WRITE DOWN THIS DATE: MARCH 11, 2024

On this date, a desperate move by Central Bank officials could transform the U.S. dollar forever. If you hold any money in a U.S. bank account, consider taking these 3 steps immediately…

My name is Dan Ferris. I’m an analyst at one of America’s largest independent financial research firms.

If you have any money stashed away in a U.S. savings account, an IRA, or a 401(k) right now… I urge you to pay close attention to what I’m about to show you.

As you may know, last year we witnessed the collapse of three regional banks. It sent shockwaves throughout the financial markets…

But what you may not realize is that those three bank failures were LARGER than the 25 that collapsed during the financial crisis, combined.

And while these bank collapses quickly disappeared from the news as the government bailed out regional banks across the country…

None of the fundamental problems that caused last year’s bank run have gone away today.

Last year alone, U.S. banks lost over $1 trillion in deposits – the BIGGEST outflow we’ve ever seen in history…

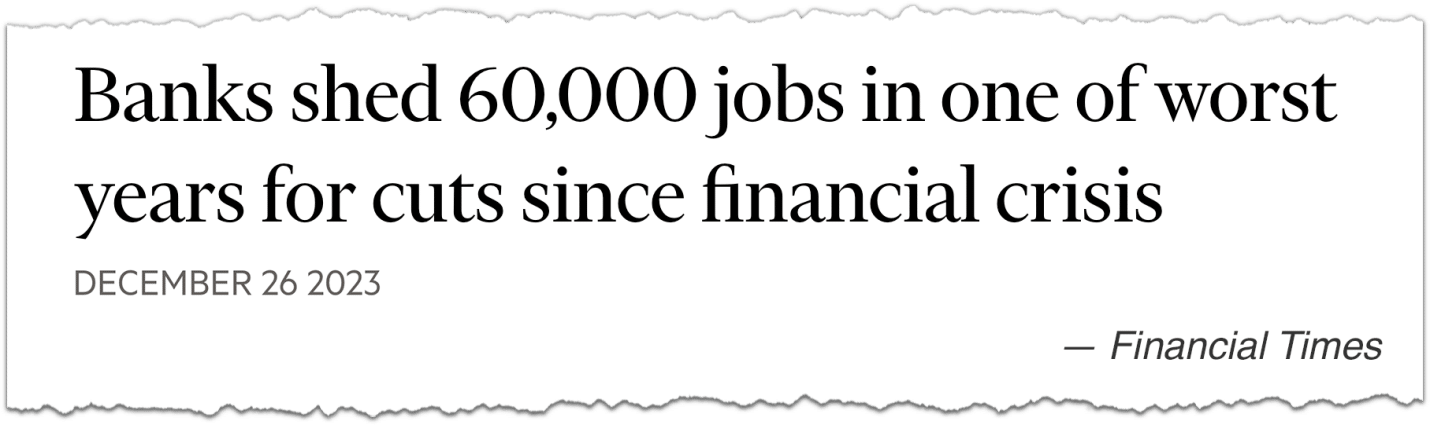

They also laid off almost 62,000 employees – the highest number since the financial crisis…

And shuttered more than 1,500 bank branches in 2023 alone…

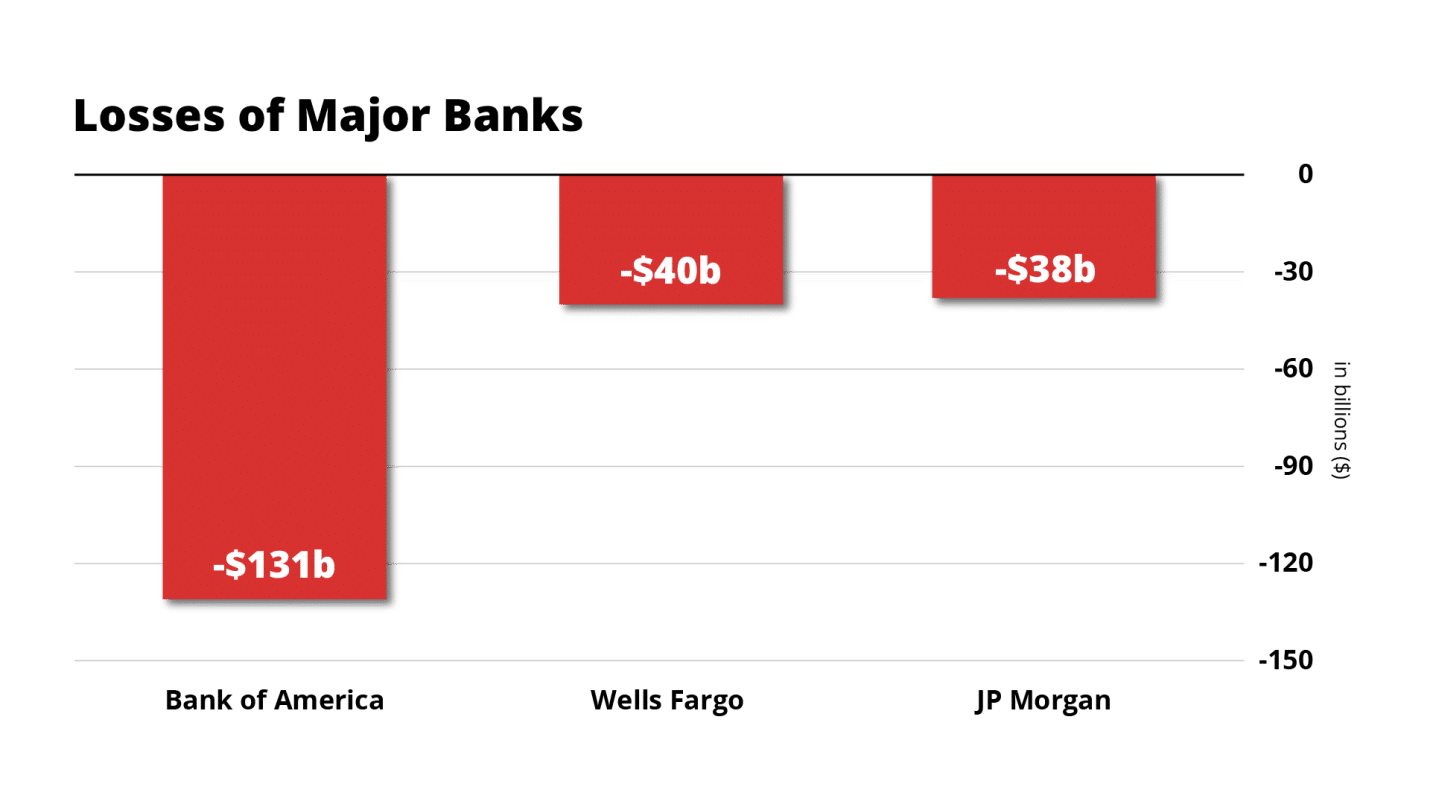

Today, as many as 722 banks across the country have seen their portfolios of U.S. Treasury bonds crash by as much as 50% from their peak…

And I’m just talking about the so-called safe investments that our banks are required to hold as collateral.

Bank of America, alone, has already lost $131 billion in deposits, while Wells Fargo and JPMorgan Chase have lost nearly $40 billion in deposits, each.

Together with over 700 other banks, these losses are now worth at least $680 billion…

Although some experts estimate this number is as high as $1.3 trillion – more than HALF of the total equity in our entire banking system!

In other words, if Americans were to go and try to get all their money out of banks today, our entire banking system would collapse…

And I believe that as soon as March 11, our government will make an unprecedented move that they’ll say will “save” the economy” from this current banking crisis…

A policy change that will permanently alter the U.S. dollar and ultimately make Americans much, much poorer as a result.

I know this might sound hard to believe…

Nobody wanted to believe me back in 2008 when I predicted the collapse of Lehman Brothers – the fourth-largest investment bank in America at the time.

But five months later, shares had fallen over 80%, and the company went bankrupt.

Today my research has led me to a similar conclusion. Only the scale of the problem today is many times worse than anything I witnessed during the financial crisis.

My friend, hedge-fund manager Hugh Hendry – renowned for achieving a 31% positive return at the height of the financial crisis – recently told Bloomberg:

“We’re at the point where the Fed and the Treasury officials are having to consider [desperate measures to protect] our bank deposits.”

As I’m sure you’ve experienced in the past, when the government takes drastic measures to save the economy, it doesn’t usually work out like they say it will… at least not for people like you and me.

The problems in our banking system today have only reached these levels two other times in the last 90 years…

And in both instances, the president of the United States issued an executive order that fundamentally changed our money, our economy, and our way of life…

Leaving millions of Americans poorer, virtually overnight.

I call these kinds of executive orders “Trojan Horses”…

Because while they are designed to seem like solutions to the crisis… they are always radical monetary experiments that end up destroying Americans’ savings instead.

And Biden’s Trojan Horse will be no different. In fact, our president laid the groundwork for his Trojan Horse when he inked Executive Order 14067.

It’s one of the 127 executive orders he’s signed since taking office… which may be why so few people have paid attention.

But you should be paying attention.

Today, I want to show you exactly how our country got into this mess and why I believe March 11 will be a turning point for our country.

For the first time, you’ll clearly understand why it feels like hope has disappeared for the vast majority of Americans.

You’ll begin to understand why the country has never been more divided, politically and economically…

And you’ll be able to clearly see how history can show us exactly what to expect next.

As our government attempts the most radical experiment with our money, our currency, and our economy in history…

I’ll show you three simple ways to position yourself to survive – and even grow your wealth…

Before Biden’s Trojan Horse fundamentally alters the value of your savings forever.

It’s a lot to take in, I know. But you can check every number I’m sharing with you today.

Once this message is finished you can check all my sources by going to our details & disclosures page, linked below.

But before you do anything else…

We need to go back almost 90 years, where the story really begins.

An Age-Old pattern

Most people know about the Roaring Twenties, the stock market crash of 1929, and the Great Depression that followed…

But what they don’t understand is just how the crisis happened… and how quickly it prompted our leaders to overhaul our financial system almost overnight…

You see, the story of the Great Depression actually begins in Great Britain.

At the turn of the century, the British Empire was the largest in history, covering a whopping quarter of the world’s land and ruling over a fifth of its people.

It was the dominant global superpower, both economically and politically.

The empire’s currency, the pound sterling, was also the world’s dominant currency for international trade and finance.

But after dominating the world economy for more than a century… World War I broke out in 1914 and devastated the British Empire and the rest of Europe.

The cost of the war and maintaining its vast empire was tremendous.

The national debt soared nearly 10-fold by the time the war ended.

And though finally at peace, the British economy slid into a deep slump in 1920.

Meanwhile, American soldiers returned home to what would quickly become a prosperous and optimistic economy… and a time of incredible innovation.

The automobile had largely replaced the horse and carriage across the country…

Radio sales soared from $60 million in 1922 to $426 million in 1929…

Our economy was booming, and it didn’t take long for the U.S. to become the world’s top creditor…

Soon, the U.S. dollar replaced the British pound as the preferred global currency.

Many newly prosperous Americans began to seek out investments for their excess savings…

And a new financial industry was born to supply those demands.

Banks, brokerage houses, trusts, and margin accounts encouraged Americans not only to buy stocks and bonds… but also to do it with tremendous leverage.

To buy stocks, they’d put down about 10% and borrow the rest.

Money poured into the market, and stocks soared.

It was not unlike what we saw in 2020, when new and inexperienced investors took their pandemic stimulus checks and pumped them into the worst possible stocks you could imagine.

And just like today, it took a WHILE for the governors of the Federal Reserve banks to finally realize this leveraged bubble was a danger to the economy.

So the Fed stepped in to take direct action…

In an attempt to deflate the speculative mania, the Fed raised interest rates to 6% in the fall of 1929.

Just as we’ve seen recently when the Fed embarked on its fastest rate-hike cycle in history…

Stocks began to fall when the borrowing stopped…

… And then, the panic set in.

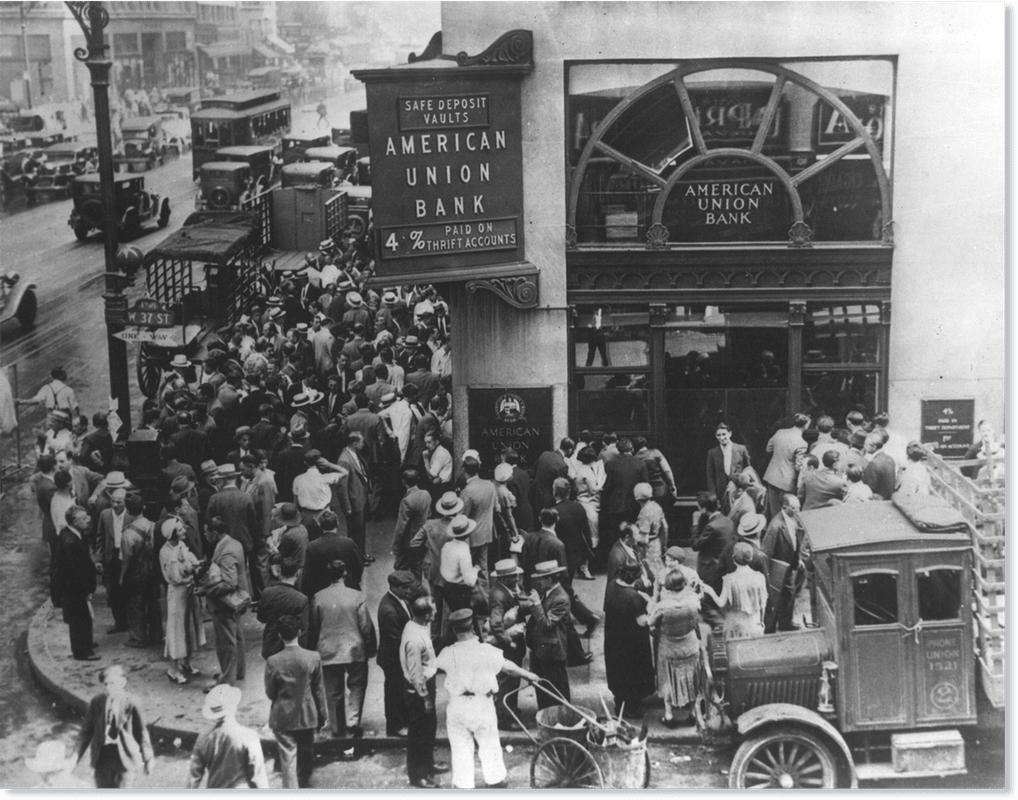

Over the next five years, nearly 40% of the nation’s 25,000 banks collapsed…

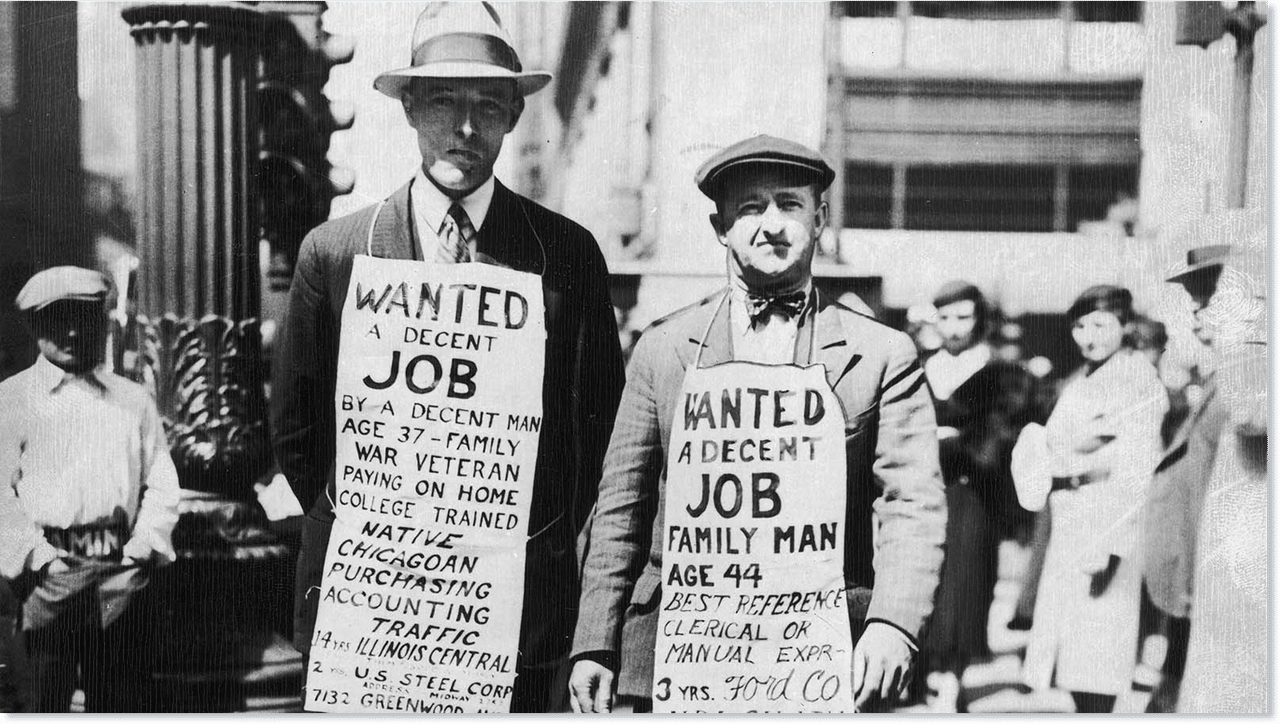

Fifty percent of American workers lost their jobs within three years…

And Americans were desperate for hope.

When Franklin D. Roosevelt was inaugurated in 1933…

Depositors had not only lost faith in commercial banks, but they’d also lost faith in the Federal Reserve.

On the eve of FDR’s inauguration, the LARGEST democracy in the world barely had a functional banking system…

NONE of the Federal Reserve banks were open for business that day.

But FDR had a plan…

One that we now know changed our currency and our monetary system forever…

And set a dangerous precedent for our current leaders to enact the biggest-ever upheaval to our financial system today, as you’ll see in a moment.

Within a few days of taking the oath, FDR issued the Emergency Banking Act of 1933…

Most people know that this law created the Federal Deposit Insurance Corporation (FDIC), which insured bank accounts at no cost for up to $2,500… and up to $250,000 today.

But did you know that this act also gave the president of the United States executive power to operate independently of the Federal Reserve in times of financial crisis?

A power the President still holds today?

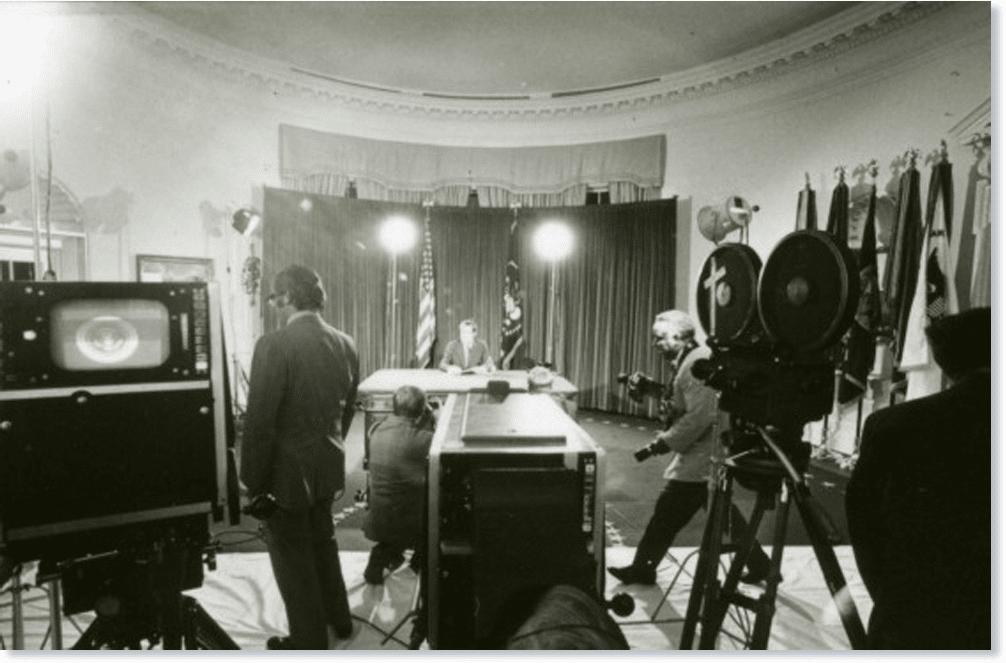

A week later – on March 12, 1933, FDR delivered his first ever “fireside chat.”

President Franklin D. Roosevelt broadcasts his first fireside chat regarding the banking crisis from the White House on March 12, 1933

As he told about 60 million Americans who listened over the radio that day:

“People will again be glad to have their money where it will be safely taken care of, and where they can use it conveniently at any time. I can assure you that it is safer to keep your money in a reopened bank than under the mattress.”

You see, after three years of joblessness, poverty, and depression, Americans were desperate for hope.

And FDR had made promises of a “New Deal” to help the American people during his election campaign.

The country was relieved – even elated – to see the president deliver on his promise.

Folks lined up to redeposit their money into their bank accounts.

Thousands of letters soon poured into the White House, thanking the president.

In fact, no president since FDR has enjoyed higher approval ratings.

Blindsided

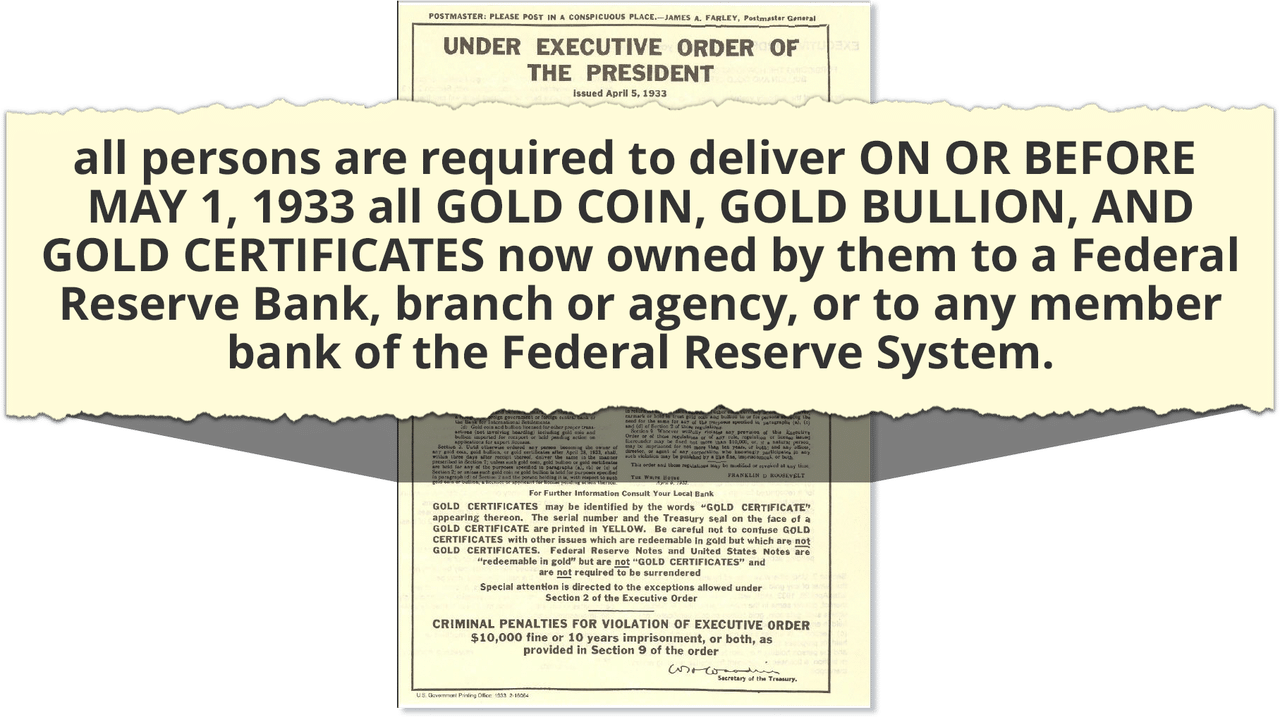

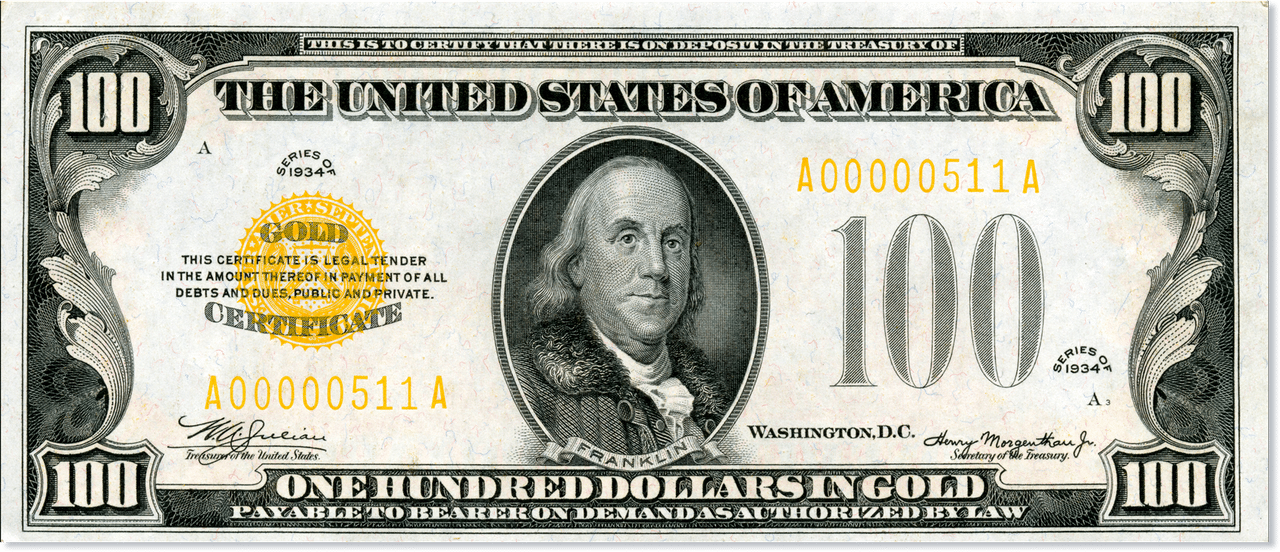

Just a month later, FDR issued Executive Order 6102, his Trojan Horse. In it, he wrote:

“[Everyone has to deliver] on or before May 1, 1933, all gold coin, gold bullion, and gold certificates now owned by them to a Federal Reserve Bank, branch or agency.”

But this wasn’t a confiscation, he said. The government would pay about $20 an ounce for gold – a price that had been fixed for a century.

This stunned everyday Americans.

Most people kept their savings in gold, after all.

But knowing this was part of the solution to the crisis, patriotic Americans complied. Those who didn’t risked huge fines and imprisonment.

Within a month, the federal government confiscated almost $800 million in gold.

The gold was melted down and sent to Fort Knox.

Although Americans received $20 in cash for every ounce of gold they turned in…

This was a Trojan Horse for what would come next.

Only a few months later, FDR signed the Gold Reserve Act.

President Roosevelt signs the Gold Reserve Act into law on January 30, 1934

This allowed the federal government to confiscate ALL remaining gold from people, businesses, and even institutions like the Federal Reserve…

Growing the TOTAL amount of gold held at Fort Knox to $2 billion.

And then…

FDR also fixed the new price of gold at $35 an ounce… and the government declared a profit of about $14 per ounce of gold.

In other words, America woke up to discover that the paper money they had received for their gold was now worth 41% less than the day before…

And that they were 41% poorer overnight.

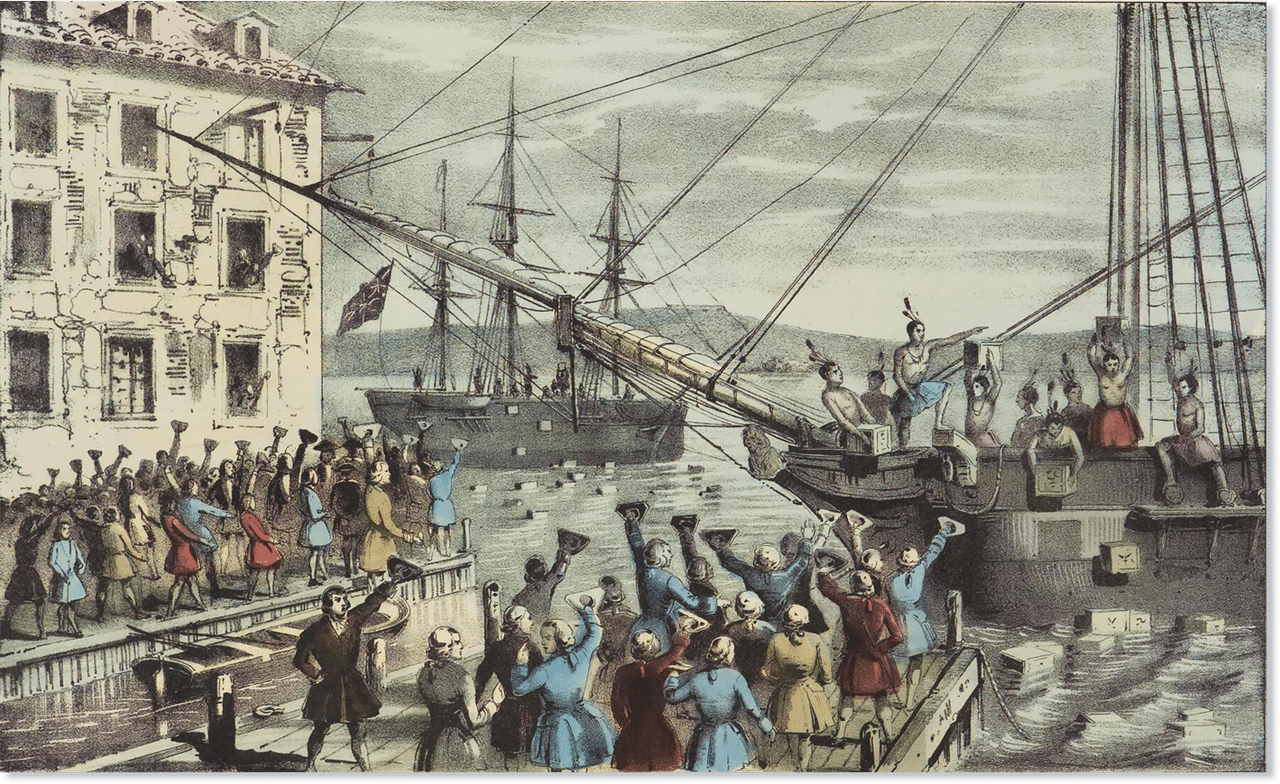

The country that was founded on the fight against unjust government taxation… the country that flooded Boston Harbor with 342 chests of tea… was suddenly forcing its citizens to report to federal banks and cough up billions in privately earned and owned wealth.

But history is written by the victors, and there’s a reason the government doesn’t include these details when they teach our children history…

Because if they did, people would easily realize that the exact same thing is happening today with Biden’s Executive Order 14067.

And just like today, plenty of people could see what was coming…

One of the Supreme Court’s associate justices, James Clark McReynolds, tried to warn the country in his dissenting speech on FDR’s gold policies:

“[The country is now] confronted by a dollar reduced to sixty cents, with the possibility of twenty tomorrow, ten the next day, and then one.”

One crisis, one executive order, and America’s money was changed forever.

Despite erasing 41% of Americans’ savings overnight, the majority of Americans approved of what FDR did next.

In short, he went on to triple taxes.

The money was promised to fund his famous New Deal programs – such as the creation of the Social Security Administration – along with other programs that ensured his re-election in 1936.

For example, FDR’s New Deal gave about $60 to each farmer in South Dakota, Montana, and Maryland, coincidentally the swing states that could clinch a victory for FDR in his next election… while the poorest farmers in the South only received between $3 and $8 each.

Of course, it isn’t hard to guess how the debasement of our currency, higher taxes, and massive new spending on social-welfare programs transformed the economy.

America soon slid back into a recession.

As Nobel prize-winning economist Milton Friedman writes:

“[This was the only] occasion in our record when one deep depression followed immediately on the heels of another.”

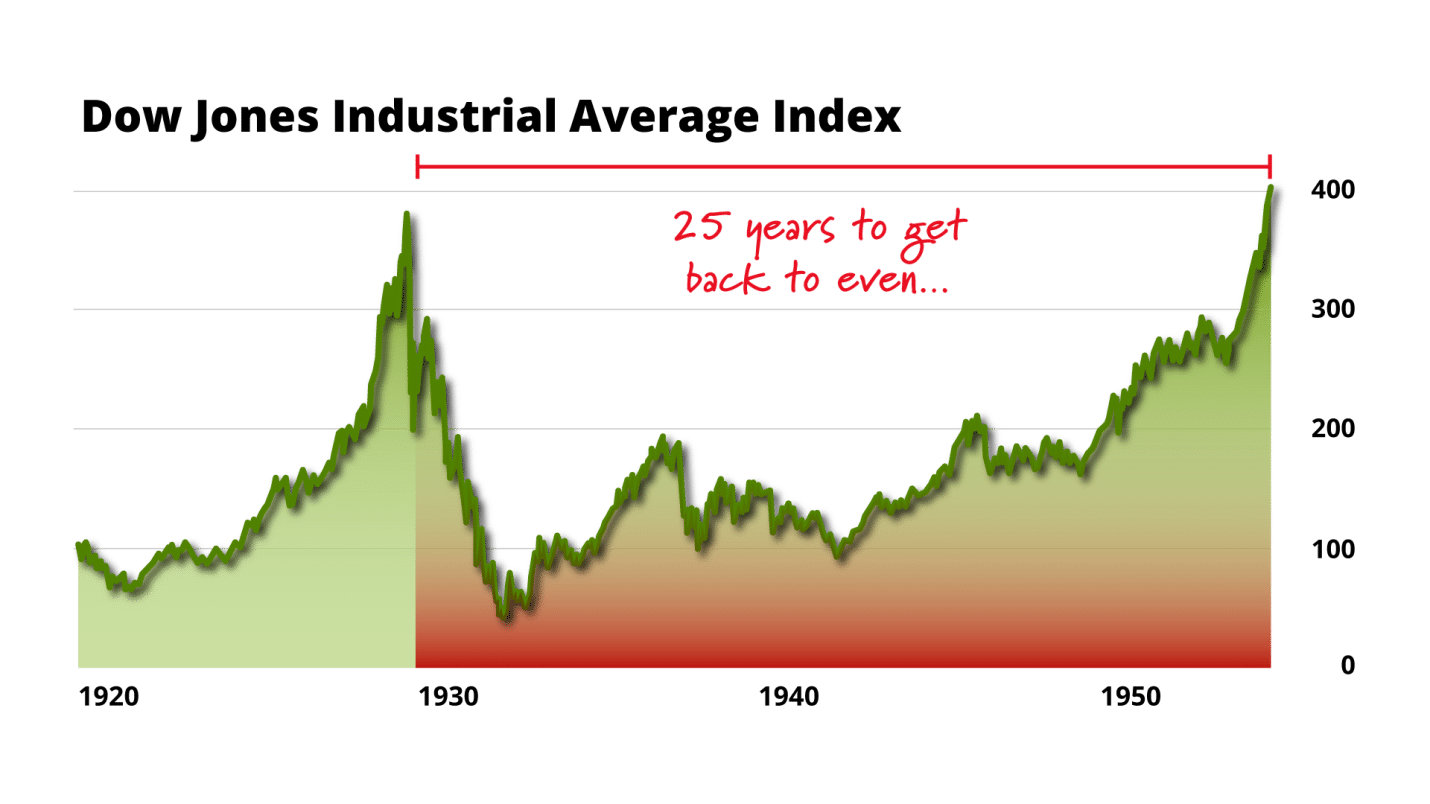

We now know that the depression would continue for years and years and become the longest downturn in our nation’s history…

And Americans who used a buy-and-hold strategy wouldn’t recover their losses for 25 years.

But those who understood what was happening managed to make a lot of money during this period.

One of the most well-known examples was President John F. Kennedy’s father, Joseph Kennedy Sr.

He shorted stocks ahead of the 1929 stock market crash…

And then turned around and bought real estate at a bargain during the ensuing real estate crash.

That move made Joseph Kennedy 45X his money during the Great Depression… from $4 million in 1929 to $180 million by 1935.

Or take Bernard Mannes Baruch, a financier and presidential advisor to Presidents Woodrow Wilson and FDR.

Baruch foresaw a Wall Street crash as early as 1927 and shorted stocks for two years before the crash.

By the 1930s, his net worth had grown to $16 million… which would have been worth almost $2 billion today.

He also kept cash reserves on hand to snap up high-quality assets at a bargain whenever the market crashed.

So why am I telling you all this?

We’ve seen stunning parallels to the Great Depression in recent years.

And just like in 1933, the government has a Trojan Horse they’ll claim is our only option.

It’s all spelled out in Executive Order 14067…

A proposal that lays out the blueprint for an overhaul of our financial system…

One that will likely result in the massive devaluation of our currency… and destroy the fundamental fabric of commerce and our economy.

As with any government scheme, there are always those who will be left holding the bag… and those who will come out on top.

I’m going to show you three strategies that I expect will benefit you greatly as this banking crisis enters a new phase.

But first, you have to know that FDR wasn’t the only president who pulled off a heist like this during a time of crisis…

“What Masterful Politicians Do”

The same thing happened again just 37 years later…

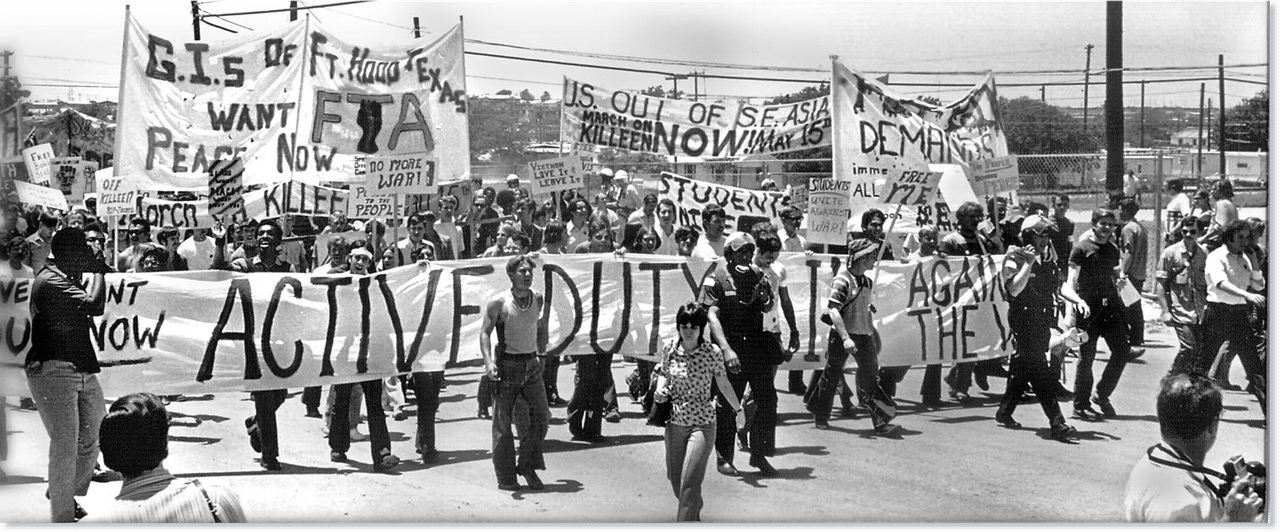

When America was torn apart by the Vietnam War…

Protests…

And the aftermath of the assassinations of both Martin Luther King Jr. and Robert F. Kennedy.

Economically, we were in another recession…

And two years after Nixon took office, our unemployment rate almost doubled.

Inflation was running at nearly 6%. That’s enough to cut the value of your money in half within twelve years, not unlike what we’ve seen recently.

And it was no secret why…

FDR’s New Deal and three decades of similar policies were driving the country into debt… as our leaders dipped into our gold reserves to finance their spending.

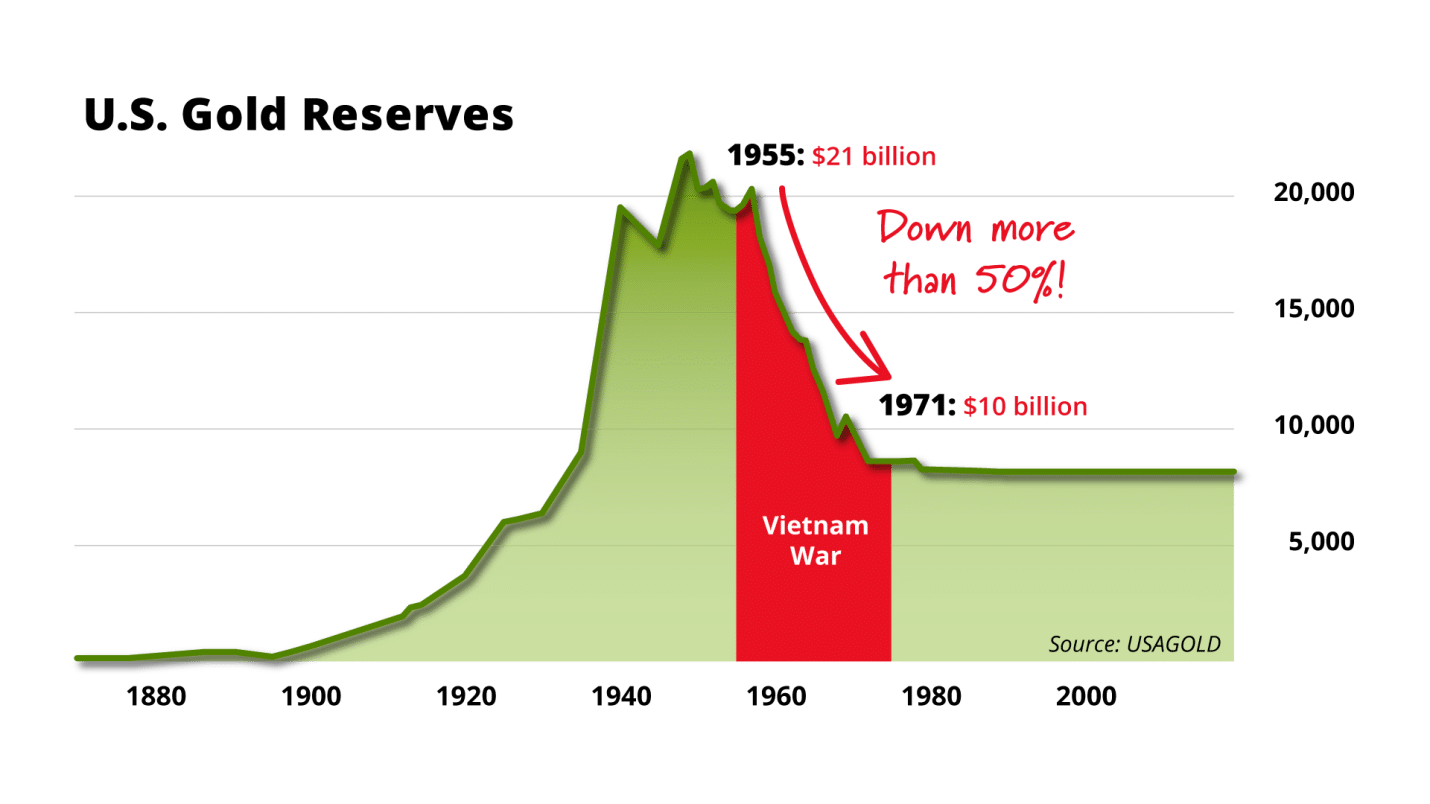

By 1971, our gold reserves had plummeted by more than 50%.

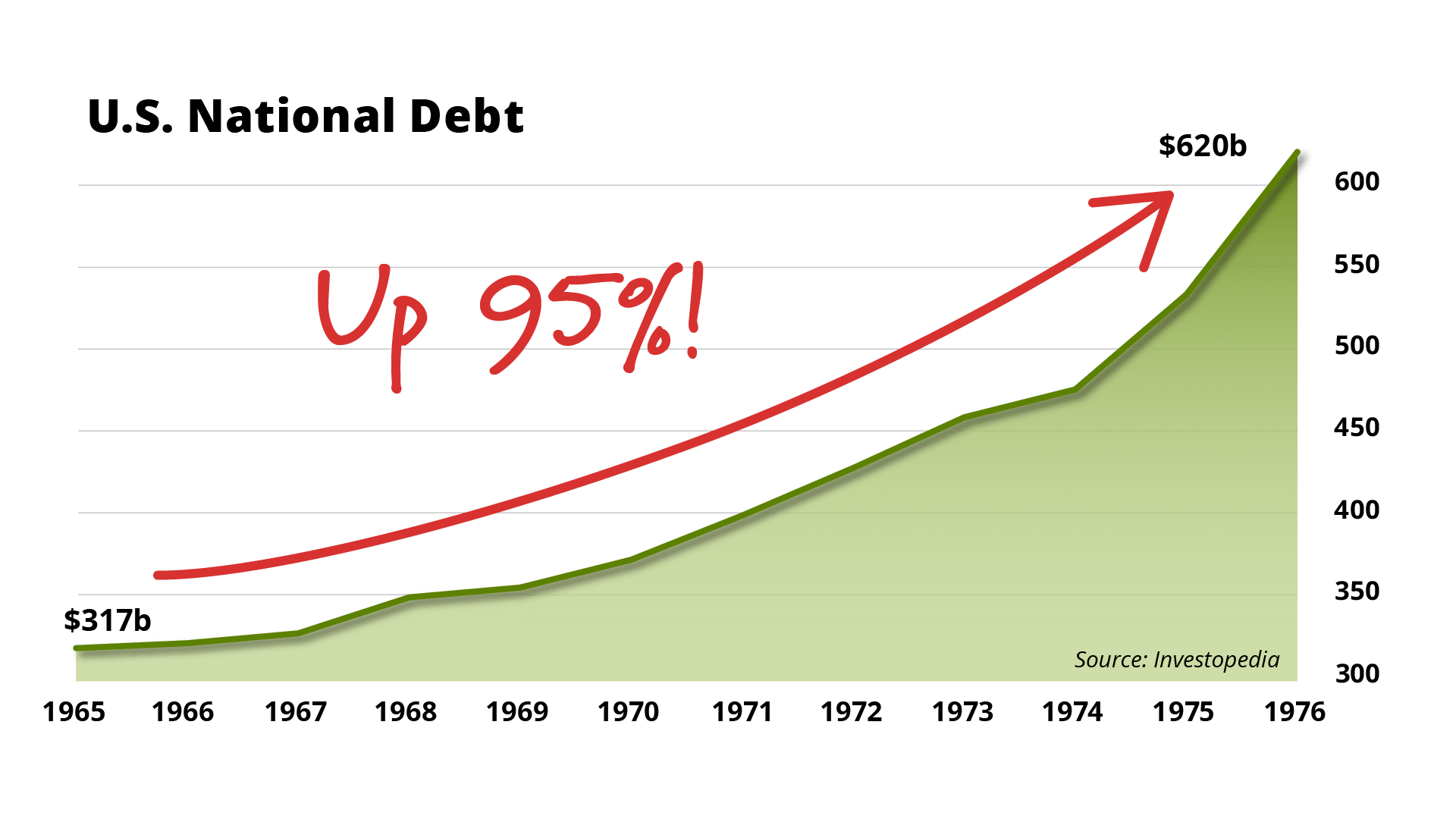

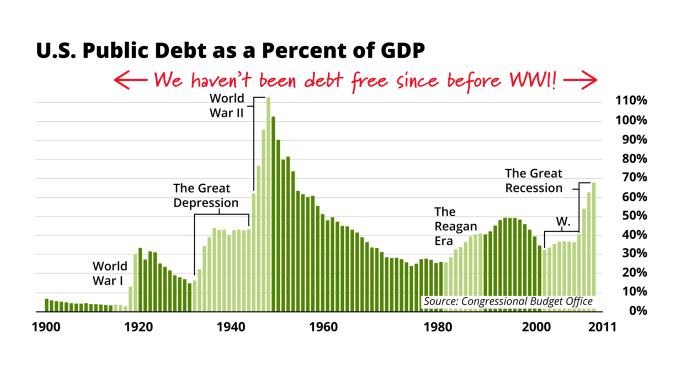

In fact, our national debt nearly doubled within the span of the Vietnam War alone!

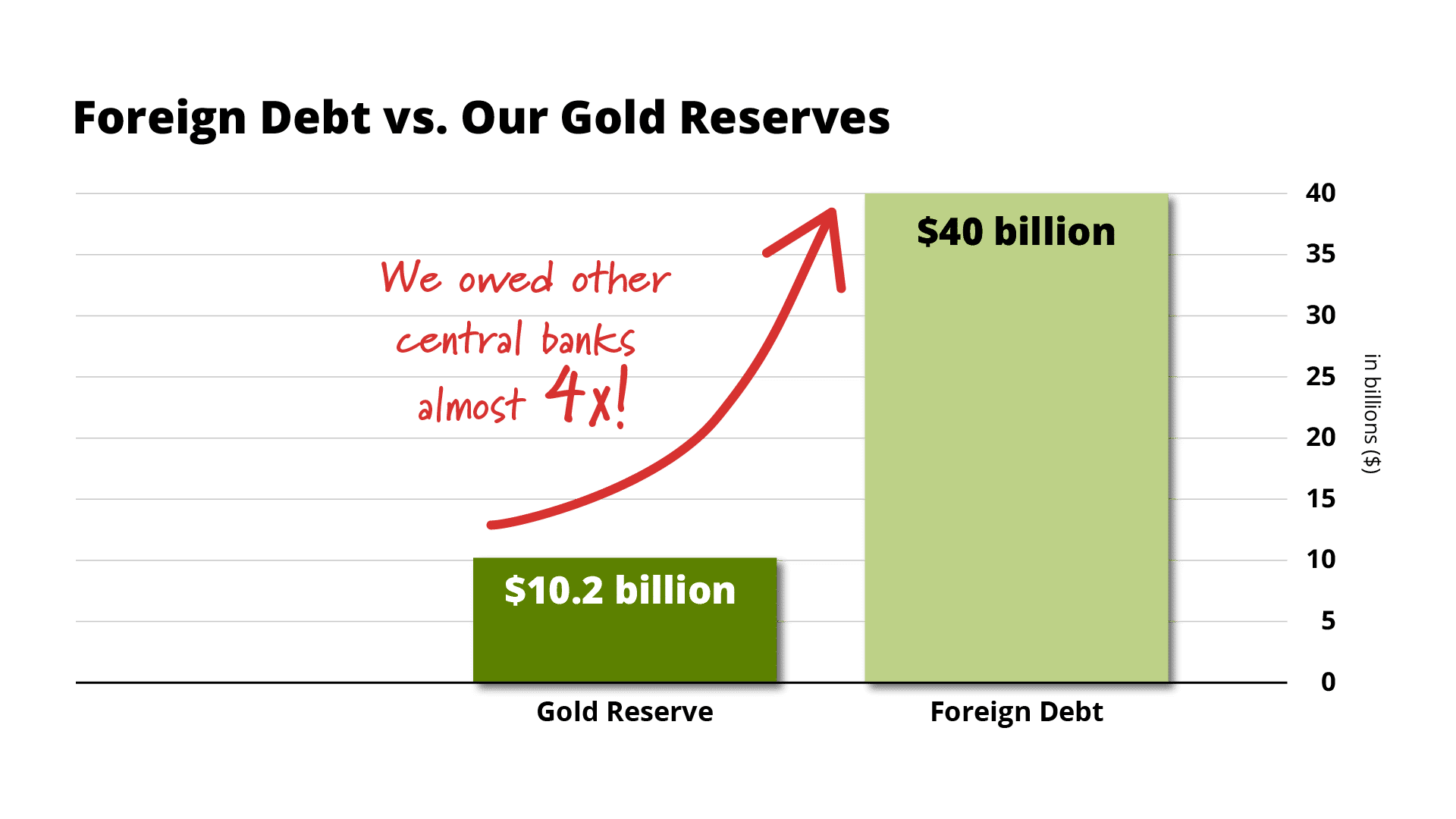

By 1971, we owed other central banks nearly 4 TIMES more money than we kept in gold reserves.

And remember, this money was still legally convertible to gold at $35 an ounce.

Foreign governments that owned U.S. Treasuries got worried… Much like they did during the recent debt ceiling crisis we saw in 2023.

And it was no surprise in 1971 when several countries began demanding payment on America’s debt – in gold – at an alarming rate.

This time, it was our central bank that was the target of the bank run.

In fact, foreign banks withdrew $4 billion of the $10 billion in gold reserves at Fort Knox within a single week!

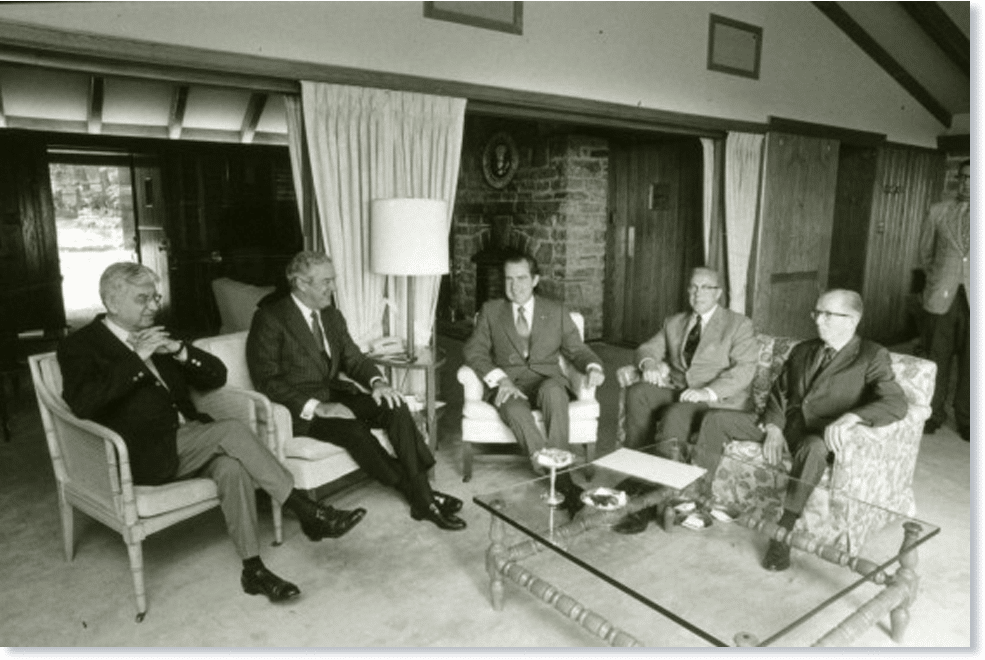

So, President Nixon gathered his advisors for a secret meeting at Camp David to formulate a plan to save America…

On August 15, 1971, after just two days of discussion…

Nixon announced his executive decision to sever America’s long-standing commitment to the gold standard, forever.

You’d think Americans would have protested…

Euphoria

But we didn’t…

We rewarded Nixon instead.

A day later, the stock market jumped 32 points. It was the largest one-day jump at the time.

Over the following week, White House aides talked to people all over the country and “encountered enthusiasm bordering on euphoria.”

As one pollster said:

“In all the years I’ve been doing this business… I’ve never seen anything this unanimous unless maybe it was [the reaction to] Pearl Harbor.”

White House chief of staff, H.R. Haldeman, wrote that Nixon was obsessed with domestic and international reactions.

He craved credit for being an extraordinary leader.

And he got it.

Americans praised Nixon for saving the economy…

Only they couldn’t have foreseen what it would do to their money, jobs, and cost of living… when the economy entered a severe recession just two years later.

And that’s when troubled banks began to collapse, reaching a peak in 1976 with 16 failures – the most bank failures we’d seen since 1942.

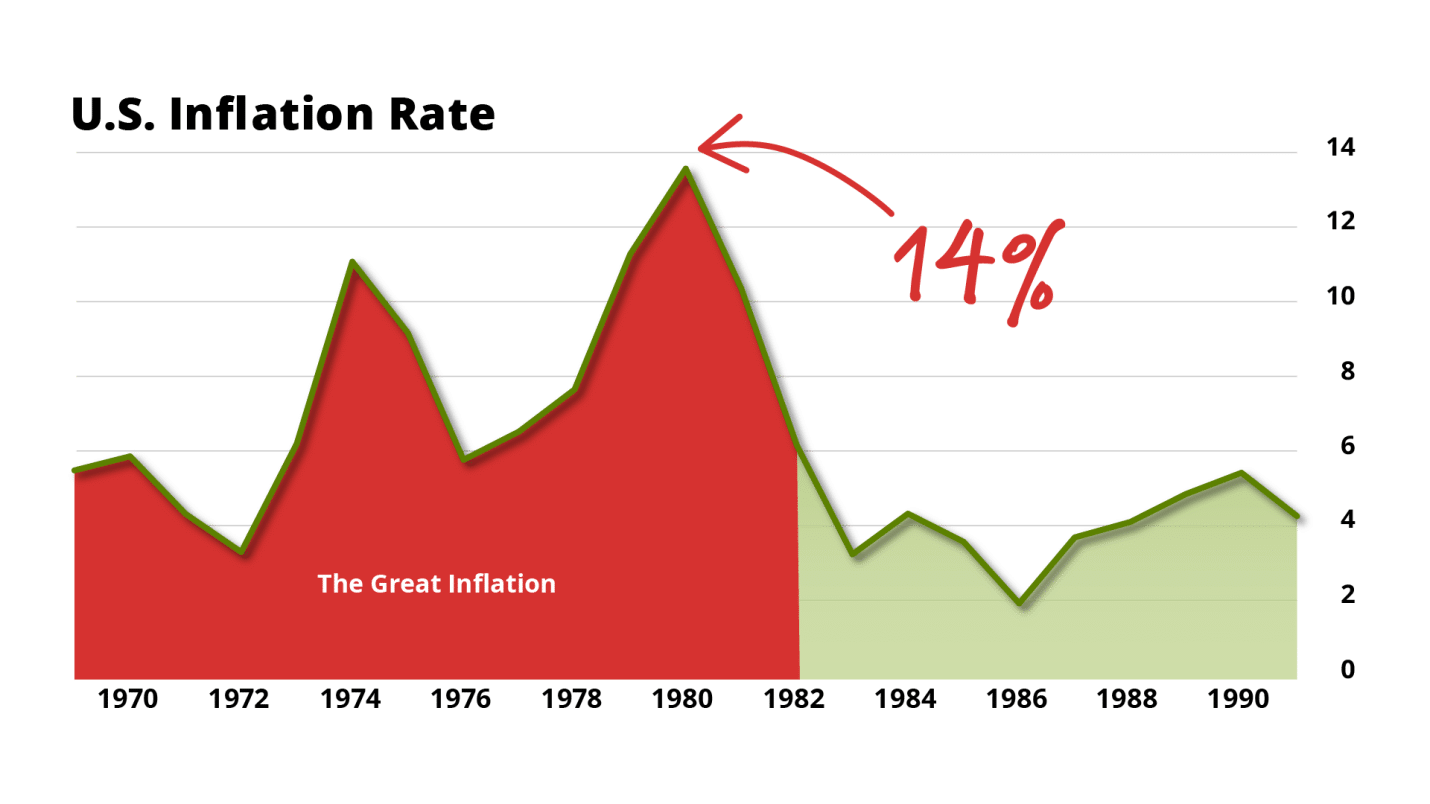

We also saw one of the worst inflationary crises of American financial history – a period we now call the “Great Inflation.”

By 1980, the inflation rate hit 14%. It was the kind of inflation that could decimate the value of your savings in just five years.

That was until Paul Volcker became the chairman of the Federal Reserve.

Volcker famously raised interest rates up to a peak of 20% to get inflation under control… and to this day, he’s widely credited with ending the Great Inflation.

But it’s ironic that Volcker became so famous for this feat.

You see, he was in the room at Camp David when Nixon decided to untether the dollar from gold.

Volcker later regretted it and said:

“I learned a good lesson about what masterful politicians do.”

You might think this could never happen in America today… but the exact same pattern is playing out, right now, with Executive Order 14067…

All it takes is one crisis… one president… and one decision to change our money forever.

Like FDR, Nixon’s Trojan Horse had an added benefit of ensuring his re-election…

And just like with FDR, the people cheered Nixon on while our currency was altered forever.

But in practice, Nixon created an even bolder and more sinister change to our money than FDR did.

You see, when FDR confiscated our gold and devalued our currency by 41% overnight…

The dollar was still backed by gold… just less of it.

But Nixon RIPPED US OFF THE GOLD STANDARD COMPLETELY…

And ushered in a new era of fiat money, leaving the dollar backed by nothing – except our full faith and trust in the U.S. government.

This created a new way for the government to spend money it didn’t have, endlessly, with no limit in sight.

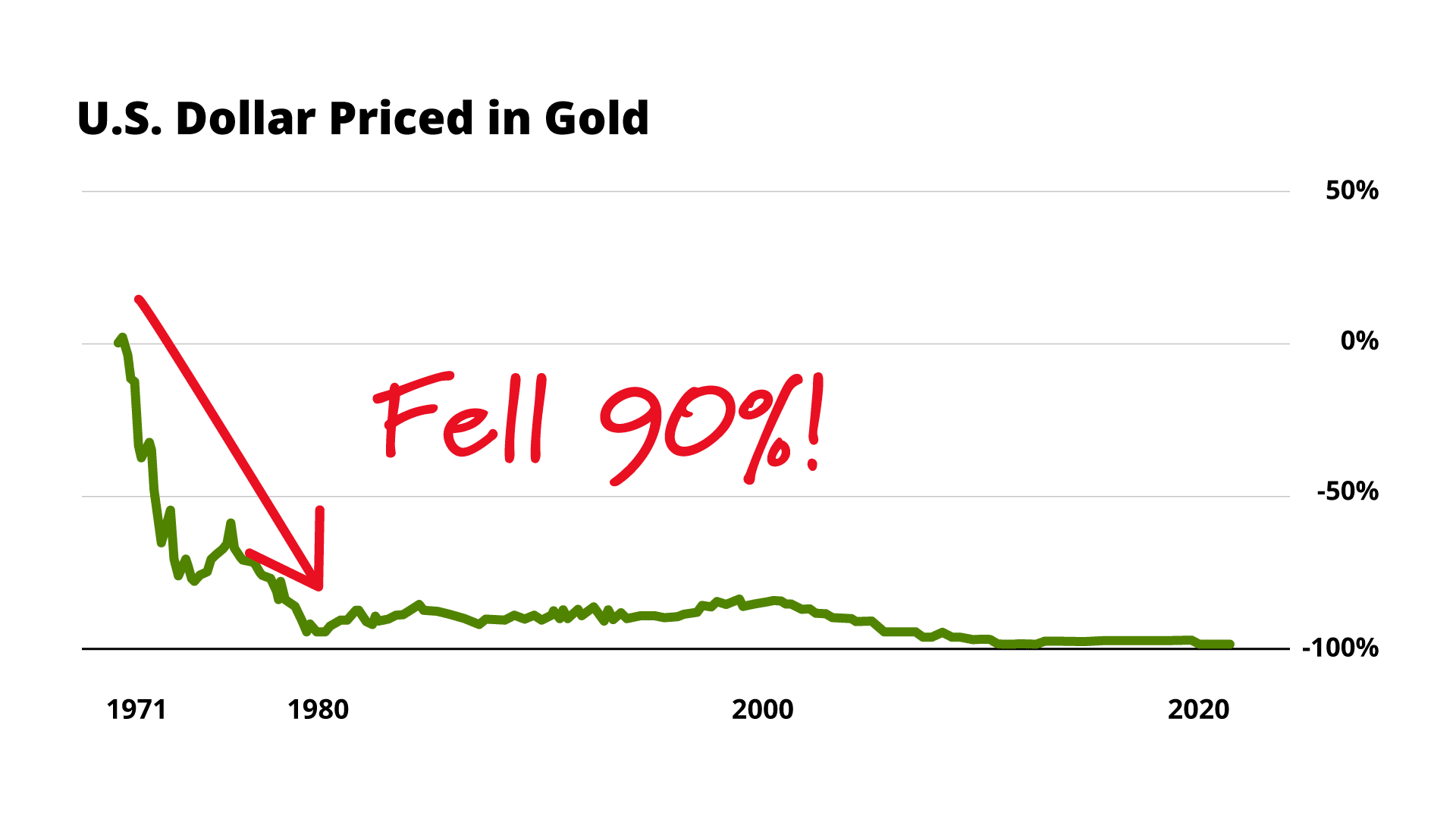

Unsurprisingly, the U.S. dollar lost 90% of its value – priced in gold – in the ten years following Nixon’s decision…

And we’re still paying the price of the “Nixon Shock” today.

This decision, more than any other, has been responsible for so many of the problems we talk about in America today.

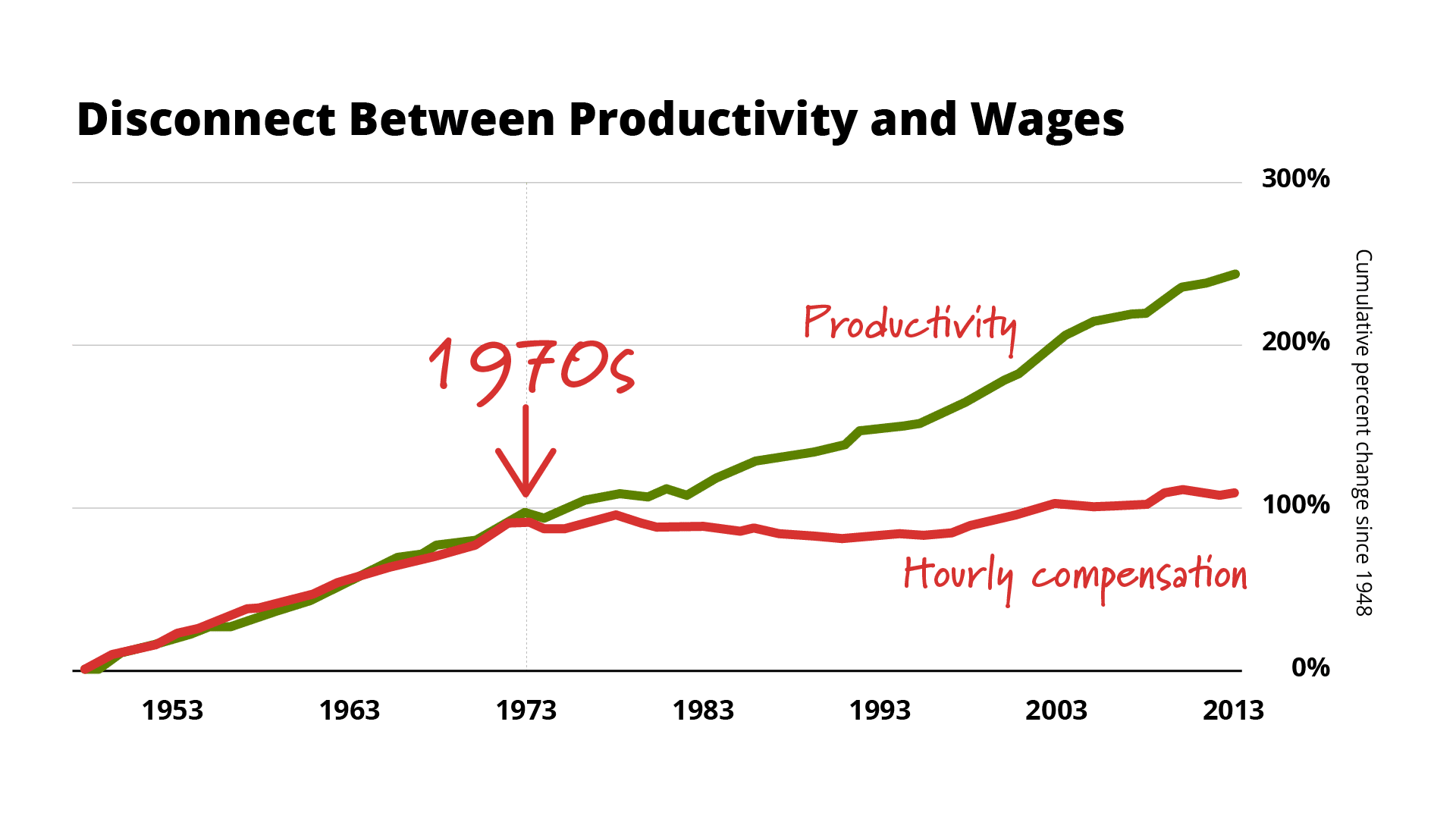

Just consider this chart, which compares our productivity to our wages…

For decades, the two were interlocked, moving in parallel.

As Americans got more efficient and more productive, they made more money for their efforts…

But as you can see, something changed in the early ’70s… and these lines haven’t moved together ever since.

If you’ve ever wondered why income inequality seems worse than it should be in our country…

If you feel like people didn’t have to worry about these kinds of financial problems in the past…

You are right.

Sound currencies keep inflation and rising living costs in check.

Since the dollar lost its gold backing, we’ve seen terrible consequences ripple throughout EVERY aspect of our society.

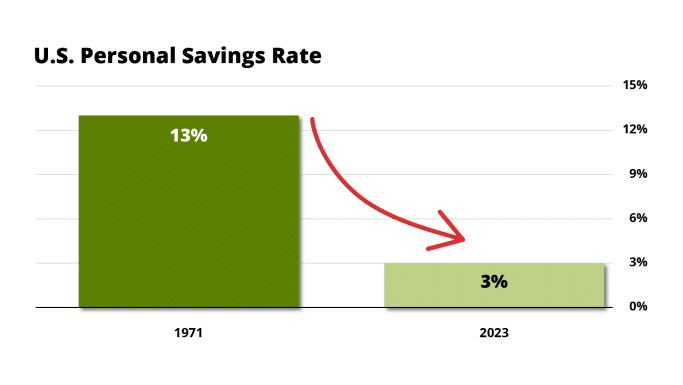

Our personal-savings rate has fallen drastically since August 1971… from 13% to a mere 3% in 2023.

In other words, most Americans are barely treading water.

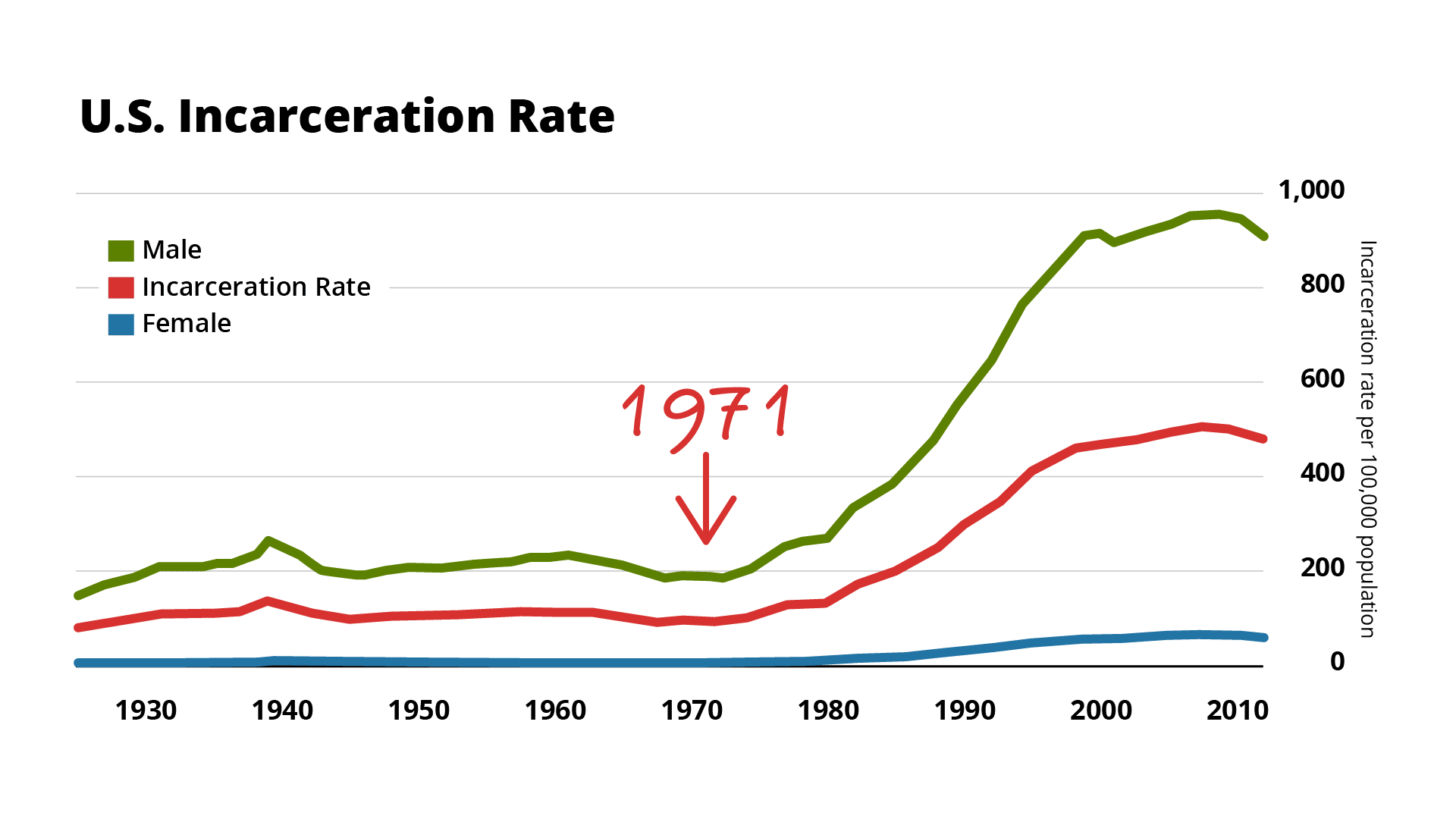

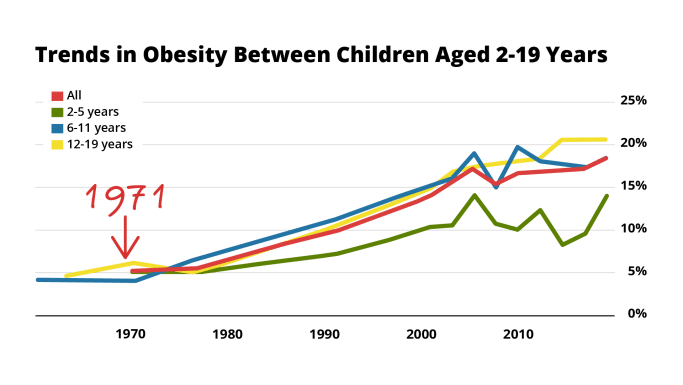

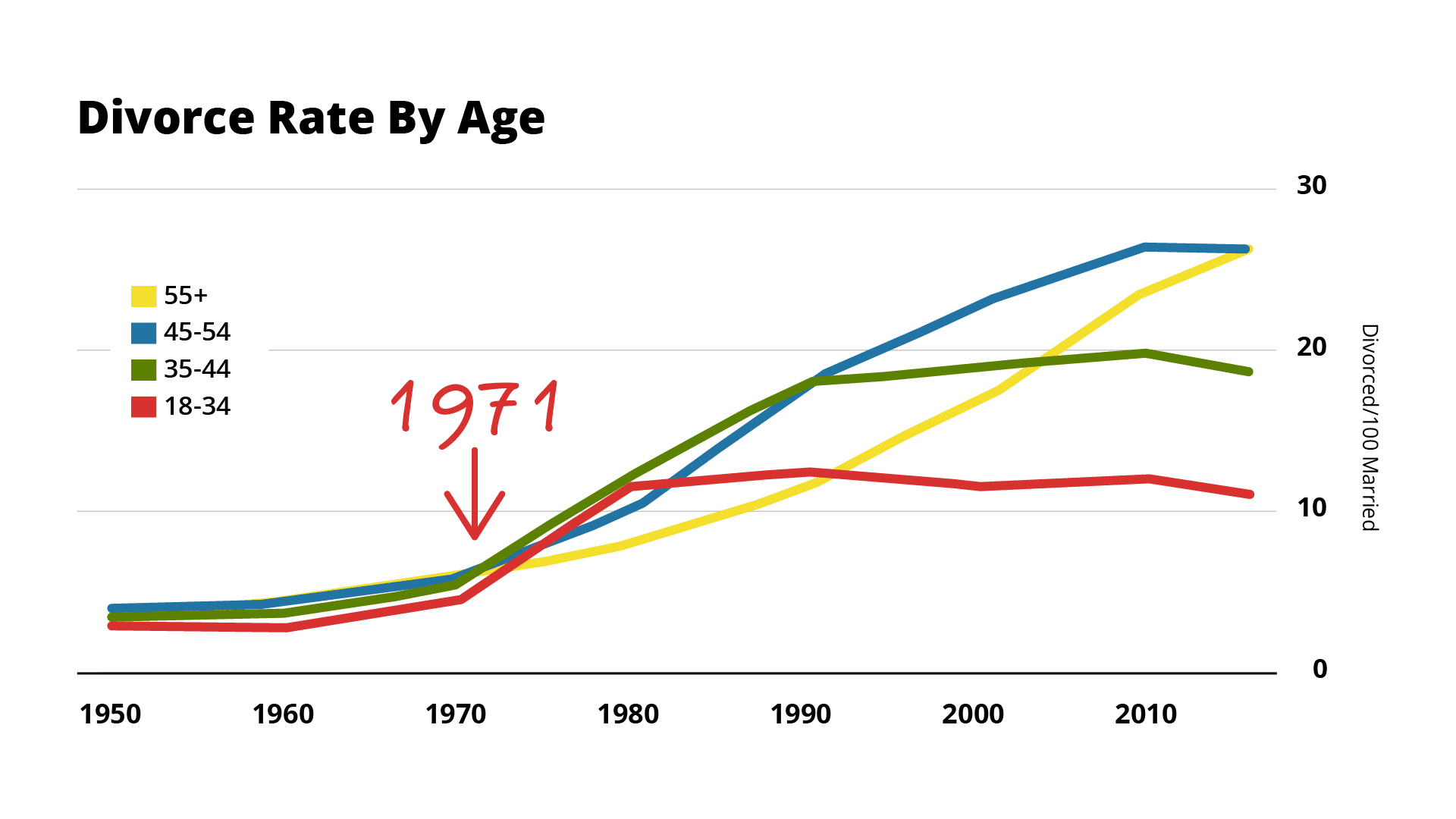

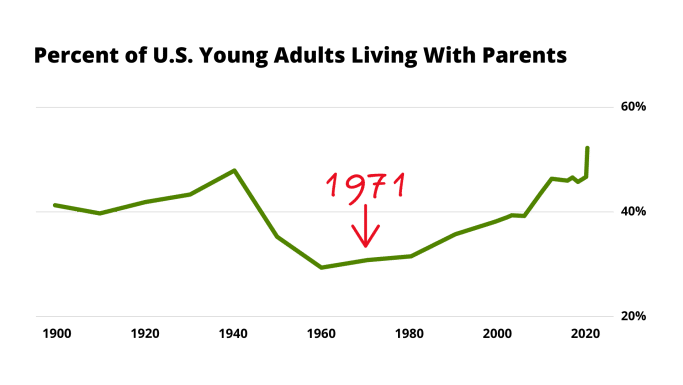

Almost everything you can think of – from incarceration to childhood obesity to divorce numbers to the number of young adults living with their parents – all coincidentally hit an inflection point exactly in 1971.

Instead of the American middle class growing and prospering in the decades since the Nixon Shock…

A Pew Research Center study shows that the middle class has steadily shrunk since 1971. In fact, it is no longer the majority in America.

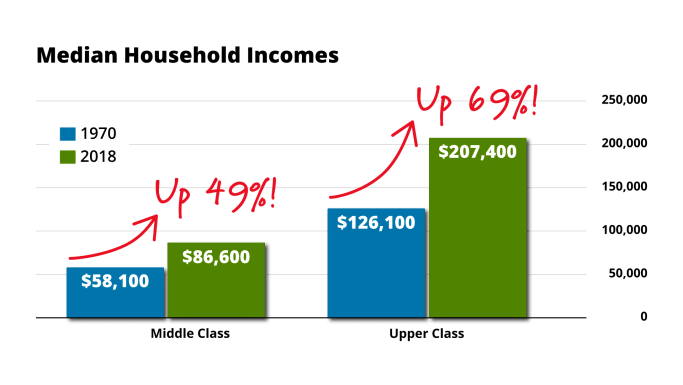

Meanwhile, the wealthiest group of Americans saw their wealth soar 69% since the 1970s.

Because if you know what assets to buy in periods like this one, it can absolutely change everything for you.

For example, American oil and shipping tycoon Daniel K. Ludwig became the country’s richest man at the height of the Great Inflation… and America’s “only remaining billionaire” at the time.

He turned a $25 investment into a $3 billion empire across several industries, such as finance, oil and gas, and real estate.

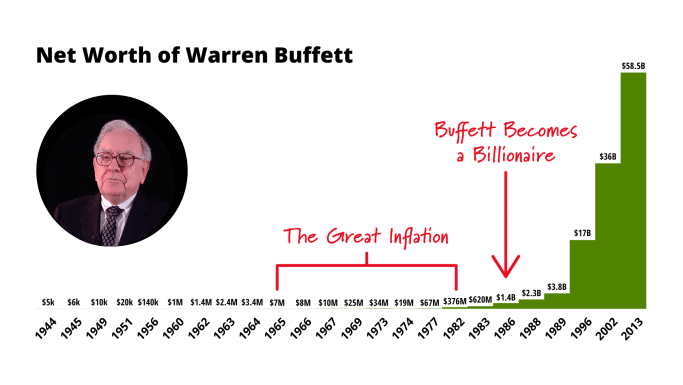

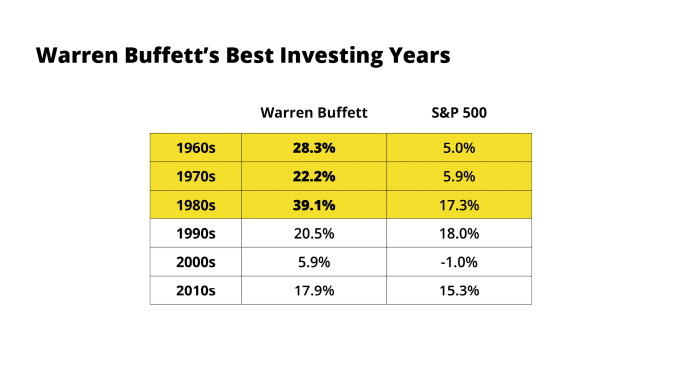

Legendary investor Warren Buffett, who foresaw the grave consequences of the Great Inflation, also emerged from this crisis a billionaire…

And after the Nixon Shock, when the stock market plummeted nearly 50% within 20 months…

Buffett even managed to grow Berkshire Hathaway’s stock by double-digit real returns and beat the S&P 500…

Making the Great Inflation years some of the billionaire’s BEST investing years – even in a crisis.

I’m sharing these stories with you because our country is once again about to face a financial catastrophe of the government’s own making.

My hope is that once you see what’s coming, you can protect yourself, your family, and your wealth from the crisis we’re about to face… and even profit with the strategic investments I’ll be showing you today.

Remember, two presidents… two crises… and two executive decisions changed the course of history and redefined our money forever.

And like those two presidents, I believe Joe Biden has laid the groundwork for his “solution” to our banking crisis: Executive Order 14067…

A Trojan Horse that will transform our currency and our money forever.

But first, you need to know why the consequences of today’s crisis will be much worse than what we experienced in 1933 and 1971…

‘All Hands on Deck’

Did you know that America still hasn’t paid off the debts we incurred since before World War I?

Or the wars in Vietnam, Korea, Iraq, Afghanistan, Syria, Ukraine, and any other from the past 100 years?

No, we refinanced them instead.

In fact, centuries of debt are still on our books.

That’s true of all the bad debt from 2008 too. When the government bails out a bank or corporation, we pay for it and take on that bad debt… paid for by our taxes.

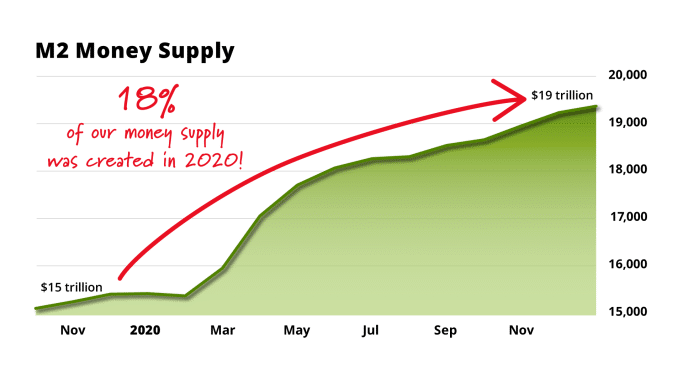

And that’s also true of the more than $3 trillion that was printed to prop up the economy at the beginning of the COVID-19 scare.

That’s 18% of all our money supply at the time… meaning almost 1 in 5 dollars in America was created in 2020 alone!

As a result, we saw the largest flood of federal money into our economy in recorded history.

About $5 trillion went to households, mom-and-pop shops, restaurants, airlines, hospitals, local governments, schools, and other institutions around the country.

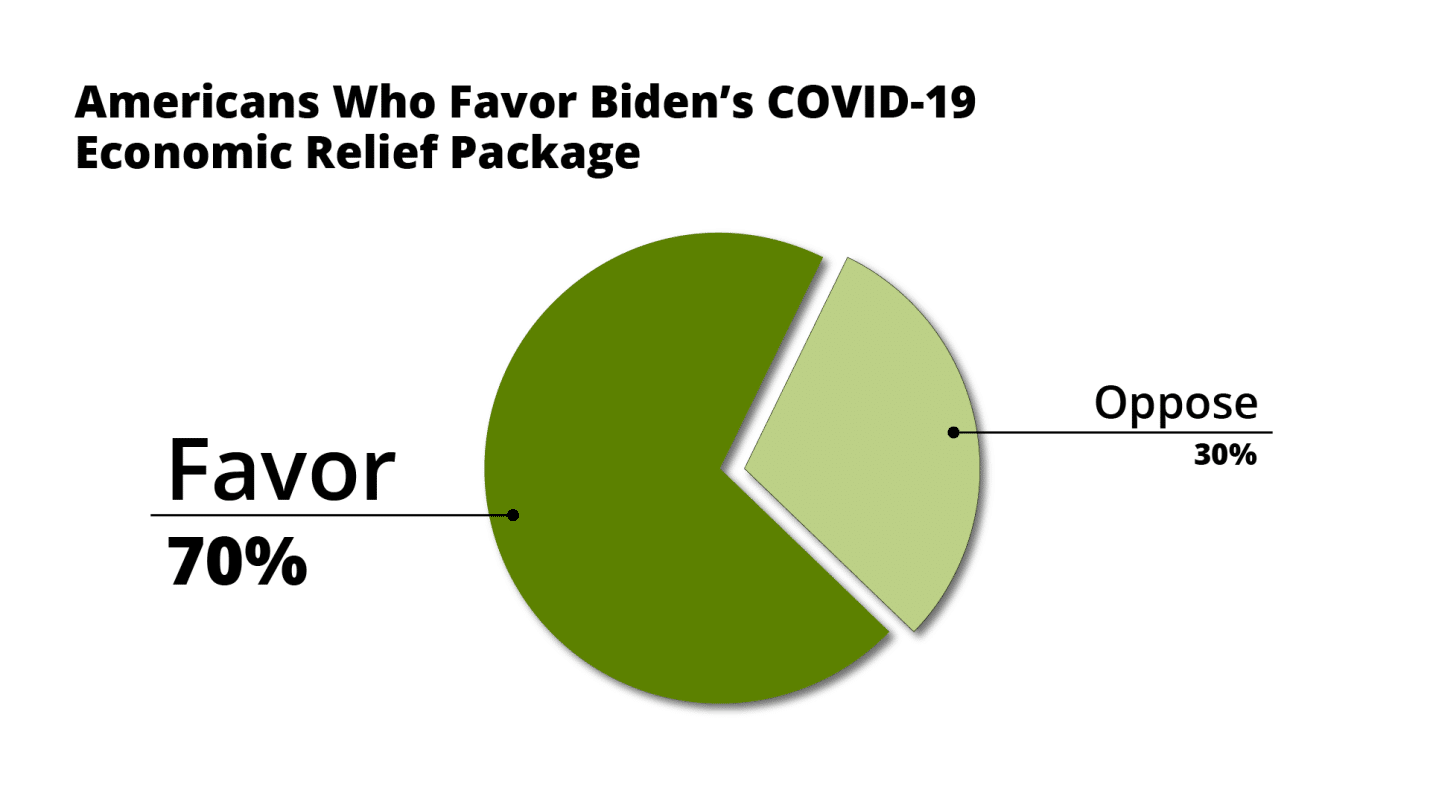

Of course, few Americans complained about receiving a $1,200 stimulus check at the time.

In fact, 70% of Americans told Pew Research they were in favor of the COVID-19 Economic Relief package!

So where did this money go?

Just like the stock bubble of the 1920s before the Great Depression…

The stimulus money was invested in some of the biggest speculative bubbles in our lifetimes – from meme stocks to pot stocks to cryptocurrencies…

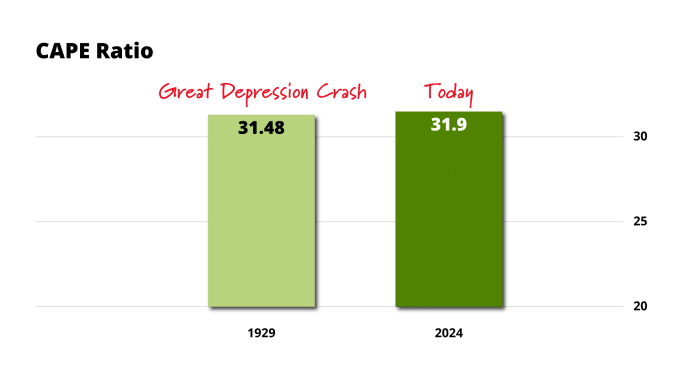

In fact, the CAPE ratio, which measures how overvalued the stock market is at any given time, has recently reached levels rivalling that of the 1929 crash.

And just like in 1929, dire consequences came soon after.

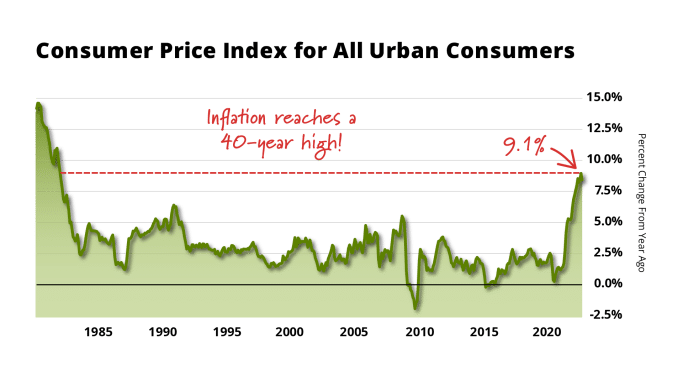

Prices for everything – from cars and gasoline… to food and clothing – rose at the fastest pace we’ve seen since the Great Inflation.

Inflation catapulted to a record-breaking 40-year high at 9.1%.

And when the free government money stopped, so did the bubbles…

The Fed, of course, waited too long to act again – insisting that inflation was transitory…

But eventually the problem became too difficult for Americans to ignore.

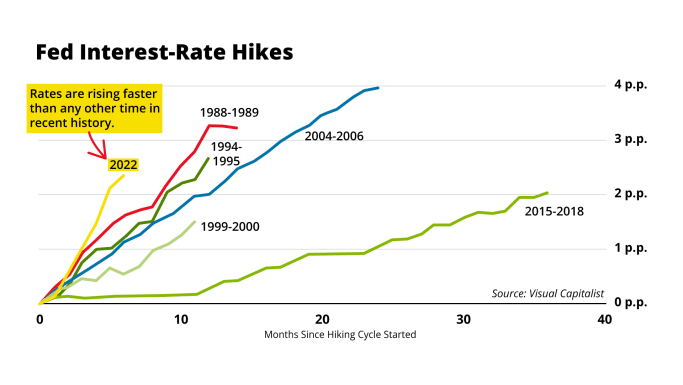

So the Fed raised rates 5 percentage points from nearly zero in just a year, marking the fastest rate hikes we’ve seen in 40 years…

Sure enough, 2022 turned into the WORST year for stocks since the Great Financial Crisis in 2008.

Just like what we saw in 1933 and 1971, the government’s desperate measures – to solve the economic crisis caused by the pandemic – has only made things worse.

More cracks in the system are starting to show.

Today, the Wall Street Journal reports that more Baby Boomers are sliding into homelessness… and retirees on fixed incomes are “overwhelmed by the high cost of housing and other financial shocks at a level ‘not seen since the Great Depression.'”

Just in the last year alone, we’ve seen echoes of the 1930s and ’70s everywhere.

The worst bankruptcy levels in a decade…

Emergency bailouts worth billions in taxpayer dollars…

Our national credit being downgraded for the second time in history…

All because the safe government bonds – that banks are legally required to own – have now fallen over 50% in value… due to the Fed’s breakneck interest-rate hikes.

In short… the massive bank collapses of 2023 were a crisis of the Fed’s own making…

Except what used to take days and weeks to occur is now happening in mere hours.

Even the Fed is publishing paper after paper demonstrating concern over how quickly the bank runs of 2023 occurred:

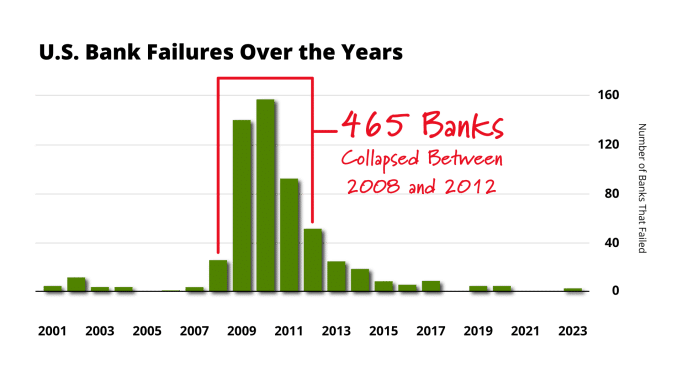

Remember: The three bank failures we saw in 2023 were bigger than the 25 banks that crumbled in the great financial crisis…

And those 25 bank failures, in turn, were nothing compared to the 465 banks that collapsed during the four years AFTER the crisis.

The same thing could happen again soon.

Why?

You might recall that the Fed created the Bank Term Funding Program (BTFP) after the bank failures last year… “to help assure banks have the ability to meet the needs of all their depositors.”

In reality, it’s a bailout facility banks can turn to when they desperately need cash – without having to deal with the Fed’s high interest rates.

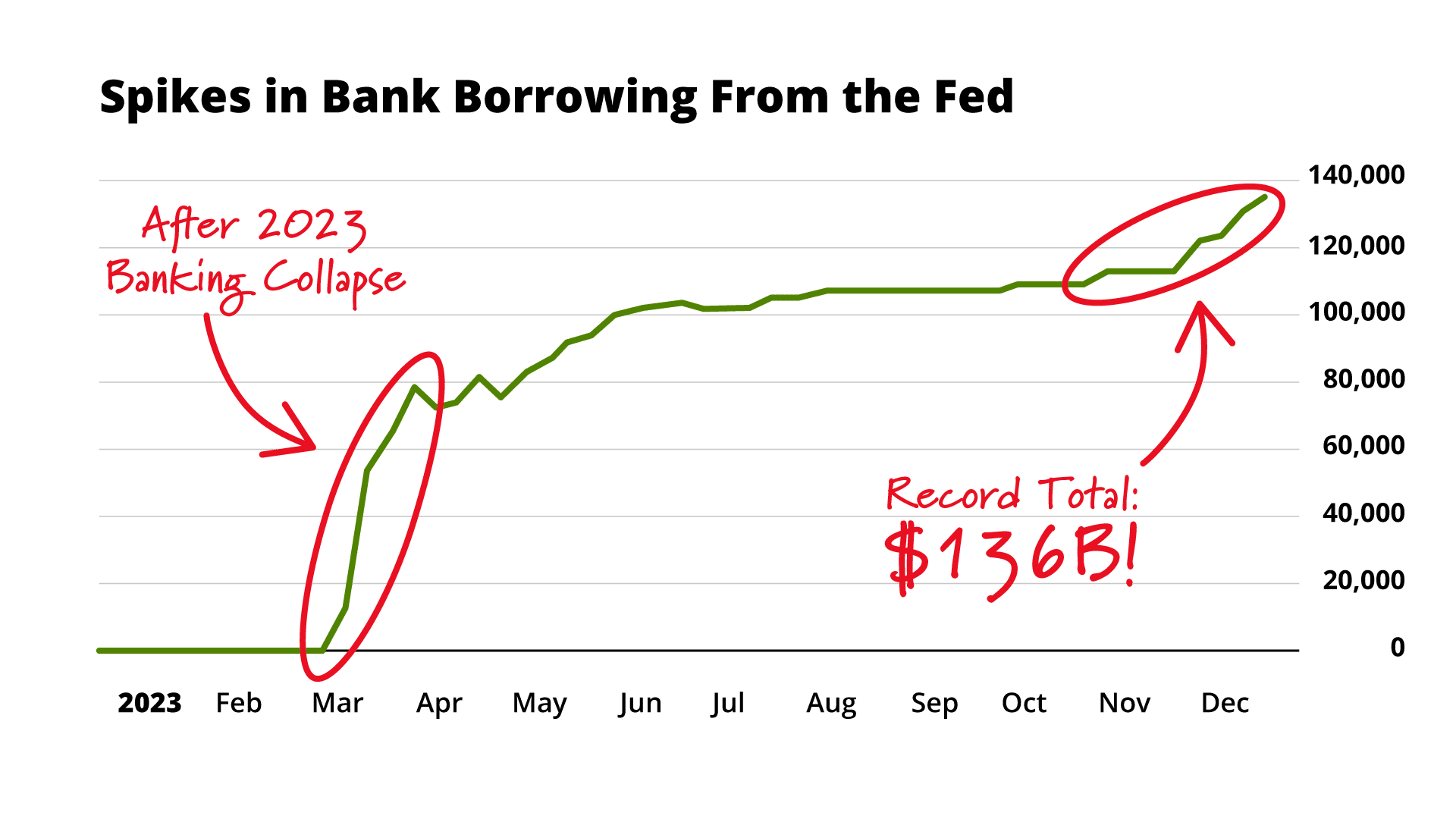

As you can see on this chart, there was a huge spike in borrowing in March last year after the bank collapses…

And recently, we saw another spike again at the end of 2023.

Clearly, more banks than ever are struggling in this high-interest-rate environment…

But thanks to this bailout program, the burgeoning bank crisis stays “out of sight, out of mind” for the Fed – and for most Americans.

And it won’t stay that way much longer…

Here’s the thing: this facility is set to shut down on March 11.

With at least 722 banks across America sitting on major unrealized losses right now…

Losses that are worth up to $1.3 trillion, according to a senior fellow at American Enterprise Institute…

What do you think is going to happen when banks no longer have the BTFP program to turn to for bailouts?

What is going to happen when their paper losses become REALIZED?

The clock is ticking till the Fed shuts it all down on March 11.

That’s why it’s CRITICAL for you to prepare NOW with the three simple steps I’m about to show you.

Don’t forget, U.S. banks saw the biggest trillion-dollar loss in deposit outflows last year – the biggest in our financial history!

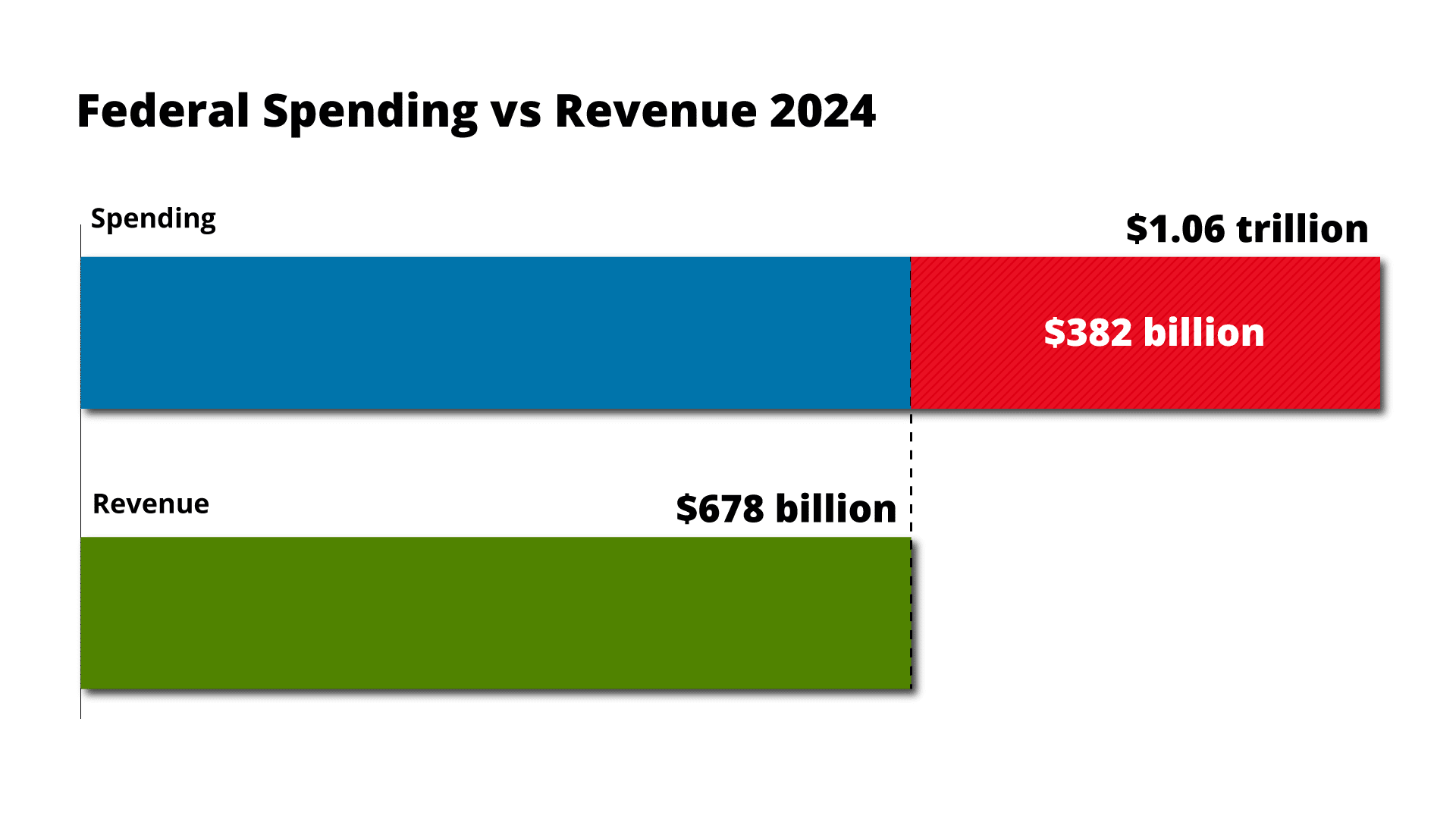

It gets even crazier when you consider we are on track to spend over $1.06 trillion this year… that we don’t have.

Interest payments on our debt alone have reached over $900 billion.

And that’s a big reason the deficit is growing.

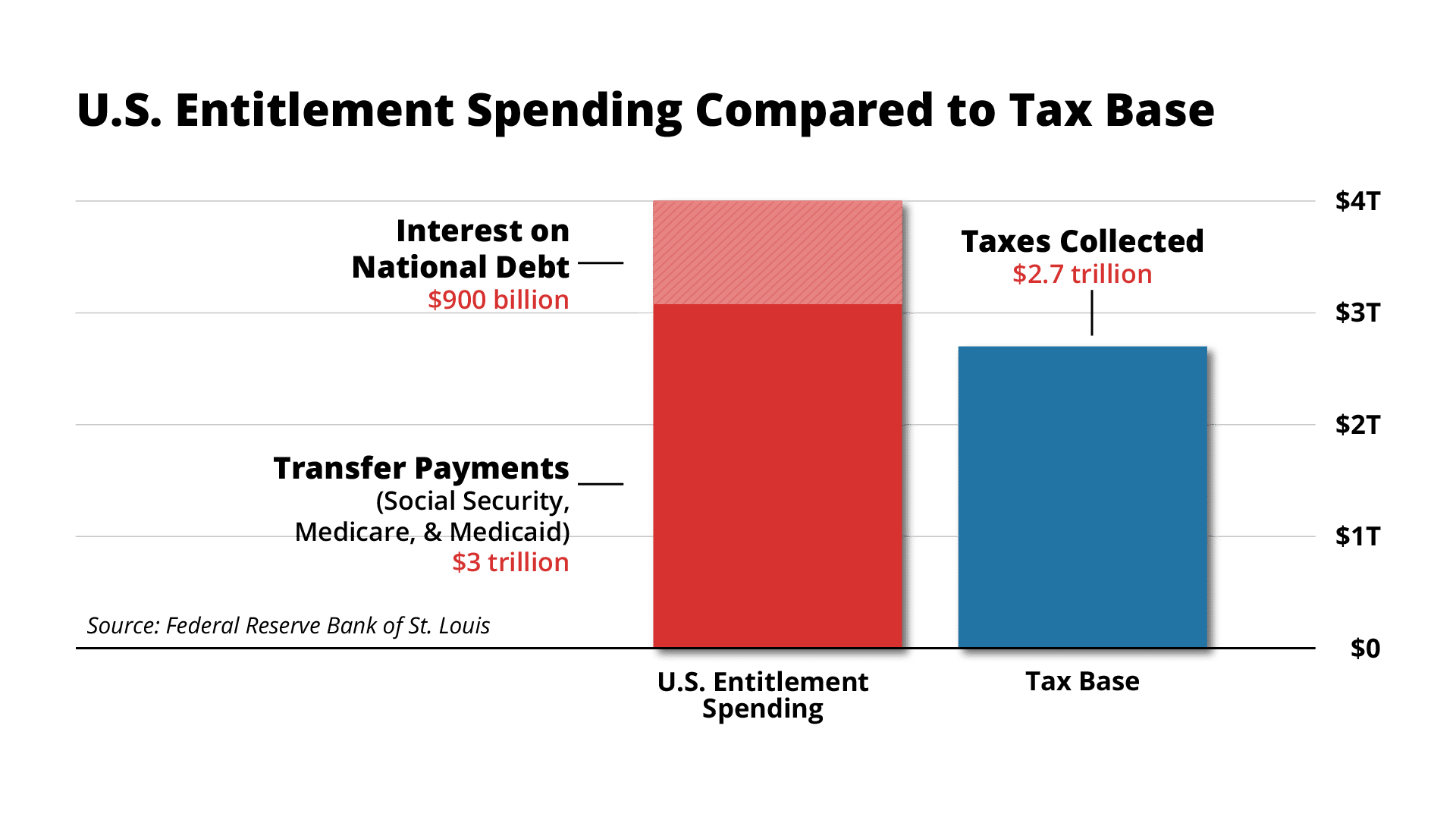

Social Security, Medicare, Medicaid, and other transfer payments – what are often referred to as “entitlements” – now total close to $3 trillion.

Yet the government will only collect $2.7 trillion in taxes.

And remember, the biggest banks in our country are ALL sitting on 50%-plus losses on their bond portfolios.

Are we expected to believe that these banks can stay solvent once the Fed’s bailouts dry up?

When America wakes up to this situation, your neighbors will be clawing over each other to pull cash out of the bank…

Only there won’t be enough for everyone to withdraw.

The government understands this problem, too. What’s happening is no secret among financial experts and economists.

A board member of the New York Fed, Scott Rechler, even recently revealed that 500 to 1000 more banks will probably get wiped out.

And it is exactly why President Biden issued Executive Order 14067 in 2022 – a Trojan Horse which could at any moment set in motion the biggest and most drastic change to our monetary system since 1933…

Drastic Measures

Here’s what I mean…

In 2022, President Biden quietly signed Executive Order 14067.

In it, he wrote about a U.S. central bank digital currency (CBDC). In non-financial jargon, that means a digital dollar.

You might be wondering… isn’t the dollar already digital?

Technically, the dollars in your bank account represent IOUs from your bank.

But as MIT writes:

“A true digital dollar would be a debt the U.S. government owes you.”

In other words, your savings would transform into pixels in our country’s national computer systems… with its value backed by nothing but our government’s word.

Don’t get me wrong – you will still be able to use your money…

But there’s no telling how far the government could carry this new and unprecedented level of access to one of the most private things in your life – your finances.

In other words…

With a digital dollar, the Fed could stop you from buying certain foods they deem “unhealthy”…

Or stop you from boarding a flight just because you’ve exceeded your carbon emissions for the month…

Or cut you off from your savings and retirement accounts altogether because you are late on a tax payment.

The Fed has even gone as far as to admit that CBDCs can be used as a form of social control:

This isn’t something that will happen 5 years or 10 years from today…

It is already underway right now.

In July 2023, the New York Fed completed a 12-week pilot program for a CBDC where select banks experimented with using digital dollars for transactions and payments…

While the Fed launched its long-anticipated instant-digital-payments system, called FedNow…

It’s available to more than 10,000 financial institutions that operate within the Fed’s network.

Chances are, you’re already using this payment system without knowing it.

Some financial institutions that have joined the FedNow network report, “Our members don’t even know they’re using FedNow.”

While the government says a CBDC will create more stability in the market, the reality is just the opposite.

The Financial Times recently warned that with FedNow’s instant transactions… bank runs could happen faster than ever before.

And the brave members of the Cleveland Fed have even spoken out and warned that FedNow could cause large outflows of deposits and cause a bank run.

They have literally already changed our monetary system in a way that makes another major bank run more likely…

At a time when the banking industry is more vulnerable to bank runs than ever before.

That’s why I urge you to protect your savings BEFORE the Fed’s bank bailouts dry up.

I know I keep repeating this, but many banks are currently sitting on 50%-plus losses in their bond portfolios.

As the crisis accelerates, the FedNow system is the Trojan Horse that Biden and the Fed will use to supposedly save the economy once again.

How?

As money manager Hugh Hendry says:

“We’re at the point where the Fed and the Treasury officials are having to consider a gate, a lock on U.S. bank deposits… the Fed may have to come in and actually restrict your right as a U.S. citizen to pull money out of the U.S. banking sector.”

And the Cleveland Fed revealed in a recent update that in the case of a potential bank run, banks in the FedNow system can ALREADY use it to instantly:

- Lower your transaction limit

- Restrict access to your bank account by “customer type”

- Change your bank account to “receive payments only” status

You could wake up one morning with zero access to your hard-earned savings because of this technology.

With this kind of power, who knows how long they might hold our money hostage?

You might not believe something like this could happen in America… but the truth is, desperate governments around the world have proved time and again that they’re capable of locking their citizens out of their life savings during an economic crisis.

We’ve seen it in Argentina, Brazil, Ecuador, Panama, and even as recently in 2013 in the European Union, with Cyprus.

And Executive Order 14067 is designed to allow our government to do the same.

Just like in 1933 and 1971, I believe this executive order will change the U.S. dollar forever…

When it goes into full effect, starting with the FedNow system they’ve already launched, you know all too well what kind of disaster will follow for our monetary system and your money.

I believe the digital dollar is going to be a disaster for anyone with a bank account, IRA, or 401(k).

Sure, speculators might spot some chances to earn a buck.

But let me be clear – I’m not into that speculative game.

Because right now, you have an important decision to make.

Are you prepared to trust the government, the Biden administration, and the Federal Reserve?

Like the Americans who lost 41% of their savings in 1934 when FDR issued his Gold Reserve Act?

Or would you rather take action today… and invest your savings in the kinds of assets and investments that we know will be much, much more difficult for the government to control and access?

Take a moment and think about all the unusual economic turmoil we’ve seen in the last two years alone.

The highest inflation we’ve seen in forty years… the record-breaking trillions in national debt we’ve hit… the largest bank failures we’ve seen since 2008…

Ask yourself… how much longer do you think our government can continue to bail out banks and other institutions in addition to trillions in deficit spending each year?

If history is any indicator of what’s to come…

The digital dollar – Biden’s Trojan Horse – could be the most destructive monetary event of our lifetimes.

And like in 1933 and 1971, most people will thank the government at first… thinking their hard-earned money will be saved…

But before long, our monetary system will suffer a profound, irreversible transformation.

Just like in the 1930s and 1970s… our country could see new waves of bank collapses… bankruptcies… and record-breaking inflation in the years to come.

And 99% of Americans will become much, much poorer as a result.

But by choosing the right investments now, there’s a chance you’ll end up wealthier than you ever imagined…

So here are three steps I suggest you take immediately.

Step 1: Get Some Money

OUTSIDE the U.S. Dollar

When the government messes around with our economy – and, specifically, our currency – it creates all kinds of dislocations…

And I believe the digital dollar is going to have a terrible impact on the portfolios of average Americans.

While speculators may find pockets of opportunity in such a crisis, speculating isn’t the kind of investing I focus on…

Which is why I believe one of the best ways to protect yourself and your bank account against higher inflation, higher interest rates, and – therefore – a weaker U.S. dollar…

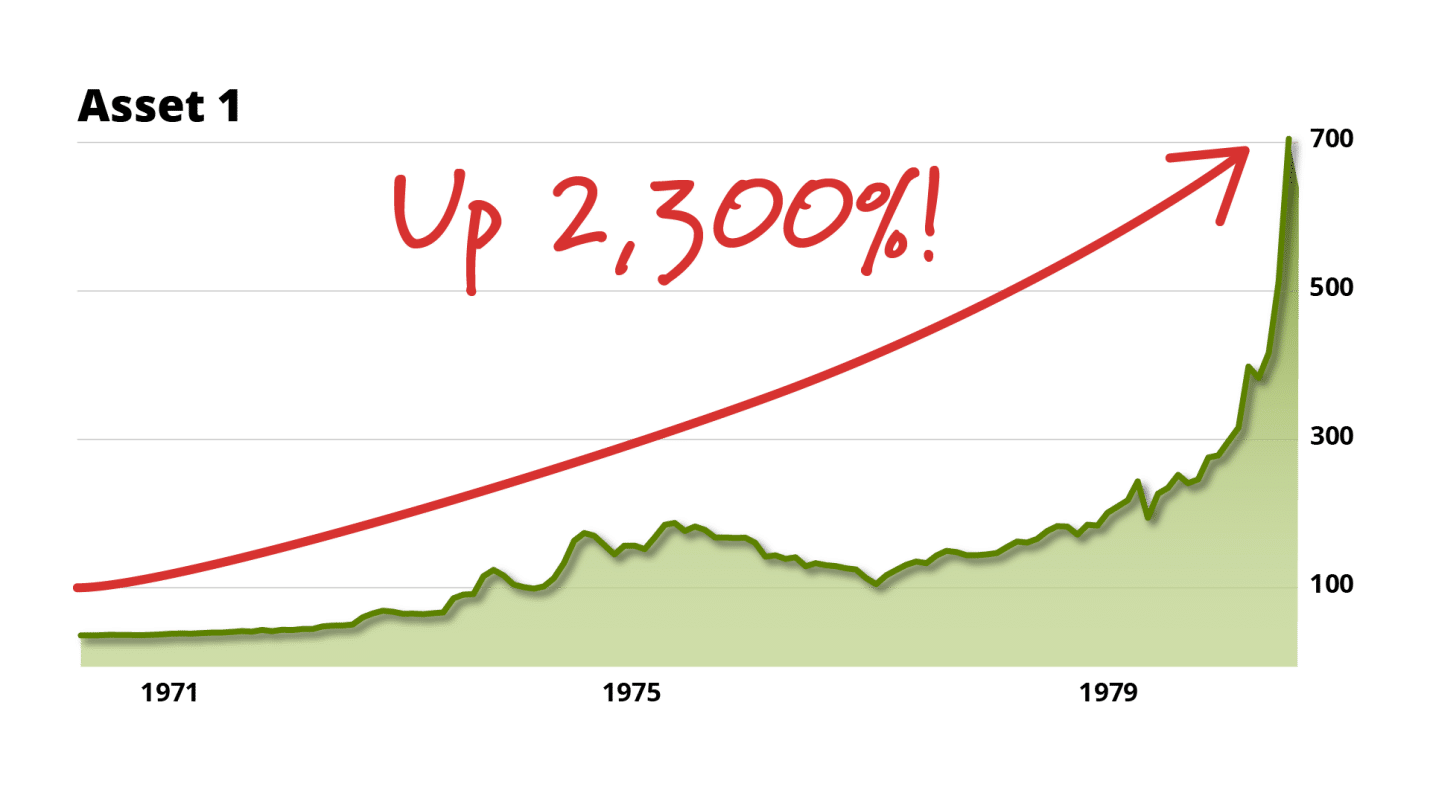

Is to do exactly what the world’s central banks started doing in 1967…

And what they are doing again in record volume right now.

In short, they’re hoarding one specific asset at a record pace we haven’t seen since 1967.

And as our financial system crumbles and the dollar goes digital… I believe we’ll soon see these assets set new records in the days ahead.

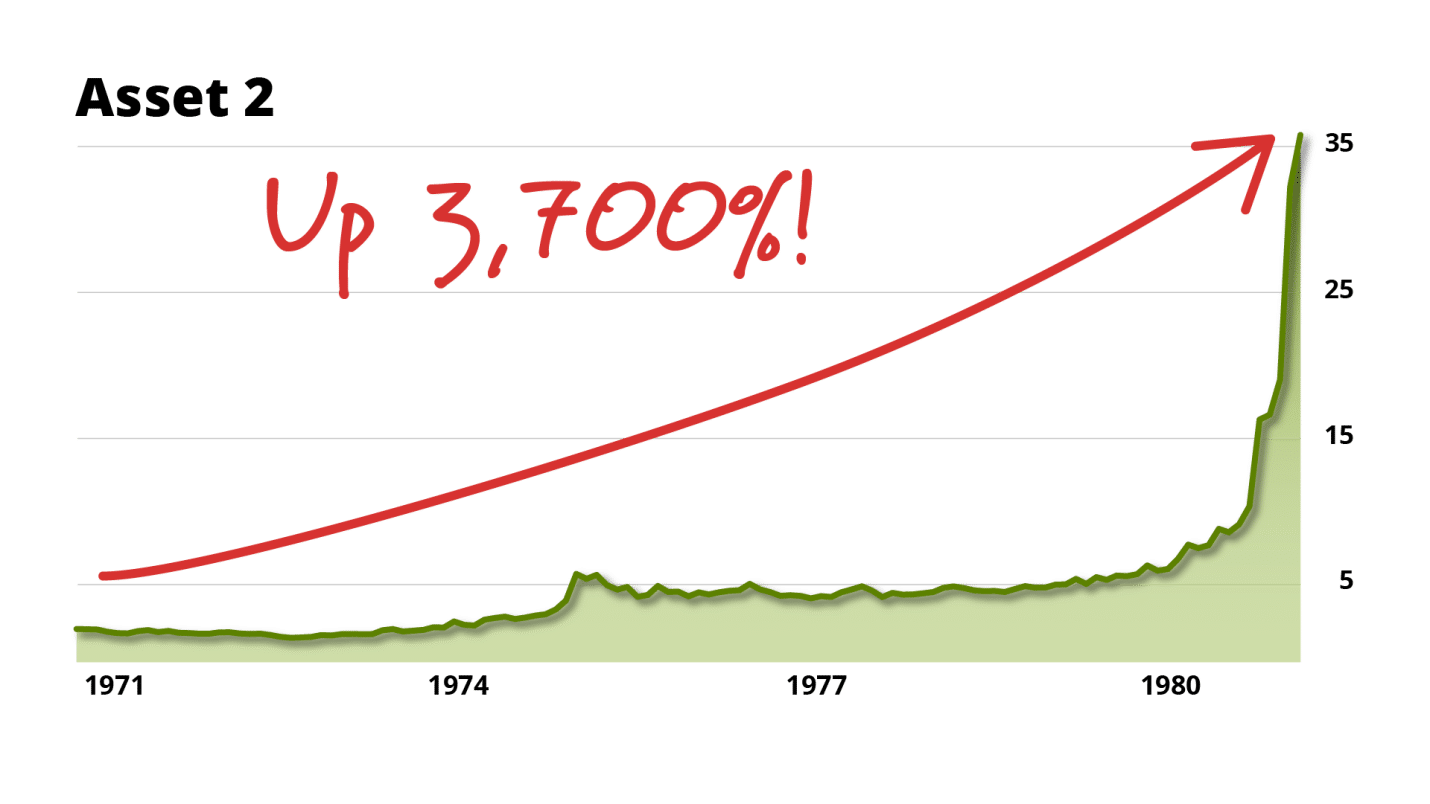

The last time central bankers made a similar move, one of these assets soared 2,300%.

Another more obscure one went up 3,700%.

What’s amazing is, you can do the EXACT SAME THING right now… It’s a very easy move to make and could prove to be extremely profitable in the years to come.

I lay it all out in this special report, called The Power of the Central Bank.

You’ll learn the best ways to allocate your hard-earned capital to these assets…

A surprisingly easy method of owning them physically, without touching the stock market…

And an even more convenient way to buy them straight from your brokerage account.

All it takes is a few clicks…

And that brings me to…

Step 2: The Crash Protection

and Profit Portfolio

After forty years of falling rates and government-supported asset prices…

We’re now living in the biggest financial mega-bubble in all recorded history.

And when that bubble bursts?

I predict our government will swoop in with fresh bailouts very swiftly – this time, with digital dollars they will deposit straight into your account.

As they pump trillions of new digital dollars into our economy, more cracks will continue to appear in the system…

Similar to what we’ve experienced since the unprecedented money printing of 2020.

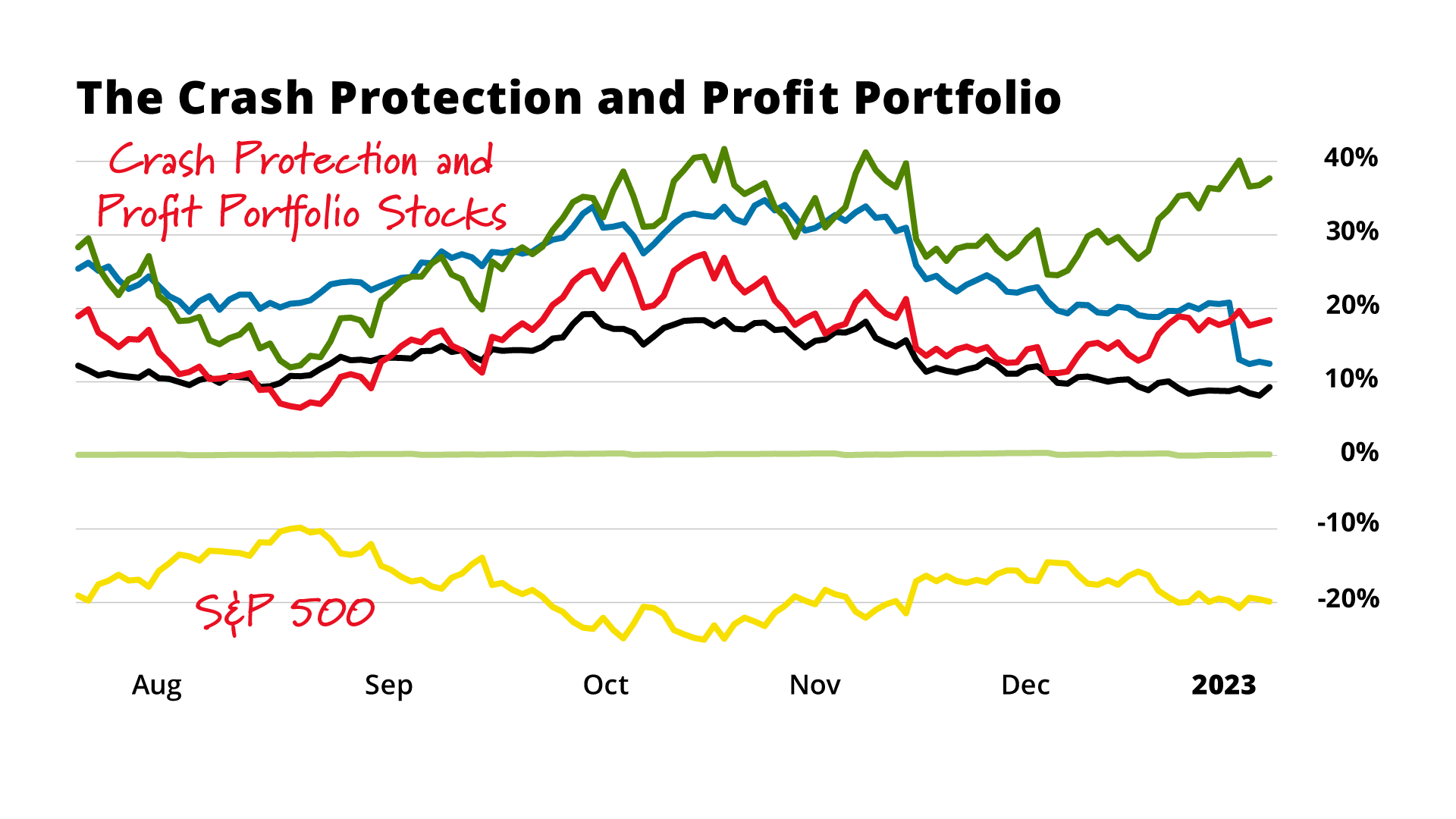

That’s why I’ve put together a brand-new report, The Crash Protection and Profit Portfolio…

It’s a bona fide portfolio of stocks that generated excellent gains after the S&P 500 peaked at the end of July 2023. And historically, they’ve all done well in market downturns.

One of the latest additions is an unusual stock that soared 37% in 2022 as stock and bond markets melted down. Like cash and gold, it’s a true diversifier… and it preserves your wealth by paying you cash, whether the market is going up, down, or sideways.

Another stock in this portfolio will benefit as foreign investors flee volatile currencies and bond markets in their home countries during a crisis…

And another is a stock I believe everyone from the ages of 19 to 90 should own. It’s my No. 1 no-brainer way to profit off a market crash.

It pays the lowest-risk 4%-plus yield on the planet right now… and it could pay you even more if the economy tanks as predicted.

These are the stocks you WANT to own over the next decade… as countries around the world begin using digital currencies to further inflate our money and destroy the value of your savings.

I hope I’m wrong. But hope is not a strategy. And as I always say, “Prepare, don’t predict.”

And The Crash Protection and Profit Portfolio is how you prepare.

I can’t say any more about these ideas right here.

But if you want to take advantage of these opportunities right away, it’s easy to do.

Before I give you the specifics, there’s one more critical resource I want to send you immediately…

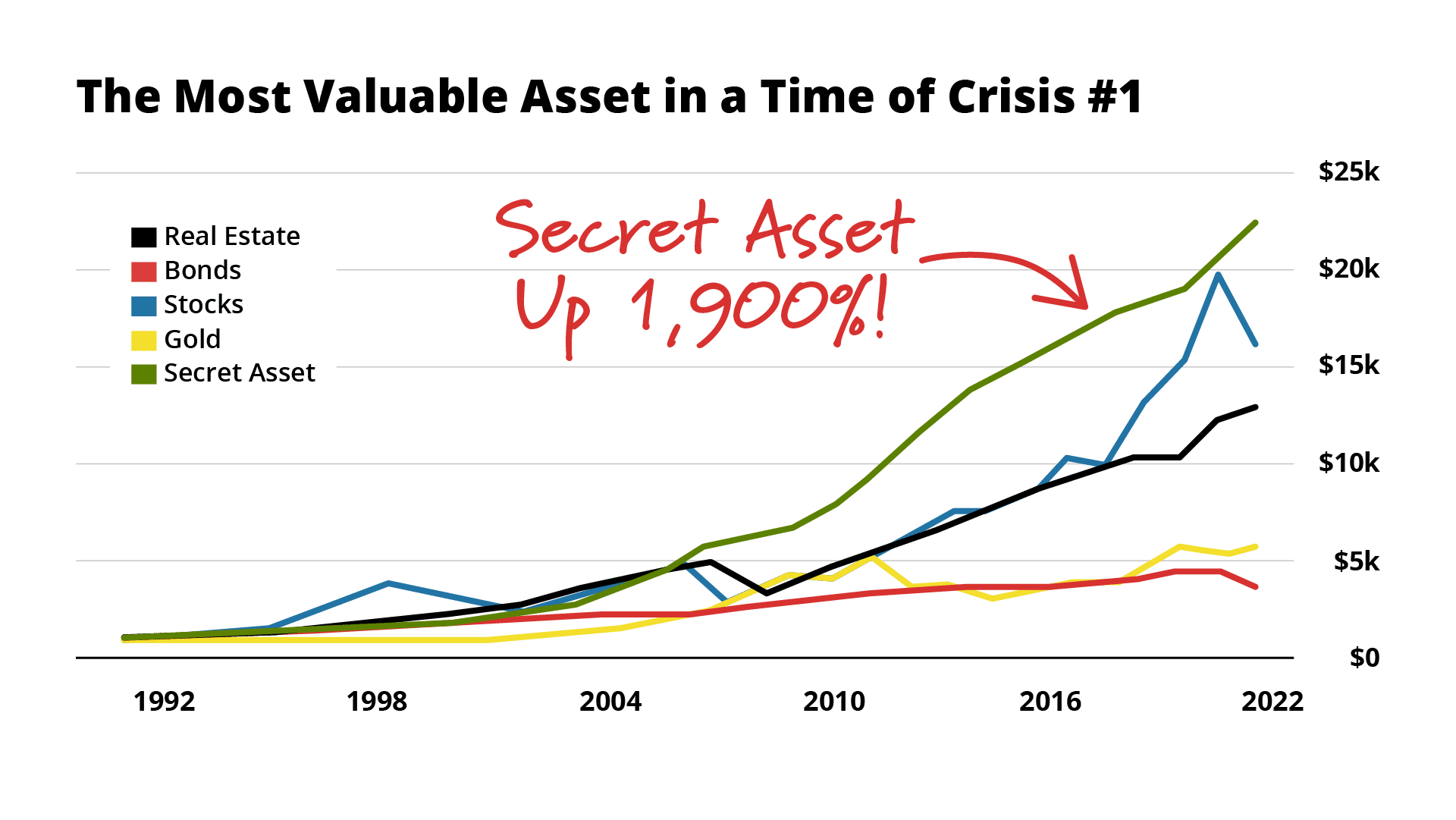

Step 3: The World’s Two Most

Valuable Assets in a Time of Crisis

It’s critical that you know about two assets that go up the most (with the least amount of risk) in times like this…

While still allowing you to grow your wealth outside of the digital dollar.

I’m not talking about bonds, gold, or precious metals… or anything else like that. And this has absolutely nothing to do with the stock market.

In fact, one of these assets has crushed gold and even stocks at times. Some even call it “gold with yield.”

It’s up 1,900% over the long term, without a single down year in decades.

And the second has consistently delivered returns of around 10% per year for the last 35 years.

It’s all detailed in this special report, The World’s Two Most Valuable Assets in a Time of Crisis.

So if you’re interested in receiving these, let me explain what I’m offering…

No One Else Does This

As I mentioned earlier, my name is Dan Ferris.

I started working at Stansberry Research 23 years ago as one of the company’s pioneering stock analysts.

Since we started this business over two decades ago, we’ve helped more than a million subscribers in over a hundred countries take control of their finances without having to pay the onerous fees charged by Wall Street and money managers.

We’re very committed to our work: producing the kind of investing ideas, strategies, and recommendations that can realistically change your financial situation.

I’m not going to tell you that you can make 100%, 200%, 500%, or more overnight.

That’s what many of the companies we compete against would tell you.

But you and I both know… that’s all BS.

The next time someone claims such a thing, ask to see their complete track record. I think our firm is the only one in the entire industry that publishes a full track record, every single year…

Because what really counts is helping folks transform their financial lives over a period of several years.

That’s why over the long run, my team and I have an unmatched track record for finding double and triple-digit gains with less risk…

- 140% on Aneuser-Busch InBev (BUD)

- 237% on Alex & Baldwin (MATX)

- 194% on Apple (AAPL)

- 124% on Berkshire Hathaway (BRK.A)

- 190% on bitcoin (BTC)

- 111% on Blair Corp. (BL)

- 105% on Circuit City

- 597% on Constellation Brands (STZ)

- 134% on Foreign Trade Bank of Latin America BLADEX (BLX)

- 130% on Gateway

- 151% on Icahn Enterprises (IEP)

- 122% on Intel (INTC)

- 286% on International Royalty

- 99% on JAKKS Pacific (JAKK)

- 146% on Johnson & Johnson (JNJ)

- 99% on Lehman Brothers

- 91% on Microsoft (MSFT)

- 90% on Portfolio Recovery Associates (PRAA)

- 117% on POSCO (PKX)

- 410% on Prestige Brands (PBH)

- 94% on Walmart (WMT)

All investments carry risk. These are some of Dan’s best recommendations across his services; not all companies will perform as well. His average gain for The Ferris Letter since its inception in 2022 is 7.9%.

These are obviously some of my best picks from across the research services I offer.

But I can’t promise you’ll make a large fortune following our research. All investments involve risk, obviously, and past performance does not indicate future returns. Folks who don’t understand that should not be reading my research, period.

What I can tell you is this:

We’ve had incredible success over two decades helping people radically change their financial lives.

Our work is ridiculously inexpensive compared to its value and compared to the fees you’d typically pay an advisor or wealth manager.

And you can try a subscription risk-free… because I simply don’t want your money if you’re not happy with our work.

But before you decide whether or not to take action on our government’s frightening shift to a digital dollar…

I’d like for you to simply pause for a minute.

Don’t listen to what I’m saying.

Don’t pay any attention to the historical examples in this presentation.

Don’t think about the facts or figures.

Just think about your own experience in life.

Think about how many things you’ve seen in our country that simply don’t make sense…

Companies with no profits worth billions of dollars… houses doubling and tripling in value in just a few years… trillions of dollars in new government spending with no end in sight…

Inflation, we are told, is “transitory” but never seems to go away… Wages are stagnating… while the wealthy hold a higher percentage of our country’s wealth than ever before.

If any of this seems normal to you… put this presentation aside.

But I’m sure if you think for just a minute, you’ll realize you’ve been wondering about all this stuff for years.

Something in our country just hasn’t been right. Hardly anyone can live within their means anymore.

Haven’t you wondered if there is something behind the growing desperation you sense among your friends and neighbors… something to explain what’s been going on?

There is.

The historic amounts of debt and new money our country has created out of thin air have destroyed our economy and the value of your savings, and this situation is finally hitting a tipping point.

After devaluing the dollar and making credit almost interest-free…

It should be no surprise that instead of getting out of debt, Americans – particularly the poor – have piled on huge new debts.

Corporations have, too. And of course, the government is now more in debt than any time in history.

In short – huge losses are coming. Economists know it. Most of the senior leaders in Washington know it, too.

Almost one-fifth of our banking system is sitting on massive unrealized losses…

And now, we are at a point of no return…

Where any number of crises can erupt and tip the country into a digital-dollar system on March 11.

So get the facts for yourself. Learn what you need to do.

The three special research reports I just mentioned… The Power of the Central Bank, The Crash Protection and Profit Portfolio and The World’s Two Most Valuable Assets in a Time of Crisis… will be among the first things I send you when you start a no-risk trial subscription to my research service called The Ferris Report.

To ensure you are fully prepared to protect yourself and your family from this crisis, I’ve also prepared two more bonus reports, which you’ll see soon.

You’ll also get my monthly analysis delivered to your email inbox on the fourth Friday of each month, around 5 p.m. Eastern time.

PLUS you’ll get our daily update, called the Digest, around 6 p.m. each weekday.

There is so much to stay on top of in the financial markets today. Things are breaking apart faster and faster every month. But I’ll keep you posted on everything you need to know.

You’ll also have subscribers-only access to a full library of financial ideas, secrets, and strategies that could change your life…

I’ll send you all the research above, in a matter of minutes, so you can start getting your financial life in order ahead of the next crisis…

Because if you make the right choices right now, you and your loved ones could not only survive what’s coming… but you could set yourself up to become wealthier than ever before…

But if you continue to stay on the sidelines… or rely on the wrong investments… your hard-earned savings could evaporate overnight as we shift to a digital dollar.

To make sure there’s nothing standing in your way of making the RIGHT decision… I’m offering you a 75% discount on my research immediately.

Normally a year of my research costs $199, which I think is more than fair.

Today, a one-time fee of as little as $49 entitles you to an entire year of my work with everything I’ve described here.

Get Started Now

And you can try a subscription risk-free.

If you’re not happy with my work for any reason, just let us know within 30 days of placing your order.

You’ll receive a full refund for your subscription, and we’ll part as friends.

But I doubt that will happen. If you’re like the rest of my subscribers, you’ll probably decide to become a reader for life…

Here’s just a tiny fraction of the notes I’ve personally received in the past few years from my followers…

Mark M. says:

“You have helped me put six grandkids through college with no debt. One through law school, one in medical school, and one who has given me two great grandchildren.”

Jim S. writes:

I went from $3,000 in Apple to $200K over 8 years!!”

And Bernie M. says:

“[Your recommendations] have done quite well, with gains of 50% to 250%, and have actually fared much better than my other investments during this recent economic turmoil.”

The investment results described in these testimonials are not typical. Investing in securities carries a high degree of risk. You may lose some or all of the investment.

You can join my subscribers when you click the “Get Started” button below.

Get Started Now

This will take you to a secure form… where you can review everything once more, including two more free bonuses I haven’t shared, before submitting your order.

Please, please, take everything I’ve shown you today seriously.

Remember, the moves you make with your money in the coming days could be the most important of your life.

Sincerely,

Dan Ferris

February 2024