we are looking at a new era… this painful period is going to last much longer than most people expect.

A financial crisis… becomes an energy crisis… becomes a political crisis.

I say that because the last time we faced similar circumstances, the crisis lasted about 14 years.

Take a look…

Here’s what Happened 50 Years Ago – Will it be Worse this Time?

In 1965, President Lyndon Johnson began massive spending and took on huge budget deficits for the Vietnam war and his “Great Society” benefits: Medicare, Medicaid, Head Start, urban renewal, environmental issues, new immigration policies, and more.

Sure, sounds a lot like the new programs that are being rolled out today, doesn’t it?

Back then, like today, inflation was gradual at first…

Then… things began to spin out of control…

And America got exactly what it is getting right now: Big increases in both inflation and interest rates… combined with an energy crisis.

Most Americans alive today don’t remember this, but OPEC banned oil exports to the U.S. in October of 1973.

Gas prices quickly shot up 37%. Gas was rationed. Many stations ran out. Those with supply had to lock up their pumps.

The ban on exporting oil to the U.S. lasted only five months – a tiny crisis compared to what’s going on today – but by then the wheels of crisis were already in motion.

By 1974, inflation hit more than 11%, and the stock market fell 35%. Inflation eventually hit 13.5% in 1980.

In one incredible five-year stretch from 1977 to 1981, cumulative inflation was over 50%… in other words the value of your savings was essentially cut by one-third.

President Carter wore a sweater on national television, and the government launched a huge initiative to get Americans to bundle up and conserve energy…

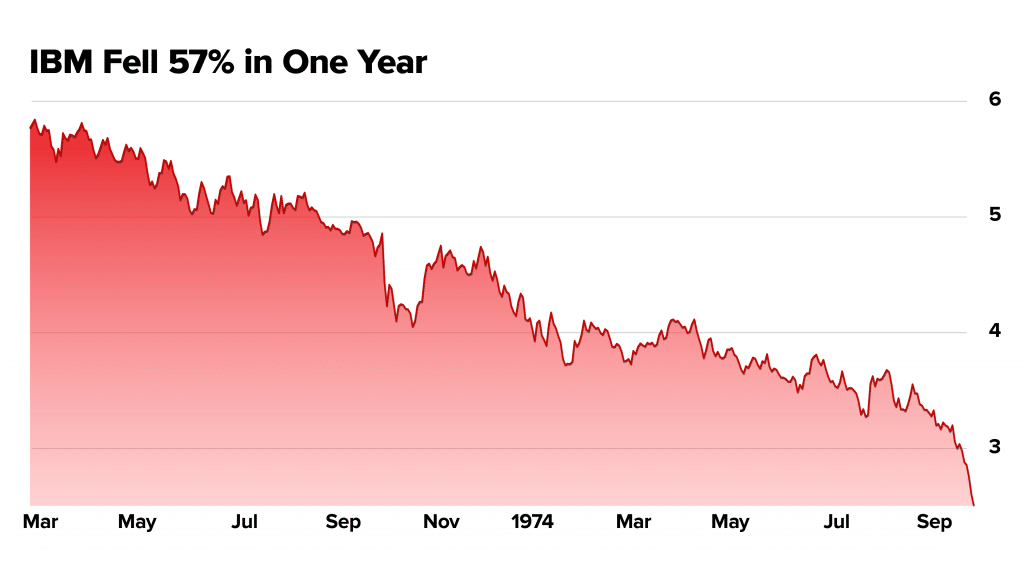

But even the “best” and supposedly “safest” stocks in America collapsed…

Get this: after peaking in 1972, the share price of essentially the hottest tech company in the world at the time, IBM, fell 57% and did not get back to even for nine years.

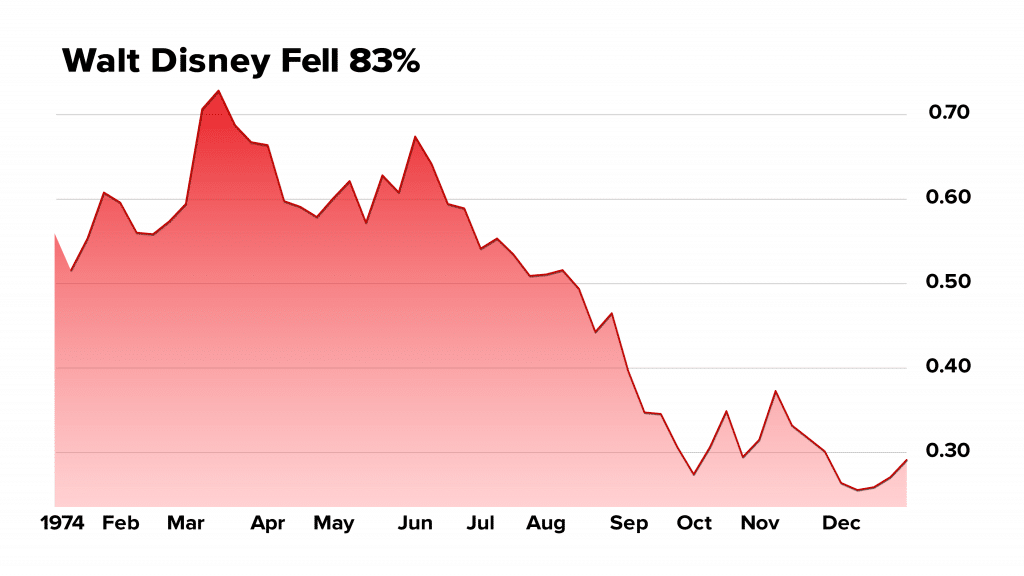

I’ve heard lots of people talk today about buying Disney lately, because it’s fallen about 40% from its highs… but I doubt Disney’s fall is done. During the 1970s, the stock fell 83% in less than two years.

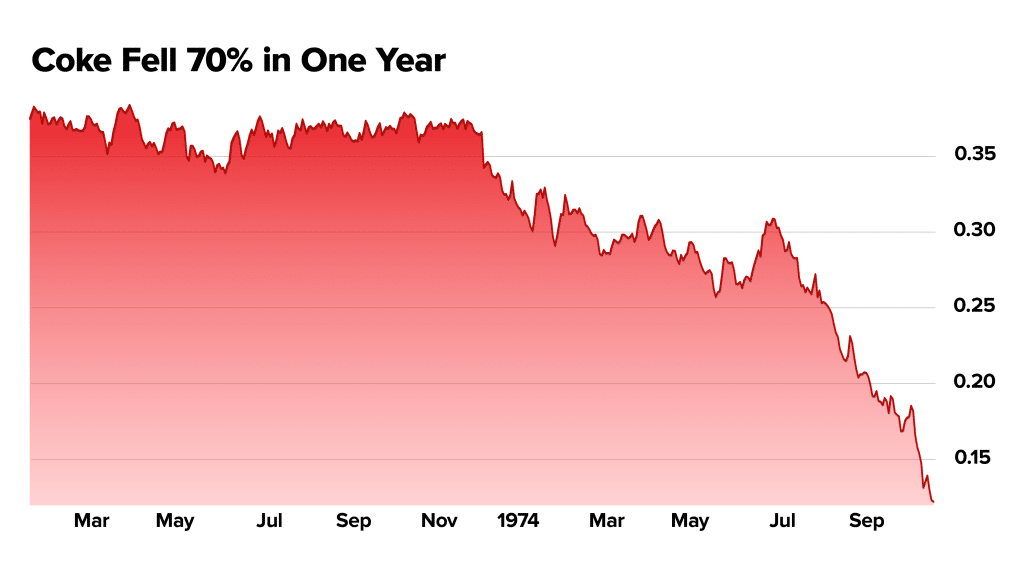

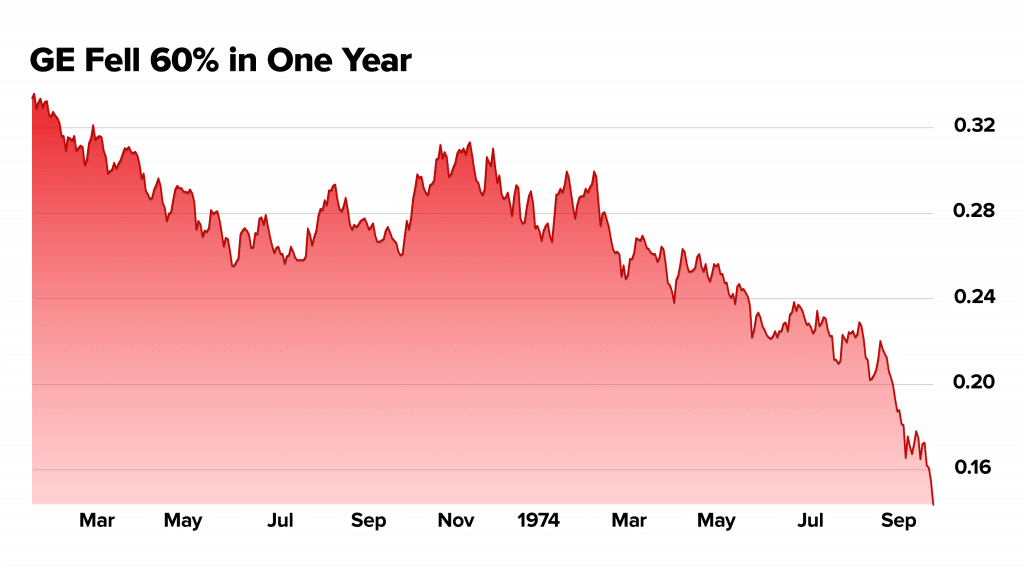

Other iconic businesses collapsed as well – Coca-Cola fell nearly 70% and General Electric fell nearly 60% and both took nine years just to get back to even.

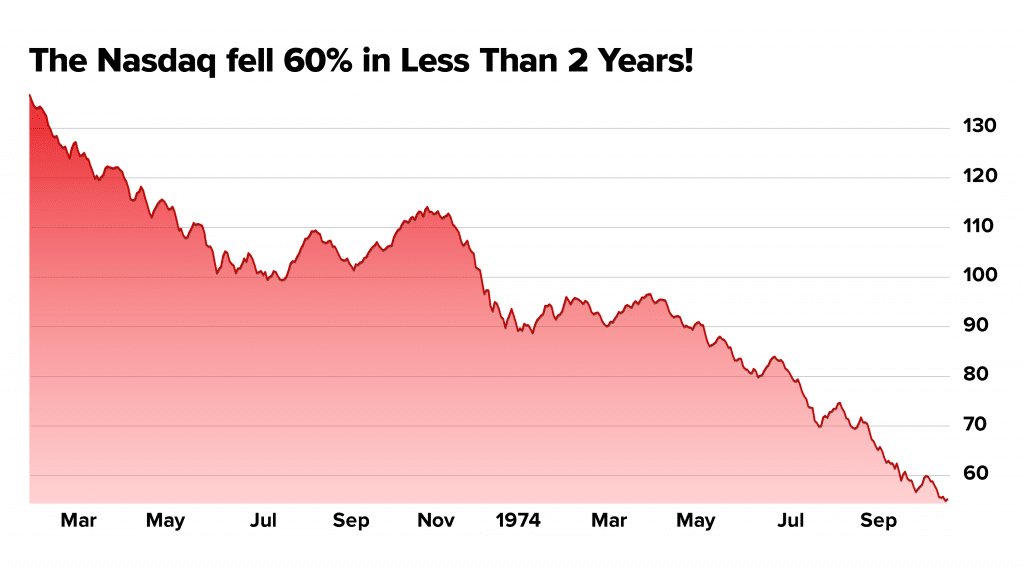

The entire Nasdaq stock index fell nearly 60% in less than a year.

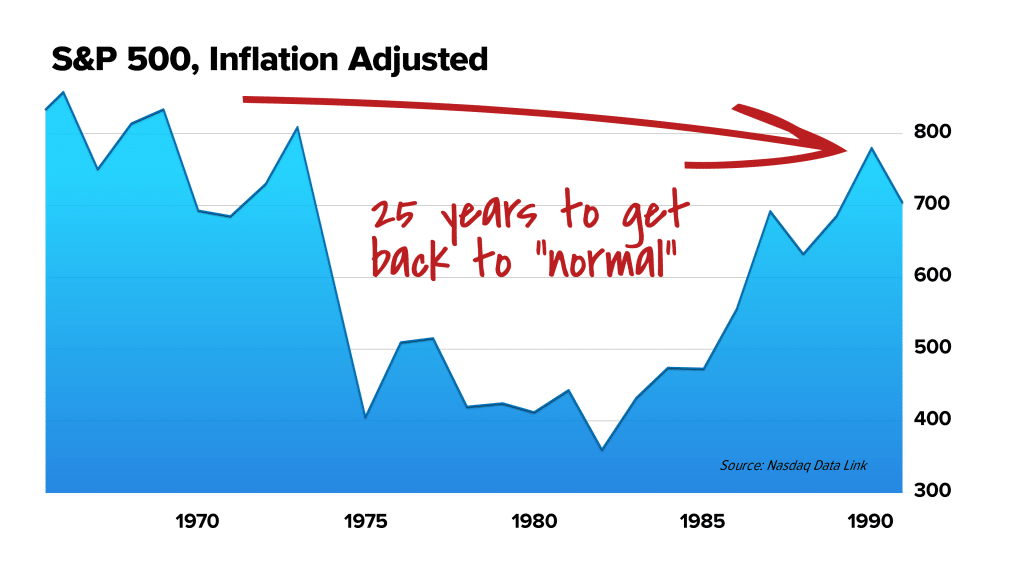

In fact, it would take until 1993 – 25 YEARS LATER until the S&P 500 reached a level that, after adjusting for inflation, exceeded its high from 1968.

In short: anyone who tells you stocks are the best inflation hedge simply does not know their financial history.

At the same time stocks were falling, prices were skyrocketing…

Meat, for example, soared more than 150% between 1973 and ’79… gasoline prices soared more than 225% between 1970 and 1980… while average airfare prices went up more than threefold over roughly the same period.

From January 1973 to January 1982, the cumulative rate of inflation was a whopping 130.9%.

Oil prices ultimately jumped 350% and the higher energy costs rippled through the economy.

The situation got so bad the U.S. dollar nearly ceased to function as the world’s reserve currency.

In fact, in 1978, the U.S. Treasury was forced to issue government bonds denominated in Swiss francs.

Foreign creditors no longer trusted the U.S. dollar as a store of value.

The point I’m trying to make is that an energy crisis is bad enough. So is inflation.

But when these two freight trains collide, it leads to disaster.

The last time we saw this type of cycle, it lasted about 14 years.

That’s where we’re headed today… if we’re lucky. This is America’s Nightmare Winter… and it could be much worse than last time.

Today we’ve got so much debt we can’t raise rates much – it will bankrupt us. And Americans are completely unwilling to go for any policies that bring any type of financial pain or hardship.

So today we are looking at a new era.

Blackstone CEO Stephen Schwarzman calls the period we’ve just entered, “A new regime.”

Many, many people are going to get a LOT poorer in the years to come.

And the sad part is, most Americans will do exactly what the Argentines… the Germans… the Austrians… the Hungarians… and the citizens of dozens of other nations before them have done when their governments destroyed their currencies…

They will cling to their increasingly worthless money, in a state of confusion and bewilderment.

This is human nature. Most people simply don’t understand what’s happening in America right now and won’t know what to do even after their money has been devalued yet again… and our energy infrastructure collapses.

And that’s exactly why I’m issuing this warning.

This is not the end of America. But it is definitely a new era. It is definitely the end of America as you have known it for the past 50 years.

It’s going to be bad for a lot of people, but it doesn’t have to be that way for you.

Here’s what my team and I recommend you do, starting immediately…

Step No. 1: Buy the Best Assets Now Soaring in Value

Over the past 50 years, I’ve had an interest in companies that have engaged with many great investors and many of the most connected people in D.C., like former U.S. Congressman Ron Paul, Federal government consultant Jim Rickards, and legendary accountant Joel Litman, who’s been asked to address the Pentagon five times in just the past year.

For my current project, I hand-picked a team that can show you the best ways to both protect and grow your money in the years to come…

One of those guys is Dr. Steve Sjuggerud.

I hired Steve decades ago. I flew down to Florida to recruit him to work for me in Baltimore. Steve has a PhD in Finance and has done everything in the conventional Wall Street world… from running a mutual fund to managing a hedge fund.

But really… I don’t care about any of that.

What Steve has proven to be incredibly good at over so many years is finding assets he describes as: “Cheap, hated, and in an uptrend.”

In other words, Steve’s expertise is finding assets at bargain prices… long before the mainstream catches on… which are just starting a potential big move up.

Over the past 21 years, he and his team have found hundreds of great investment opportunities most people would probably never hear about on their own or through their advisor or broker.

And Steve says right now, while most stocks are plummeting, one group of assets are making a massive move up… with no sign of stopping anytime soon.

In fact, Steve’s team’s open recommendations in this space have soared as high as 100%, 134%, and 42% in recent months… while the rest of the market continues to get clobbered.

Steve’s team, as usual, identified this trend long before almost everyone else. In fact, although it received little attention in the press, Steve says Warren Buffett just made one of his biggest investments ever in the exact same space.

In Steve’s latest Special Report, called: Buy The Best Assets Now Soaring in Value, you’ll get all the details on these stocks and this entire sector.

Everything Steve is going to show you is easily accessible on the stock market. He says this is the No. 1 money move you can make right now.

Steve thinks you have the potential to see great gains over the next few years with these investments, while most people continue to lose money holding yesterday’s winners, which are still collapsing in value.

After getting some of your money into these assets now soaring in value, we recommend you take Step No. 2…

STEP No. 2: The Only 100% Legal Way to Get Serious Money Beyond the Reach of the U.S. Government

Step No. 2 is a little unusual. It has nothing to do with stocks, bonds, or anything Wall Street folks typically recommend.

But I’ve taken advantage of this strategy myself, at least a half-dozen times… and have helped many others learn how to do it too.

It’s not right for everyone, but if you have the means and the time, this could prove to be the most important financial move you ever make.

In short, I want to share with you a secret I’ve learned that offers you essentially the best way to get serious money outside of the U.S. dollar, which you don’t even have to report to the government.

Why should you do this?

Well, as I’ve said, in any crisis, desperate governments do desperate things. So, I think it’s prudent to (legally) get some money beyond the U.S. government’s reach.

This has nothing to do with opening a foreign bank account or anything like that. I actually discovered this secret way back in the 1970s and built a whole business around it.

Today, I employ the guy who is almost certainly the world’s No. 1 expert on this strategy.

And in our new report with this expert, called: A Unique Way to Protect Your Wealth (The Government Doesn’t Even Have to Know About It), you’ll learn everything you need to know.

Of course, when and if you collect a profit on this investment, you’ll need to report your gains to the IRS, just like anything else. But until then, you don’t have to tell a single soul. This move will help you sleep better at night and could prove to be potentially very lucrative in the years to come.

And that brings me to…

Step No. 3: Better than Gold Bullion or Gold Stocks?

The next move I suggest you make is another idea from Steve Sjuggerud… he discovered this strategy about 20 years ago and has helped thousands of people learn how to take advantage of it ever since.

And Steve says it’s an absolutely perfect money move right now.

In a nutshell, Steve says there’s a unique way to buy gold and silver that has nothing to do with gold or silver bullion… and nothing to do with the stock market.

In essence it’s like gold or silver, only better. It’s like a “secret currency,” and according to Steve’s research…

- From 1972 to 1974, this investment rose 348%, according to an index that keeps track of it. At the same time, stocks dropped more than 30%.

- From 1976 to 1980, while the S&P 500 plummeted 35%, this investment realized 1,195% profits.

- And between 1987 and 1989, investors who took advantage of the secret currency saw profits of 665%.

Stocks, meanwhile, went on a roller coaster ride – up and down dozens of times (sound familiar?) during this period.

Steve tells me the last time Salomon Brothers included this vehicle in its annual investment survey, this investment ranked No. 1 over the prior 20-year span, with an annual return of 17.3%. In other words, it was the single most profitable thing you could do with your money over those 20 years.

It beat stocks, bonds, artwork, diamonds, U.S. Treasury bills, real estate, and oil, according to an article in the Chicago Tribune.

Everything you need to know is in Steve’s detailed Special Report, called: The Secret Currency – How to make 500% from the U.S. Govt’s second currency.

So how do you get started if you’re interested in making these moves?

And how much does it cost to access this research?

Here’s the deal…

Why I Won’t Be Suing the Federal Government Again

The last time we faced an energy crisis combined with massive inflation, Nixon was in the White House, and changed the world’s monetary system, cutting the last link between the dollar and gold.

As I explained earlier, back then I was deeply involved in an effort in Washington, D.C. to stop the government from wrecking the country.

First, we tried the lawsuit I mentioned. On behalf of America’s children and its future, my son and I sued the U.S. government in Bonner v. Baker. The “Baker” was James Baker, the U.S. secretary of the Treasury.

National debt was a tax on future generations, we argued. Laying on this sort of intergenerational obligation amounted to taxation without representation and should be banned.

The court threw out our suit.

So next we tried an amendment to the U.S. Constitution. The “Balanced Budget Amendment” would have blocked the feds from running deficits except in times of war or national emergency. Thirty-two states approved it – two short of the required number.

I learned my lesson; It’s a waste of time, money, and energy to fight the Feds. It’s a no-win situation.

So, this time I’m doing something different.

I’m not organizing a protest or filing a lawsuit. In the 50 years since I tried to take on the Feds, my companies have made billions of dollars. And I’ve assembled a collection of some of the best investment and political analysts in the world.

So instead of going after the government, I’ve partnered up with some of the best analysts my companies have hired over the years and have put together what we think is the perfect mix of research and analysis to help folks right now.

We are 100% convinced America has entered a new era… a new regime.

America’s two runaway freight trains… the mandated switch to green energy… and soaring money printing, borrowing, and inflation…

Will cause huge problems… and much, much higher prices.

Like I said, this is not the end of America… but the rules for making and protecting your money are going to be very different in the years to come… and I think we’ve assembled the right mix of folks who can help you do both of these things… protect what you’ve got and grow your wealth too.

But before I show you exactly how to get started with this research, there’s one more interesting step my group thinks you should consider…

STEP No. 4: The Art of Speculation

In times of market chaos and massive inflation such as this, you often have the chance to make enormous gains with prudent speculations.

You see, inflation causes huge distortions and wild mispricings that can lead to big gains.

For example, did you know that coal stocks have shot up as much as 3,100% in less than two years… and shipping companies have soared as much as 3,800% over roughly the same period?

Well, this fourth step we recommend is a series of calculated speculations, but they are not for everyone.

It’s not for your rent money. Or any money you might need any time in the near future.

These ideas come from one of the analysts I handpicked to join me in this venture – a former British banker named Tom Dyson.

Tom has a unique way of looking at the world. He is an extreme contrarian and simply incredible at finding profitable speculations.

One thing I like about Tom is that he is incredibly patient. He sits… and waits… until he finds something extraordinary.

For example, not too long ago, Tom recommended shipping stocks when he saw a huge opportunity in this sector. He found eight companies and the average gains were 114% on these positions.

Tom did something similar a few years back when he noticed the Bank of England (which owned gold for its entire 300-year history), dumping about 395 tons of gold starting in 1999 at an average price of about $275 per ounce.

So, Tom took a large stake in precious metals. Gold is up 500% since then, and Tom made $200,000, although he’s the first to admit he sold too soon.

Tom is also the first person I know who bought Bitcoin. He even gave me one, although I have no idea where it is today. Tom started buying Bitcoin when it was just $6.

It’s up about 300,000% since then.

Again, Tom made a killing.

And today Tom has found another set of mispriced speculations, which he says have the potential of returning 1,000% or more, even in the worst of markets.

I’m not going to say much more about these moves here, because we’d like our subscribers to learn how to get into these trades before we reveal them to the public.

But I will say you can get into these speculations today for less than $5.

Again… this is not right for everyone. You will probably do just fine by following the first three steps I already outlined.

Also, you must remember that all investments carry risk, and these speculations even more so. Just because Tom and Steve have found so many incredible opportunities over their long careers does not mean they will do so again. And of course, you should never invest money you can’t afford to lose.

Everything you need to know about this fourth Step is explained in our detailed report called: The Art of Speculation.

In this report, Tom details a handful of fascinating trades brought about by wild recent price swings. If even just one hits, it could make a big difference to your bottom line.

So… how much does all of this research cost?

Well, the regular retail price for everything I’ve described here is more than $300… but as part of this deal I’ve put together, you’ll pay just $49 for the next year.

This $49 fee entitles you to a one-year subscription to Steve Sjuggerud’s True Wealth research, where Steve and his team show you the best investments in the world that are cheap, hated, and moving in an uptrend. Every month, I’m sure Steve and his team will introduce you to many money-making ideas you’ve never considered before.

With this one-year subscription purchase, you’ll also receive the next year of our Bonner Private Research monthly reports, delivered on the fourth Thursday of every month.

$49 is an embarrassingly low price. But please understand it’s only available to you today as part of this special offer. You won’t find it on any website.

When you take advantage of this deal, you’ll immediately receive all of the Research Reports I’ve described here today…

- Special Report No. 1: Buy The Best Assets Now Soaring in Value

- Special Report No. 2: A Unique Way to Protect Your Wealth (The Government Doesn’t Even Have to Know About It)

- Special Report No. 3: The Secret Currency

- Special Report No. 4: The Art of Speculation.

You’ll also begin receiving Steve Sjuggerud’s True Wealth each month and our Bonner Private Research monthly reports.

Plus, you’ll get the daily market analysis and updates from Steve’s team and mine… and access to Steve’s archives, which includes more than 100 Special Investment Reports, on subjects such as how to structure the perfect portfolio right now… how to know exactly when to sell any investment… and even a digital copy of my latest book, and much, much more.

Again… as a first-year subscriber, you’ll pay just $49. I can’t imagine a better deal exists anywhere on or off Wall Street.

Now of course, all investments carry risk. So please do not invest more than you are willing to lose.

One more thing: Our research is not for everyone, so if you find it’s not right for you for any reason, simply let our Maryland-based customer service team know, and they’ll issue you a full refund any time within the next 30 days for your subscription.

I hope you take advantage of this opportunity and don’t get caught flat-footed.

As I’ve described in this presentation, the Elite Establishment is playing two dangerous games at once…

They are aiming to change the way a modern economy works… and to pay for it by printing up “paper” money.

In the 1970s we had a near miss with a very similar kind of crisis.

As a result, our steel and auto industries began to fail; gas prices soared; riots broke out all across the country. Angry mobs swarmed gas stations.

But in terms of an economic crisis, the mess of the 1970s was tiny compared to what we’re facing today.

Can you imagine a full-blown inflationary and energy collapse in today’s America, where anger at police, corporations, and opposing political parties has reached a boiling point?

Where half the population pays no taxes and depends on aid from the federal government?

Where students are so crippled by college loans that politicians are forgiving their debts?

Where bailouts are the norm for every type of crisis or setback?

Given what we have seen in recent years all over the country…

From Baltimore to Seattle… New York to Portland… Minnesota to Buffalo… with people seizing just about any excuse to loot stores and take over entire swaths of public property…

How long do you think those same people will refrain from stealing and violence when the lights go out… and they can no longer afford to fill up their gas tanks either because of shortages, or because prices have gone far too high?

My feeling is, not very long.

Learn what you can do to protect yourself right now. We’ve done an incredible amount of work to help you make the best moves right now. I strongly recommend you take these steps while they are all inexpensive, and easy. And every month, we’ll keep you updated on this situation, and show you immediately when opportunities arise.

This is going to be bad for a lot of people, but it doesn’t have to be bad for you.

Click the Get Started button below to get started.

This will take you to a secure order form, where you can review everything once more before submitting your order.

Again, you can get started for just $49… there’s a full 30-day money-back guarantee… and after placing your order, you’ll receive an email with access to everything described here,

Thanks for tuning in. I look forward to potentially welcoming you into our circle.