It’s understandable why people might be skeptical about Whitney Tilson. Here’s a guy making all these bold predictions and claims, yet he had to shut down his very own investment firm due to “sustained underperformance.”

But not only that. This “sustained underperformance” occurred during one of the longest bull markets we ever had. When it shut down, it underperformed the S&P 500 by 9%.

💡 Tilson recently broke the story on the biggest tech breakthrough affecting you and your money today. He's calling it "EoD." Tilson says it can put up to $4,002 in your pocket every year - no investment needed. Get the full "EoD" report.

But here’s what makes Tilson special. While many stock gurus tend to magically never have a bad day nor underperform, Tilson embraced his failures with the utmost transparency. He never ran from it and confronted it head-on. Tilson said, “In an ironic twist, I always built my firm to survive the worst storm, but it was a nine year bull market — complacency and sunshine — that took me out.”

Tilson doesn’t pretend to have some magic formula for stock picking. He has a tried and true method that’s made the likes of Warren Buffet one of the world’s most legendary investors and one of the world’s wealthiest men. It’s not like Buffet’s been perfect, either. During the Coronavirus market crash, brash retail investors and Robinhood traders mocked him for some of his investment decisions.

Today, in 2022, with the market the way it is, value investing is back in. We’ve seen a significant rotation from growth stocks to value stocks as the Fed tightens its policy and we confront inflation and recession risks.

The Whitney Tilsons and Warren Buffetts of the investment world prove that approaching stocks with a “buy and hold” and “bottom feeding” philosophy will always prevail in the long run.

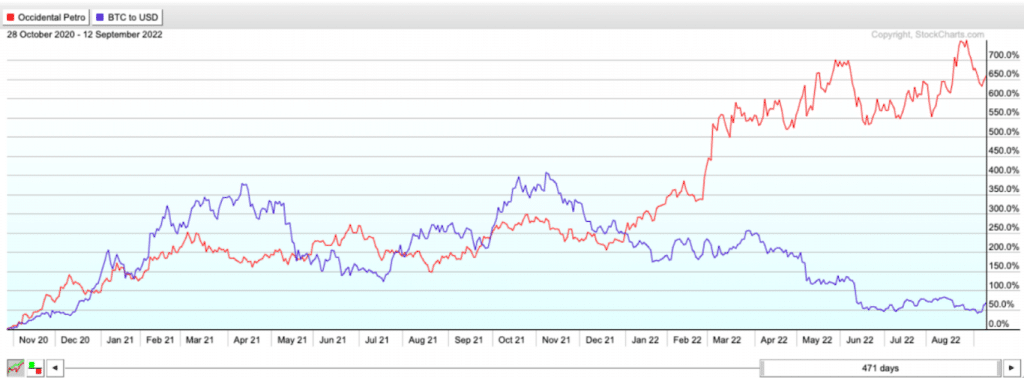

For instance, say you bought long-time Buffett and value investing favorite Occidental Petroleum after the stock closed at $8.81 on October 28, 2020. Oil stocks were undervalued and unloved then, and something like Bitcoin was a trendier pick. While Bitcoin is still up roughly 60% overall since then, it has primarily collapsed since peaking in November 2021. On the other hand, Occidental has skyrocketed by almost 660%. This comparison is a classic case of why value investing typically wins in the end.

You’ll miss the bigger picture if you only focus on an investment guru’s bad times. Tilson is educated, has a tried and true investment philosophy, and has made numerous bold predictions that have come true.

Is Whitney Tilson Legit?

Yes, Whitney Tilson is legit. If looking for sound investment advice, definitely consider Empire Financial Research. Tilson doesn’t approach stocks like a slot machine. He uses pure fundamental data and valuation tactics that typically prevail over the long term. If you’re a day trader or focused on immediate gains, maybe he’s not the guru for you. But he has made several successful predictions in his career that have received widespread recognition. There is depth behind his predictions. The only difference between him and other gurus is his transparency about his down periods.

It’s unfair to hold that against him.

Who is Whitney Tilson? Check out his bio to learn more about his performance as a hedge fund manager and stock-picking guru. Also, watch Tilson’s most recent interviews to see what he’s been up to lately.

Subscribe to our YouTube channel for more stock-picking tips.