Hi, I’m Lauren Sivan.

And you’re about to meet two men who could help change your retirement – forever.

These are two of the most knowledgeable and successful Wall Street insiders of the past 50 years. And today, they’re coming forward with the most important prediction of their careers.

Dr. David Eifrig has an MBA in Finance and International Policy from Northwestern’s Kellogg School of Management.

He worked at some of the biggest and most prestigious banks in the world, including with the first-ever derivatives trading group at Goldman Sachs.

He was on the trading desk during Black Monday in ’87… and sat with Fischer Black – the man who literally wrote the book on option modeling. The work even won a Nobel Prize.

His early success allowed him to quit Wall Street at a young age (which got him profiled in The Wall Street Journal). He then went to medical school, where he became a board-eligible eye surgeon.

Since 2008, Doc (as he’s called by his friends) has been a Senior Partner at MarketWise, an investment research firm that went public in July 2021 in a $3 billion SPAC… where he serves as the in-house expert on health, wealth, and retirement.

Mr. Louis Navellier is a $1 billion money manager, whose fund saw a 4,000% return over 15 years. Prompting The Wall Street Journal to write: “Most money managers can only dream of having the same success.”

Learn More about Louis Navellier

He’s written about the market for more than 40 years. And correctly warned about the crash of ’87… the dot-com crash… AND the 2008 meltdown.

Over that timeframe, he’s also found and recommended 18 different stocks that have shot up as high as 10,000% or more… as well as 675 stocks that have more than doubled.

As you’re about to see… these legendary experts warn we’re in the earliest stages of what they call “The Great Unraveling.”

A specific event starting to take root in America that’s behind the recent crash in stocks and the record inflation you’re seeing.

But, as you’ll see, they warn it will likely get even worse.

Which could be a lucrative opportunity if you understand what’s happening… but could ruin the retirement plans of millions of Americans who aren’t prepared.

Dr. David Eifrig and Mr. Louis Navellier, thank you for coming here to share this message with us.

DOC:

My pleasure, Lauren and Louis!

LOUIS:

Thrilled to be here with you both.

HOST:

First to you Doc: You’re essentially warning that we’re about to see the biggest retirement shock in American history…

… can you tell us what’s happening?

DOC:

Sure, Lauren.

But first – I want to talk about my beard.

Yes, I know that might seem silly. But I’m incredibly proud of it.

You see, when my trade recommendations go on a winning streak, I don’t trim my beard.

And, as you might guess… they’ve been doing well for a while.

In fact, I just hit 140 winning trades in a row. With zero losers.

But back to your question…

In short: If you’re already retired… or getting ready to retire – everything you’ve done to prepare is about to be undone.

And it’s all because of the Federal Reserve.

The Fed has backed itself into a dangerous corner. And, as you’re about to see, whatever its next move is… could be disastrous for every American with savings and investment accounts.

LOUIS:

And look – we get it…

You may be thinking this is just some exaggeration two former Wall Street guys cooked up, to scare you into listening to us…

But you owe it to yourself to listen to our full message today.

Believe it or not, Lauren… Doc and I are actually rivals!

We’ve spent the past few decades building competing businesses that help Americans find the right investments to achieve their retirement goals.

We’re often ranked against each other. And we constantly study each other’s work to see what the other’s up to.

But given everything that’s going on… we decided to cast our differences aside today, and work together for the first time ever, to get this important message in front of as many people as possible.

Because we’re worried whatever you’ve done to prepare for retirement could be completely undone by “The Great Unraveling.”

This is the economic story of our lifetime…

And if there’s EVER been a time for us to help people, together… it’s right now.

HOST:

What do you mean by that, exactly?

DOC:

Well, for one… many of the things you take for granted right now are due for a big disruption in the months and years ahead.

As you’re about to see, your Social Security benefits will likely be slashed.

Your taxes are probably going way up.

Many of your investments are likely to continue falling.

Meaning even if you think you’ve saved enough money to retire… you’re probably going to need way more money than you thought.

LOUIS:

Not only that… but “The Great Unraveling” will also require a totally different investing approach than any you’ve probably been using.

As you know, stocks are in a bear market. Treasuries just suffered their worst year since 1788 – the year the Constitution was ratified. The average savings account in the U.S. pays just 0.1% a year.

Even cryptos have been a bloodbath recently.

Most normal investments, and most normal investment strategies, aren’t going to give you the kind of protection and growth your money may need right now.

And that’s true whether you’ve saved millions. Or even if you only have a few thousand.

DOC:

That’s right.

For decades, most financial planners recommended you retire with 60% of your money in stocks and 40% in bonds.

They say that’s the ideal mix of growth and safety to weather the ups and downs of the stock market, and grow your money over time.

But that strategy hasn’t been working, which is something my team and I warned about over a year ago.

In fact, if you had your money 60% in stocks and 40% in bonds… you recently saw your worst quarter since the Financial Crisis of 2008!

Point being, a 60/40 portfolio is definitely NOT going to work during “The Great Unraveling.”

So now, more than ever, you need to know which assets should do well during times of crisis.

As you heard, Louis and I have firsthand experience with ALL the major meltdowns of the past 35 years.

We’ve also studied economic history.

So, we know what happens when a government backs themselves into a corner, like the Fed has done to America today.

Bottom line: We know what works, and what doesn’t, in times like this.

Money isn’t everything, of course.

But it is important. It gives you peace of mind. And it can help you live a rich, fulfilling life.

Maybe you’re like me… and your dream is to spend your golden years sending friends bottles of Cabernet Sauvignon or Chardonnay from your own winery.

Or you’re like Louis, and you’d prefer to drive around in high-end sports cars.

Whatever the case… we’ve condensed more than 70 years of combined experience down to just five simple steps that could help save your retirement from the disaster we see coming.

LOUIS:

Exactly right.

There will be clear winners and clear losers in the coming months. So, your personal success all comes down to your understanding of what’s heading your way.

And I promise: if you stick with us today, you’ll have a better understanding of what’s REALLY happening in America than any of your neighbors have.

You might already feel like something is “off” in this country right now.

Maybe you have this sense, deep down, that things don’t feel normal.

So, whether you just want some tips on how to make sure your money is in the right place, so you can sleep soundly at night… Or you want to be the only one in your circle of friends who TRULY understands what’s happening in America…

We’re going to open your eyes to all that.

DOC:

That’s right. Because the people MOST at risk right now…

It’s those of you who spent your life playing by the rules!

Those of you who worked hard, tried to do the right thing… and save what money you could for retirement.

LOUIS:

And nobody in the media or anywhere else – NOBODY is telling you why this is happening, or how to protect yourself!

DOC:

That’s right.

All these things you’re seeing on TV and online – about the fastest-growing inflation in history… the talk of recession… the bear market in stocks – these are all just symptoms of a much deeper problem in America.

LOUIS:

Doc and I have dedicated our lives to studying this.

And as you can tell, we’re not exactly young men!

We’ve been thinking about these things for a LONG time.

And the conclusion Doc and I independently are coming together on… is simple: There is no easy way out of the corner the Fed has backed us into.

And that’s essentially what “The Great Unraveling” is all about…

HOST:

So, what you’re saying is… we’re trapped? Do I have that right?

DOC:

Well, let me put it this way, Lauren… The Fed doesn’t exist to protect YOU or YOUR money – like some folks might think.

The Fed is there to protect banks and the government.

The decisions they make are all about next quarter’s numbers… or the next election.

Because of this, the Fed’s policies tend to be short-sighted in nature.

They’re not thinking about the effects their actions will have 5, 10, or even 20 years down the road.

And so, the way we see it… the Fed has put temporary band-aids on major wounds that needed more time to heal.

And today, that band-aid needs to be ripped off and get some air so it can heal.

Now, don’t get me wrong… these band-aids have helped the good times roll.

If you’re a Baby Boomer like Louis and I, you belong to the wealthiest generation in history.

Asset prices have soared during our lifetime.

But it’s come at a cost…

LOUIS:

That’s right. Which is the real reason why so many Americans feel burnt out…

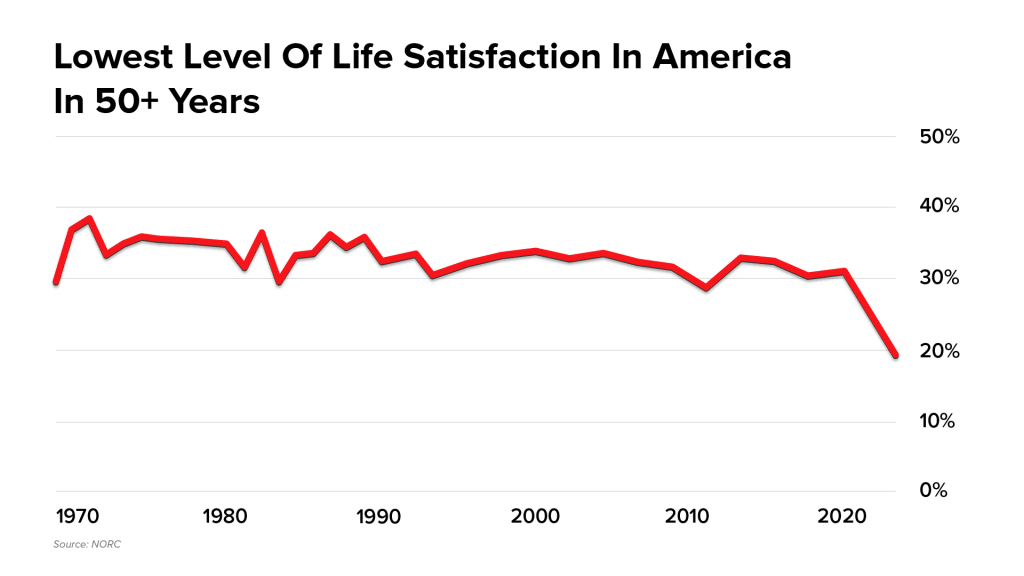

Why American life satisfaction is at the lowest level in 50 years…

Why Americans’ confidence in the government, big business, and the media are at all-time lows…

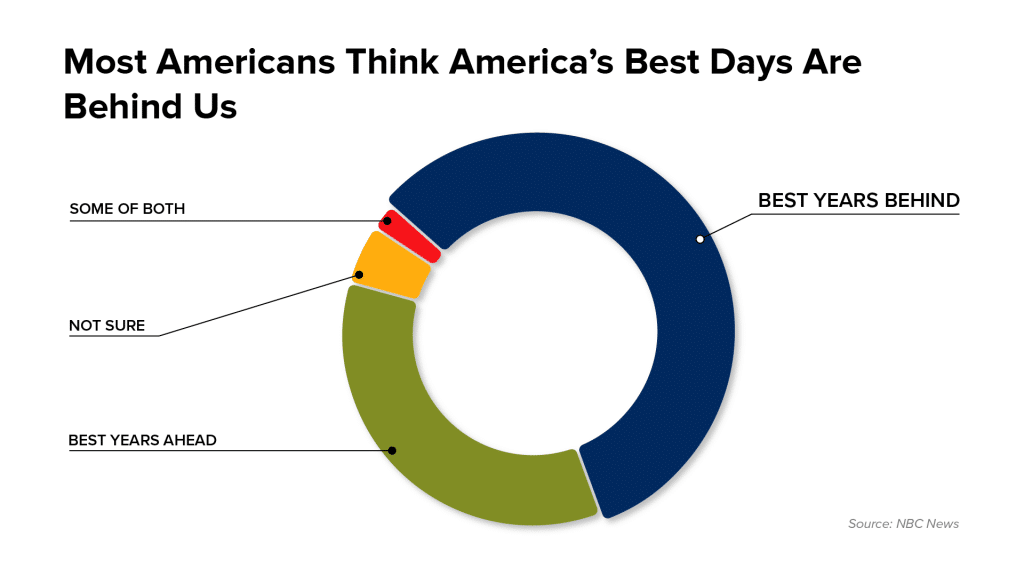

And why an unprecedented 58% of Americans believe “America’s best years are already behind us.”

DOC:

And it’s getting worse by the day.

For example, you’re now hearing tragic stories about food banks in cities like Phoenix…

They’ve seen a 78% increase in the size of their lines, as more and more families struggle to put food on the table…

Major crimes like auto theft and grand larceny are soaring more than 50% in our nation’s most populated cities, like New York…

And now… 20 million American homes are behind on their electric bill – and in danger of getting shut off!

Point being – most of what we’re going to show you today will help you connect the dots of what you’re seeing online or on TV.

LOUIS:

And this is extremely important. Because the misinformation is everywhere.

Even the federal government is gaslighting you!

HOST:

Now, for anyone not familiar with that term… gaslighting is a form of psychological manipulation.

It’s actually a form of abuse… and describes when someone is telling you so many lies that you actually start to question your own sanity!

So that’s a bold statement to say that the government is gaslighting Americans… could you show us what you mean by that?

LOUIS:

Sure.

The other day, for example, Fed chairman Jerome Powell held a press conference, where said: “Households are in very strong financial shape.”

The White House press secretary said nearly the same thing: “We are stronger economically than have been in history.”

It certainly paints a rosy picture, would you agree?

HOST:

Absolutely.

LOUIS:

But it’s simply not true!

Just days before they said this… the Wall Street Journal reported that 83% of the country describe the economy as poor or not so good.

That’s the highest level in 50 years!

And it’s not just people FEELING like the economy isn’t strong…

The official numbers prove that they’re lying to you, too.

DOC:

Lauren, would you say our nation is “stronger than ever before in history” … when inflation continues to hit new 40-year highs, month after month?

HOST:

No, I don’t think so.

DOC:

Or that households are in “strong financial shape” – when you hear that nearly HALF of Americans have almost no savings… and are expecting to make ends meet by taking on more debt in the next few months?

HOST:

Nope.

DOC:

Of course not.

LOUIS:

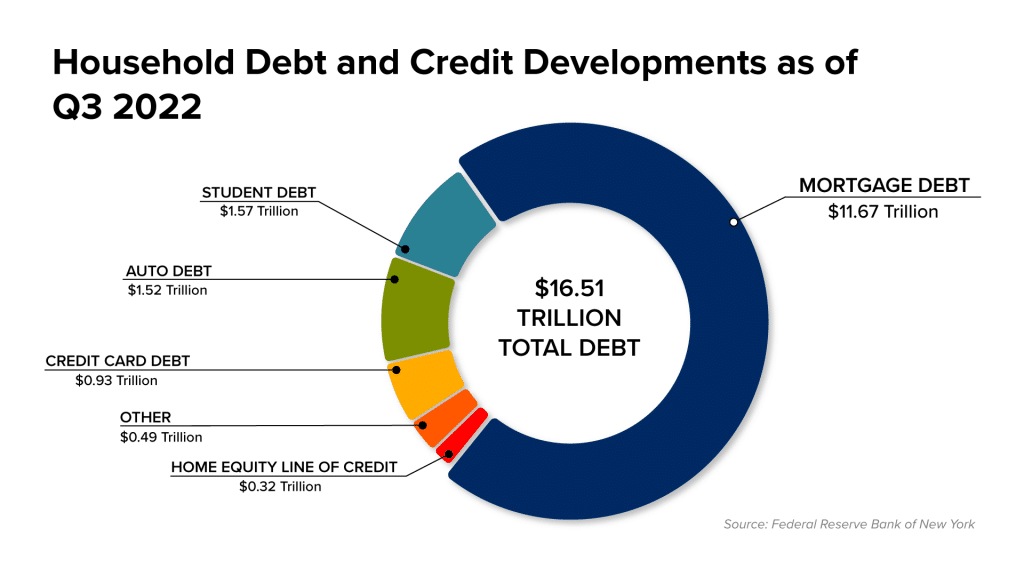

And as you can see, Americans ALREADY have way too much debt.

Currently over $16 trillion, which is a record high.

And it’s growing at a frightening pace…

Household debt just saw the largest increase in 14 years!

Americans’ credit card balances just hit an all-time high of $930 billion.

And mortgage debt now sits at a whopping $11 trillion.

DOC:

Of course, those record-high numbers only reflect those folks who can afford a home!

Home prices have soared four times faster than incomes.

And are now so high that 9 million Americans are priced out of the homebuying market.

LOUIS:

And it’s a similar story in cars… The auto-industry company Edmunds recently reported that more than half of American households couldn’t even afford a used car at current prices.

And all those folks who bought NEW cars back in 2020 or 2021… when the government’s stimulus checks were flowing like cheap wine?

Many of those vehicles are now getting repossessed!

DOC:

Now all of this is troubling, of course.

But “The Great Unraveling” Louis and I are warning you about is way bigger than not being able to buy a new home. Or folks having their cars repossessed.

Because now you’re starting to see even scarier scenarios playing out.

For instance, did you know that 1-in-4 older Americans have been forced to delay their retirement?

Or that younger Americans – including Millennials and Generation Z – have given up on saving altogether?

LOUIS:

And yet, as bad as all this is…

This is just the beginning. We’re convinced things are about to get even worse.

And if you don’t take the right steps today, YOU might be one of the millions of Americans who pays the price as “The Great Unraveling” continues.

HOST:

I want to come back to that in just a minute…

But first I want to point out that it’s not just you and Doc sounding the alarm on how bad the economy is right now.

Elon Musk, the billionaire founder of Tesla and SpaceX and new owner of Twitter, recently admitted he has a “super bad feeling” about the economy.

Paul Tudor Jones – the legendary billionaire hedge-fund tycoon – says: “You can’t think of a worse macro environment than now.”

And, just like you guys, Tudor Jones was trading on Wall Street during the crash of ’87… the dot-com burst… and the financial meltdown.

And this might be the scariest quote of all…

Charlie Munger, Warren Buffett’s right-hand man, says inflation like we’re seeing today “is the way democracies die.”

DOC:

All of this is true, I’m afraid.

What we’re seeing right now is not all that different than what happened during the fall of the Roman Empire and the Weimar Republic.

There’s a ton of great research to back this up…

So, in case you’re wondering where we’re getting our facts from, you can click the “Details and Disclosures” link at the bottom of this window when you’re finished with this presentation.

But the problem with headlines like the ones you shared, Lauren… is that even if you take these warnings seriously – you still don’t know who to turn to!

Because who can you trust?

You can’t trust the government.

They’re lying to you!

We already showed you one example…

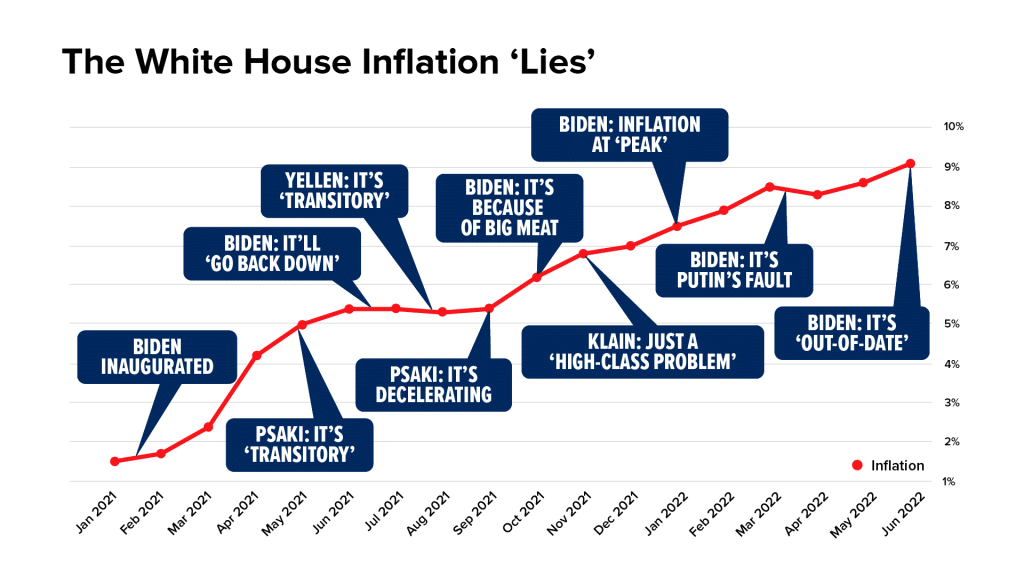

But look at the government’s official response to inflation over the past few years…

“It’s transitory… it’s slowing down… it’s Putin’s fault…”

One excuse after another.

And yet what has happened since then?

HOST:

It seems to be getting worse!

DOC:

Exactly right, Lauren.

The lies about the numbers continue…

Get this… in August, President Biden said inflation was at 0% in July 2022!

Even the fact-checking website Snopes declared that proclamation “misleading!”

LOUIS:

Or did you see the recent debate over the word “recession”?

HOST:

You mean the White House saying that two quarters of negative GDP growth is NOT the actual definition of a recession?

LOUIS:

Exactly.

Even though this was the standard definition for my entire career… all of a sudden, the White House and all these other government officials say that this is no longer the definition.

Which is bad enough on its own.

But someone even went in and changed the official definition on Wikipedia! And then blocked users from editing it back to the correct definition!

DOC:

It’s absolutely nuts. I never thought I’d see these things happen in America.

And this next one might be the worst of all. The White House recently tweeted out that seniors are getting the biggest increase in Social Security in 10 years because of Biden’s leadership.

Now, the first part of that is true. The cost-of-living adjustment for Social Security is rising 8.7% in 2023.

But President Biden didn’t do anything to cause that increase… it’s all based on the inflation rate, and the inflation adjustment President Nixon signed into law in the 1970s.

Of course, someone called the White House out on this error. And they’ve since deleted the Tweets.

But again… it’s a strange time we’re living in right now.

Of course, it’s not just the feds you can’t trust.

You can’t trust Wall Street either…

While Main Street, you and I, were starting to worry about inflation… Wall Street traders were making billions of dollars by placing bets to profit from higher inflation.

HOST:

Let me get this straight…

You’re saying that while most Americans had to cut spending… and ordinary Americans’ retirement accounts were tanking, after stocks saw their worst first-half performance in more than 50 years…

Bankers on Wall Street were cashing in on all this misery?

DOC:

That’s right, Lauren…

In fact, according to Bloomberg… most of Goldman Sachs’ profit last year came from bets made by traders like this.

It’s not all that surprising, of course. And it’s perfectly legal.

There are far worse things that go on.

When I worked on Wall Street, I saw guys get away with fraud… forged documents… illegal trades, you name it.

It’s behavior like this that made me leave my job at Goldman Sachs decades ago… And it’s why Louis and I really had no choice but to come forward, together, with this important warning today.

Sure, maybe you already know that hard-working Americans are falling further and further behind, year after year…

And maybe you’re aware that a perfect retirement is getting harder and harder to achieve.

And if you’ve been to the grocery story this year, you certainly know that your dollars aren’t quite going as far as they used to.

But most Americans don’t realize that the Fed is actually behind it all.

Not Putin. Not Trump or Biden, not Congress, or even Wall Street.

The Fed has stacked the odds against you.

And now all their financial shenanigans must be unwound.

There’s no other option at this point.

So that’s the bad news Louis and I are coming forward with.

HOST:

But… there’s a bright side to all this?

DOC:

There can be, if you pay close attention.

Again, Louis and I spent our lives preparing for this exact moment in time.

And, today, we’re going to show you exactly what you need to do today, to potentially protect and grow what you’ve saved.

If you take our advice… and everything goes right, we think you’ll not only come out of “The Great Unraveling” OK… but possibly in an even better position than you are today.

LOUIS:

That’s right.

Now before we jump in with what’s going on, and how you should react… we need to start with a few simple definitions.

Because most people don’t fully grasp what inflation actually is.

The average person – and this is true for the folks on TV, too – equates inflation with rising prices.

HOST:

So… are you saying that higher gas prices, food costs, etc. – those aren’t inflation?

LOUIS:

No, it is.

But inflation isn’t just some term for when prices rise.

And this is extremely important for you to know…

Because if you don’t understand this concept, you’ll likely be totally screwed as inflation gets even worse.

Inflation is a symptom of something else. It’s not when items are suddenly costing you MORE.

Inflation is when your dollars are suddenly worth LESS.

You see, money operates on the principle of supply and demand…

As more dollars are created, or in other words, as the supply of dollars increase… the value of each individual dollar goes down.

So, prices rise in response.

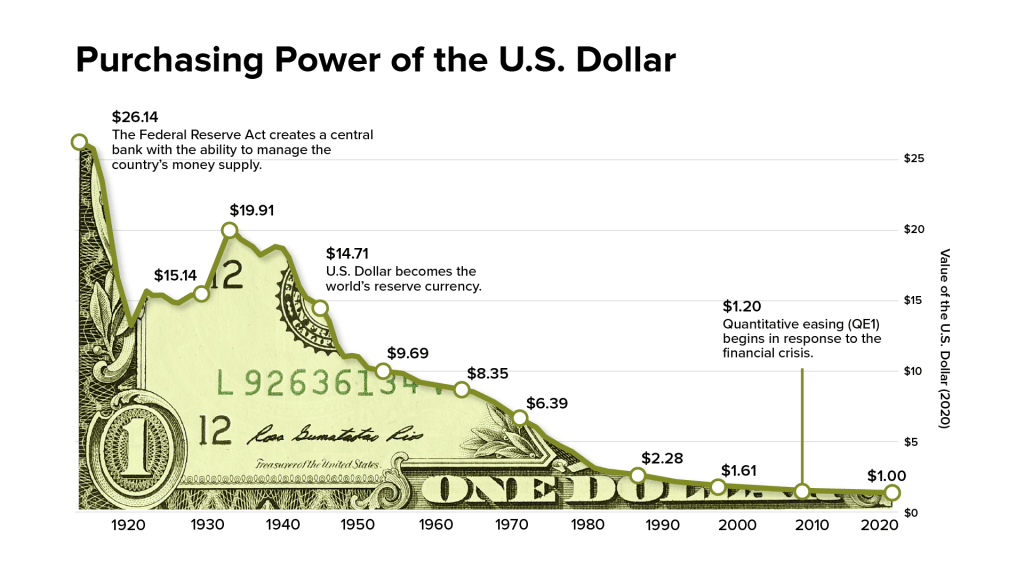

Which is why the U.S. dollar has lost more than 90% of its value since the Federal Reserve was created in 1913 – and printed more and more money over its lifetime.

In fact, it might surprise you to hear this… but Doc and I believe the real seeds of the inflation we’re seeing today were sown back in the mid-1990s.

HOST:

You’re saying you believe this all started more than 25 years ago?

I’m not sure I follow…

LOUIS:

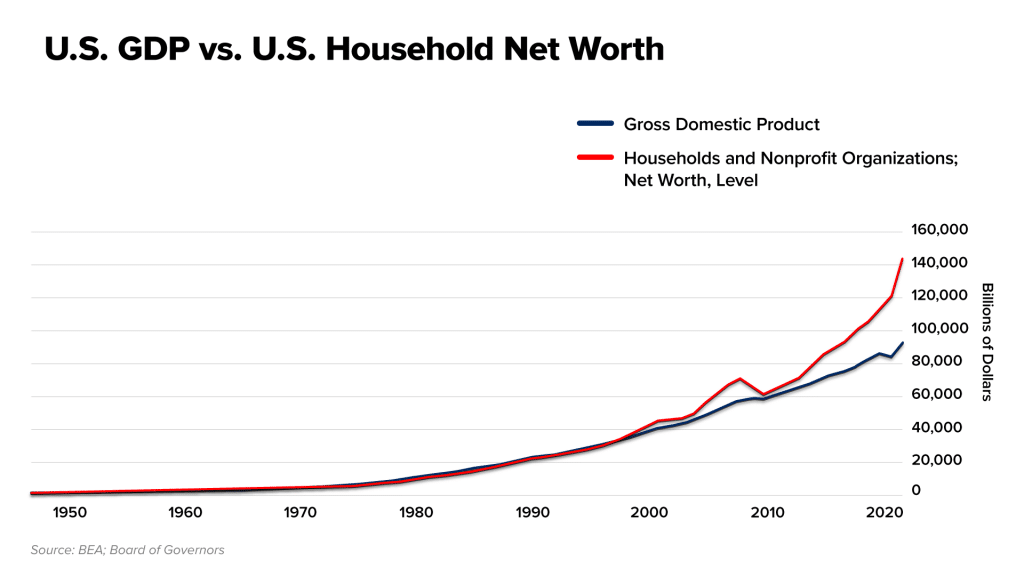

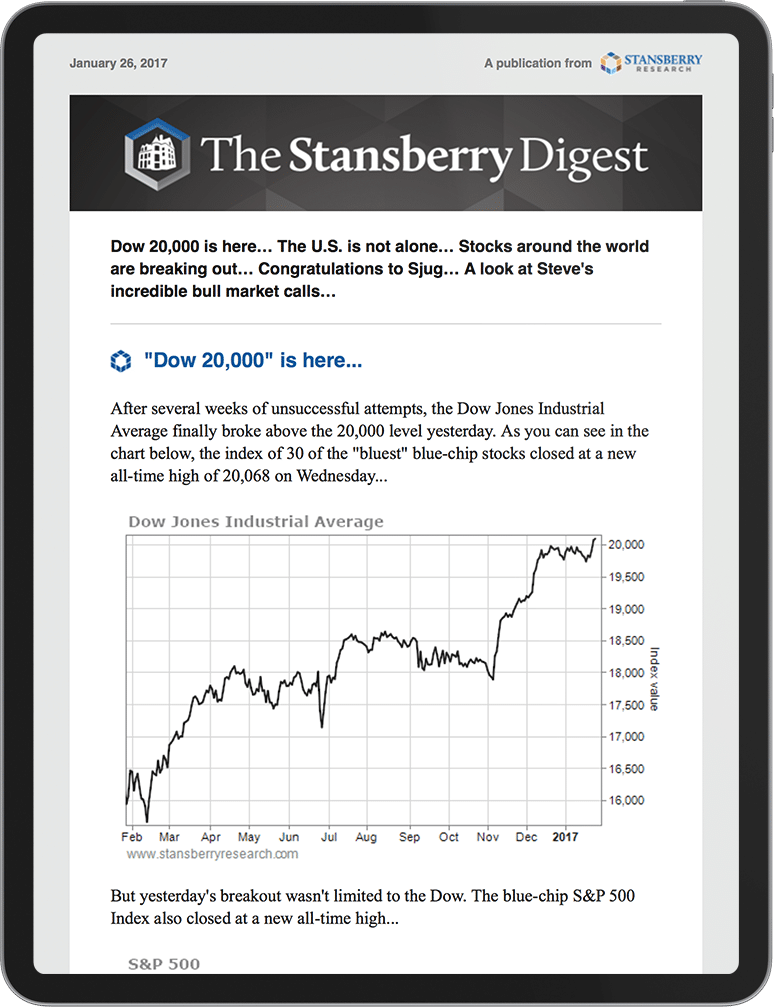

The best way to show you what I’m talking about is with a chart we brought with us.

Could we put it up on the screen for everyone?

HOST:

Alright… what exactly am I looking at here?

LOUIS:

Well, the first thing you should know… is that this is all built with official Federal Reserve data.

You could go to the Fed’s website later if you’d like and re-create this chart on your own.

HOST:

OK.

LOUIS:

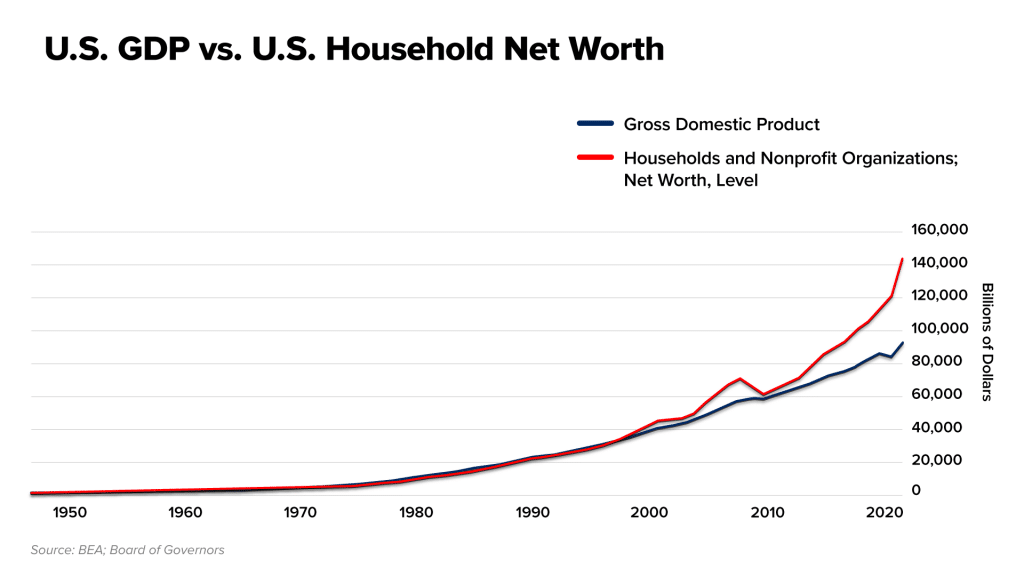

This chart compares U.S. GDP (how many goods and services are produced in America)… to household net worth.

Which is simply how much money Americans have in their checking and savings accounts, investment and retirement accounts, etc. – minus the debt they owe.

Now, I have a question for you, Lauren…

What do you notice about the chart?

HOST:

Well… it seems like from the beginning… it looks like 1950 or so… until the middle, these two lines moved closely in-line with each other.

But then these two lines diverge quite noticeably…

It looks like maybe… ’95? ’96?

And then today, they’re farther apart than ever before!

LOUIS:

Exactly right.

As I said, we believe everything we’re seeing today got its start in the mid-1990s.

HOST:

OK – I see that in the chart here.

But I still don’t understand what caused it…

What happened in the mid-1990s to cause this massive divergence in GDP and household net worth?

And how did that set the stage for soaring inflation, and everything else we’re seeing today – as you mentioned?

And, most importantly, why does this indicate to you guys that things are about to get worse?

DOC:

Let me use an analogy here… if that’s alright?

HOST:

By all means!

DOC:

I saw this in Forbes a few years ago. And I think it might help this chart make a little bit more sense.

GDP is a measure of how efficiently a country’s economic engine is working.

So, if America was a car… GDP would tell you how many miles per gallon your car is using, as you’re driving down the road.

HOST:

OK, that makes sense.

DOC:

Wealth, on the other hand, is economic potential.

Folks who are wealthy have excess capital.

They have savings they can keep as cash in the bank… they can invest in their friend’s new business venture… they can hire people to do things for them, and so on.

They have all these things they COULD do with their money – if they wanted to.

HOST:

Yep, got it.

DOC:

So, going back to that analogy… If America was a car, wealth is that indicator your car probably has… telling you how many gallons you have left in a tank.

“100 miles until empty” – or something to that effect.

HOST:

OK, I think I see what you’re saying.

So, if we go back to this chart… it looks like GDP has grown at a steady pace. Which makes sense – the economy has grown over time.

But that level of wealth really starts to take off in the mid-1990s – and continues to outgrow GDP?

Almost as if the tank itself keeps growing?

I can’t quite make sense of that… it almost seems like wealth becomes unhinged from GDP?

LOUIS:

Bingo.

Something DID happen in the mid-1990s that caused wealth to become “unhinged” from GDP.

And, as we’ve been hinting at, it all has to do with the Fed!

In the mid-1990s, the Fed made a major shift in the way it operates.

And it’s this shift in policy that’s behind the massive wealth gap we see today.

It’s behind inflation.

It’s behind every asset bubble we’ve seen since then, as well. Including the dot-com bubble… the real estate bubble… even the “Everything Bubble” many folks believe we’re in today.

EVERYTHING traces its roots back to the mid-1990s, when these two numbers diverge.

When, in your words, wealth started to become unhinged from GDP.

And that’s what “The Great Unraveling” is all about, too.

Because we’re about to see the “unraveling” of all the disastrous decisions the Fed began making in the mid-1990s.

HOST:

OK.

So, I guess my next question is… what exactly happened in the ’90s?

DOC:

Great question.

But it’s going to take us a few minutes to properly explain what’s going on… and why it’s created such a mess.

So, sit back and relax for a minute, while Louis and I give you a brief economic history lesson – for anyone that doesn’t remember those days too clearly.

HOST:

I’m ready!

DOC:

OK. Back in 1994, the American economy was doing well.

These were the early Clinton years. And housing, car sales, industry – everything was booming.

Jobs were being created.

Unemployment was falling.

Basically, everything you want to see in a strong economy.

But then something bizarre happened in the summer of ’95…

During the Fed’s July 1995 meeting, Fed Chairman Alan Greenspan declared:

“Since the risks are beginning to ease slightly…

“I do think we should move [rates] because I find it increasingly difficult to argue in favor of staying where we are right now unless one can argue that inflationary pressures are still building.”

You would think with the economy in such good shape… they would move rates upward.

But the OPPOSITE happened.

And with that, the Fed began to CUT rates.

LOUIS:

As Doc said, it was a very strange move.

Usually, rates are cut to help the economy when the economic cycle weakens.

But the economy was strong. Businesses didn’t need the jolt lower rates provide!

This seemingly simple decision marked a major turning point.

The Fed was effectively now taking a much more active role in trying to boost the economy and stocks – even though neither needed it!

But things got even stranger in 1998.

That’s when the Russian ruble collapsed. And when that notoriously overleveraged hedge fund, Long Term Capital Management, fell along with it.

The Fed continued lowering interest rates, to try and soften the ripple effects they were worried about, as the fund liquidated.

Only it didn’t stop…

Rates went lower.

And then lower still until the mid-1990s.

DOC:

Now, Lauren, most folks don’t understand how the Fed’s cutting rates affect investors…

But to put it in the simplest terms possible… when the Fed cuts interest rates, the amount you can make on bonds and other fixed income securities drops.

So investors start to chase higher gains elsewhere.

In other words, if you’re used to making 10% yields on bonds – considered “safe” investments, because they’re backed by hundreds of pages of legal documents – and then suddenly your yield gets cut in half… you have to find those returns on your money elsewhere.

So, you start to look at slightly riskier investments, which could give you a higher return.

Of course, as you know, around this time a new technology called “the Internet” was starting to take off.

And it was giving investors who were willing to speculate on these new stocks the chance to make some big, quick gains.

For example, random Internet companies like TheGlobe.com – which went public in November 1998 – soared more than 600% on its first day of trading!

By January 1999… the AVERAGE first-day gain for companies going public was 271%.

The AVERAGE gain! On the first day of trading!!

Which is crazy on its own… but even crazier was the fact that many, maybe even MOST, of these companies didn’t have any revenue.

LOUIS:

Heck, most of them didn’t even have a business model!

DOC:

Exactly Louis!

Stocks were CLEARLY in a bubble.

But the Fed didn’t seem to mind…

Not only were rates kept low way longer than they should’ve… but the Fed was ALSO printing money like crazy.

Again, all while the economy is chugging along just fine!

From February 1996 through October 1999, the U.S. money supply – the amount of dollars in circulation – grew by $1.6 trillion.

And again, I can’t emphasize this enough… this is all while the economy was already booming, and stocks were soaring!

No government stimulus was needed.

But more and more, the Fed started being the puppeteer of the entire market.

LOUIS:

Of course, as you know… all bubbles must pop.

And that’s why, in early 2000, I warned my readers the market was “Obviously a bubble waiting to burst.”

Sure enough, it popped that year.

And so, the Fed cut rates even lower.

DOC:

By 2003, rates were down to just 1%.

Which, at that point, was the lowest rate ever in American history!

Of course, it was around this time that Wall Street started to catch on to another trend that was happening.

Everyone was rushing to buy the most expensive asset you can buy: a home.

With the Fed keeping interest rates around 1%, it was historically cheap for banks to borrow money and loan it out for a profit.

So, they came up with all sorts of newfangled products to make houses even more affordable for even more Americans, including many who otherwise would’ve never been able to afford a home!

HOST:

And this is when we start to see subprime mortgages, I’m guessing?

DOC:

Subprime, adjustable rate, collateralized debt… all of that.

And again – these products were, at its core, fueled by the Fed’s low interest rates. And unchecked money-printing.

HOST:

And yet, as you said earlier Louis… all bubbles must eventually pop.

Which is why you AGAIN warned your followers about this. In January 2008 you wrote:

LOUIS:

That’s right.

The real estate bubble DID burst.

The effects were contagious.

And just as in ’98… the Fed believed it could save the economy with its policies.

DOC:

That’s right – interest rates then dropped below 1%. And the Fed printed even more money.

Between 2007 and 2017… the Fed printed nearly five times as much money as it had printed in its first 100 years of existence!

LOUIS:

Let that sink in for a minute…

FIVE TIMES the amount of money it took more than 100 years to print… were created out of thin air – in the span of a decade!

DOC:

Now to most people… money-printing doesn’t sound all that bad.

More money injected into the system… well it must mean the economy can keep running, right?

But it’s not that simple or innocent.

We already talked about how more money in circulation causes inflation… because it means every dollar you own is worth less.

But there’s another problem too…

And it’s that when the Fed creates money like this – it doesn’t evenly distribute the money.

These policies create clear winners and clear losers.

HOST:

What do you mean by that?

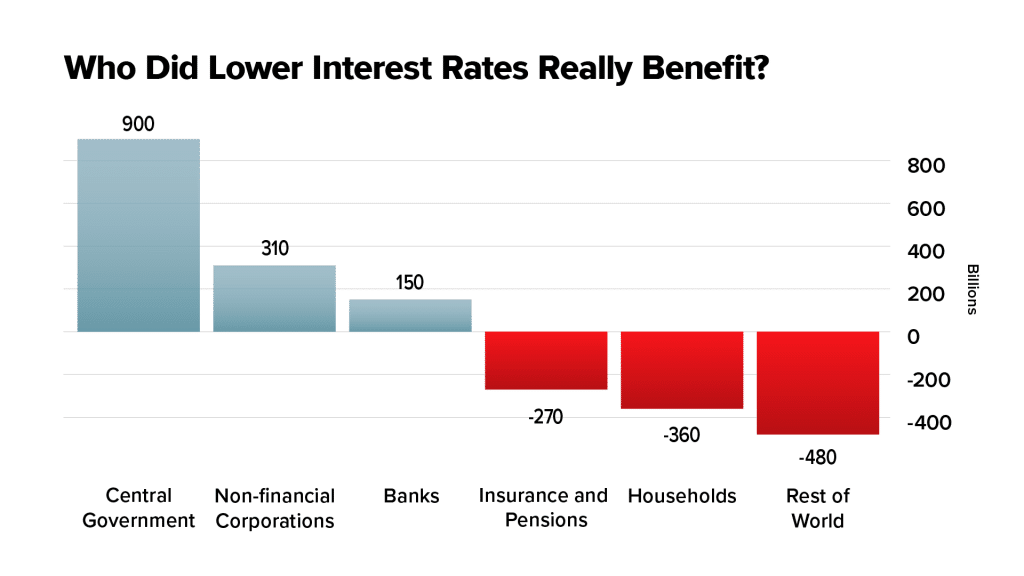

DOC:

The research firm McKinsey Global spent some time digging into this… and the numbers are disturbing.

Between 2007 and 2012, companies made an extra $310 billion, thanks to lower interest payments on their debt. In other words, they saved money because the Fed lowered interest rates.

On the other hand, the average American household was robbed. They had approximately $360 billion in interest they would’ve otherwise received in interest payments taken away from them… all because of the Fed’s moves.

Same for insurance companies and pension funds, which many retirees count on for income… they lost another $270 billion on lower interest rates, too.

All told, the money printing after the 2008 financial crisis cost every single American roughly $70,000.

HOST:

So, let me see if I have this right… You’re saying that by keeping interest rates low… and printing money… the Fed essentially took money that should’ve gone to ordinary Americans… and funneled it a small group of people?

DOC:

Precisely.

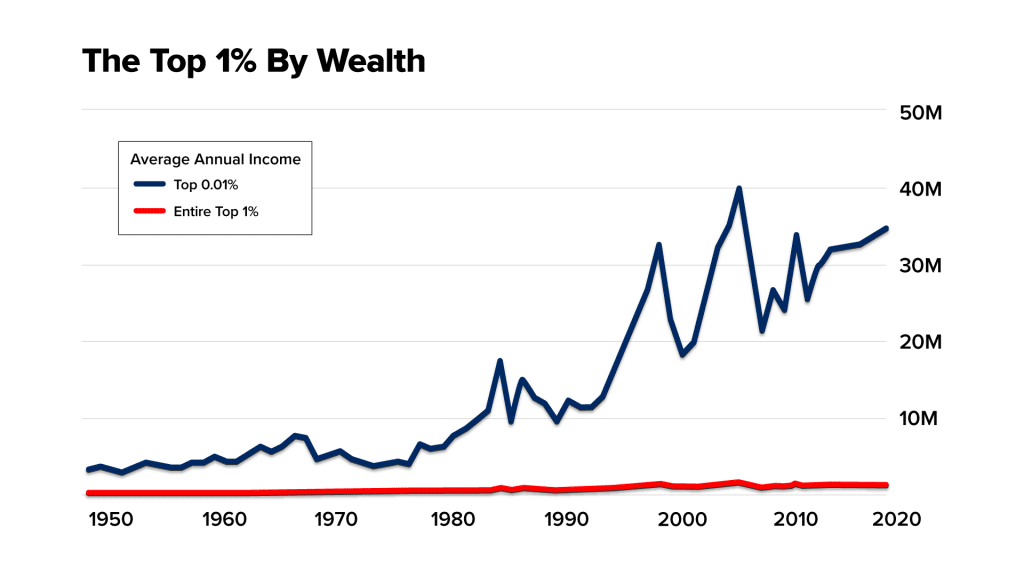

The Fed has enriched the few at the expense of the many.

And I’m not talking about the 1%. Or even the 0.1%.

I’m talking about the 0.01%. The 1% of the 1%.

The folks at the very, very top.

Think Bezos, Musk, Zuckerberg… guys like that.

The folks who have more access to cheap credit and debt than ANYONE else in America.

Again, this might come as a surprise… but it’s not the 1% that’s the problem in America today.

The net worth of the 1% over the past 65 years is essentially flat.

The wealth of the 0.01%, however, has absolutely soared.

LOUIS:

Now, I don’t know about you… but I’m not exactly worried about them.

They’re going to be fine.

They’ll make it through “The Great Unraveling” largely unscathed.

Even now – when most companies are cutting costs and struggling… luxury companies that cater to this elite group of the wealthiest people are posting record profits, and even raising prices.

But that’s not to say that even THEY aren’t preparing for a worst-case scenario.

One well-known Virginia farmer, for example, recently shared he’s had FOUR billionaires secretly reach out to him… about how to ensure they’ll have enough food when things collapse.

DOC:

Now back to our story…

Things were already bad, coming out of the Financial Crisis.

But the Fed made things EVEN WORSE during the Covid crisis.

Because would you believe… that 80% of all the dollars that exist today… 80 PERCENT! – were created out of thin air since Covid first became a household term in 2020?

LOUIS:

That’s almost incomprehensible to wrap your mind around.

But THAT’S the real reason for those higher prices you’re seeing for gas… food… and so forth.

However, this is NOT what Doc and I are warning you about today.

The problem, as Doc and I see it, is what comes NEXT.

You see, for the past 30 or so years… Americans – especially Americans our age and older… folks who have retired or are starting to retire… you’ve gotten used to these Fed bailouts.

I’m not saying you’ve received golden parachutes like many Wall Street execs.

But your wealth benefited from these policies, whether you realize it or not.

During every bubble, and every burst… the Fed’s moves have softened the blow.

Sure, there were a few painful bear markets during these past 30 years. I certainly don’t want to downplay the pain those downturns caused.

But with lower interest rates and money printing… if you’d stayed in the market, everything slowly rebounded, and your money likely continued to grow.

But the problem now is that the Fed has run out of options.

HOST:

What do you mean?

Can’t they continue printing money – if they think the economy needs it?

DOC:

Well… they CAN, in theory.

But remember, all this money-printing is the real driver of this inflation we’re experiencing.

As we mentioned a few minutes ago… money respects the law of supply and demand.

More money in the system, and your dollars are worth less.

So, every dollar printed means the dollars you’re earning… the dollars you’ve saved… the dollars you’ve invested – they’re all going to be worth less.

LOUIS:

It’s ECON 101 stuff.

But the experts at the Fed haven’t seemed to catch on to this!

The other problem is that they’ve essentially backed themselves into a wall with the artificially low interest rates that have become the norm.

The business world has gotten so used to near-zero interest rates.

DOC:

Maybe even addicted?

LOUIS:

Maybe even addicted! You’re right, Doc…

We recently reviewed some data on the world’s most indebted companies, from Global Finance magazine…

And we believe that, in a worst-case scenario, as much as 40% of companies today could go out of business if rates continue to be pushed higher, as the Fed is trying to do.

DOC:

And it’s already happening!

LOUIS:

That’s right, Doc… the Fed has already destroyed the housing market, with mortgage rates doubling.

And we’re now seeing ripple effects, especially with small lenders.

Many of these companies were hooked on cheap money and low interest rates.

Well, interest rates have spiked… and credit lines are being cut.

Now, many of these mortgage lenders are starting to go broke!

So, if the Fed continues trying to raise rates as much as they’d realistically need, to keep “inflation” under control… hundreds – maybe even THOUSANDS – more companies could go out of business!

HOST:

But wasn’t the Fed able to raise rates in the ’70s to combat inflation?

DOC:

You’re absolutely right – it did.

Paul Volcker jacked up rates as high as 22.36% in ’81.

But we’re not living in the same America today!

Americans are no longer willing to suffer short-term economic pain for the long-term good of the country.

Everyone these days – especially Millennials and Gen Z, who, by the way, now make up the largest voting bloc in the country – they all want a quick bailout, more stimulus… more handouts.

Even right now, as Louis and I show you all this… there’s an active petition online, asking Congress to send out even more stimulus checks.

And this petition has already received more than 3 million signatures!

LOUIS:

But again, the important thing you need to understand is that hundreds of companies are ONLY being kept alive today because they carry debt at these artificially, and historically, low rates.

For years, they’ve been able to keep refinancing at historically low rates… and keep rolling the problem down the line.

But if rates were double, triple, or more what they are today – these firms won’t be able to refinance that debt because they couldn’t afford the interest payments.So they’d likely go out of business.

And we’re not just talking about small mom and pops… like the companies who had to shut their doors during Covid lockdowns.

We’re talking about some of the largest companies in America today – companies that provide your cellphone… your cable… your car… they’d ALL likely go out of business if rates go high enough.

Which would be disastrous in so many ways…

DOC:

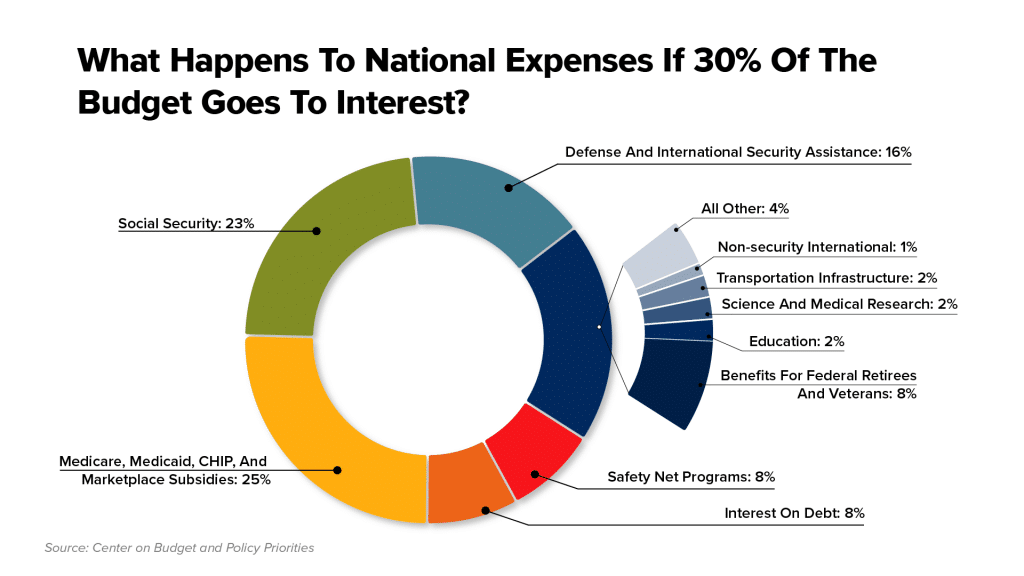

I also want to point out that the federal government already pays $1 billion a day – EVERY DAY – in interest on the money it’s borrowed.

If the Fed raised interest rates any higher… this could also become unsustainable and could ultimately bankrupt the entire nation!

According to legendary investor Stanley Druckenmiller, if 10-year rates went to just 4.9% (which is their “normalized” projection), the government would have to spend about 30% of its revenues just to pay the interest on our loans every single year!

To put that in perspective… that’s more than the government currently spends on Social Security.

So… do you cover your debt, then? Or cut Social Security?

Maybe a mix of both.

Or what about this…

What happens if rates went even higher than 4.9%?

No matter how you look at it… there’s no silver lining to what’s likely to happen.

Bottom line: the Fed is trapped!

LOUIS:

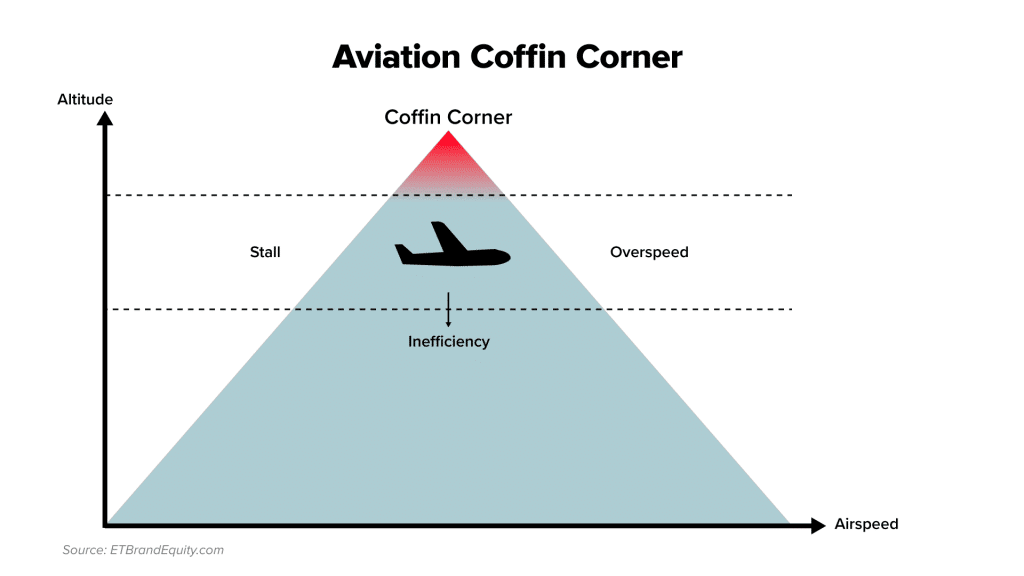

They’ve backed themselves into a Coffin Corner, Lauren.

HOST:

I’m not familiar with that term – could you explain what you mean by that?

LOUIS:

Sure. It’s a phrase pilots use.

It’s also known as the “aerodynamic ceiling.”

There’s some physics that go into it…

But essentially, airplanes typically try to fly in a “sweet spot.”

They cruise at just the right altitude, and just the right speed for the aircraft.

Too low an altitude, or too fast a speed… and the plane burns more fuel than is necessary.

But too high an altitude, or too fast a speed… and it becomes deadly.

You become trapped.

That’s what the Coffin Corner is.

It’s a frightening scenario where, if the pilot tried to slow the plane to get out… the plane will stall and fall out of the sky.

But if the pilot goes any faster to get out, it will destroy the plane – because it’s flying faster than the parts can stay bolted together.

There’s no way out.

You’re trapped.

Say your prayers. Because you’re dead.

HOST:

So how does this tie into the Fed and “The Great Unraveling” you’ve been warning us about?

DOC:

We believe the Fed has trapped itself in a “monetary Coffin Corner.”

The Fed can’t do any of the things it OUGHT to do to get us out of this monetary Coffin Corner.

If the Fed tried to fix things by continuing to raise interest rates, as it’s been doing… and seems committed to continue doing so in the coming months… countless companies will likely go out of business.

That could cause unemployment to soar. Millions could default on their mortgages. Cars could be repossessed in even greater numbers. And so much more.

The U.S. would also be stuck… and have to decide whether to drastically cut spending on things like Social Security and Medicare – or default on its debt.

You’d likely see an even worse Great Depression than your parents or grandparents saw in 1929.

And all of this would be catastrophic, leading to social and political chaos as well.

LOUIS:

But on the other hand… the Fed can’t get itself out of this mess by continuing its policy of printing money, either.

Money printing will just make inflation even worse.

And inflation can only continue for so long until it starts to bring social and political chaos of its own.

Look at what happened in Germany during the Weimar Republic. Or Venezuela.

Or Zimbabwe – where inflation soared so high, they had to print trillion-dollar bills.

Out of control inflation causes society to become unstable, and ultimately break.

HOST:

So… let me see if I have this right…

To sum up everything you’re saying… the Fed began a series of reckless policy decisions in the mid-1990s.

Low interest rates and massive amounts of money-printing caused the dot-com bubble… the real-estate bubble… and the “Everything Bubble” we are in today.

Only now, for the first time in more than 30 years… the Fed is trapped!

They can’t lower rates any further. Interest rates are already below zero, after factoring in inflation.

They can’t raise rates to try and stop inflation – because it would cause hundreds, maybe even THOUSANDS, of companies to go out of business.

And they can’t continue printing money either… because this only makes inflation worse…

DOC:

That’s right, Lauren.

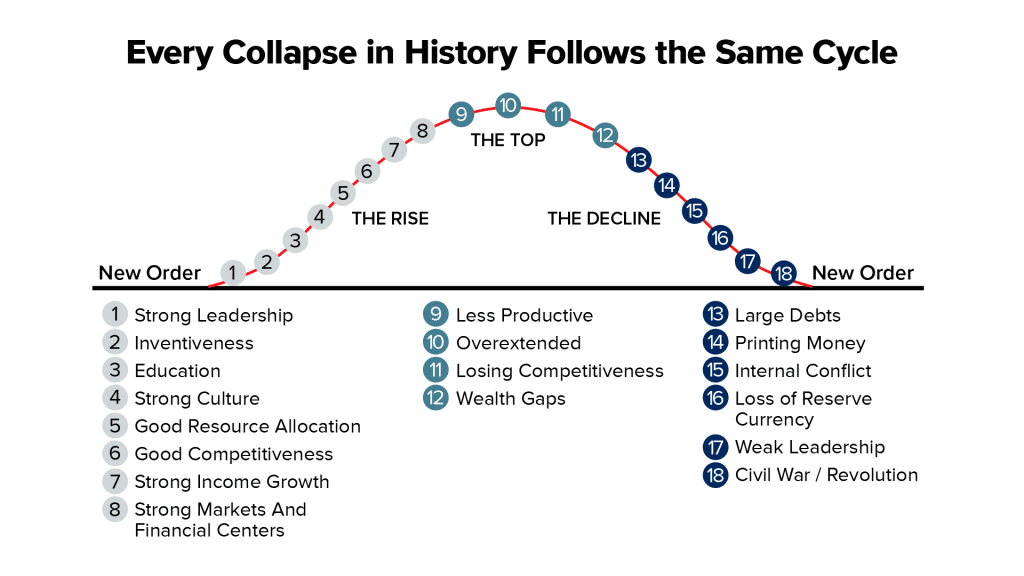

The hedge fund billionaire Ray Dalio has done a lot of research on this as well.

And he’s written that “no system of government, no economic system, no currency and no empire lasts forever… yet almost everyone is surprised and ruined when they fail.”

And yet despite this belief that the good times can always continue… he determined that every great collapse in history has followed the exact same cycle:

HOST:

Wow, this is fascinating…

So where are we in this cycle?

DOC:

Well, in my opinion… we’re somewhere between 15 and 17.

In other words, we are likely approaching the end of America’s decline, at least in its current form.

HOST:

So… what happens next?

LOUIS:

Well, Lauren, whatever the Fed does next could lead us into one of the biggest financial meltdowns in American history.

DOC:

And THAT is “The Great Unraveling.”

Everything the Fed has caused – the wealth gap, rampant financial speculation, high home prices and car prices, high food prices, the pandemic of economic misery and hopelessness… ALL of this has been caused by artificially low interest rates and trillions of dollars that continue to be created out of thin air….

And, Lauren, I wish I didn’t have to say this… but it’s all going to come undone.

It HAS to be unraveled.

It’s inevitable.

Sure, if everyone’s debt was forgiven, as part of some widespread jubilee… it might be different.

And, yes… many in politics and elsewhere are arguing for just that. We’ve already seen it begin… with Biden’s move to forgive student loan debt.

But the wealthiest few – those who own the bulk of the debt average Americans owe today (auto loans, mortgages, etc.)… do you really think the 0.01% is going to let this happen?

HOST:

Probably not likely…

DOC:

Exactly. They’re the ones who hold the real power. They’re the ones calling the shots.

But this means that what happens next is likely going to be a painful experience… a VERY painful experience – for most Americans.

HOST:

Which is why you’re saying that what’s about to happen will be unlike anything any of us have lived through before?

DOC:

Exactly right.

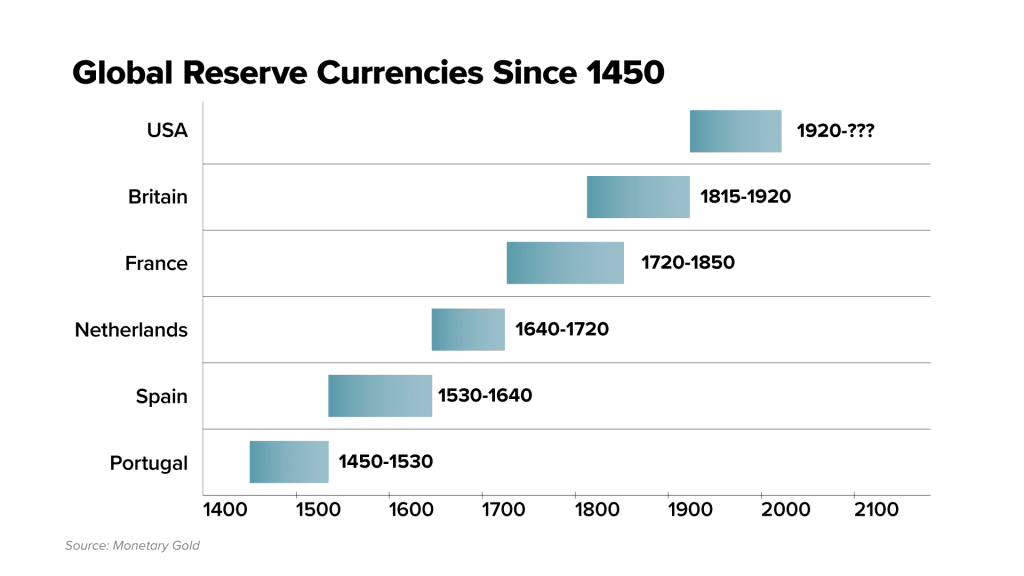

I mean, look at this image on the screen now.

Most people assume that cash is always the safest asset to own.

But all great currencies – even those that were considered the global reserve currency in the past – have died.

And, as you can see… it almost never lasts longer than 100 years.

And, as you can also see… we recently crossed the 100-year mark for the U.S. dollar.

HOST:

That is frightening.

DOC:

It is.

But look, all hope is not lost…

If you followed along with our little history lesson there, you have a better understanding of what’s happening in the American economy than almost everyone else in this country.

None of your neighbors or relatives truly know what’s going on – and why the Fed is trapped. Or that whatever they decide to do next could have major repercussions that affect you personally.

HOST:

So… what can you do?

DOC:

I’m glad you asked.

Because everything I’ve done in my 30-year career in finance has prepared me for this moment. And Louis, he has been in the financial industry as long as me.

We’ve spent decades waiting for a moment like this.

And what we’ve learned… is that there are a surprising number of simple things you can do to not only protect whatever money you’ve saved… but to potentially make quite a bit of money as “The Great Unraveling” continues.

LOUIS:

That’s right, Lauren.

Unless you take the right steps today, I think you’ll be lucky to be able to afford your own doctor a few years from now. Or your own retirement home. Or anything else you’d hoped for.

Doc and I believe this will be an extraordinary retirement crisis for most Americans. The money, funds, and programs you are counting on today (your IRAs, 401(k)s, insurance policies, annuities, pension plan – even Social Security and Medicare) – they could all collapse in value or disappear, because of “The Great Unraveling.”

And no matter what the Fed does next… it could be disastrous for whatever money you’ve saved or invested.

DOC:

And all of this might seem like hyperbole…

But even Warren Buffett has predicted that if things get too bad: “They will come after corporations. They will come after individuals.”

No matter how you look at it… massive changes are coming to American society and our financial system.

And, again, it doesn’t matter what the Fed’s next move is.

You don’t need to guess whether they’re raising rates, or lowering rates, or printing money, or not printing money – or any of that.

No matter what they do next (and they will do something), their next move will likely be bad for savers and investors.

Let me ask you this: Can you really afford to see the REAL value of your savings cut in half?

Or worse?

Don’t forget… the Fed is not there to protect you and your money.

The Fed is there to protect banks, the government, and the 0.01%.

If you follow these 5 steps, you might emerge from “The Great Unraveling” in a better position than you’re in today.]

All that said, if you follow the five simple steps Louis and I are about to lay out for you… you’ll not only come out unscathed… but possibly even further ahead than you are today.

That’s why Louis and I just wrote perhaps the most valuable report of our careers.

It’s called: The Great Unraveling Playbook. And in it, you’ll learn which assets are most likely to soar dramatically in value over the next few years… as well as which stocks, bonds, and other investments you’ll want to avoid.

Plus, so much more, including:

- Why “The Great Unraveling” is likely to result in the rise of a new political party.

- 10 widely held stocks you should sell now. You DO NOT want to own these companies as “The Great Unraveling” gets worse.

- How to preserve your CASH – while others are decimated by the dollar’s fall. This simple savings vehicle could be a lifesaver in the years to come.

- We’ll show you the only way to REALLY protect the money you have in the bank. You could see a serious bank run in the not-too-distant-future, with millions trying to get as much money as possible OUT of the system.

- You’ll learn one of our favorite secrets for multiplying the value of your retirement savings by 300%… without touching the stock market or any typical type of investment. This secret could transform your retirement, yet we’ve met VERY FEW people who are aware of it.

- You’ll see the entire timeline on how we believe “The Great Unraveling” is most likely to play out.

- We’ll show you a clever move you can make with your insurance policies that could also transform your finances in the years to come.

- We’ll even show you three assets you LEGALLY do not have to report to the IRS or any other branch of government. This could prove extremely beneficial during “The Great Unraveling.”

In short, you’ll get our FULL playbook on exactly how we believe “The Great Unraveling” will play out… plus all the steps you’ll want to take now… to not only protect, but also grow your wealth.

As far as I know, there’s nothing like this playbook available anywhere else.

LOUIS:

But it’s not just an in-depth playbook for how to get through the coming months and the next few years…

This event could be unlike ANYTHING we’ve seen in American history before.

As we’ve mentioned, similar situations have played out in other countries throughout history.

But after spending more than 30 years each in the investment world… we know that most investors have no idea how to structure their investment portfolio for “The Great Unraveling.”

So, we want to show you a portfolio we’ve constructed that should help you do very well as this progresses…

Doc and I have done a ton of research on this.

For example, we’ve found one portfolio which, over the long term, has performed about five times better than the S&P 500 stock market index… and about seven times better than the traditional 60/40 portfolio most financial planners recommend.

We’ll show a specific model portfolio you could buy today – the exact stocks and other investments we recommend to own.

We’ll show you which ones to avoid.

And we’ll show you how to put it all together into a rock-solid portfolio that could help you weather this period that will be so difficult for so many.

Some people are going to make a fortune in the years to come.

Some are going to experience enormous losses.

What happens to your retirement… if your portfolio falls in half or more – and takes 25 years to cover on an inflation-adjusted basis?

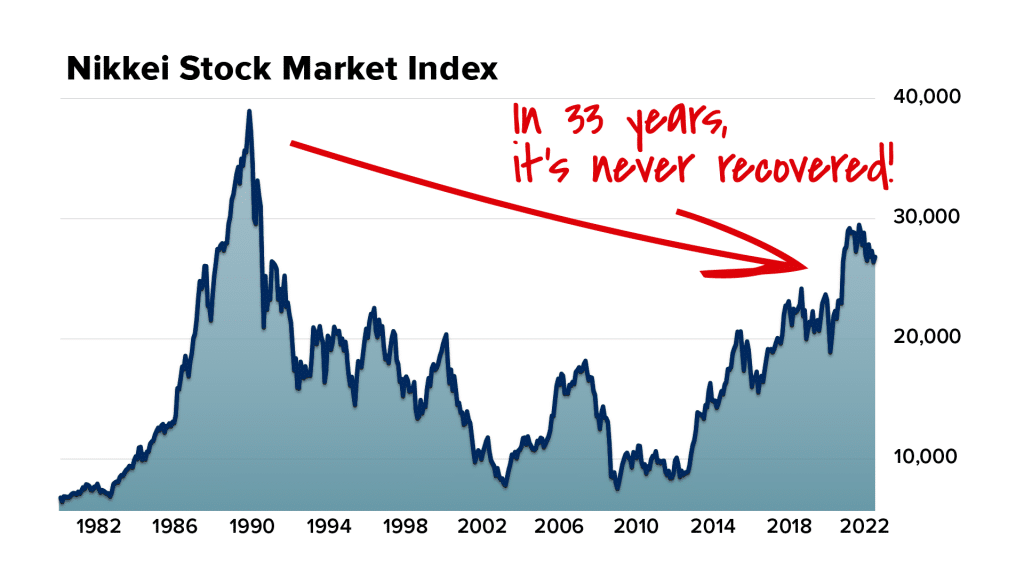

As hard as it is to believe, Japanese stocks still haven’t recovered from a similar crisis 33 years later!

Even today, investors in the Nikkei are still a third below their 1980s highs.

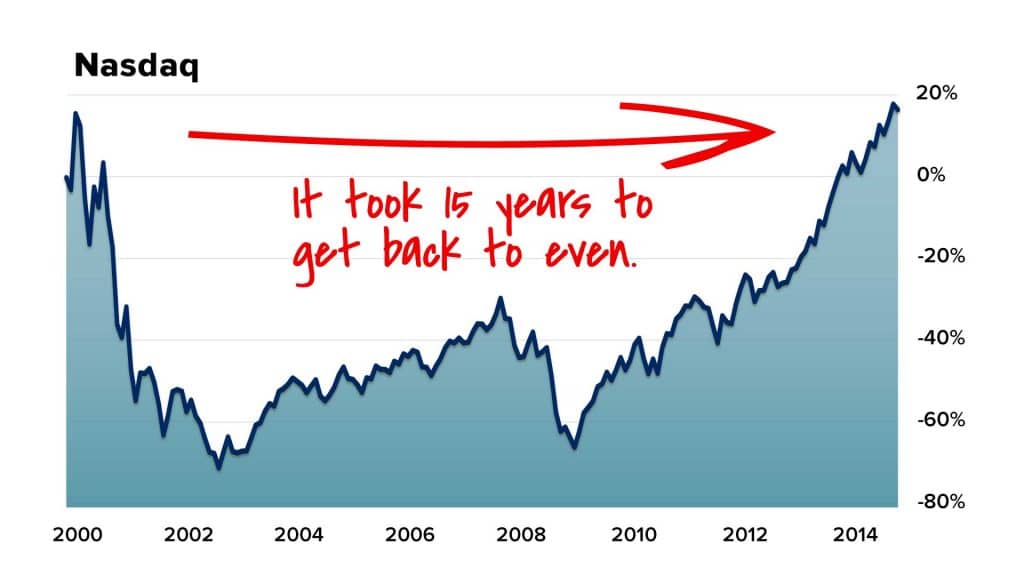

Look at how the Nasdaq fell about 80% after the dot-com bubble burst.

It took 15 years to get back to even.

The Great Unraveling Perfect Portfolio will help ensure you’re positioned properly, based on the assets that survived periods of inflation and crisis throughout history.

DOC:

Not only that… but Louis and I have something we believe could change your financial future. Rather than showing you exactly what to buy and sell… we want to give you a proven strategy for the chance to maximize your gains on EVERY SINGLE investment you make. We strongly recommend you do NOT make a single investment in the months to come without using this approach.

Most people we meet are clueless about how to enter and exit their positions.

So, believe me… this one’s a game changer.

Everything you need to know is in our Special Report called: The 100% Stock Secret. You’ll also get full access to our website and system, where you’ll learn the best way to maximize the gains on any position you now hold… or any investment you make in the years to come.

The three resources I’ve just told you about… The Great Unraveling Playbook… The Great Unraveling Perfect Portfolio… and The 100% Stock Secret will quickly bring you up to speed on the important steps Louis and I strongly recommend you take right now.

Now earlier, we mentioned that Louis and I are rivals.

I work for a financial publisher called Stansberry Research.

Louis works for a financial publisher called InvestorPlace.

And these are the first three things we’ll send when you start a no-risk trial subscription to MY firm’s flagship investment research service called: Stansberry’s Investment Advisory.

Stansberry Research publishes dozens of research letters.

Our flagship letter is the one that launched the company in 1999 and will always be the “crown jewel” of our research.

It’s where we’re famous for speaking the truth about the markets… the economy… and our country.

Especially when what we have to say is controversial or unpopular.

This is a storied publication and a lot of folks read it because it cuts through the lies and B.S. of the mainstream media in a wildly entertaining fashion.

But this is ALSO where we publish some of our best investing ideas and analysis.

Meaning specific, actionable stock recommendations every month, along with a full recommended model portfolio.

We explain exactly when we recommend you buy and sell… including how to protect your wealth with inflation hedges.

Most of all, we show you where to find world-class, enduring businesses to grow your wealth with the least amount of risk as possible… and then make a few smart speculations by getting in early on the great companies of the coming decades.

Stansberry’s Investment Advisory has done things this way – never wavering – for more than 20 years… even while investing trends have come and gone… and quite a few research letters have come and gone, too.

Tens of thousands of Americans follow our recommendations. But millions more should not let this pass them by.

Which is why we’re opening the doors today in a way we’ve never done before.

Because if this message can reach just one person and motivate them to act before it’s too late – it’ll be worth it.

As you’ve seen – “The Great Unraveling” is already under way.

You HAVE to begin preparing immediately.

And we want to help you do that.

HOST:

That’s right, Stansberry Research has put together something very special for everyone watching today – a way to try their research, risk free, for a fraction of the typical price.

A one-year subscription to their flagship investment research service, Stansberry’s Investment Advisory… which, as Doc mentioned, is followed by tens of thousands of people…

Which gives you access to all the research on “The Great Unraveling” Doc and Louis just shared with you… a model portfolio they designed specifically for this exact moment in time…

Where they will not only tell you what to buy, where, and how… but also WHY these are such good investment opportunities.

Access to this research typically costs $199 per year. That’s what thousands of others are paying.

But because we are in such a rare moment in history, and so many Americans have been failed by the Fed’s policies – Stansberry Research has agreed to do something incredibly generous.

In other words, you can try this research, risk free, at a huge discount to the normal price.

That’s right – as little as $49 for an entire year. That’s a 75% discount.

And, like I said, it’s totally risk free for anyone watching right now.

Plus, you’ll receive a library filled with hundreds of back issues and special reports… each one focused on a unique investment strategy or opportunity you’d likely never hear from your financial advisor or broker… but could help you make loads of money in the coming months.

In other words, for less than what you probably pay for dinner out… you can get information that could change the course of your financial life – forever.

Keep in mind, the average open recommendation in Stansberry’s Investment Advisory is up 84%.

And last year, 77% of their recommendations were winners, which is a world-class result. And the average annualized gain was 27.7%. This return measures the results achieved by ALL of our recommendations in 2021, scaled to a one-year period.

I challenge you to find any other research group in America that has produced gains like this over the long term.

Of course, there are risks. All investments have some degree of risk. And past performance does not indicate future success.

So we’d never recommend investing any amount you aren’t willing to lose.

But Louis is actually taking all this one step further and offering an extraordinary bonus – for the first time ever.

Doc, do you want to quickly explain?

DOC:

Sure!

I want every single one of our readers to get through “The Great Unraveling” – not just unscathed… but in a BETTER position than they’re in today.

With my firm’s research, I think you’ll have a real shot at achieving that. Certainly way better than 99% of Americans who are likely still in the dark about what’s about to happen.

That being said, the safety of our readers is our top priority right now.

Louis and I may be rivals… but we are experts in the things we’ve studied and experienced firsthand in the markets over the past 30-plus years, in different ways. And we care about you.

In other words, I would be doing you a major disservice if I didn’t give you the chance to learn about EVEN MORE ways to protect your money, and cash in on the rare opportunities that are popping up right now.

And Louis is the best analyst I know of when it comes to investing during times like this.

As we already discussed, he’s written about the market for more than 40 years.

He correctly warned about the crash of ’87… the dot-com crash… AND the 2008 meltdown.

And over that time, he’s recommended 18 different stocks that have shot up 10,000% or more… as well as 675 stocks that have more than doubled.

That’s why money management firms, like the one he runs today… won’t take on new clients worth less than $250,000.

And why he’s charged pension funds and institutional money managers as much as $30,000 PER YEAR for his research. And they gladly pay it!

But like we’ve shown you, these are NOT normal times. America is in the early stages of a serious shift.

And we want to make sure that you have access to some of the best information available… to make the best decisions for you and your family, as “The Great Unraveling” progresses.

LOUIS:

That’s right, Doc.

And that’s why I’m agreeing to throw in one more research report – with 99 stocks I believe every American should SELL right now.

There’s more than just knowing what to buy during “The Great Unraveling”… you also need to know what to avoid.

There’s a good chance you own at least one of these stocks. And, once you see my research… you’ll see why you’ll want to get out of these stocks – immediately!

I’m going to give this report – for FREE – to everyone who takes a risk-free trial to Stansberry’s Investment Advisory right now.

PLUS… I’m ALSO going to throw in a full year of access to my research letter, again – absolutely free.

HOST:

Yes, you heard that correctly.

A 12-month subscription to Louis Navellier’s Growth Investor letter usually costs $99.

But through this special offer, you can get it absolutely free, when you take a trial subscription to Stansberry’s Investment Advisory.

That’s nearly a $300 value – all for as little as $49.

I think it’s pretty clear how incredible this offer is.

If you’re ready to place your order, Click the Get Started link below.

It’ll take you to a secure order form where you can review everything you’ll receive through this special deal Doc and Louis put together.

I’m sure I don’t need to remind you, there is no other stock picker in this industry quite like Louis.

His track record is unlike anything we’ve seen…

He’s found 18 different stocks that have shot up 10,000% or more… as well as 675 stocks that have more than doubled.

Which is why he regularly hears from readers like Doug R., who says:

“I just wanted to thank Louis for my very first 1,000% winner. Nobody picks them like Louis.”

And Jerry M., who says:

“I’m retired now and thanks to you I have the money that makes my retirement more enjoyable and comfortable.”

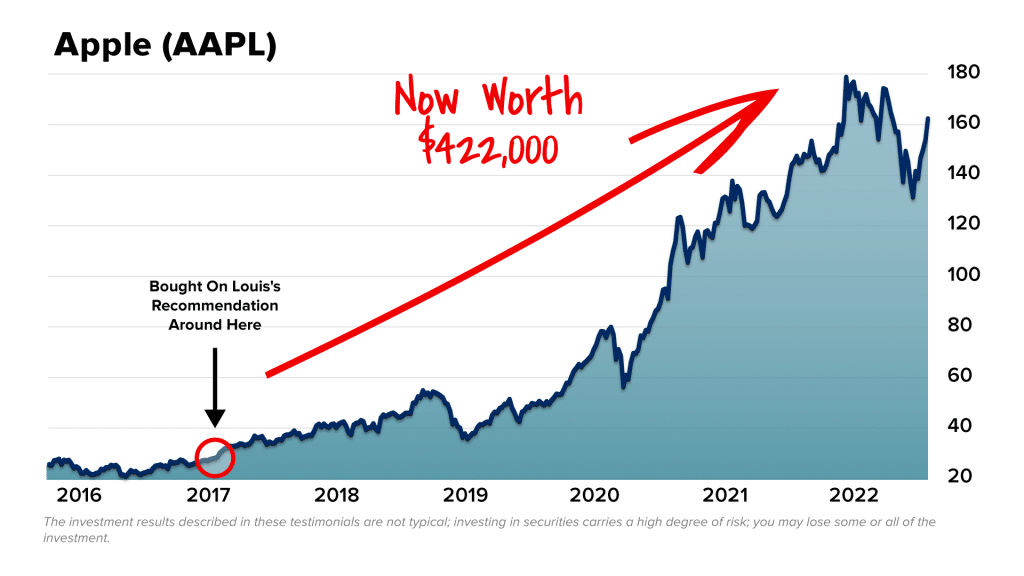

And long-time reader Betty S., who followed Louis’ advice to buy Apple when it was trading for just $30 a share…

And recently wrote in to tell us that her small $3,000 investment has grown into $422,000.

The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

So, the fact that he’s agreed to give away 99 sell recommendations AND a year of his research, well it’s frankly a little surreal.

LOUIS:

Thanks, Lauren.

Helping people learn how to make money – regular, hardworking folks without degrees in finance, or millions of dollars on hand – it’s my passion.

This is the kind of research you need, quite frankly, to help you prepare for what’s coming.

And so I want to do whatever I can to help spread the word.

DOC:

And there’s actually one more very important step I want to tell you about…

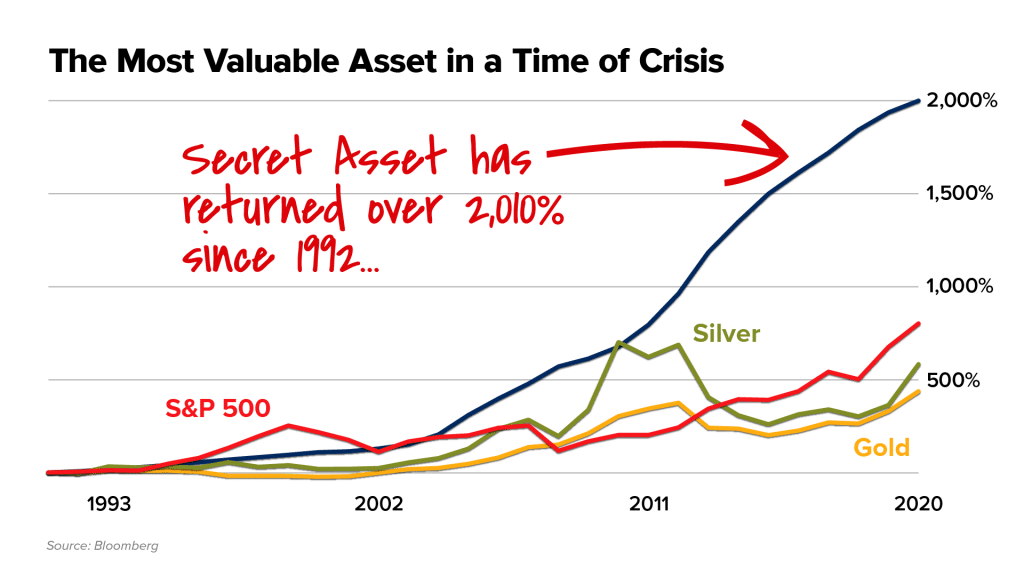

Few Americans know this, but there are two assets we’ve studied over the past decade, which have proven to be among the best ways to protect and grow your wealth, even in the worst type of monetary crisis.

And I believe it’s absolutely critical for you to learn about these assets right now – and the best ways to buy them.

During World War II, for example, when millions of families lost their entire life savings through inflation and government seizure, one of the assets I’m going to show you enabled some families to not just survive, but also protect, preserve, and grow their money.

That’s why at my firm we call it: “The Most Valuable Asset in a Time of Crisis.”

Take a look…

The numbers are just incredible…

This asset is up over 2,010% over the long term since 1992, without a single down year.

Let me repeat that – it has NEVER had a down year since 1992.

That’s 30 straight years of positive returns… despite all the Fed’s shenanigans over that timeframe.

It’s essentially the only Fed-proof investment vehicle I know of!

A story like this should be on the front page of every financial newspaper in America. But very few Americans know anything about it.

I’ll tell you everything you need to know, and the best possible ways for ordinary Americans to invest in it today.

In this report, I’ll ALSO tell you about another asset that offers you a powerful way to profit during a currency crisis – yet it has absolutely nothing to do with gold or even cryptos.

I first recommended folks begin buying this asset back in 2009.

I even showed how to possibly get it at your local bank.

But in a crisis like “The Great Unraveling” that’s happening in America right now, this asset could soar as much as 10 times higher.

I strongly recommend you make at least a small purchase today.

My team’s new report, called The Two Most Valuable Assets In a Time of Crisis, explains everything you need to know about both of these assets… including how to buy them and get the best possible deal.

And remember, I’ll send you everything I’ve mentioned here as soon as you start a no-risk, trial subscription to Stansberry’s Investment Advisory.

HOST:

So… just to be clear, you’re also recommending investments OUTSIDE of the stock market?

DOC:

That’s right, Lauren.

When stocks are the right place to be… we research and write about stocks.

But when stocks are a minefield, we won’t just keep recommending them to you.

In fact, some of Stansberry’s most successful recommendations over the years have been OUTSIDE of the stock market…

Like the rare type of gold coin we recommended in 2003. It ultimately soared as much as 273%…

And many of the cryptos we uncovered and recommended… which have shot up more than 1,000% in value.

And the little-known real estate opportunities one of my colleagues is finding, month after month… some of which are expected to pay out as much as 22.5% per year!

Point being, it’s very possible to continue growing your wealth during a crash.

But you have to know where to look.

That’s why we put together this special report.

And if you follow the simple instructions inside, I can all but promise you’ll know the best possible way to grow your wealth in the coming years – even if things fall apart.

HOST:

Folks, this is it.

“The Great Unraveling” has begun.

Most Americans will be flying blind through one of the scariest financial events in history.

But for as little as $49 you don’t have to be one of them.

Doc and Louis have put together everything you could possibly need to stay safe and learn how to grow your wealth in the months and years to come.

And keep in mind…

This research is designed for everyone, not just the experts.

It’s meant for everyone from folks with just a few thousand dollars to invest in their IRAs… to folks with millions of dollars to play with… even folks who are just curious… and want to read some of the best financial research in the world.

To recap, here’s everything you’ll get as part of this introductory offer:

#1. First, you’ll receive “The Great Unraveling” Playbook. There’s no better resource for understanding everything that’s happening in America right now… and how it will likely play out over the next few years.Some assets are going to suffer, big time. Others will skyrocket in value. The wealth gap will get wider than ever before. But you can potentially grow and protect your wealth in the years to come. This step-by-step guide is likely to be the most valuable resource you’ll have over the next few years.

#2. Second, you’ll get a copy of the new Research Report called: “The Great Unraveling” Perfect Portfolio. Through every crisis in history, some investors are able to grow their wealth in extraordinary ways… while others suffer enormous losses. This thorough report explains everything you need to know, including which stocks and other investments to buy, which to sell, and how to allocate what we believe is the perfect portfolio right now.

#3. Third, you’ll get a copy of the report called The 100% Stock Secret. Doc and Louis’ firms have spent $10 million-plus over the past decade building the perfect software database system that will allow you to track and maximize your gains. You’ll get full access – all you need is Internet access, and you will never again have to wonder about the best moment to buy or sell your investments to maximize your gains.

#4. Fourth, you’ll get a copy of The Two Most Valuable Assets In a Time of Crisis. You’ll get the full story on two assets likely to grow in value in a big way over the next few years. There’s a very good chance you’ve never owned either of these assets before, but this step-by-step guide explains everything you need to know.

#5. Of course, you’ll also get the next 12 monthly issues of Stansberry’s Investment Advisory. Your new advisory service will be delivered to you on the first Friday of each month, just after the markets close.

#6. You’ll also get 12 months of Louis Navellier’s Growth Investor – absolutely free as part of this one-time special offer.

#7. Plus, Louis’ brand-new research report, showing you 99 stocks he believes you should sell today.

But that’s not all…

#8. You’ll also get full, subscribers-only access to the Stansberry’s Investment Advisory Library. This includes instant access to dozens of reports and electronic books we’ve published. Here’s just one quick example: a 263-page e-book we published in 2020 that predicted the beginning of the debt-forgiveness we’ve started to see. Even though it was published two years ago, it contains countless ideas for how to radically improve your investing career, such as: The most profitable and stable form of leveraged investing (page 105)… how to make commodity investing potentially less risky (page 165)… the No. 1 way to invest for retirement (page 213)… a strategy for buying elite businesses at bargain prices (page 217)… and much more.

#9. You’ll also receive The Stansberry Digest.

Every weekday, the Stansberry Research editorial team writes up notes on interesting and significant events taking shape in the markets. We take you “inside the room” at Stansberry Research to share the most important news, ideas, and opportunities we’re following each day.

And just to be clear: everything here comes with a full 30-day money-back guarantee.

Meaning if you’re not happy with all this research for any reason… simply let us know within 30 days and you’ll receive a full refund for your subscription. Keep in mind, even amid the mania in high-risk speculations, the team at Stansberry’s Investment Advisory is responsible for four of the top 10 open recommendations across all our research – roughly 30 research services in total.

Winners as high as 800%.

They’ve done this while taking on far less risk than other research services… and ultimately making more consistent gains…

Maybe that’s why Stansberry’s Investment Advisory is constantly receiving glowing feedback from readers like Tim G., who said:

“Few years back you had a 10 for 10 gold miners portfolio. I’m up $131,961.”

HOST:

And Prashant M., who wrote:

“I enjoy the great historical and other stories that you all add to each monthly newsletterand how easily and proficently you convey difficult concepts to interstingly that my mind has only one word for it “wow!” Of course, I have immensely benefitted financially too, I would pay my subscription fees just for all those stories, anecdotes, and explanations.”

HOST:

And Jimmy P., who said:

“I realized a 489% gain from selling shares of [top tech juggernaut] in October 2021.”

HOST:

And Francis M., who wrote:

“I am most thankful for Stansberry Investment Advisory. The reason is that I like the in-depth analysis, as well as the fact that the advice is clear and easy to understand. After reading the analysis for a given recommendation, I can decide if it is a choice for something for me to invest in.”

The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Best of all, you can access all this work – every single piece of research we’ve described here, totally risk free. And at a 75% discount off the normal rate. Remember, the regular price is $199.

But today, you’ll pay as little as $49.

Why so cheap?

DOC:

I’ll answer that one, Lauren, if you don’t mind… because it’s simple…

We are on a dangerous path in America. The Fed is trapped. And no matter what it does next, it WILL have a major impact on your savings and investments… which ultimately impacts your retirement plans.

I’m one of three senior partners at me firm and I believe with 100% certainty that my independent financial research firm, Stansberry Research, which was founded more than 22 years ago, could do a better job of helping you than anyone else on the planet.

We’ve been in this business during three decades, and we now have more than 90,000 customers who have benefitted from our work in such a dramatic way that they’ve decided to become “Premier” subscribers to receive our work for as long as they wish to receive it.

No other business I know of can come anywhere close to matching our level of customer commitment.

And to give you even more expert advice… we’re pairing this incredible offer with my most-respected competitor, Louis Navellier.

I know my firm’s work can help you – and the truth is, Louis will give you EVEN MORE great advice.

That’s why I want to send you this valuable collection of Special Reports… PLUS the next year of Stansberry’s Investment Advisory, as well as Louis’s Growth Investor research, for as little as just $49.

There’s simply no better deal in the investment world – where you’ll find research of this caliber at such a bargain-basement price.

Not to mention, you can have the next 30 days to examine everything.

Simply call our Maryland office if you’re not happy and get a full refund.

With this information in hand, you’ll be among the few who understand exactly what’s happening in our financial system – and the critical steps you must take.

You know, I started on Wall Street nearly 40 years ago, and I’ve been able to repeatedly take advantage of the biggest shifts in our economy…

- I was there in the 1980s when the Federal Reserve jacked up interest rates to unprecedented levels. I locked in roughly 14% a year… for the next 30 years!

- I was at the cutting edge of Biotech in the 2000s and helped start a company called Mirus Bio Corporation. We were eventually bought out by Roche for $125 million.

- When I started at my research firm, I told readers to buy great companies like Microsoft after the last big stock crash more than a decade ago. Today, folks who followed my recommendation would be up more than 900%.

- I was there in 2017, pounding the table on the housing shortage, explaining why prices were headed much higher. Anyone who bought a home in a decent area would, at my urging, have done incredibly well.

And today, there’s a terrifying new trend that will radically change our country over the next few years.

I’ve made it easy and ridiculously cheap for you to learn about “The Great Unraveling,” and how it could affect you, your money, and your retirement.

Sadly, this is likely all going to tear our country apart over the next few years…

On one side, there will be those who understand what’s happening, who take the necessary steps.

These folks will continue to get richer and richer.

On the other side… and, unfortunately, that’s going to be most Americans… will be those who won’t understand what’s going on.

These folks will cling to assets that collapse in value and could ultimately get trapped by “The Great Unraveling,” and continue to fall further and further behind.

In a few years, the wealth gap in America will grow even bigger – much bigger – than it is today.

What will happen to our country then?

I don’t know exactly, but my best advice is simple: Make sure you are on the right side of this major trend.

Which is why today, we’re making it very easy for you to take the first necessary steps.

You’ll pay as little as $49 to receive everything I’ve described here.

And if you don’t agree with me that this is the absolute best deal in the financial world, that’s fine.

Just simply let my Maryland-based customer service team know in the first 30 days, and they’ll refund your payment.

If you care at all about your financial future, this information is critical.

We are living in a very dangerous financial time. The biggest risk right now is doing nothing.

Don’t get stuck in the denial phase.

Don’t rely on the government to save you. Or the Fed to bail you out.

Get the facts for yourself and your family.

It will cost as little as $49. Learn how to take advantage of this trend so you are not left behind.

To get started, just click the Get Started button below. You’ll be taken to a secure order form where you can review everything you’ll receive before placing your order.

HOST:

Well, there you have it folks.

“The Great Unraveling” is here.

The actions you take today will determine whether you have the protection you need as this historic crisis unfolds.

Or whether you’ll be kicking yourself in a few short months, when the real panic sets in.