Breakthrough AI Just Predicted What the Stock Prices of Tesla, Nvidia, and Apple Will Be 30 Days From Now…

(Findings revealed below)

TradeSmith, one of the world’s most cutting-edge financial tech companies, launches Project An-E — an A.I.-driven market forecasting system that accurately predicts stock prices one month into the future.

CHRIS: Good evening and welcome to The A.I. Predictive Power Event.

I’m your host, Chris Hurt.

If you’ve turned on the news lately, you’ve undoubtedly heard the world is now being swept by an Artificial Intelligence or A.I. Revolution… I’m sure you know what I’m talking about…

News stories are coming out left and right about how A.I. is going to change everything from how we learn to how we work to how we communicate to how we shop…

And the spark that launched this revolution was last December’s release of the breakthrough A.I. language processing program known as ChatGPT.

A program that could generate human-like responses to complex questions in a matter of seconds.

Well, we’re here today to investigate the latest breakthrough A.I. program, which could soon prove to be just as revolutionary.

This one is not in language processing, however… but — of all places — in the field of finance.

The program is called An-E (pronounced Annie), short for Analytical Engine.

And it’s the brainchild of one of America’s leading computer programmers and data scientists…

A man named Keith Kaplan, who you’ll meet in just a moment.

For over six years now, Keith and his team have worked with one goal in mind: harness the incredible predictive power of A.I. and put it in the hands of the everyday person.

He says they’ve finally achieved it and Keith’s ready to unveil An-E to the world here right now…

And claims its market predictions are so accurate, anyone who follows them, could add huge sums to their nest egg.

But this also begs the question…

Would you ever trust the stock analysis of A.I.?

For most people, the answer’s not so simple.

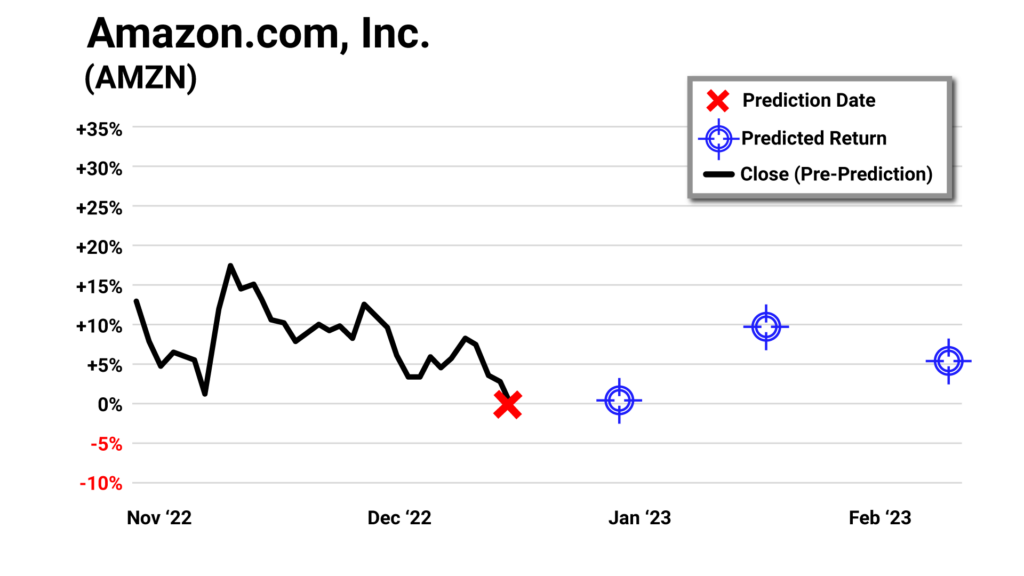

But, before you make up your mind… first, take a look at this chart…

This is a stock chart of Amazon.

Now, notice the red “X” at the end of last year.

That’s when a AN-E made a prediction of what was going to happen to Amazon’s stock price in the near future…

If you look to your right, those blue circles represent where An-E thinks Amazon’s stock price will be two weeks, one month, and two months from its prediction date.

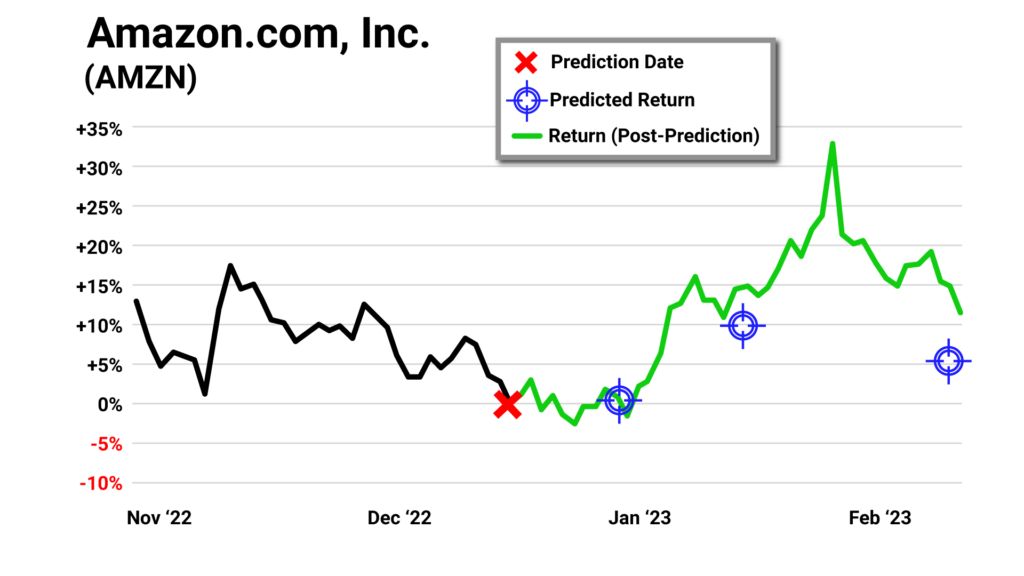

So, how did An-E do?

Well, take a look at the results…

The green line represents the actual stock price… this is what Amazon stock actually did over the next two months.

As you can see, An-E’s forecast was pretty darn close.

Two weeks into the future right here, in early January, An-E said Amazon was essentially going nowhere. It was spot on.

One month out, in January of this year, An-E said Amazon would jump 9.4%.

In reality it jumped 14.5%. Pretty accurate.

And two months into the future, in late February… An-E said Amazon would be up 5.4%. The stock was up 11.4%. A little off there. But still, very close.

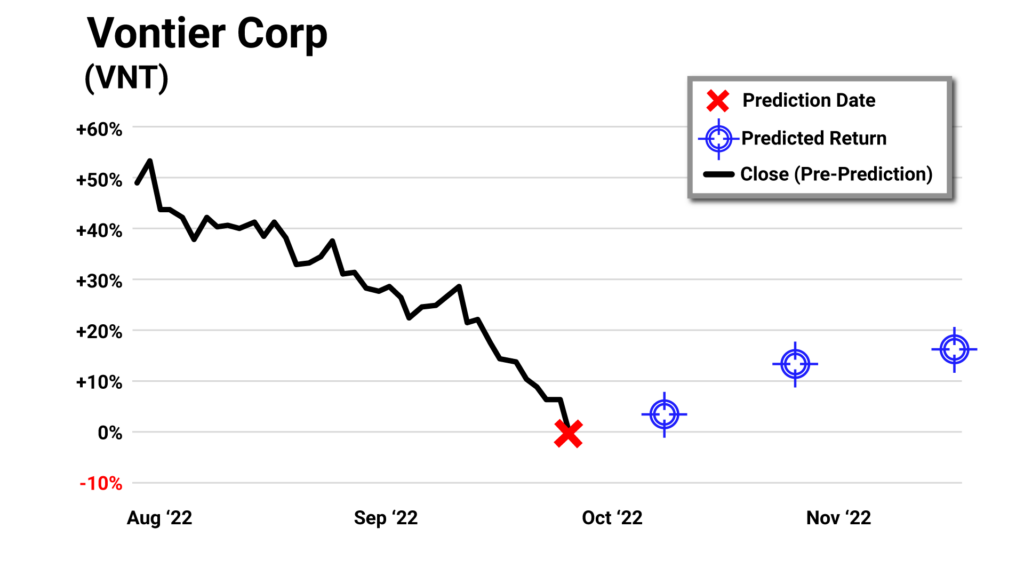

Here’s another one…

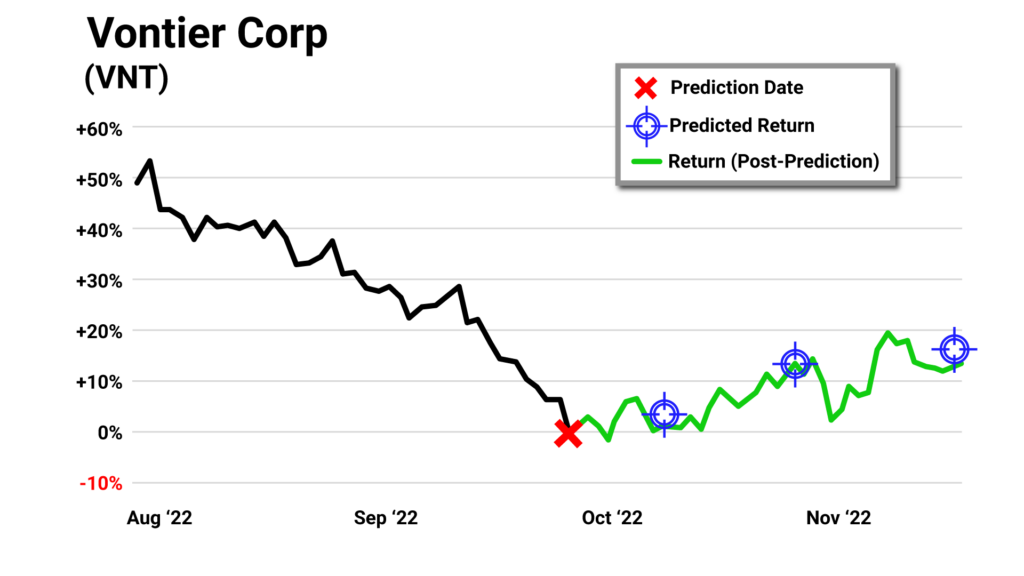

This is a manufacturing company called Vontier Corp…

An-E made this prediction in September of last year. Again, the blue circles represent the predicted stock price two weeks, one month and two months from the prediction date.

How did it do?

Here, An-E was even more accurate than it had been with Amazon.

One month into the future… An-E said Vontier would increase 11.7%. Vontier actually increased 11.8%.

It was almost spot on to the tenth of a percent!

Two months out, An-E said Vontier would go up 14.7%. It actually went up 13.5%.

Again, almost exactly right.

Here’s another example…

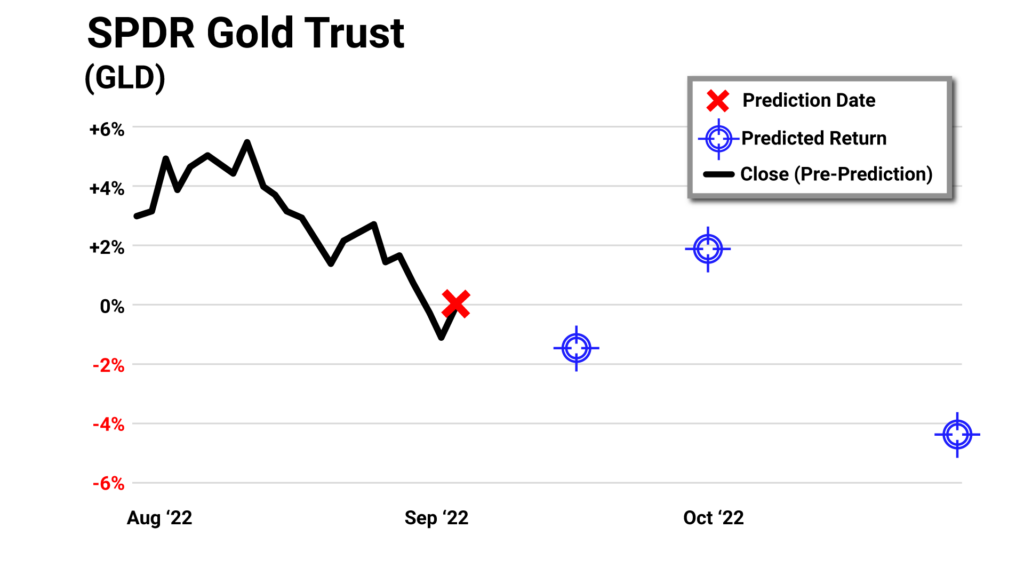

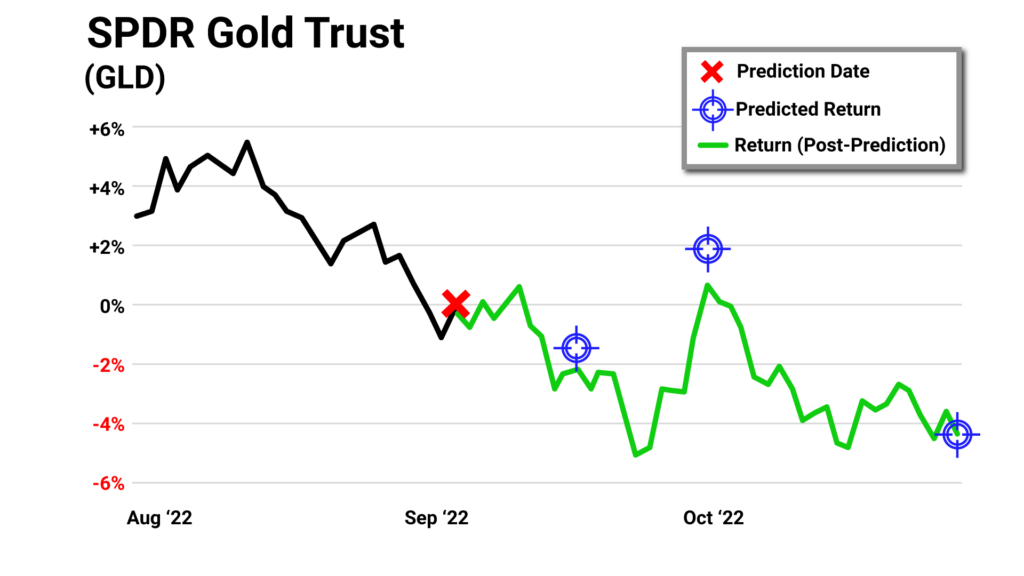

Last September, An-E was also tasked with predicting the future price of the exchange-traded fund GLD, which is designed to track the price of gold.

An-E said that in two months GLD would go down 4.3%.

Two months later…

…GLD was down exactly 4.3%.

This time… it was dead accurate.

So, here’s another question…

What would you do if you had access to these kinds of predictions?

What if you knew that in one month Amazon would be worth 10% more than it is today?

Would you buy shares?

Of course, you would.

What if you knew that two months from now, gold was going to be down 4%?

Would you sell?

Maybe, maybe not. You’d certainly be more informed.

And what if you had this predictive data for all the major stocks or ETFs on the market?

What would you do with this kind of predictive power?

Even the worst investor out there could start with a modest sum and build substantial wealth in no time.

If you invested in stocks An-E says are positioned to go up…

Depending on your initial investment, that alone could add hundreds of thousands of dollars to your nest egg, in just a few months time.

Any money you did accumulate… you could hold on to.

On the other hand, if you stay away from the stocks An-E says are poised to go down…

You could avoid punishing losses.

Market crashes… inflation…

Not having enough money for retirement…

Outliving your current nest egg…

These would be worries of the past.

In fact, what I’m leading up to here, this could be a complete retirement gamechanger.

But, the question is… does the technology really exist to make these kinds of spot-on predictions?

Is An-E for real or is it too good to be true?

How accurate is it?

And is it really safe to trust the analysis of an A.I. computer program?

These are valid questions and we’re going to be addressing in this broadcast.

And I have just the guest to help answer them.

Joining me is Keith Kaplan.

He heads up a company called TradeSmith — a company known for its groundbreaking financial innovations.

But, perhaps none more ground-breaking than what Keith is going to reveal today…

Today, Keith’s going to unveil, An-E… what promises to be one of the most revolutionary financial technologies in decades.

And Keith is here to give us all the details…

Keith, thanks for joining us. Great to have you.

KEITH:

It’s great to be here Chris, thanks for having me.

CHRIS:

So Keith, this as I said just a moment ago, is the big reveal of an innovation I know you and your team have worked so hard on. I mean six years is a long time…

I’m sure you must be excited.

KEITH:

Very much so.

CHRIS:

But, your company, TradeSmith, is known for developing financial innovations that can predict the markets…

So, just to kick things off here… tell me, why is so An-E special?

What makes this so different from anything you’ve done in the past?

KEITH:

That’s a great question Chris and I’m glad you asked…

And it boils down to two things:

Number 1…

A.I. is an absolutely revolutionary tool when it comes to predicting and potentially profiting from the markets. We’re always trying to push our products to the next level.

And A.I. was really the “missing link” that allowed us to do that.

And number 2 is accuracy.

You’re right, over the years, we’ve developed a lot of financial innovations that can predict the markets…

But this is by far our most accurate tool for that. This is on a completely different level than anything we’ve done before…

In fact, what our team was able to produce was better than we could have ever imagined at the outset.

And A.I. is the reason for that.

In fact, because of the predictive power of A.I., I could see An-E soon becoming our flagship technology.

A.I.’s that much of a gamechanger.

And I’m proud my team has found a way to harness its power and put it into the hands of the everyday person.

I think folks are going to be quite pleased with what we’re going to share.

CHRIS:

And we’re excited to have you here sharing with us.

Because when I first heard about An-E I was very intrigued… and I was really hoping to get a chance to talk to you about your innovation, so I’m glad I’m getting that opportunity.

But I have to admit… when I heard about what your team had developed, I was also a bit skeptical.

So, I did lot of research for this interview…

I met with your team and I appreciate how candid they were with me.

They let me look through your data and through many of An-E’s predictions.

And I have to say, what your team has developed is quite impressive.

After all, I showed a few of its forecasts at the top of this broadcast… and they were obviously remarkably accurate.

But I also have to play devil’s advocate here…

Because, the idea that anything can so accurately predict the stock market — whether it’s a person or a machine — that’s a little hard to believe.

Some might even say it’s laughable.

KEITH:

You’re right!

Any normal person should immediately call B.S.

But I’m prepared to show you how An-E works.

The examples you showed are just a few of many that show just how accurate our system is… we have thousands more.

But even more important is the data.

At TradeSmith, we’re obsessed with data.

And we wouldn’t introduce anything to the public unless we could prove it’s able to do what we say it will — beyond the shadow of a doubt — with real, hard numbers… and that’s what we have to back up each and every one of An-E’s predictions.

CHRIS:

Speaking of predictions, as I understand it, you’re going to reveal some of An-E’s latest predictions during this broadcast.

KEITH:

That’s right, Chris.

I want to give the folks at home a sneak peek at An-E’s capabilities, so they can start using its forecasts right away.

So, a little later on in the broadcast, we’re going to show a few of An-E’s latest predictions about the future stock prices of some of the most talked about companies on the planet.

These companies are in the news almost on a daily basis, so I think folks are going to be intrigued to see what An-E’s saying about them.

Are An-E’s forecasts different from what the mainstream media is saying?

Folks will get to find out for FREE a little later on.

CHRIS:

Well, it’ll be interesting to see what An-E is saying about those companies, especially considering your company, TradeSmith, is no stranger to making accurate predictions about the markets.

KEITH:

We aren’t Chris…

This is something TradeSmith has been doing for over a decade now…

We have a staff of 36 data scientists, software engineers, and investment analysts working on developing our market algorithms. Our team literally has hundreds of years of collective experience in the software development and data science fields.

We’ve spent over $18 million and over 50,000-man hours developing the most cutting-edge financial innovations on the market.

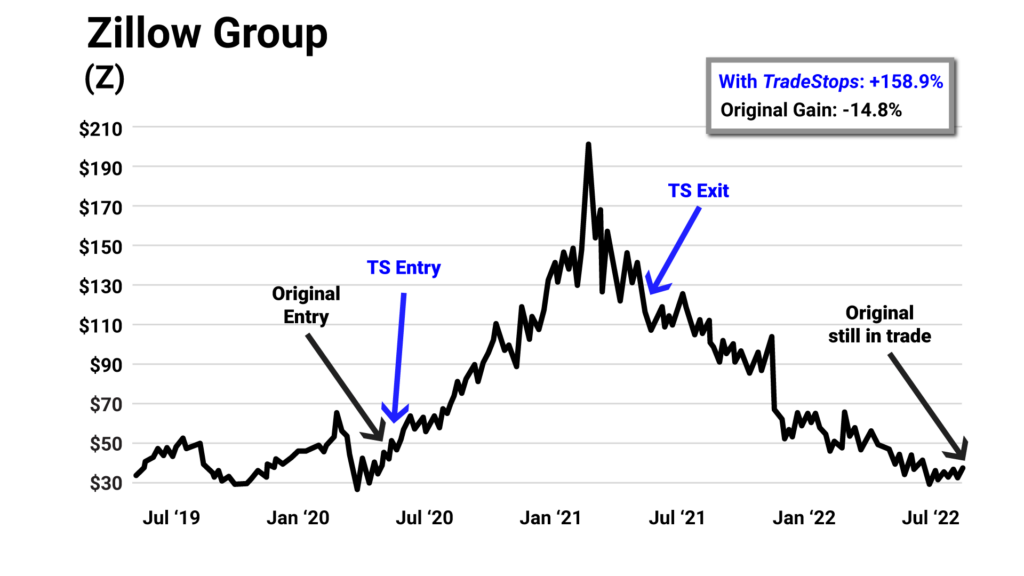

One of our most popular products is called TradeStops.

It’s one of the smartest predictive technologies in the world.

It makes 9,250 calculations every day for over 6,000 stocks.

It analyzes all kinds of metrics like volatility and trading volume to predict future stock price movement.

This enables you to time the market with incredible accuracy.

This has helped many people get in and out of stocks at the optimal time… which can increase their gains by sometimes as much as 10X.

Lately, we’ve been helping a top trader — who’s followed by thousands of everyday folks– improve his trade recommendations.

For example…

He recommended Zillow in April of 2020.

The stock exploded after he said to get in, but he didn’t time the exit right and lost 15%.

Because of its incredible ability to “time” the markets, TradeStops would have gotten him out of the trade at just the right time before a big drop to instead hand him a 158% gain…

An improvement of more than 10X.

CHRIS:

That is quite an improvement…

KEITH:

It is.

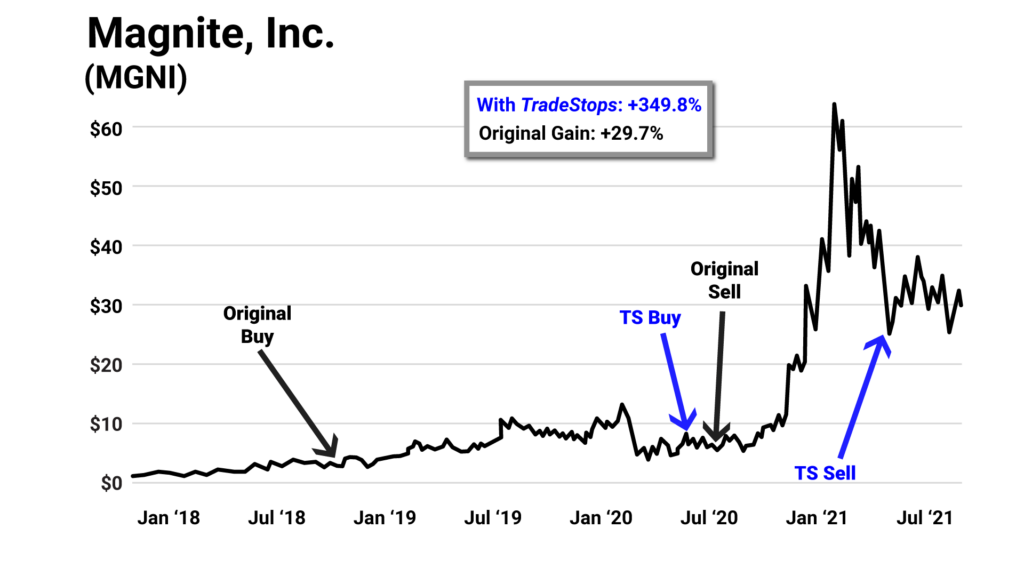

It did the same thing with a company called Magnite…

Helping another top trader with a huge following earn nearly a 350% gain instead of a mere 30% gain.

Another 10X increase.

And TradeStops is only one example.

We’ve also developed technologies to master the options market…

We’ve engineered the world’s first software that we know of that can tell you the probability that an options trade will be profitable before you invest.

CHRIS:

So, before I sell a put option on Tesla stock for example… it would tell me that a particular option would have, say, a 90% chance of being profitable.

KEITH:

Exactly. It’s that precise.

CHRIS:

That’s pretty impressive considering there’s something like 40 million options trades on the exchanges every single day.

KEITH:

Like I said… at TradeSmith, we’re obsessed with data…

Our company analyzes all kinds of financial data using ultra-high-speed computers to make sense of nearly every asset on the market.

We’ve done the same thing with the crypto markets. Ever since bitcoin burst onto the scene, we’ve used cutting-edge technology to predict the future price of alt-coins.

And we’ve done the same thing for the market as a whole… accurately forecasting the stock market crash in early 2020, caused by the coronavirus…

The big tech crash at the beginning of last year — one of the worst in 50 years… and our technologies would’ve also predicted major market events in the past…

Like, the housing crash of 2008…

And the dot-com crash in 2000.

In fact, backtests show it would’ve predicted every major bull and bear market of the last 20 years.

Our technologies have made all these predictions the same way, by analyzing reams and reams of data.

CHRIS:

That is something.

And in doing research for this interview, I noticed these innovations have helped a lot of people secure a rich retirement…

For example, I remember coming across a letter from Amy K. who said she has been able to amass $5.4 million using TradeSmith’s products.

I’ve been able to amass $5.4 million over the last 3 years thanks to TradeSmith.– Amy K.

And a gentleman named Rob S. said he made $1 million using your innovations. Pretty impressive.

My portfolio has increased $1 million since I started using TradeSmith.– Rob S.

** The investment results described in these testimonials are not typical. Investing in securities carries a high degree of risk; you may lose some or all of the investment.

KEITH:

That’s right. Our technologies have helped a lot of folks.

In fact, they’re now being used by over 66,000 individuals to help track over $30 billion in assets.

And we get letters like the ones you just described all the time.

CHRIS:

So Keith, the message I’m getting here is that TradeSmith is the leader in financial technology. That’s the bottom line, right?

KEITH:

It is. That’s been one of our core missions for the past decade.

CHRIS:

OK, but today… what you’re here to present is the next level of that technology and that is… A.I.

We already covered An-E is all about A.I.

And from everything we’ve just discussed, it seems as though you’re uniquely positioned to bring this kind of innovation to market.

It’s almost as if you’ve been preparing for it all along… it’s right in your wheelhouse.

KEITH:

That’s exactly right, Chris.

A.I. has been in the news a lot lately, especially with the launch of ChatGPT.

And when it was released, it surprised a lot of folks with its capabilities…

But not the folks on my team.

We’ve been researching A.I. for years now… we knew what it was capable of a long time ago…

We knew it was going to be an absolute breakthrough technology.

And we wanted to see what would happen if we took the incredible predictive power our innovations are known for, but this time add in A.I.

CHRIS:

So, this isn’t just some trend you’re chasing…

KEITH:

Not at all, Chris.

Our company is — and has always has been — in a constant state of R&D (Research and Development) to make our products better…

We’re always looking to “push the envelope,” to take our innovations to the next level…

And years ago, we saw A.I. was the way to do that.

So, developing a predictive A.I. algorithm was really the next logical step.

We then set about creating the most predictive market algorithm possible.

And to do that, we developed everything on our own.

That’s all the data science, all the computer programming, all the A.I. development… it was all engineered “in-house.” It’s all proprietary.

This isn’t some “plug and play” A.I. algorithm we downloaded from a third party.

To get it right, we had to start from scratch.

CHRIS:

Sounds like you really went all out on this one, Keith.

But what made you decide back then — six years ago — A.I. was going to be the thing to take your products to the next level?

KEITH:

That’s a great question Chris…

And it has to do what A.I. really is, at its core.

There are a lot of misconceptions about A.I.

Folks are picturing robots taking over the world.

They’re wondering if it will take their jobs.

But, really at its core, A.I. is simply an advanced form of pattern recognition.

And that’s what my company has been doing for the last decade… developing highly sophisticated software to analyze data to recognize patterns in the markets.

But, A.I. takes that to another level…

Adding in A.I. can improve pattern recognition exponentially.

Because A.I. is pattern recognition on steroids.

It’s like going from a rotary phone to a smartphone.

Like going from dialup to 5G.

When it comes to sifting, sorting, and analyzing data… then recognizing patterns within that data to make predictions… now that we have this technology, looking back it’s like we were using a bicycle to cross the country, whereas today — thanks to A.I. — we can take a supersonic jet.

A.I. is an absolute game changing technology.

And so, with An-E, we’re harnessing the power of A.I, and directing it toward the arena where it can quite possibly make the greatest impact on society… certainly on the lives of everyday folks… the financial world.

CHRIS:

OK… I can see now how A.I. could bring your company’s products to the next level, as you mentioned.

But, let’s get down to brass tacks as they say…

I showed a few charts of An-E’s predictions at the beginning of this broadcast… and I’d like to revisit those, because this is, essentially, what’s so revolutionary about this innovation — it’s predictive power.

Especially when it comes to stocks prices.

Let’s dive deeper into those so folks can really get a sense of what it’s all about.

I think the best way to do it is to look at another example I came across when doing research for this interview and have you walk us through it to help and try and really paint the picture.

KEITH:

Great idea.

CHRIS:

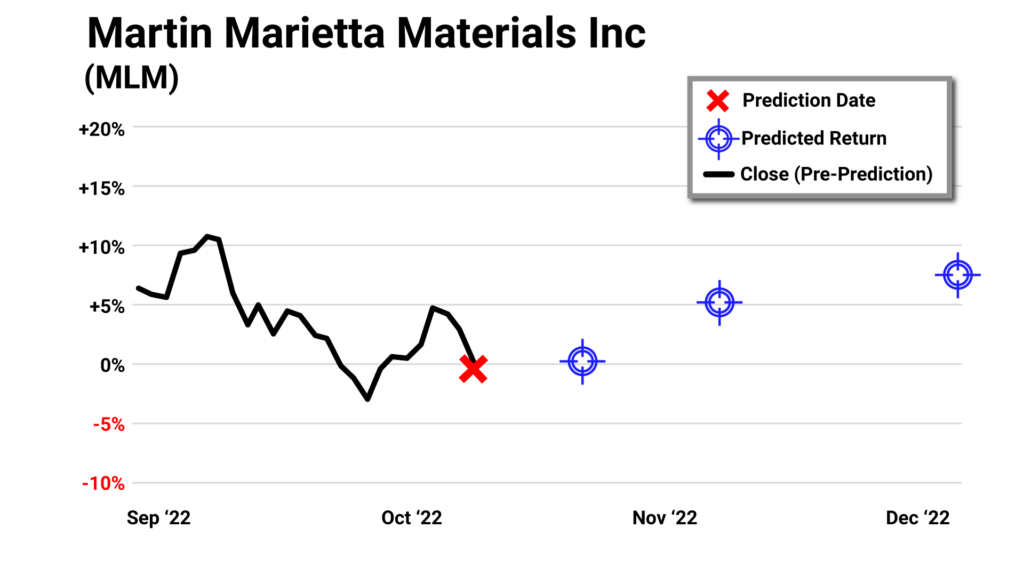

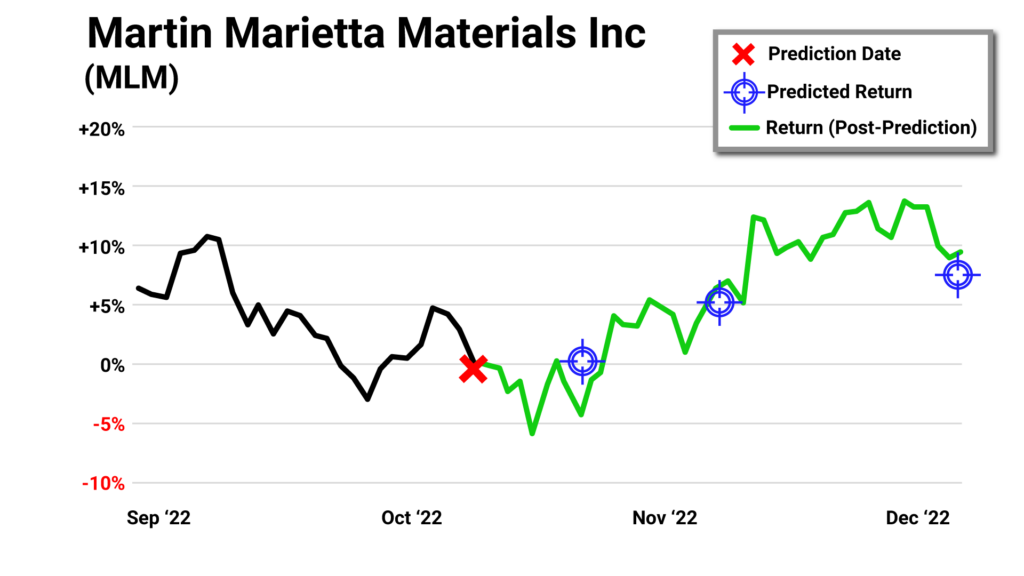

OK. So, here’s a company called Martin Marietta Materials. Ticker symbol MLM.

So again, we see the “X” where An-E made its prediction… sometime in last October.

And again, we have those interesting blue circles…

Which represent An-E’s predictions two weeks, one month, and two months out.

And now… let’s go to what actually happened.

And again, this is pretty incredible…

An-E is a little off in its forecast.

But, by and large… the stock price is going right where An-E predicted.

Especially at the one-month mark… I mean An-E is only off by a percent or so.

If you think about how the stock price of Martin Marietta could have moved during that month… it could have gone up 10%, down 10%… could have jumped 23%… or nosedived 36%… or not moved at all…

The possibilities are endless…

And yet from this circle it looks like An-E predicted it would go up around 6% or so… and it looks like Martin Marietta stock is up about 7%.

This accuracy is pretty remarkable.

I’m not trying to be a Doubting Thomas here… but this seems too good to be true.

How is An-E doing this?

Walk us through it…

KEITH:

Well, don’t worry about being too doubtful, Chris… you won’t offend me.

I welcome your skepticism.

This is what we do at my company when we analyze our technology.

We spend hours and hours testing our assumptions, trying to poke holes in our results… trying to prove ourselves wrong.

Everything we’ll talk about today has already been through a lot of scrutiny.

But to help you understand what’s really going on… I think it’s best to start with how our A.I. system really works.

You see, we said earlier that A.I. is an advanced form of pattern recognition… and it is.

But, that’s only part of the equation.

What makes An-E so accurate is it also employs machine learning.

CHRIS:

I always thought A.I. and machine learning were the same thing. Am I wrong?

KEITH:

Well, they’re very closely related.

Machine learning is actually a subset of A.I.

The difference is subtle, but important…

The best way to explain it is, A.I. has the ability to learn and problem solve from new information fed to it by a human… that’s the pattern recognition component.

But machine learning is when a computer uses mathematical models to make sense of those patterns and help it learn without direct instruction.

CHRIS:

So, machine learning is when a computer system can learn on its own?

KEITH:

Essentially, yes.

CHRIS:

So, how does that enable An-E to make such accurate predictions?

KEITH:

Well, the way traditional investment data analytics worked before machine learning, a human would think of a set of parameters he would like to test… and then enter those parameters into a computer.

Using pattern recognition, the computer would then perform a “test” of those parameters over past financial market data and analyze the results. If the results were great, you would consider implementing the investment strategy in real life.

For example, you might want to “test” what kind of returns you’d have earned in the past by buying a stock when it trades at a cheap 12 times earnings multiple.

CHRIS:

So, in this case… you’d be running a “test” to find the returns of “undervalued” stocks…

KEITH:

You would be. That’s a “classic” test a lot of analysts run.

Or you could run a test to see what kind of returns you could earn based on how a stock is trending.

Obviously, folks like to find stocks that are trending up.

To find that you could test what happens if you only own a stock when it trades above its 200-day moving average.

Or you could run both tests at the same time…

And see what happens when you buy a stock that is both undervalued and in an up-trend.

As we all know, everyone has their own metric they look at…

Over the years, people have tested hundreds or even thousands of indicators and combinations of indicators.

The key here is a human — not the machine — is selecting the strategy or “parameters” that are tested.

And there’s a lot wrong with that…

For instance, was their testing accurate?

Did they test the model the right way?

Will their test play out in the future like it did in the past?

Just because a particular test worked in the past, doesn’t mean it will play out the same way in the future.

Take what just happened over the last year and a half or so… since the beginning of 2022… we’ve been a completely different type of market.

Would a model that worked during the dot-com boom of the late 90s work the same as it does today?

Not likely…

CHRIS:

I never thought of it that way…

So, someone might test their model and because they’re right once, they might incorrectly assume they’re right all the time…

KEITH:

They do and it’s a big mistake a lot of analysts make.

CHRIS:

So, how does machine learning make this process better?

KEITH:

Machine learning flips this process in a powerful way.

With machine learning a human isn’t designing the parameters… the machine is designing the parameters.

CHRIS:

So, in the case of An-E, the machine is creating the marching orders instead of receiving those orders from a human?

KEITH:

Exactly. Instead of telling An-E what to test, we fed it huge amounts of data and suggested a desired outcome — like “find a reliable stock picking method that does well with 30-day holding periods” — and An-E crunched trillions of data points to see if it could create a useful system.

But, here’s the key… not just anyone can do this…

You need a lot of money, a lot of time and you need access to a tremendous amount of data.

Then you have to make sure the data is accurate before you feed it into the machine.

Not only that, once the machine finds a useful model… you have to run that model through every type of market in the past to “train” the system to work in all types of scenarios.

It took us a while to get to the point where we could reliably trust An-E to predict a stock’s future price action.

CHRIS:

Well, from the past examples it seems like you found what you were looking for…

After all, An-E’s predictions have been pretty accurate.

Let’s look at another example to make sure I’m understanding this correctly…

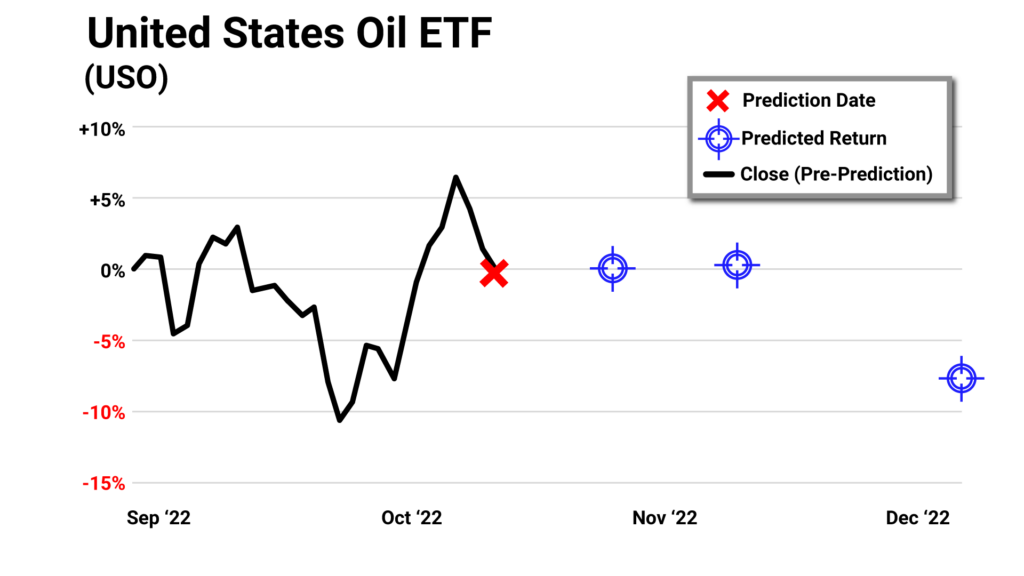

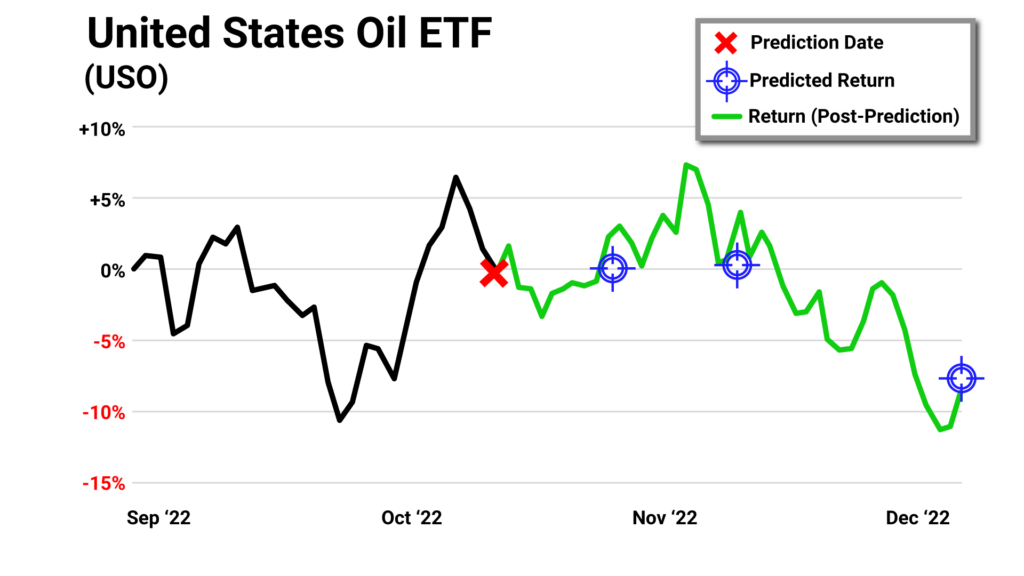

Here’s United States Oil ETF — ticker symbol USO.

Looks like An-E is saying that the price is going up over the next month and then two months from its prediction date… An-E is saying USO will drop around 8%.

OK, in this scenario, how does An-E know what to do since, as you said… no human is giving it any specific parameters on how to analyze the stock?

KEITH:

Right, so we gave An-E a single command… and that is, find the price of USO two weeks from now, one month from now, and two months from now.

We didn’t tell it what to analyze, or how to find it, and we didn’t give it any hints.

We gave An-E access to thousands of data sets. Our goal was to create a system that has strong predictive ability over the short-term (around 30 days). These data sets included macroeconomic data such as interest rates, GDP growth, stock market volatility, consumer sentiment figures, and inflation figures.

We also included fundamental data like profit margins, revenue growth, and price-to-sales ratios. We included technical data like relative price strength and moving averages.

We brought no preconceived notions or biases to the project. There wasn’t a fanatical fundamental investor on the team rooting for his strategy. There wasn’t a dedicated technical analyst rooting for her strategy.

We just gave the machine a desired destination (to find the price of a stock over the short-term)… and let the machine do the rest. We didn’t teach the program anything. It taught itself.

CHRIS:

OK, let’s check the results to see if it worked… was An-E able to teach itself how to find the future price of USO?

Here’s what it came up with…

Again, these predictions are almost spot on.

Looks like the two week and one-month predictions are just about dead accurate. Maybe a few percentage points off and at two months the stock dipped about 9%… just as An-E said it would.

Incredible.

With this information, any investor could simply avoid USO — or sell if they wanted to as well — and save a lot of money.

It’s interesting you explained how this is all a result of feeding thousands of datasets into your An-E algorithm and having it learn on its own what it needs to do to make a prediction.

Because I was reading about the revolutionary ChatGPT program and I believe it works in much the same way.

KEITH:

That’s a great observation, Chris.

Just to give some context for folks who may not know…

ChatGPT is the largest, most powerful A.I. language model ever created.

And what makes it so revolutionary is if you ask it a question… it can give you an appropriate response all in context… such that, if you didn’t know ahead of time, you wouldn’t know whether you were talking to a very smart person or a machine.

And it can also do complex tasks like: explain Newton’s laws of motion…

Write a poem in the style of Walt Whitman…

Even summarize the book “Pride and Prejudice.”

Well, how does it do that?

Machine Learning.

But more specifically, through a process called “pre-training.”

The ChatGPT A.I. algorithm is fed billions of words.

It then reads through those words with billions of parameters… and can process them all in seconds.

This primes it or “pre-trains” the A.I. algorithm ahead of time… so when presented with a scenario in the future… it will know what to say.

CHRIS:

So, essentially, ChatGPT scans billions of patterns to “learn” how to converse with a human.

KEITH:

It does. That way when the program is asked a question in real time, it can give an appropriate response in context.

And it found its way to that answer all on its own… it didn’t need a human, because it was “pre-trained” in advance.

It taught itself. That’s machine learning.

An-E does the same thing.

But, instead of words… we “pre-trained” it with numbers and data.

It considers trillions of data points.

The more information you give An-E’s self-learning algorithm, the more accurate its prediction.

CHRIS:

OK, well now we’re starting to peel back the curtain a little bit.

Because honestly, the charts we’ve been going through in this presentation… when we show An-E’s forecasts… it seemed almost as if it was arriving at its predictions by magic.

But really what’s going on behind the scenes is advanced mathematics…

“Pre-training” An-E on massive data sets so it can learn on its own.

KEITH:

Exactly.

But here’s where things get even more interesting…

Not only has this same method of “pre-training” been tried with ChatGPT and An-E to enable machines to learn on their own… but all sorts of other A.I.s.

And what’s really interesting is when scientists observed the process of how the A.I. algorithms arrived at their end result, how the A.I. accomplished its ultimate task…

The things it did along the way were pretty bizarre.

CHRIS:

Bizarre? How?

KEITH:

Let me give you an example…

A.I. first started gaining recognition after it was tested in the world of chess.

Chess was the perfect testing ground for A.I… because playing chess, well is ultimately about recognizing patterns and thinking through a series of moves and “what-if” scenarios to arrive at a single goal… checkmating the king, it’s the most important part.

But, when designers of A.I.-powered chess playing programs started testing their systems years ago, they noticed something really weird about the strategies their programs employed. They were extremely bizarre… they were strategies human players would never come up with… and in many cases would be outright ridiculed by chess grandmasters.

CHRIS:

Interesting… So, what would one of these bizarre strategies look like?

KEITH:

Well, for example, in chess, a player can “sacrifice” a key piece if they believe that sacrifice will lead to ultimate victory. Sacrificing pieces in the pursuit of victory has been a strategy in chess for centuries.

However, to the surprise of human players, A.I. chess programs often make sacrifices that seemed bizarre and nonsensical. A.I. chess programs would create wild and complex strategies humans would never think of. These A.I.-created chess strategies have been called “alien” and “chess from another dimension.” But they ended up crushing human players with those unconventional strategies… even grandmasters like the famous Garry Kasparov.

CHRIS:

So, what you’re saying is that when a chess grandmaster was observing the moves the A.I. was making, to him they may have seemed completely outlandish.

But in the end, it was hard for him to criticize because the A.I. kept winning.

The A.I. was arriving at its ultimate goal… but it got there in a way no one would think of.

KEITH:

Yes, or even outright dismiss… because the A.I. was thinking on a completely different level…

CHRIS:

So, when your team was analyzing the moves of An-E to find out the future price of Amazon, for example… did you experience the same phenomenon?

Was it making accurate predictions using data or correlations that seemed kind of weird?

Things you never would have thought to look at or compare?

KEITH:

By and large, the answer to that question is “yes”…

We experienced the same phenomenon as the chess players…

Conventional wisdom tells us that what makes a stock price go up are strong fundamentals… things like strong earnings, sales growth, cash flow, debt-to-equity…

Things like that.

But when we just fed An-E thousands of data sets, told it to find the stock price one and two months from now… and essentially said “figure it out any way you want”…

Like the chess-playing A.I. programs, An-E started making some moves that seemed a little bizarre…

That is, the combination of factors it used to predict the stock price were — often times — pretty unusual.

More often than not, An-E put a lot more emphasis than we ever would have thought on macroeconomic and technical factors than fundamentals.

But also, that question is a little tough to answer… because An-E analyzes every stock differently.

Every stock is a different size, is in a different industry, has a different price history, has different products, services, management teams, revenue targets, you name it.

Which means the weighting and combination of every factor is different for every stock.

Again, if we were to think of it like chess…

No two chess games are alike. There are 32 pieces, each moving on an 8-by-8 grid… the combinations of moves are essentially infinite.

But the goal, the outcome, is always the same… checkmate the king, that’s all you have to do.

Well, every single move is a new piece of information.

So, if A.I. were playing a human in chess…

The A.I. is adjusting based on every move and recalculating its strategy after every turn…

An-E does the same thing only with stocks.

An-E has the same goal with every stock: Find the price one month into the future…

But, each new piece of data is like a different move on a chessboard that has to be taken into account… and the analysis is slightly readjusted to make sure it’s working towards its goal.

CHRIS:

This is fascinating…

So, let’s take another example here.

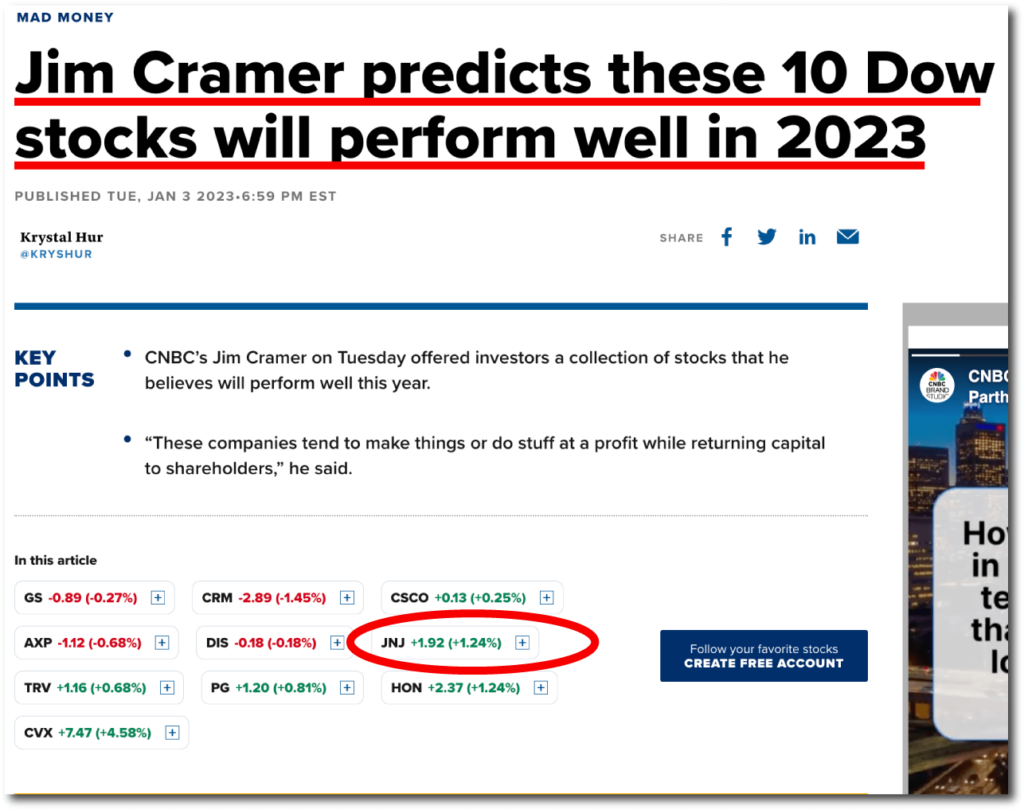

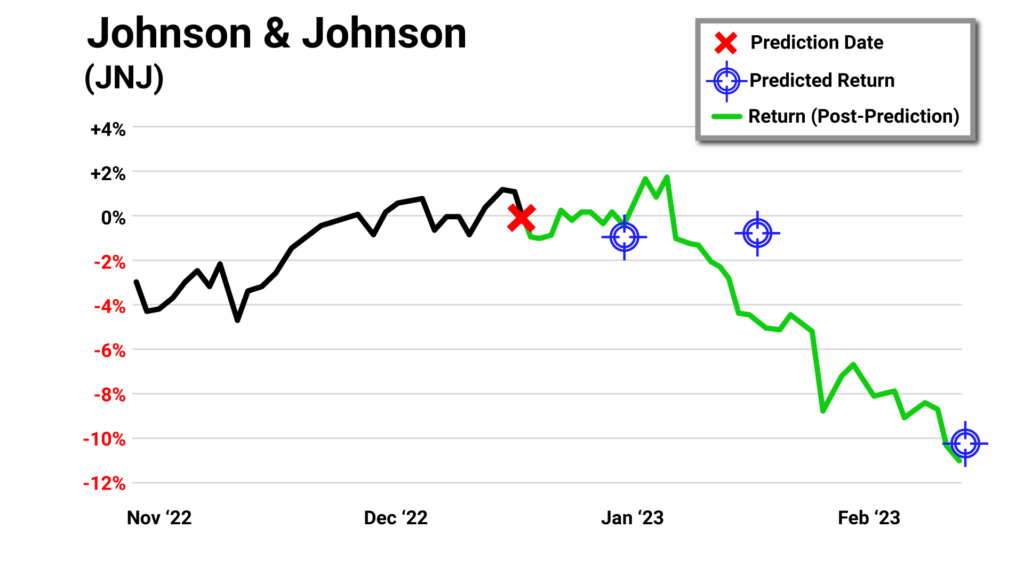

Here’s An-E’s prediction of Johnson & Johnson early this year…

As you can see in late December, An-E predicted a pretty sizable drop, around 10% or so.

And this is pretty interesting because around the time An-E made its prediction — Johnson & Johnson made big news in the healthcare field.

It spent billions acquiring medical device makers like Abiomed and partnering with healthcare providers like HCA Healthcare.

These moves were praised in the media.

Seeking Alpha called Johnson & Johnson, “Healthcare for the Win.”

Fidelity called it, “One of the Best Blue Chips to Buy for 2023.”

And at the time, Jim Cramer over at CNBC was also singing its praises saying it would return capital to shareholders.

So, what’s going on here?

An-E must be seeing something that the mainstream didn’t… because it came to the opposite conclusion than they did…

It said the stock price was headed down… and by a considerable amount.

KEITH:

It did.

It’s making connections about the data that folks in the media would never be able to see.

Conventional wisdom would tell us Johnson & Johnson is expanding its business interests… it’s getting into a whole new multi-billion-dollar market — Healthcare.

It’s made a great, strategic acquisition… this should grow profits, we should see a spike in its stock price.

This is what many of the “smartest” analysts concluded.

And, on the surface, it made total sense.

CHRIS:

But the way stock prices move isn’t always so logical.

KEITH:

Unfortunately, most investors know that harsh truth all too well.

There’s always more to the equation, more variables.

As humans, we can become blinded by a single piece of good news like a new acquisition, business deal, or earnings forecast.

An-E is a computer program. It doesn’t care, it doesn’t have those biases. It just looks at the data. And, more specifically, at things most folks would never consider.

Sure, it took Johnson & Johnson’s acquisition into account… but to An-E it wasn’t the “end all, be all.”

Its machine learning algorithm was also looking at factors the mainstream analysts probably never thought to consider and made connections and correlations they’d never even think of…

CHRIS:

An-E doesn’t have any hang-ups. So, like the early chess playing A.I.s, An-E was “making moves” financial analysts would consider weird, bizarre, and even “alien”…

KEITH:

Right, to the average analyst or trader these connections might seem totally crazy, but in reality, the opposite is true.

They are actually quite logical.

The human brain just doesn’t have the speed or the firepower to make them.

An-E was thinking on a completely different level than they were when it was trying to predict the price of Johnson & Johnson stock.

CHRIS:

And the result?

KEITH:

Checkmate.

The graph says it all…

Over the next two months… Johnson & Johnson slid 10% just as An-E said it would.

In fact, the company even had some massive layoffs.

CHRIS:

And so, An-E beat out some of the top analysts in the financial media essentially because it found connections and made correlations they could never hope to see.

And it’s those hidden connections, that are so difficult for the human brain to make, that predicted Johnson & Johnson’s stock price.

Through machine learning, An-E found out what they were… and made a much more highly informed forecast than the other human analysts.

KEITH:

I couldn’t have put it better myself.

And I’m so glad you used that term — hidden connections — because they are extremely important in the work we do.

This is what An-E is looking for while it’s being “pre-trained” on billions of data points…. and it’s what enables the algorithm to be so accurate.

Remember, we “pre-train” the algorithm with billions of data points.

And when you have billions of data points… most of those data points are just noise… they’re meaningless. They don’t have any impact on the future price of the stock.

But some data points are the opposite… they’re incredibly meaningful.

They’re a signal that can pinpoint where a stock is likely headed.

But which data points are they?

And in what combinations?

And they’re different for every stock.

What indicates that Apple is about to go up is going to be different from a small gold mining stock…

And it changes as the market changes.

Remember how earlier, I said machine learning is all about giving a machine an end goal and billions of data points and it figures out the parameters on its own.

CHRIS:

I do.

KEITH:

Well, those parameters are formed by sorting through all the data points and determining what’s important and what is NOT important.

And finding “hidden connections” or “clues” within the important data.

CHRIS:

And the unimportant data is thrown out… that’s just the “noise,” as you said…

KEITH:

It is… it doesn’t really affect the future price of a stock.

But more often than not, that’s what the mainstream media focuses on… the noise.

Things that seem like they should matter… but from a mathematical standpoint, don’t really matter.

And that’s what happened in the Johnson & Johnson example… it’s why An-E was right and the mainstream media got it wrong.

As usual, the mainstream media got caught up in “the noise.”

CHRIS:

So, An-E is “pre-trained” on millions of data points and is told to “find the likely price of a particular stock one month in the future.”

Then it sets about uncovering “hidden connections” that clue An-E in to where the price is heading, sometimes down to a tenth of a percent. So close.

KEITH:

That’s it. That’s the process in a nutshell.

And An-E has done this thousands of times.

And the results have been stunningly accurate.

This is something no human could ever do.

But, if we could, if we were able to determine the same “hidden clues” An-E is… to us, the direction of each stock would be just as obvious, just as easy to predict.

CHRIS:

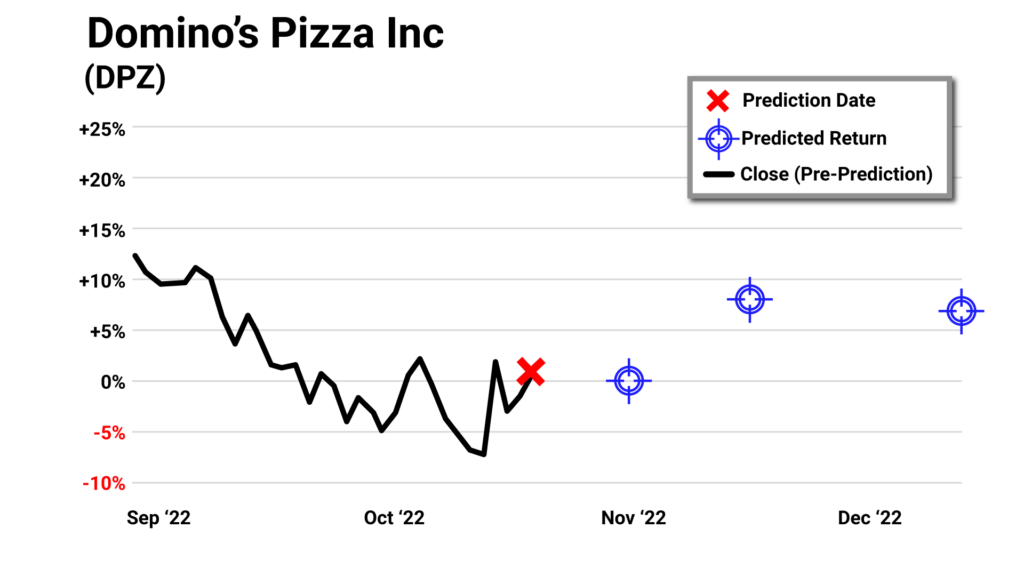

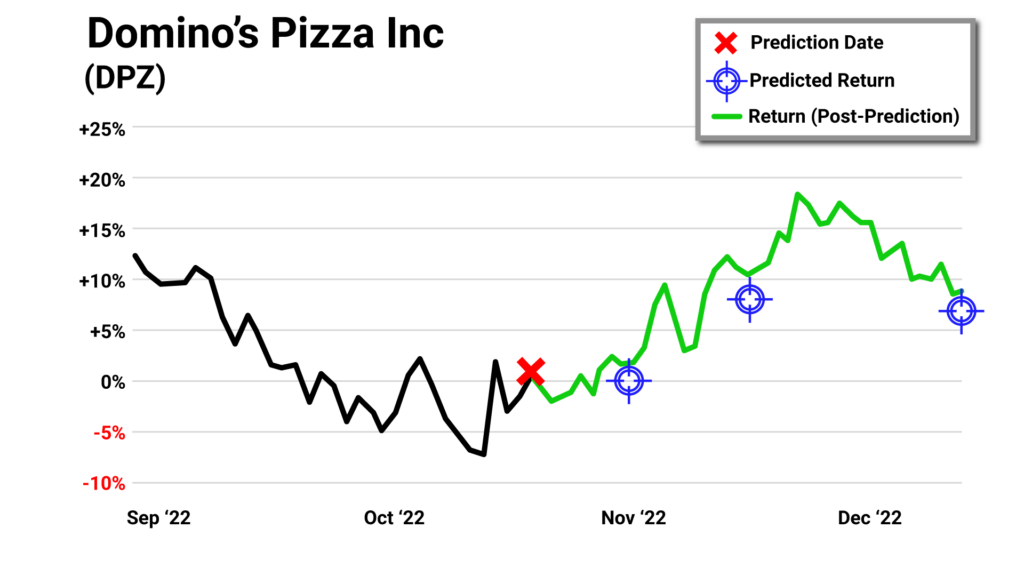

So, let’s take this example from last October, when An-E was tasked with predicting the stock price of Domino’s Pizza…

An-E is predicting the stock is going up about 7% to 8% in the next month or two.

And you’re saying, at this particular point in time… An-E has identified the right “hidden connections” that clue it into where the stock is likely going…

So, to An-E, where Domino’s Pizza is heading is obvious? This is not guess work?

KEITH:

Precisely… it seems pretty crazy that the movement of any one individual stock on the market, down to the percentage point, would seem obvious.

But, remember, An-E is thinking on a whole different level than you and I ever could.

Factors and correlations we wouldn’t even consider are like flashing green lights to An-E saying “this stock could go up 7%”… or “danger ahead… this stock is set to tank 15% next month.”

CHRIS:

It sounds like something I couldn’t even begin to fathom.

But it’s hard to argue with the results…

Again, nearly spot on!

Over the next two months, Domino’s stock went up about 7%.

KEITH:

You’re right, Chris…

The process An-E goes through to make these predictions isn’t something you could even begin to fathom.

And that’s not a knock on your intelligence.

It’s not something I could begin to understand either.

Or any other human being for that matter… even if you’re Warren Buffett, Garry Kasparov, Stephen Hawking, or any one of the brightest minds who’s ever lived.

And this is one of the biggest lessons I learned working on our An-E project that I want to pass onto the viewers at home.

And that is… how superior the processing power of A.I. is to the human brain when it comes to certain tasks.

Don’t get me wrong our brains are incredibly complex… but when it comes to making sense of a lot of data… whether that data is in the form of historical stock prices, moves on a chess board, or baseball statistics… even a chess grandmaster like Garry Kasparov or a financial genius like Warren Buffett doesn’t have one thousandth of the computational ability that an A.I. program does…

It’s not even a contest.

So, don’t try to compete with A.I.

Instead, use it as a tool to predict the stock market and give yourself the chance to become wealthy.

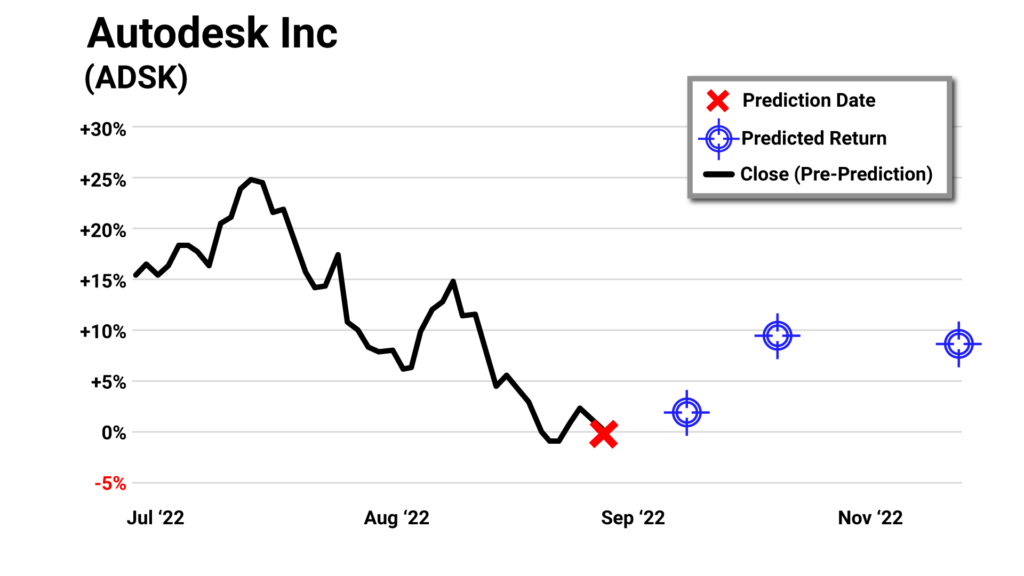

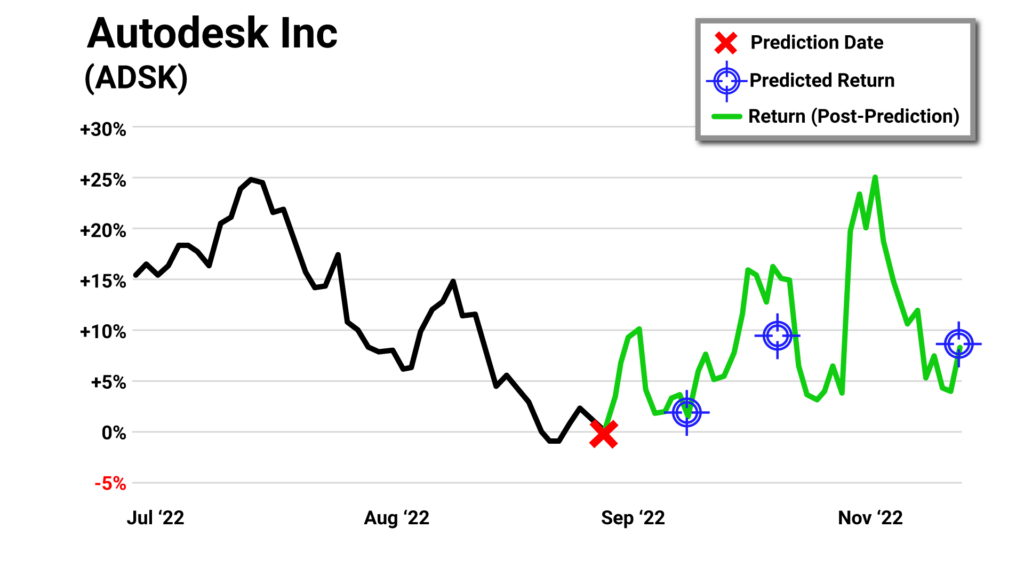

For example, you could use a prediction like this one of Autodesk…

And make as much as 15% in a month…

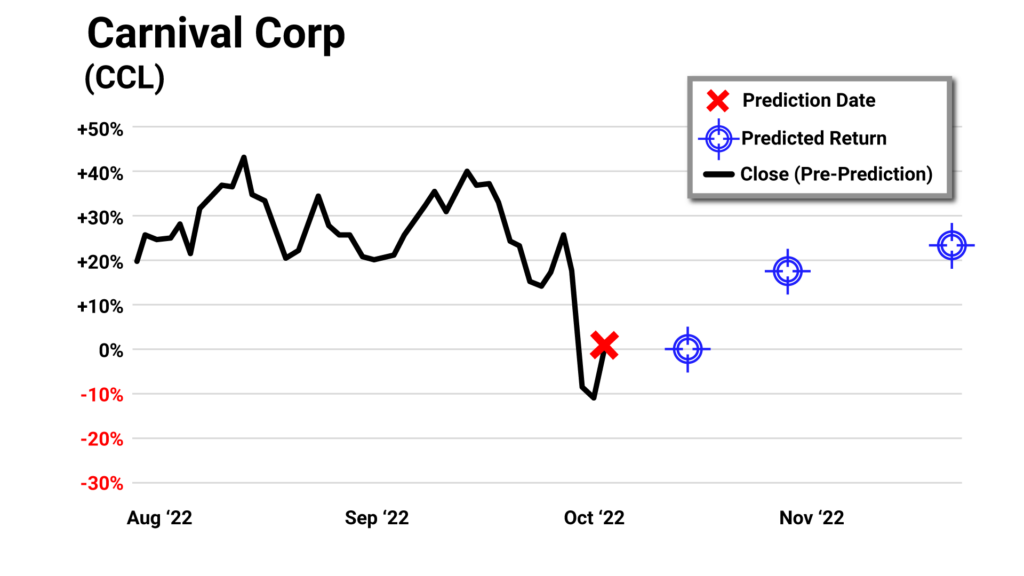

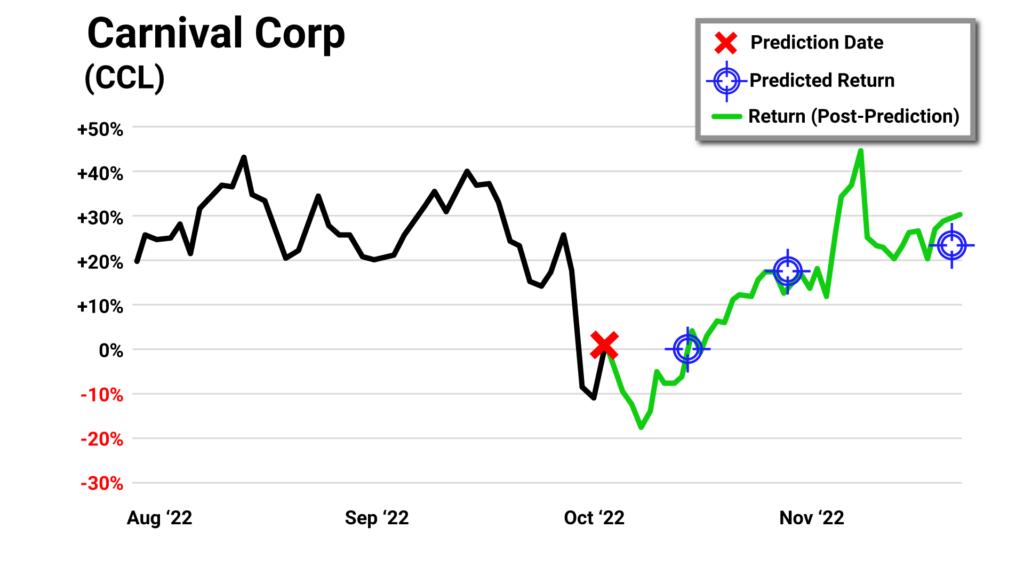

Or this one of Carnival Cruise line…

And make as much as 12% in a month…

CHRIS:

Considering not all predictions turn out like the ones you just mentioned, it’s incredible how accurate those forecasts are…

But I’m not quite seeing how they would make you wealthy.

That’s only 15% or 12% in a month…

And throughout this conversation, you’ve cited many examples of stocks An-E has predicted…

It seems like a lot of them are around that same range of around 8% to around 15% gains in a month.

Excuse me for being blunt here, but those aren’t the most exciting financial transactions I’ve ever heard of.

How could someone become wealthy by following An-E’s predictions?

Making 8% in a month isn’t bad… but it’s not exactly going to change your financial life.

KEITH:

Well, that’s where you and I disagree, Chris.

Let me ask you…

If I told you shares of Amazon would be 8% higher 30 days from now, would you buy shares?

CHRIS:

Yes, I most certainly would.

KEITH:

Why? With your line of reasoning, 8% isn’t going to “change your financial life.”

Why not take a chance on something a little more speculative, but with more upside potential?

CHRIS:

Because I’ll take a certain 8% over anything with “little or no certainty” any day of the week.

Especially these days.

KEITH:

Exactly.

And you know who else thinks that way?

Wall Street.

Believe me, I’m no fan of Wall Street at all…

But they always win, so I’ve spent a lot of time studying what they do.

And they rarely make a trade without knowing — with an extremely high degree of certainty — what will happen on the other side.

And that’s because in the world of high-stakes finance, it’s all about finding that edge… mitigating risk and maximizing gains at the same time.

Wall Street are the masters of this.

So, while yes, 7% or 8% might not sound very attractive to the uninitiated…

- What about when that 8% is as mathematically close to certainty as possible?

- What if that 8% actually turns out to be 12%… 28%… or even 50% in 30 days?

- What if you could reliably cash in those gains over and over again, as often as you’d like?

This is the kind of edge the professional traders will pay a fortune to get.

CHRIS:

So, the real power of An-E lies in the amount of certainty and trust you have going into each and every trade…

No more guesswork.

KEITH:

That’s exactly right.

The value of certainty and trust are immeasurable.

Wall Street knows this. It knows the power of A.I.

That’s why it’s essentially taken over their entire world.

After learning what has made Wall Street so successful, it dawned on me…

Everybody should be investing this way.

And that’s why we’re making such a big deal about this event, Chris.

As far as I’m aware, this is the first time in history that Wall Street grade Artificial Intelligence is being made available to Main Street.

This IS game-changing stuff.

If you can reliably make 8% per month… and compound it over a year…

$10,000 turns into $25,000.

| Return | Profit | Total | ||

|---|---|---|---|---|

| Month 1 | $10,000 | 8% | $800 | $10,800 |

| Month 2 | $10,800 | 8% | $864 | $11,664 |

| Month 3 | $11,664 | 8% | $933 | $12,597 |

| Month 4 | $12,597 | 8% | $1,008 | $13,605 |

| Month 5 | $13,605 | 8% | $1,088 | $14,693 |

| Month 6 | $14,693 | 8% | $1,175 | $15,869 |

| Month 7 | $15,869 | 8% | $1,269 | $17,138 |

| Month 8 | $17,138 | 8% | $1,371 | $18,509 |

| Month 9 | $18,509 | 8% | $1,481 | $19,990 |

| Month 10 | $19,990 | 8% | $1,599 | $21,589 |

| Month 11 | $21,589 | 8% | $1,727 | $23,316 |

| Month 12 | $23,316 | 8% | $1,865 | $25,182 |

$25,000 turns into $62,000.

| Return | Profit | Total | ||

|---|---|---|---|---|

| Month 1 | $25,000 | 8% | $2,000 | $27,000 |

| Month 2 | $27,000 | 8% | $2,160 | $29,160 |

| Month 3 | $29,160 | 8% | $2,333 | $31,493 |

| Month 4 | $31,493 | 8% | $2,519 | $34,012 |

| Month 5 | $34,012 | 8% | $2,721 | $36,733 |

| Month 6 | $36,733 | 8% | $2,939 | $39,672 |

| Month 7 | $39,672 | 8% | $3,174 | $42,846 |

| Month 8 | $42,846 | 8% | $3,428 | $46,273 |

| Month 9 | $46,273 | 8% | $3,702 | $49,975 |

| Month 10 | $49,975 | 8% | $3,998 | $53,973 |

| Month 11 | $53,973 | 8% | $4,318 | $58,291 |

| Month 12 | $58,291 | 8% | $4,663 | $62,954 |

That’s around a 150% gain.

CHRIS:

That is quite a return… especially considering you’re making just modest gains along the way…

KEITH:

It is and it shows you the power the compounding affect can have in just a short time…

And that’s on a modest 8% return.

What if we dial it up just a notch to a 12% monthly return?

Remember, that 8% turned $10,000 into $25,000 in a year…

Look what happens when we take the monthly gains up to 12%… a mere 4% greater than the original 8%.

| Return | Profit | Total | ||

|---|---|---|---|---|

| Month 1 | $10,000 | 12% | $1,200 | $11,200 |

| Month 2 | $11,200 | 12% | $1,344 | $12,544 |

| Month 3 | $12,544 | 12% | $1,505 | $14,049 |

| Month 4 | $14,049 | 12% | $1,686 | $15,735 |

| Month 5 | $15,735 | 12% | $1,888 | $17,623 |

| Month 6 | $17,623 | 12% | $2,115 | $19,738 |

| Month 7 | $19,738 | 12% | $2,369 | $22,107 |

| Month 8 | $22,107 | 12% | $2,635 | $24,760 |

| Month 9 | $24,760 | 12% | $2,971 | $27,731 |

| Month 10 | $27,731 | 12% | $3,328 | $31,058 |

| Month 11 | $31,058 | 12% | $3,727 | $34,785 |

| Month 12 | $34,785 | 12% | $4,174 | $38,960 |

Still a very achievable gain.

But, at 12%, the results are much better. That $10,000 turns into nearly $40,000.

$25,000 would turn into $100,000.

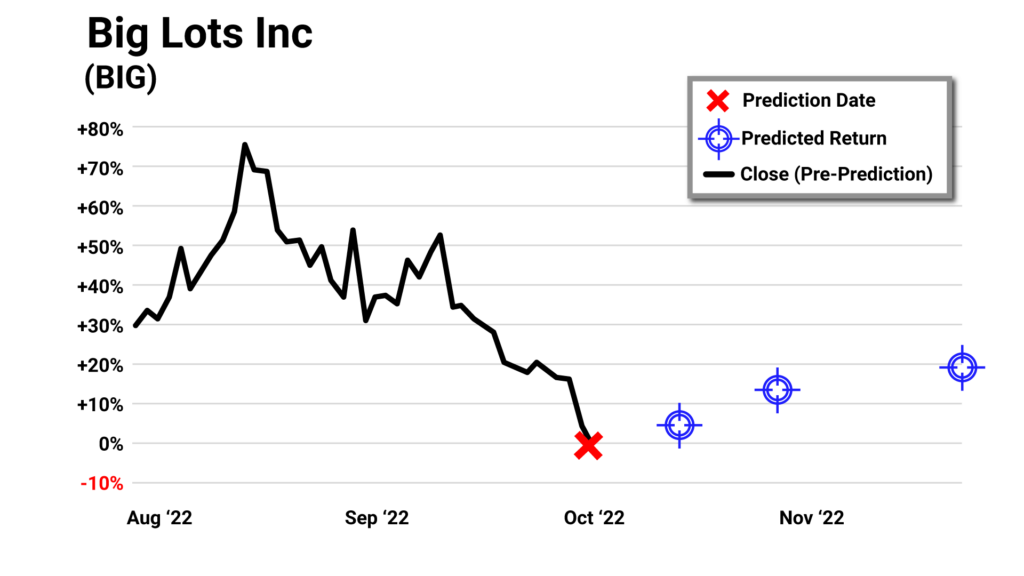

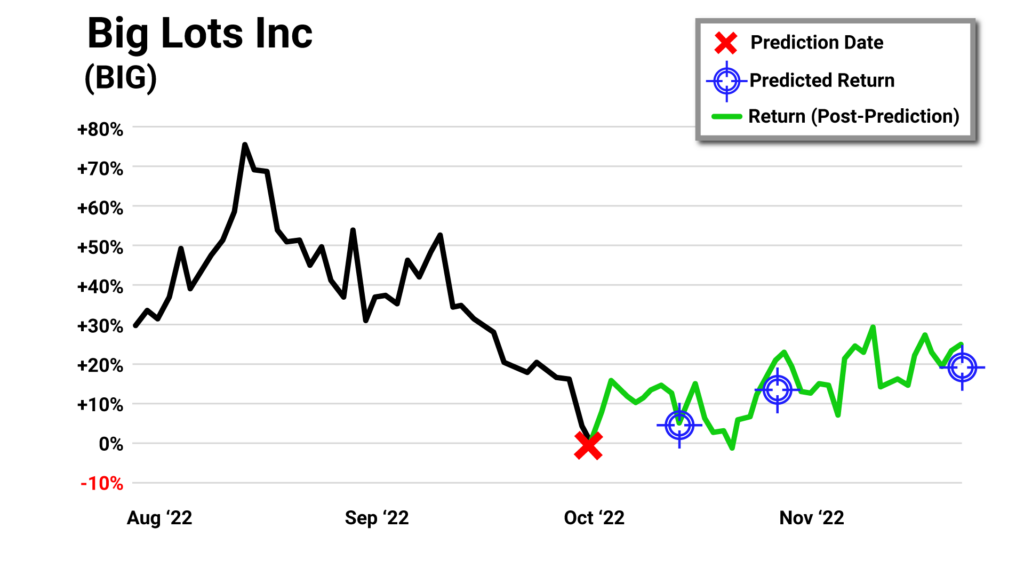

Or take this prediction of Big Lots…

CHRIS:

Looks like An-E says it’s likely to go up 14% in a month… right in the range we’ve been talking about…

Which before didn’t seem like anything special… but now looks like it could be a big money maker.

KEITH:

Totally changes your perception of a 14% gain, doesn’t it?

CHRIS:

It does… KNOWING I stand a good chance to make 14% is way more exciting than a 1 in 10 shot I’m going to make 100%.

I can see now how having a high level of certainty can be a true gamechanger.

KEITH:

And let’s see if that high level of certainty panned out…

An-E was a little off… but in the right direction…

Instead of making 14%, you would have made 21% on this trade.

And if you were to compound 21% monthly… you would turn that $10,000 into nearly $100,000…

| Return | Profit | Total | ||

|---|---|---|---|---|

| Month 1 | $10,000 | 21% | $2,100 | $12,100 |

| Month 2 | $12,100 | 21% | $2,541 | $14,641 |

| Month 3 | $14,641 | 21% | $3,075 | $17,716 |

| Month 4 | $17,716 | 21% | $3,720 | $21,436 |

| Month 5 | $21,436 | 21% | $4,502 | $25,937 |

| Month 6 | $25,937 | 21% | $5,447 | $31,384 |

| Month 7 | $31,384 | 21% | $6,591 | $37,975 |

| Month 8 | $37,975 | 21% | $7,975 | $45,950 |

| Month 9 | $45,950 | 21% | $9,649 | $55,599 |

| Month 10 | $55,599 | 21% | $11,676 | $67,275 |

| Month 11 | $67,275 | 21% | $14,128 | $81,403 |

| Month 12 | $81,403 | 21% | $17,095 | $98,497 |

And that $25,000 into nearly $250,000.

CHRIS:

And just like the 8% monthly gains, and 12% monthly gains… 21% isn’t exactly shooting for the moon.

I mean that’s still a pretty reasonable gain… it’s quite attainable.

But the results are incredible.

Game changing… as you said.

And as you showed, since the gains aren’t that huge, those incredible results come from the level of conviction and not the size of the gains.

We’re not talking 400%, 300%, or even 100% in a month.

Just… 12% here, 20% there and depending on the size of your investment, within a matter of months you could be adding tens of thousands, or even hundreds of thousands to your account.

KEITH:

And this is one of the biggest things most investors overlook… and it’s why they aren’t successful.

They don’t take into account the probability that a particular investment will actually play out in real life the way they think it will or the way they’re told at the beginning.

They hear about the next hot stock pick… they’re told could make them 1,000% returns or more and then how does it turn out?

Well from the start, it’s a wild guess. They have no idea.

That’s why more often than not… it doesn’t end up being a 1,000% gain… does it?

More often than not, it ends up being a loss… or takes years and years to make a modest gain.

And that’s because there are two huge factors to every investment:

- The amount of money you can make

- And the probability that outcome will occur

Everyone is focusing on factor #1: “How much money can I make from this investment?”

While not even giving a second thought to the second factor which is: “How likely am I to actually make that money?”

That’s why they’re unsuccessful.

Often times, without even realizing it, they’ve gone for the “all or nothing” shot…

And passed up tons of other investments that could have still made them a solid return… but were far more likely to pan out.

This is why so many individual investors fail to beat the market.

An-E enables you to choose that first scenario… A solid return and a high probability it’ll happen.

And choose it month after month.

Until you stack up such huge profits you don’t know what to do with them all.

An-E’s not perfect 100% of the time…

But its smart, machine learning, predictive A.I. program puts the odds so much in your favor that once you start using it… you’ll never want to invest any other way again.

Like I said, as far as I’m aware, nothing like it has ever been made available to Main Street before.

CHRIS:

So, the message I’m getting here is probability is just as important as gains.

KEITH:

It absolutely is.

CHRIS:

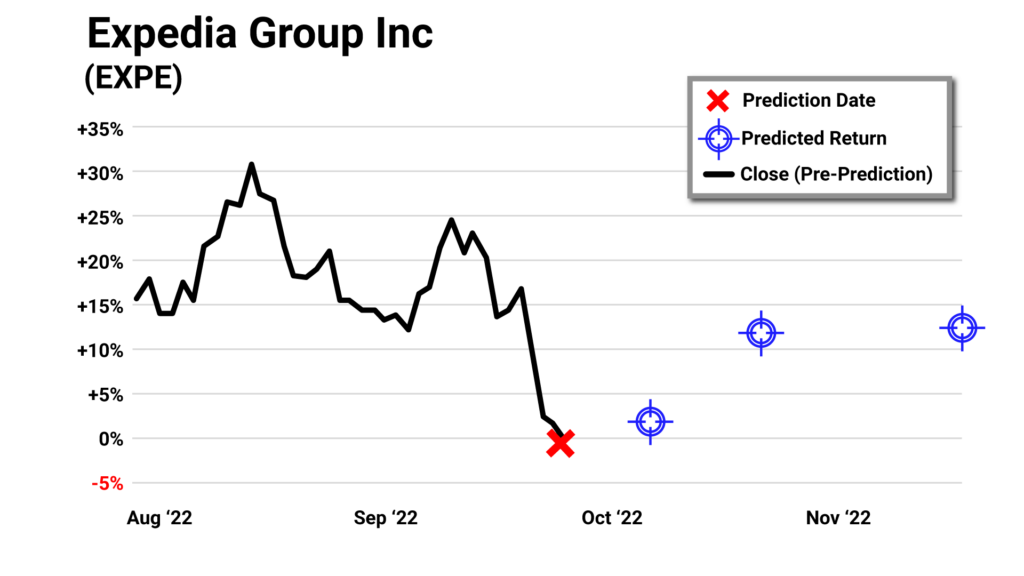

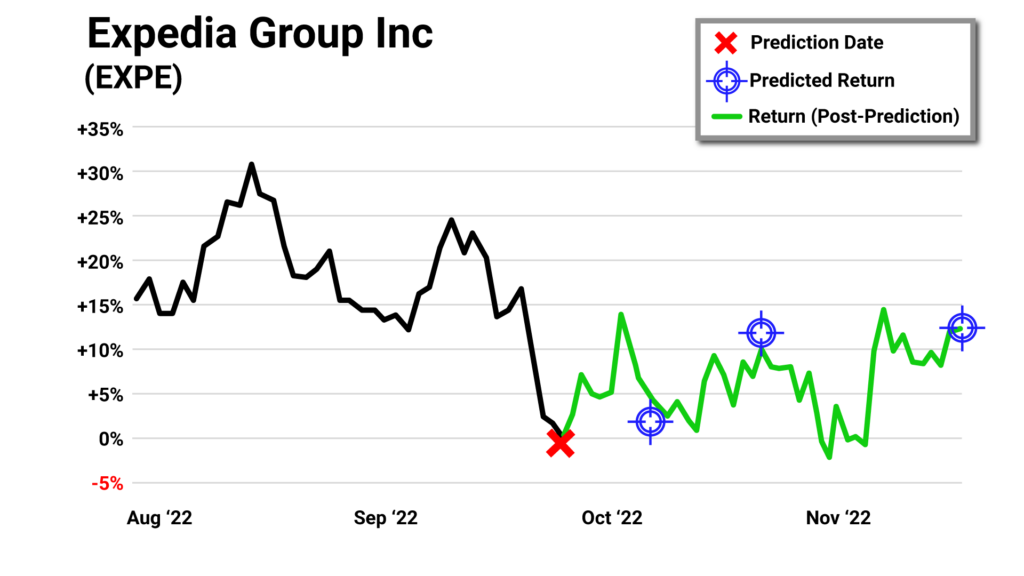

So, let’s take this example of Expedia…

In this example…

It looks like An-E’s predicting you could make about 10% in a month on Expedia… and what you’re saying Keith is the high likelihood you’ll make that 10% is just as important as the 10% gain itself.

KEITH:

That’s exactly right…

Remember how we simply gave An-E a single command and had it learn on its own?

There’s a reason why we gave it the command of finding stock prices 30 and 60 days in the future… and not two and three years in the future.

And that comes back to how confident we could be in those predictions.

The closer to the present, the more accurate the prediction.

The further into the future… the less accurate.

CHRIS:

And here, the accuracy speaks for itself, Expedia’s up almost exactly 10% in 4 weeks, one month.

KEITH:

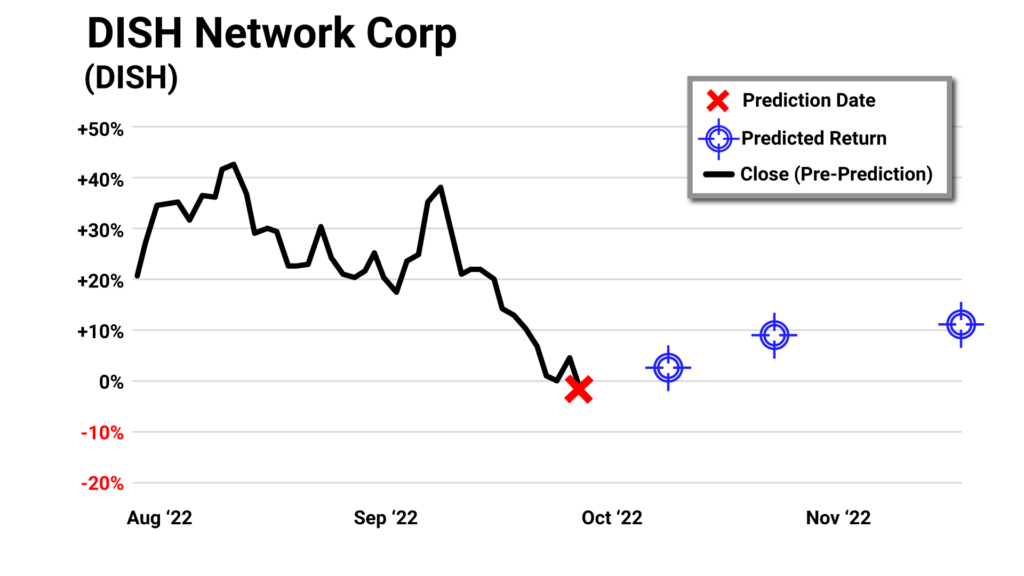

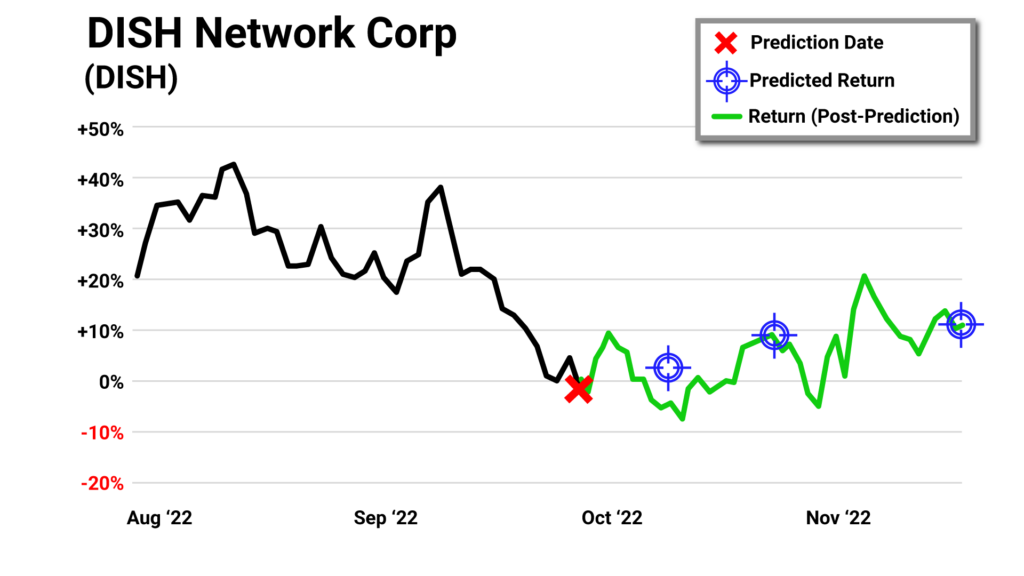

It’s the same concept with this example of Dish Network’s stock…

Up almost 8% in a month… just as An-E predicted…

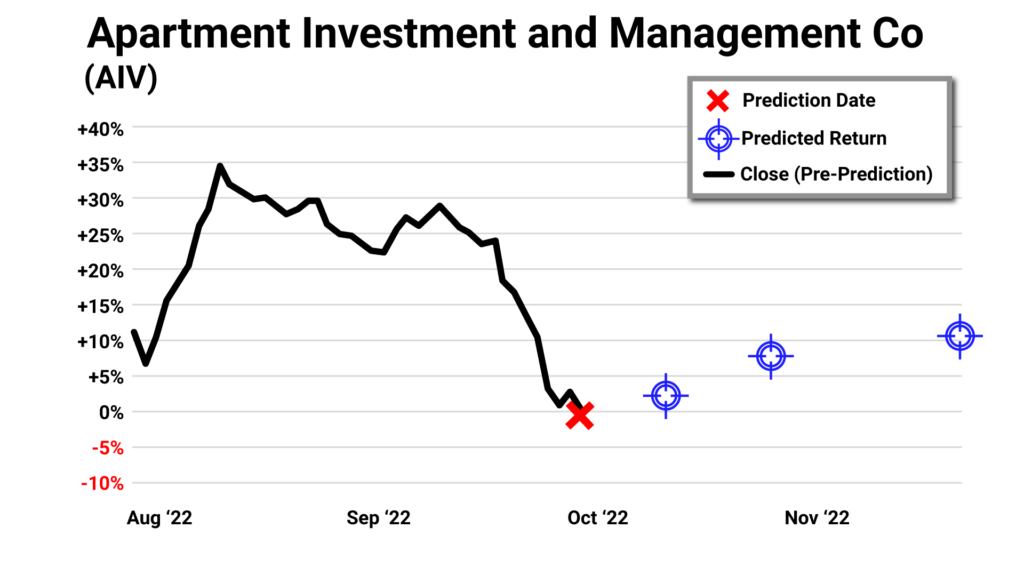

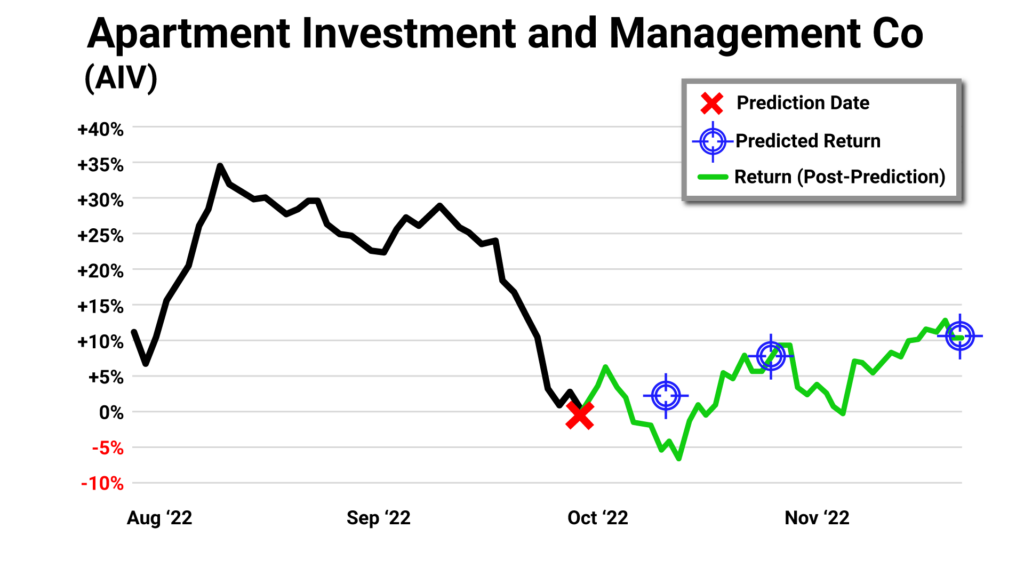

Or the stock of the Apartment Investment and Management Company — AIV…

Here, you had another great opportunity to make 8% in a month.

This is why we focus on profiting from the market’s short-term moves.

Do you want to pick a stock based on how you think the world will be in three years?

Good luck.

Just look at all the madness that’s happening in the world today.

No one could have predicted it several years ago.

Who would have thought back in 2017 or 2018 that in a few years a virus would sweep across the world, forcing folks to quarantine in their homes, shutting down businesses, and cratering the stock market.

Or that Russia would invade Ukraine…

Or that we would see gas at $7 a gallon.

No one could have seen these events coming.

My point is… even if you’re using A.I., trying to forecast years into the future is a difficult task.

But, one month from now, we can get pretty accurate. Humans can’t do that.

In today’s chaotic world, there’s still a lot of money to be made.

You just need to put the odds in your favor by focusing on what’s more predictable — the market’s short-term moves.

CHRIS:

I’ll say!

As we’ve seen, you can use An-E to ring up one one-month move after another and amass some incredible gains.

It makes waiting three years to see your gains materialize look like a fool’s errand.

This is truly a revolutionary system you’re revealing today, Keith.

But it also makes me wonder… why now?

After all, A.I. has been around for a while… as you said, your company, TradeSmith, has been a leader in financial technology for a decade.

Couldn’t you have rolled out An-E years ago?

That way, you would have given your members the chance to make good money even in all the chaotic times we’ve been experiencing lately.

KEITH:

Chris, believe me… if we could have, we would have.

And you’re right… A.I. has been around for many, many years now…

As we’ve mentioned it’s mastered board games like chess. It also made a splash by beating a grandmaster in the ultra-complex Chinese board game “Go.”

It’s been used by companies like Google and Amazon to predict customer behavior…

Even companies like Hershey’s to help reduce waste in their manufacturing process.

But remember, we’re using it for the financial markets…

An arena with a nearly infinite number of data points to analyze.

We couldn’t have created An-E in the final form it’s in today with early versions of A.I — they weren’t sophisticated enough.

We needed A.I. to reach a level where it could learn on its own.

And that’s where A.I. is now.

It’s reached an inflection point.

CHRIS:

An inflection point?

Meaning it’s going to grow exponentially from where it is right now?

We already have ChatGPT where folks can’t tell whether they’re chatting with a human or a machine.

It feels like we’ve reached a pinnacle, not an inflection point.

KEITH:

You’re right, it does feel that way…

But a big reason I believe A.I. is at an inflection point is because A.I. has recently “broken” a long-standing scientific law about the growth of technology.

A law known as Moore’s Law.

CHRIS:

I think I’ve heard of that.

Doesn’t it have something to do with the doubling speed of computing?

KEITH:

It does.

Back in the 1960s, a scientist named Gordon Moore observed the exponential growth rate of computing power… and predicted every two years the number of transistors on microchips would double.

In other words, computing would double every two years, like you said.

This is now commonly referred to as Moore’s Law.

At the time, this predicted growth rate was seen as a breakneck pace.

But it happened just as Moore predicted…

In fact, over the past few decades, we’ve seen it happen with our own eyes.

Just look at the advances in computing power. They’ve been remarkable.

Today, the smartphone you have in your pocket has far more computing power than all of NASA had when we sent a man to the moon in 1969. All of NASA!

So, since the dawn of computing, Moore’s Law has held true…

The growth rate of computing, fast as it’s been, has held constant… doubling roughly every two years for the last five decades.

But, just recently, that’s changed… and in a huge way.

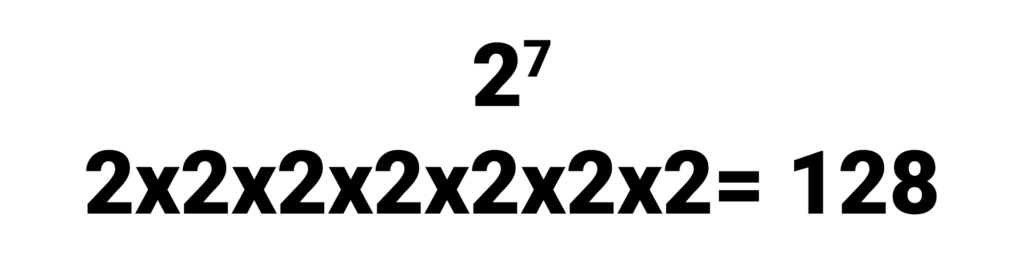

A.I. is now said to have “broken” Moore’s Law.

Now, top researchers are saying A.I. is doubling its computing rate not every two years, but every three and a half months.

CHRIS:

Three and half months!?!

That’s a huge change, especially when you consider the fact that the growth rate is exponential.

KEITH:

That’s the key…

Three and a half months is roughly seven times a shorter time frame than two years.

But, shortening the time computing takes to double from 24 months to three and a half months doesn’t mean it’s advancing seven times quicker.

Since the growth rate is exponential like you said, it’s doubling on top of itself every three and a half months… doubling on top of doubling on top of doubling…

Meaning it’s actually increasing by a rate not of 7 times faster… but of 2 to the 7th power faster.

Or 128 times faster.

CHRIS:

And my brain just exploded…

That’s why you’re the data scientist.

KEITH:

Math aside, what all this means is as smart as A.I. is… it’s only going to get smarter and smarter over time, and it will be doing so at an extremely rapid pace.

And as we’ve said, because of machine learning, it’ll be able to become smarter without a human, learning on its own.

An-E is a part of this new technological paradigm.

It gets smarter over time.

Giving anyone with access to it a tremendous edge over everyone else.

CHRIS:

So, with all the accelerated growth of A.I. you just outlined… where we are today — at this point in time — is really a critical point in technological history…

KEITH:

It really is.

And unfortunately, most people don’t fully understand that idea…

And as a result, they’ll get left behind.

CHRIS:

Left behind… what do you mean?

KEITH:

Well, like I mentioned earlier, there’s really only one place in America where folks truly understand the financial impact of everything I’ve just outlined.

And that is Wall Street.

Look, A.I. is the entire game these days. Any Wall Street firm worth its salt is using machine learning and A.I. to analyze the market…

Goldman Sachs, Bridgewater, JPMorgan, BlackRock… you name it… they’re all using A.I. to gain an edge.

But here’s the rub, Chris…

While these guys are happily using this technology to line their own pockets, they’re not sharing it with the main street investor.

You know the game. These guys will sell you mutual funds and other expensive fee-based products that rarely beat the market…

But they keep the good stuff — the stuff that actually works — to themselves.

That means if you’re a regular guy who’s not using A.I. and machine learning to invest…you’re not getting the best possible research that’s available today.

Especially if you’re trying to play “catch up” on your retirement.

Did you know that many Wall Street firms and hedge funds still made huge profits In 2022?

CHRIS:

I didn’t know that but it doesn’t surprise me.

KEITH:

In fact, one hedge fund (who uses A.I. primarily to make trades) made the most money any hedge fund has ever made!

Meanwhile, the average investor — who doesn’t have access to A.I. — lost around $40,000 in 2022. To this day, many investors are still sitting on major losses from last year.

The simple fact of the matter is, index funds and mutual funds are NOT going to save your retirement.

A.I. can — An-E is living proof of that.

CHRIS:

So everyday investors are only going to fall further and further behind as we move into a more technologically driven future?

KEITH:

I wish that wasn’t the case, Chris. But sadly, that’s the reality we’re faced with today.

As we’ve seen today, never before in history has there been a tool with capabilities even close to A.I. and machine learning…

To find incredible gains, quickly AND most importantly, with as little risk as possible.

Using it to analyze stocks is like having 100,000 financial analysts at your fingertips.

It’s a godsend for any investor…

But unfortunately, most folks don’t have access to it. A.I.’s expensive and complicated — and so it will remain the domain of Wall Street for years to come. This puts the everyday investor — and the vast majority of Americans — at a MASSIVE disadvantage…

It’s like this… imagine competing in a race where you’re on a bicycle and everyone else is in a Formula 1 racecar.

It doesn’t matter how much you’ve trained, how fast you can pedal… even if you’re a Tour De France champion… you’re still going to lose.

CHRIS:

Because the guys on Wall Street are using a far superior technology… and there’s no incentive for them to share it with you.

KEITH:

Exactly. That’s the world we live in today…

CHRIS:

So, you and An-E are really the only path that regular people have to take on Wall Street and beat the market in this new A.I. powered world we’ve entered?

KEITH:

As I mentioned before, my company has spent the past decade developing the most cutting-edge financial technologies on the market… this has connected me to quite a few folks in the highest circles of the financial world… and I don’t know of anyone else who’s using A.I. to help the regular guy…

As far as I know, other than our firm… Wall Street’s the only game in town…

CHRIS:

So, that doesn’t leave regular folks with many options especially in all the chaos we’ve entered.

KEITH:

Unfortunately, Chris it doesn’t…

CHRIS:

And so that’s a big reason you’ve stepped forward today…

That’s why you’re not keeping An-E’s forecasts all to yourself?

KEITH:

That’s right…

You see, we have a retirement crisis in America today.

I read recently that roughly 50% of seniors have little to no savings.

And with everything that’s going on in the economy…

Things aren’t getting any easier.

Just last year we saw the stock market drop nearly 20%.

We’ve seen inflation hit historic highs.

Groceries, gas, healthcare, and education…

The rising cost of everything is draining your savings.

It’s a terrible situation for people still working.

But it’s even worse for those who aren’t working.

These folks are counting on their nest eggs to provide them with security and comfort.

The value of their savings is being destroyed.

And the future is only going to get more chaotic.

What are folks to do?

The answer isn’t to invest in some longshot cryptocurrency or tech startup that has low odds of panning out at some distant point in the future.

The answer is to get smarter.

That is, to invest in things you know have a high-probability of working out.

That’s what An-E does…

It gives you an edge…

It tips the scales in your direction, puts the odds on your side.

And it won’t take you years to see results…

You could start making sizable gains in as little as a month.

CHRIS:

I love the sound of this, Keith. So, if I’m 65 years old, about to retire…

And I’m looking at all the chaos that’s been happening in the markets… and I want to make it all back and then some so I can live a rich retirement…

I shouldn’t be thinking “what’s the ‘magic’ stock or crypto recommendation that’s going to solve all my problems?”

Instead, I should be thinking about certainty, high probability.

KEITH:

Exactly. There’s no “magic bullet” out there.

And even if there was, it’d probably take five years or more to hand you the kind of gains you need to catch up on your retirement.

Not to mention, that’s putting all your eggs in one basket.

CHRIS:

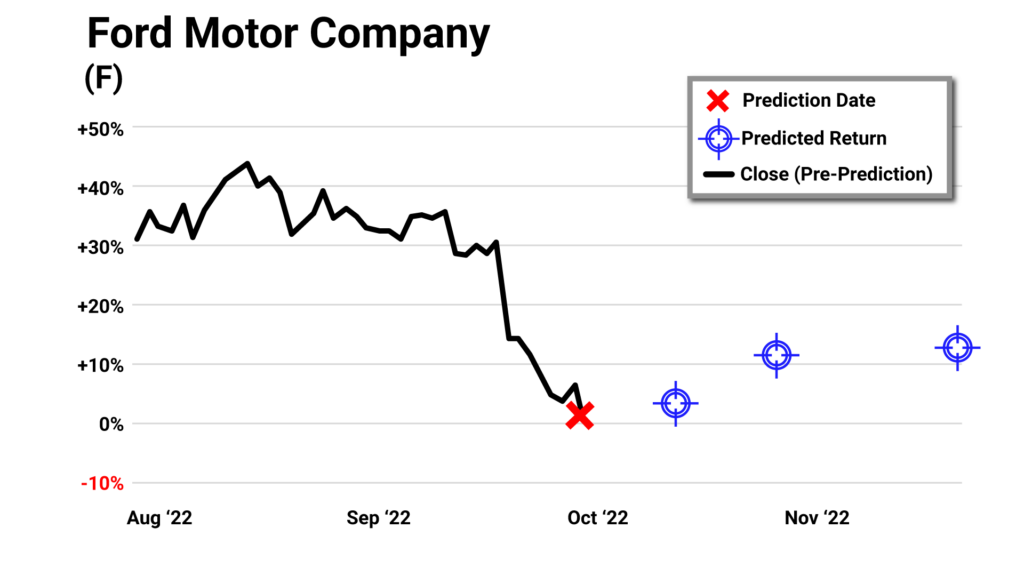

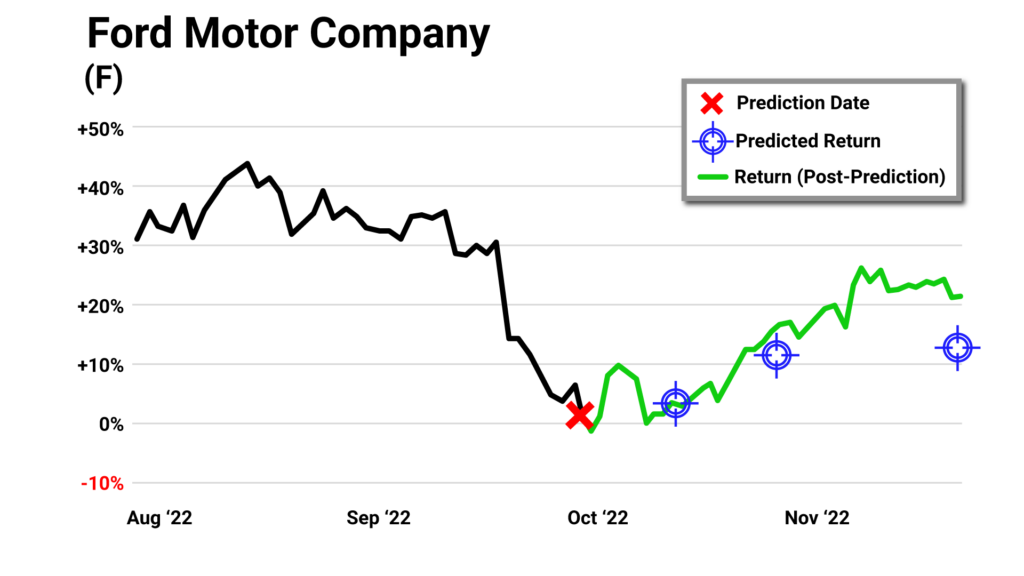

So, I should be looking at one of An-E’s forecasts like this one of Ford.

And say to myself… An-E is predicting Ford could make me almost 12% this month…

Why don’t I put some money in Ford?

So, I do…

The month ends… we check the results…

In this case, Ford actually went up a little higher than An-E predicted… it went up 15%.

I sell… I take my 15%.

And then, as we discussed, I can put my money into my next trade…

And before I know it… in six or eight months I could be sitting on some pretty nice, big gains.

KEITH:

Exactly. Doesn’t that sound a lot better than putting your money in a stock and waiting three years hoping and praying?

CHRIS:

It sure does.

KEITH:

And 15% might even be on the lower end.

We’ve seen many examples of stocks An-E’s predicting will go up 25% or more in month.

50% is well within reach.

This is a system that could put you on the path to living the retirement of your dreams in just a few months.

If you took $10,000 and made 50% gains per month, you’d walk away with nearly a whopping $1.3 million in a year.

Even if you do a fraction as well, you’re still walking away with several hundred thousand dollars.

CHRIS:

That would be quite a tidy, little profit, especially considering all investing carries some risk, and past performance doesn’t equal future success.

But, going back to what we were discussing before, I know there are a lot of folks at home that find themselves in the situation you described earlier.

They’re at or near retirement age.

They may have suffered investment losses the last year or two.

They feel behind because of inflation.

And they like this idea of certainty…

That advanced mathematics, A.I., and machine learning can tip the odds in their favor and not only help them make big gains, but give them the peace of mind that an investment prediction has a high probability of going where it’s forecasted to go at the outset.

We’ve covered the theoretical.

Now, let’s talk about the practical…

How do people out there at home put everything we’ve talked about into practice?

How do they take An-E’s predictions and incorporate them into their investing to make the kind of money we’ve been talking about?

KEITH:

That’s a great question, Chris and it all starts with a brand-new research service my company, TradeSmith, is launching for the very first time.

Remember, for the past decade, TradeSmith has been a leader in creating the most cutting-edge financial innovations for the everyday person.

We’ve created predictive technologies for the stock market, the options market, the crypto market… our systems analyze commodities, ETFs, real-estate trusts, you name it, we study it…

And we’ve helped thousands of everyday folks — from school teachers like my parents to accountants to doctors — live the retirement of their dreams.

CHRIS:

You certainly have.

I’ve had the privilege of reading some of the letters your customers wrote and here’s what a few of them said…

Robert M. Said:

I have close to 30 positions over 100% and many more that are still open and climbing. With my leader being a 2,400% winner. I’m up over $200,000.– Robert M.

Leslie S. said one of your products was the best tool she’s ever purchased. And that she no longer feels like she’s guessing, but relying on factual data at her fingertips.

It’s by far the best tool I have ever purchased. I no longer feel like I just guessing, but relying on factual data at my fingertips.– Leslie S.

Wes W. said your tools have helped him make $100,000.

[TradeSmith tools have helped me make] at least $100,000.– Wes W.

And Frank K. said that thanks to your company’s research and tools, he and his wife have finally hit “millionaire status.”

Thanks to TradeSmith, my wife and I have finally hit ‘millionaire status’.– Frank K.

That has to feel good not just for them but for you too.

** The investment results described in these testimonials are not typical. Investing in securities carries a high degree of risk; you may lose some or all of the investment.

KEITH:

Chris, we love receiving letters like those. Especially considering the terrible market we’ve been in the last 18 months.

Those stories are why we do what we do.

But I imagine we might be receiving some even better than those, just a short time from now.

Because as good as all the innovations we’ve launched in the past have been…

Today, I’m happy to announce TradeSmith is launching a research-service that’s on an entirely new-level, the next generation in predictive technology…

It’s a research service called Predictive Alpha.

And it’s the only A.I. and machine-learning based research service we know of available to the everyday person.

Predictive Alpha will contain all of An-E’s stock forecasts, updated daily, for nearly 3,000 stocks, funds, and ETFs.

And members will be able to look up one stock per week to see what An-E’s saying the future price of that stock will be in one month.

But that’s just the start…

Remember, An-E is getting “smarter” all the time… so It’s only a matter of time before we’re confident in An-E’s predictions in even more stocks… beyond the nearly 3,000 that are currently available… and we add even more stock predictions to Predictive Alpha.

Just type in the ticker symbol and you’ll be able to see what An-E’s saying the future price will likely be.

Not only that, we have a team of data scientists and market analysts who will be devoted to this research service full-time, analyzing An-E’s predictions, finding the most potentially lucrative stocks, and issuing easy-to-follow trade recommendations.

CHRIS:

This interview keeps getting better as it goes. So, it sounds like there are really two ways to go about using this service…

You can either do your own research, and search for stock opportunities yourself or take the recommendations from your team of experts.

KEITH:

That’s right. Or a combination of both.

CHRIS:

If I was watching this at home, this sound like great news… to have access to technology of this caliber. But I do have a few questions…

The first of which is… do you need to be good with numbers or computers to use Predictive Alpha?

KEITH:

Not at all, Chris.

As you said there are two ways to use this service…

The first is to do your own research.

We’ve created a members-only website where we’ll be hosting Predictive Alpha.

When you sign up to become a member, you’ll receive access to the site.

When you get to the site, all you have to do is type the ticker symbol of any stock that we cover, press the search button and An-E’s prediction will be produced for you right there on the screen in a matter of seconds.

A new prediction is generated every day for nearly 3,000 stocks and ETFs.

And, as I said, we plan on adding even more in the future.

CHRIS:

That does seem pretty easy.

I like to say if you can use a search engine like Google, you can use Predictive Alpha.

That’s the level of computer savvy you need to use this service.

Simply type the ticker symbol or name of the stock into the search box and select the Predictive Alpha tab, then An-E will generate a fully detailed prediction forecast for the next 30 days.

Do this once per week, for any one of the stocks that we cover. This can add a lot of conviction to your investing, both in terms of the ability to make big gains and avoid big losses.

But, believe it or not, we’ve made it even easier than that…

As I mentioned, we also have a team of devoted analysts who will interpret An-E’s findings and send you their favorite recommendations, via email Trade Alerts, whenever a great new opportunity arises.

One every other week, or two per month.

The two gentleman who head up this team are some of the top market experts in the country.

One is a Harvard educated analyst who holds two of the most difficult financial certifications that you can attain. He’s both a CFA — a Chartered Financial Analyst and a CMT — a Chartered Market Technician. Because of his market experience and insights, he’s been featured in Forbes and on Nasdaq.com.

He’s also a natural born teacher and coach who’s created investment courses for some of the largest banks and brokerage houses in the country.

The other is cut from the same cloth… he’s an MBA who lives and breathes investing. He’s also developed investment courses and has been published numerous times, including a book he co-authored about Forex trading.

And every week, these gentlemen are going to get on camera and provide a weekly video, in which they discuss the state of the markets and provide updates about their recommendations.

You’ll also receive a transcript of these videos if you’d prefer to read these updates instead.

CHRIS:

Sounds like if I were to sign up, I’d be in good hands.

KEITH:

You’d be in great hands.

We know that investing using an A.I., machine learning algorithm is new for most people.

So, we wanted Predictive Alpha to also include a personal touch… we wanted to add in that extra level of service.

So, there will also be folks I trust probably even more than myself helping you get the most out of your membership every step of the way.

When you become a member of Predictive Alpha, you’re also getting research and analysis from an entire group of some of the brightest financial analysts in the country.

CHRIS:

So, it seems as though using this tool is fairly easy, as simple as looking at a chart…

But, for folks who don’t want to look up stocks on their own, the two gentlemen you mentioned earlier are going to issue recommendations?

KEITH:

They are.

Every day, they’re analyzing An-E’s findings to determine the most lucrative trades on the market — ones with the highest probability of going up.

And once every other week, they’re going to issue a trade with a holding-time of about a month.

CHRIS:

Interesting… throughout this presentation, we’ve shown An-E’s predictions of two weeks, a month, and two months.

So, all the trade recommendations in Predictive Alpha are going to have the holding time of one month?

KEITH:

They are. One month which translates to about 21 trading days.

And you’re right, we showed many examples of An-E’s predictions that went out as far as two months… and they were pretty accurate. But, like I said before… the shorter the time horizon from the prediction point, the more accurate the forecast is likely to be.

So, we’re more confident in the one-month forecasts.

And this shorter holding time allows you to compound your gains more quickly.

CHRIS:

So, if I were to sign up, your team is essentially doing all the heavy lifting for me, An-E is.

KEITH:

They would be. Let me give you an example of a trade.

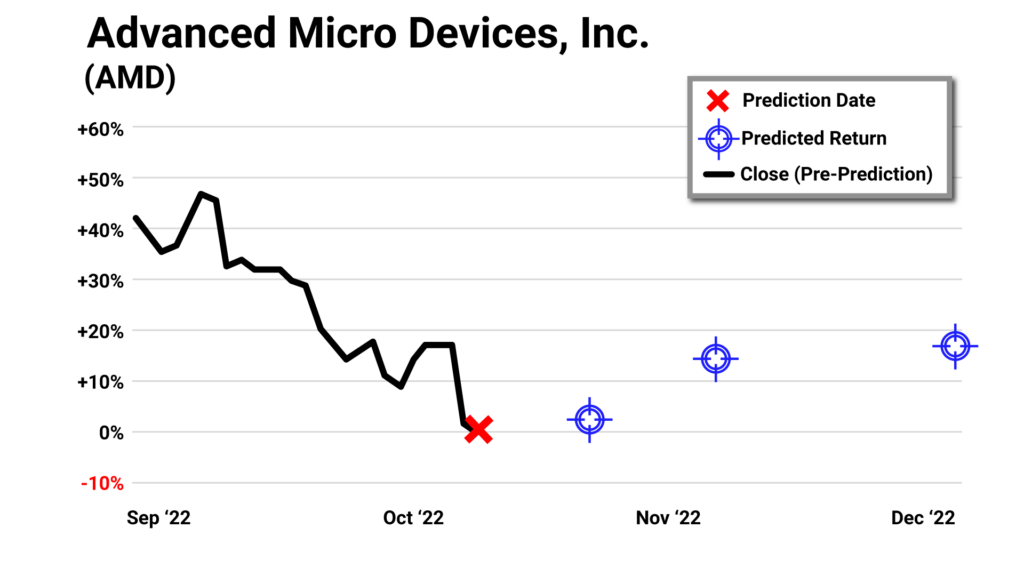

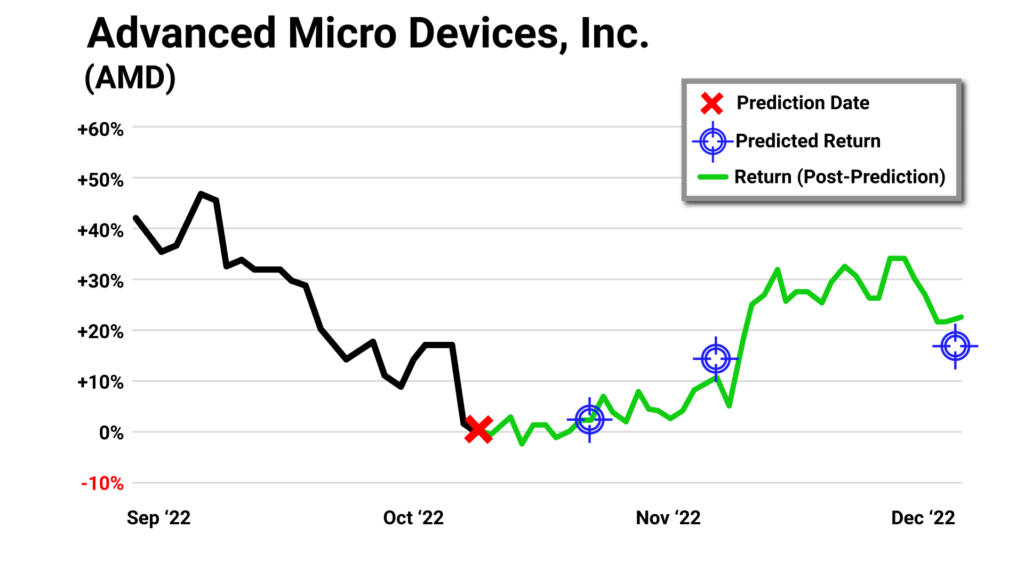

Here’s one of An-E’s predictions for Advanced Micro Devices.

Here, in early October, An-E is predicting AMD will go up around 13% over the course of the next month.

So, if our team determined this was one of the best stocks to buy, they’d issue a “buy alert” in October.

Then you would simply hold the stock for about a month and then sell when we recommend.

The final step is simply to collect your potential profits.