- He turned $7 into $1 million in the dot.com boom. Now one of America’s leading tech forecasters is sharing the most important message of his career:

- As part of the biggest shift to the financial system in decades, this Government-issued code could soon be mandatory to access your social security income, pay your taxes and cash your paycheck.

“Saying [it] would be a game changer is almost downplaying the potential impact”.

– Forbes

Dear Fellow American,

Be on the look out for a letter from an organization called the ‘Bureau of the Fiscal Service’.

It’s a branch of the federal government, based in Philadelphia, P.A.

And I’m expecting it to do something that’ll shock millions of people in the near future…

It could soon mail you and millions of Americans an important document.

Inside, I think you’ll find an image like this:

It looks like the kind of QR code you scan all the time in stores, restaurants and bars all over the country.

But this code will be different.

It would be issued directly to you by the United States government.

In a move Wired claims could “shake the US Financial System,” you would be asked to keep it safe… and not to share the image with anyone or on social media.

Because just like your Social Security number…

Or your passport…

If I’m right, you’ll need this federally-issued code to do many of the things that are most important to us.

Without it, you may not be able to access or spend your Social Security income…

The IRS will demand it when you pay your taxes.

You’ll be asked to provide it to your bank in loan or mortgage applications….

And your paycheck may not clear without it.

Put simply, I’m preparing for this Federal QR code to be compulsory.

And that’s just the start…

This code could soon mean no more PayPal, ApplePay, Zelle, or Venmo…

It could mean your bank stops offering checking and saving accounts altogether.

And if you want to pay for a meal out, or a vacation… give your grandchildren money on their birthday… or split a bill with friends…

There’s a good chance you would need your government-issued code.

It’s part of the single biggest change to the financial system in decades… a “quantum leap” for money, says Bloomberg… that’ll impact every single American, whether you have $10 or $10 million.

I realize this is surprising, perhaps unbelievable. But as a currency expert at one of the largest financial research groups in America, I can say with certainty that even though most Americans have not heard of this sweeping change … it is coming. And soon.

You’ll see why I believe that in the next few minutes.

But the most important thing to understand is this: The global financial community is preparing for a massive overhaul to the way we use money in the United States.

By order of the White House…the Federal Reserve and U.S. Treasury have already started to take the necessary steps towards digital currency. So has the IRS. As have dozens banks and major American companies like Apple, Google, and PayPal.

It’s not the first time we’ve seen a major upgrade to the way we use money.

But if history is any guide, anyone who knows what’s coming and is positioned to take advantage of it, could make massive gains in the coming months.

In the next few minutes, I’m going to show you everything you need to know including:

- What changes the Federal Reserve and White House have planned for your money …

- How those changes could change your life…

- And the simple thing you can do right away to make sure you’re set to profit from while others get let behind.

If you’d like to see any of the research behind all the facts and figures I’m sharing with you today, you can do so on our Disclosures and Details page linked at the bottom of this page.

As I mentioned, this isn’t the first time something like this has happened in America…

“Lightning Money”

Consider that when the first telegraph lines launched in the 1840s, it wasn’t long before money “went electric.”

With telegraph cables suddenly growing at an exponential rate, Western Union’s “Lightning Lines” meant you could send money from New York to San Francisco in the blink of an eye.

That turned Western Union into a giant of the financial world… becoming one of the original eleven companies to be listed on the Dow Transportation Index…

It was the first in a series of shifts in the financial system that not only changed how we use money… but rewired the entire economy… and made the people involved millions of dollars.

Like Frank McNamara, who came up with the idea of the first credit card… founding the Diners Club in 1950 and ultimately putting a plastic card in every American’s pocket.

McNamara made hundreds of thousands of dollars for himself… and was voted one of Life magazine’s 100 Most Influential Americans of the century.

And the companies his invention

spawned did even better…

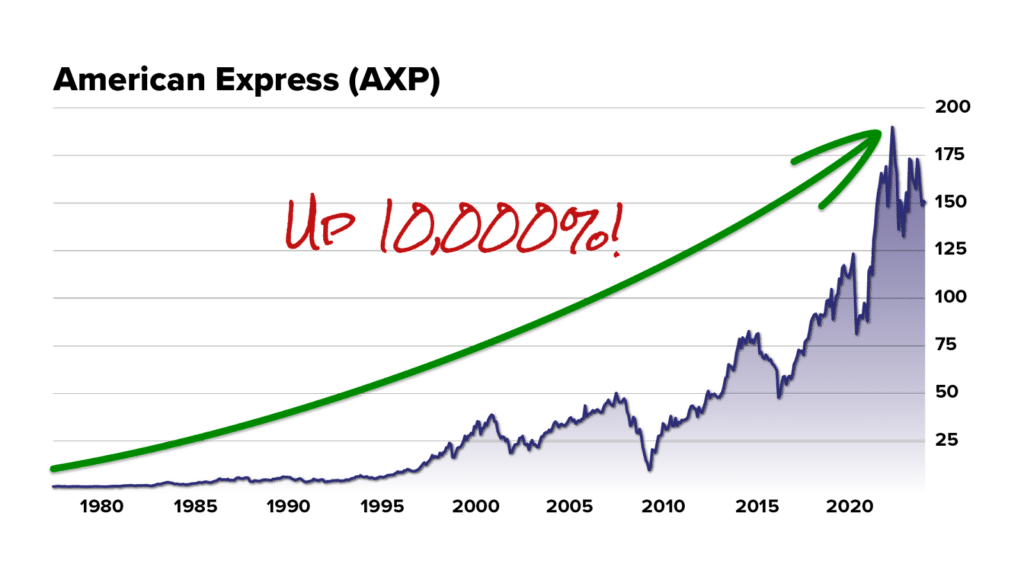

Like American Express, which rode the wave of mass adoption to rise nearly 10,000%.

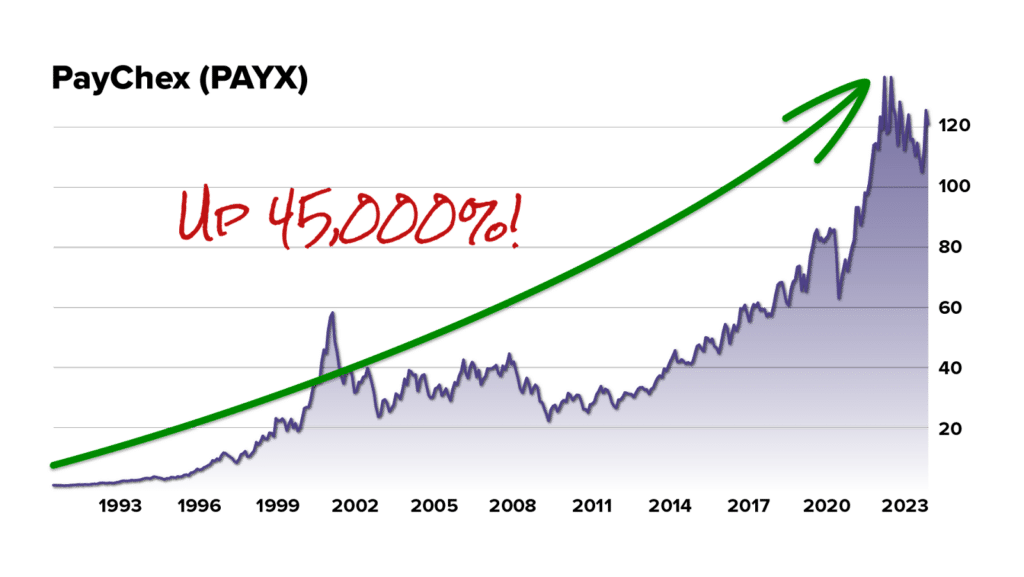

Or PayChex… which rose a staggering 45,000% since 1990… turning every $5,000 stake into $2.2 million.

Or when the roll-out of “chip and pin” technology saw millions of new bankcards being mailed out across America.

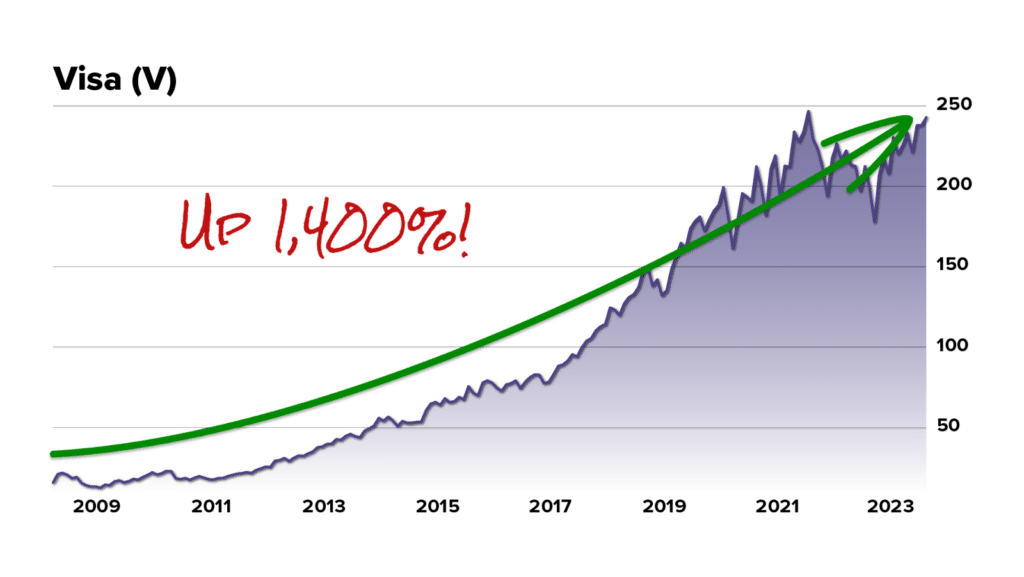

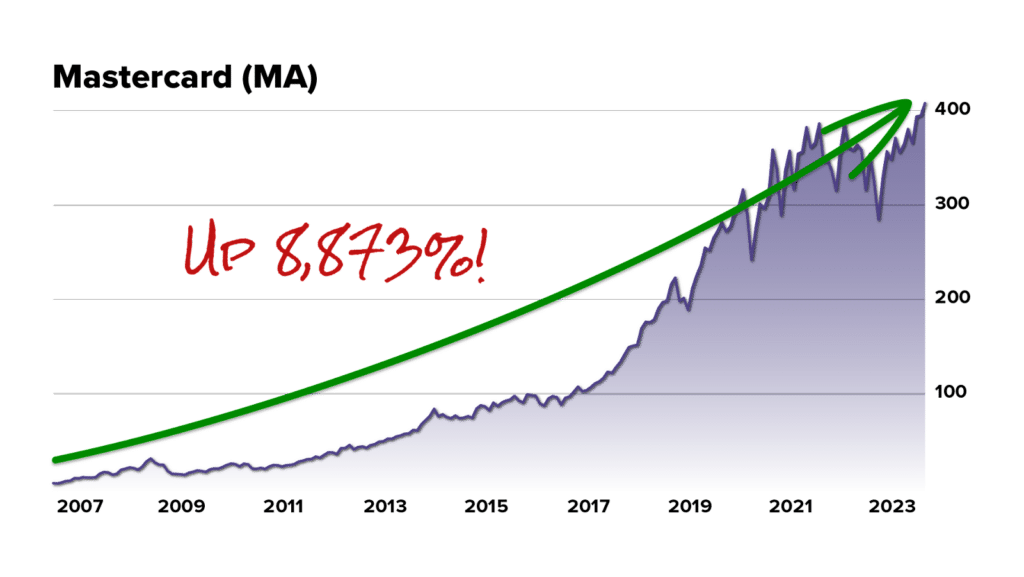

The companies behind the technology have grown to become some of the richest companies (and best investments) in the world – with Visa (V) rising more than 1,400%…

And Mastercard (MA) growing a staggering 8,873%…

Fast forward to today and it looks like history is repeating itself… thanks to the latest – and by far the biggest – shift in the financial system in living memory.

It involves what the IMF calls “the future of money.”

It has the full backing of the Federal Reserve, U.S. Treasury, and White House…

As well as many of America’s biggest companies, like Apple, Google, Bank of America, Goldman Sachs, Microsoft, PayPal, JP Morgan and Wells Fargo.

In fact, thanks to an Executive Order signed by President Biden last year, it could be the biggest mass adoption of new technology since Western Union’s “lightning lines”.

And what I’ve dubbed “Federal QR Codes” like this one are at the heart of it all.

But here’s the thing…

The rollout of the underlying technology behind this shift has already begun.

The Federal Reserve’s own numbers forecast it’ll grow 24,290% in the near future.

So if you want to capitalize on that growth, there’s not much time to mull it over.

You’ll need to make the handful of simple moves I’m going to tell you about right away.

Because if I’m right, by the time your code shows up at your home…

The really big returns will have gone… banked by insiders and other early-movers in the financial system.

I know that – because

I’m one of them

My name is Eric Wade.

I don’t work for the federal government.

Neither do I run a Silicon Valley tech firm… or a Wall Street hedge fund.

I do something far more interesting.

I specialize in understanding – and investing in – new technology that’ll change life for millions of people… and transform society in ways most people aren’t prepared for.

You can’t do this from behind a desk.

The only way to do it is to get your hands dirty… and do the work most other analysts won’t do.

Luckily, that’s exactly what I’m good at.

I grew up in a trailer in the mountains outside of Los Alamos, New Mexico – in this trailer, to be precise.

My whole family had to scrap for every dollar.

I had to walk a mile down the mountain, just to get to the school bus stop.

I learned early on that life doesn’t owe you anything.

To get ahead, you have to be willing to work 10 times harder than everyone else – and do it with a smile on your face.

That attitude helped me start my first business while still in high school (I ran a valet parking business and hired all my friends).

It helped me get ahead after college, when I joined the investment firm AG Edwards, before being recruited to join Merril Lynch.

And it helped me get every financial certification I could get, including Series 6, 7, 63, 65 and CFM (Merril Lynch’s own financial planning certification).

I spotted early on that the world was moving from a paper-based Analog world… to a digital society. And that the folks who took advantage of that would become tremendously wealthy.

Fortunately, my dad was a computer programmer… so I’d grown up knowing new technology “inside out”.

That’s why in the earliest days of the dot com boom when most folks were content to read about the Internet or open their first email account… I dove headfirst into the whole industry.

I was writing code and buying up domain names while most folks were still deciphering the @ symbol.

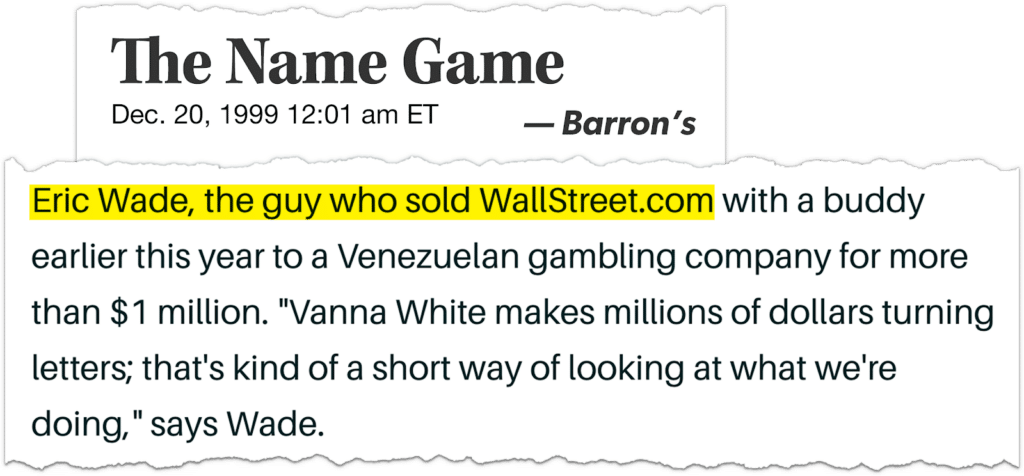

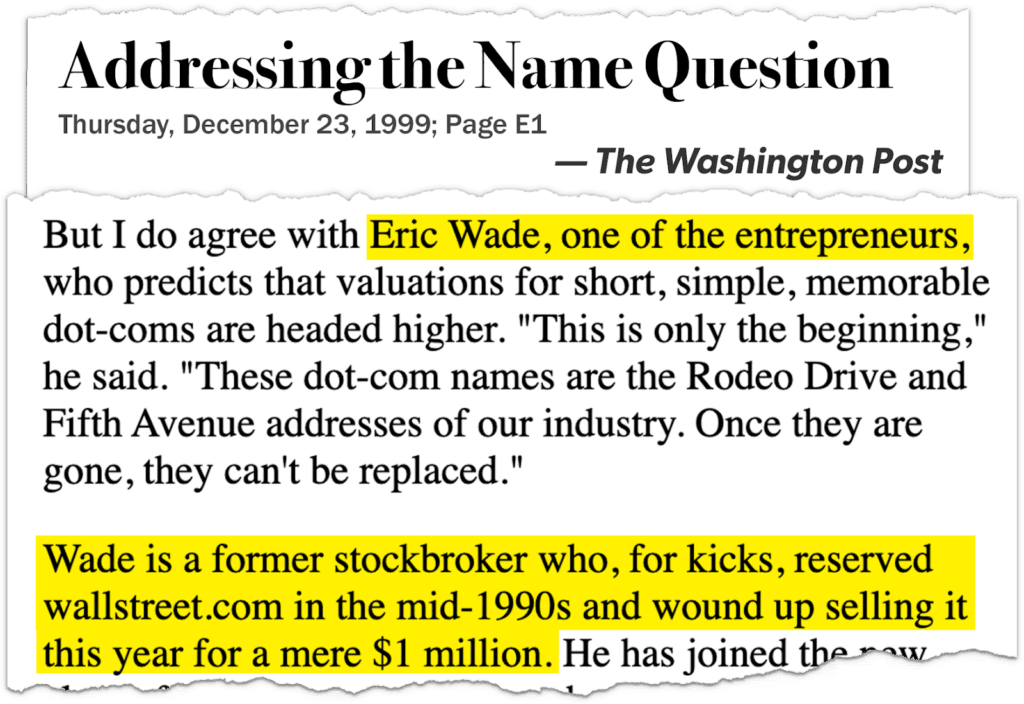

In fact, I bought WallStreet.com for just $7 in the mid-1990s…

…and sold it in 1999 for more than a million dollars.

That put me in the front page of Barron’s and The Washington Post.

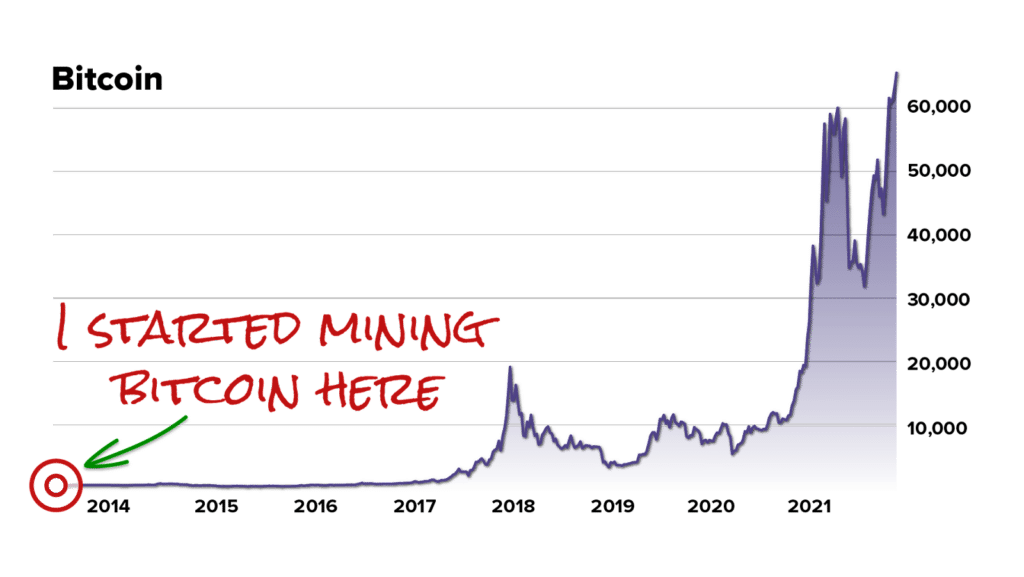

Fast forward to 2013 and I heard about a new financial innovation called Bitcoin.

Again: I didn’t want to just read about it… I wanted to roll up my sleeves and learn everything from the inside out.

I set up a Bitcoin mining rig in my garage in 2013.

By 2021, Bitcoin had risen nearly 1,000-fold.

I used the same approach when I tracked down Vitalik Buterin, founder of Ethereum.

Here we are together…

Soon after, I recommended Ethereum to a small group of people who started following my work. Back then you could buy in for just $90.

Within three years, the price shot up 30x to more than $3,000

Given my expertise in the field, I was recruited by one of the biggest financial research firms in the world – Stansberry Research – to share my findings with their subscribers.

Since then, I’ve helped hundreds of thousands of folks all over the world understand and profit from new technology.

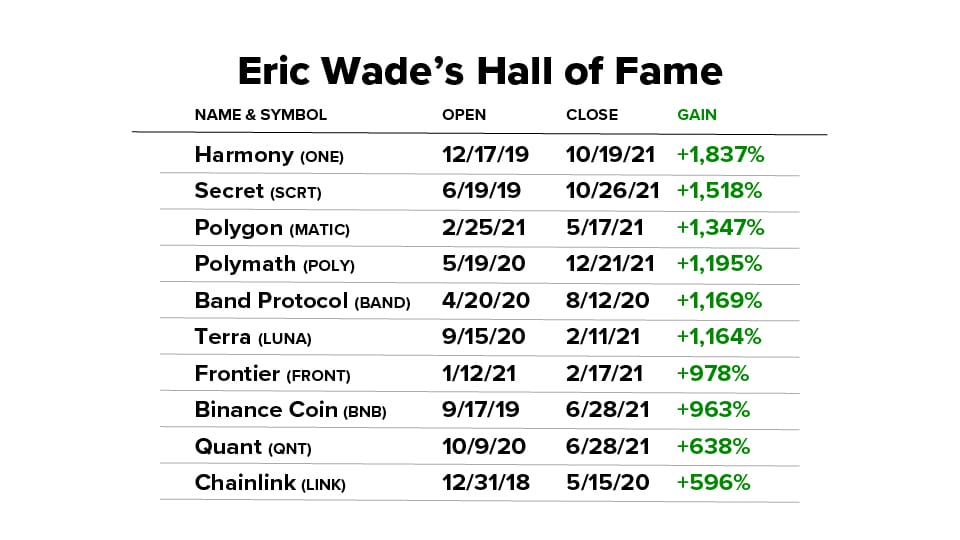

Of my recommendations, 27 would have doubled your money… 20 would have tripled or quadrupled your money… 13 would have made you at least five times your money… And 9 would have returned a minimum of 10 times your money.

One man even reported making $54 million with my research.

*Standard Disclaimer: The investment results described in this testimonial may not be typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

In fact, Stansberry had to create a “Hall of Fame” just for my research… because the cryptocurrencies I picked outperformed almost everything else.

Again, all this can be attributed to my ability to predict huge upgrades to the underlying technology of our financial system long before the mainstream.

It’s my life’s passion.

And that brings me to today… because the rollout of a NEW technology might be the biggest of my career.

This is bigger than Bitcoin or cryptocurrency, and will change life for everyone in the near future.

It has the complete backing of the Federal Reserve… U.S. Treasury… and the White House as you’re about to see.

That’s why I believe that once these “Federal QR Codes” start appearing in homes across America… the way you think about and use money will never be the same again.

A “Quantum Leap” for the dollar

You’ve likely heard a million different warnings about the changes taking place in America’s financial system right now…

How the White House plans take the dollar fully digital…

Track and monitor every transaction you make…

Even to ban cash altogether…

You may even have heard our rivals abroad – now known as the BRICS+ group – are preparing to launch a rival currency to “destroy the dollar.”

But the problem is…

Those wild predictions are one gigantic DISTRACTION.

Pay too much attention and you risk missing the much bigger… and far more urgent… shift unfolding with the U.S. dollar.

It’s going to have seismic implications not just for our currency… but for our savings, retirement, and whole way of life.

The problem is, I haven’t seen anyone out there properly explain what’s really going on – and what you need to do to prepare for it.

Today I’m stepping forward to change all that.

See, by now you’ve probably heard that in July, the Federal Reserve launched its “FedNow” payment system.

It allows banks to move money through the financial system at light speed… settling payments instantly… at any time of day… and on any day of the year.

Now, maybe you haven’t noticed much of a difference to your day-to-day life since the announcement, but the institutions involved with FedNow sure have.

If you bank with Wells Fargo… JP Morgan… BNY Mellon… or any of the banks onscreen now…

- 1st Bank Yuma

- 1st Source Bank

- Adyen

- Alloya Corporate Federal Credit Union

- Atlantic Community Bankers Bank

- Avidia Bank

- Bankers’ Bank of the West

- BNY Mellon

- Bridge Community Bank

- Bryant Bank

- Buffalo Federal Bank

- Catalyst Corporate Federal Credit Union

- Community Bankers’ Bank

- Consumers Cooperative Credit Union

- Corporate America Credit Union

- Corporate One Federal Credit Union

- Eastern Corporate Federal Credit Union

- First Internet Bank of Indiana

- Global Innovations Bank

- HawaiiUSA Federal Credit Union

- JPMorgan Chase

- Malaga Bank

- Mediapolis Savings Bank

- Michigan Schools & Government Credit Union

- Millennium Corporate Credit Union

- Nicolet National Bank

- North American Banking Company

- PCBB

- Peoples Bank

- Pima Federal Credit Union

- Quad City Bank & Trust

- Salem Five Bank

- Star One Credit Union

- The Bankers Bank

- United Bankers’ Bank

- U.S. Bank

- U.S. Century Bank

- U.S. Department of the Treasury’s Bureau of the Fiscal Service

- Veridian Credit Union

- Vizo Financial Corporate Credit Union

- Wells Fargo Bank, N.A.

…then behind the scenes, your bank is already using FedNow.

But it won’t be long before this new technology makes the jump from being “behind the scenes”… to becoming integral to life for millions of Americans.

Look at what’s happening in the Federal Reserve, on Wall Street and in Silicon Valley and this becomes obvious.

One FedNow Partner – already announced by the Federal Reserve – runs “point of sale” technology, the card processing terminals you tap your card against at the grocery store.

Another is a market leader in mobile payments – the technology that allows you to make payments from your smartphone.

Another runs a software platform that allows businesses to apply for commercial loans.

And that’s just at the Fed.

The most powerful players on Wall Street and Silicon Valley are getting ready to finish what FedNow started – and push this technology out to the consumer.

The New York Fed spent 12 weeks testing a fully digital dollar alongside Wells Fargo and Citigroup.

Wells Fargo, JPMorgan Chase and Bank of America have launched their own digital wallet.

Google just joined the “Open Wallet Foundation.” According to one report it’s spent this year…

And then you have the real smoking gun…

Look right at the bottom of FedNow’s early adopter institutions and you’ll find the US Department of the Treasury’s Bureau of the Fiscal Service.

Early Adopter Financial Institutions

- 1st Source Bank

- Adyen

- Avidia Bank

- BNY Mellon

- Bridge Community Bank

- Bryant Bank

- Community Bank of the Bay

- Consumers Cooperative Credit Union

- Corporate America Credit Union

- Eastern Corporate Federal Credit Union

- First Internet Bank of Indiana

- Global Innovations Bank

- HawaiiUSA Federal Credit Union

- INB

- JPMorgan Chase

- Mediapolis Savings Bank

- North American Banking Company

- Peoples Bank

- Pima Federal Credit Union

- Salem Five Bank

- Star One Credit Union

- United Bankers’ Bank

- U.S. Bank

- U.S. Department of the Treasury’s Bureau of the Fiscal Service

- Veridian Credit Union

- Wells Fargo Bank, N.A.

That’s the department that handles social security payments and government benefits – the very same department that mailed stimulus checks out to millions of Americans in the pandemic.

According to Forbes magazine, it’s the beginning of a “domino effect” sweeping the financial system.

And it’s the moment I’ve been

waiting for my entire career…

See, there’s no major industry as ripe and ready for disruption as the world of finance and banking.

Despite the fact that money is the one “technology” we all use every day…

And despite the fact the US financial system is worth $135 trillion…

The entire system is old… antiquated… and terrifyingly slow.

It was built in the days of the Pony Express… when couriers on horses would put checks in bags and move them from bank to bank.

As late as the 1970s, banks were still using Morse Code era technology to move funds around…

And the banking system didn’t go fully electric until – wait for it – the 1990s!

Frankly, things aren’t much better today…

Despite the rise of online banking, financial institutions are still responsible for 20% of global paper use.

The whole financial system is “more than half a century old and run on antiquated code,” according to The Economist.

Look under the hood of your bank and you’d see a system that’s beset by strange delays… ancient procedures… middlemen… and weird inefficiencies.

For instance, some banks use technology so old that the only people who know how to fix it are already retired… or worse.

It’s “not so much that an individual may have retired,” an analyst at consulting group Accenture said.

“He may have expired, so there is no option to get him or her to come back.”

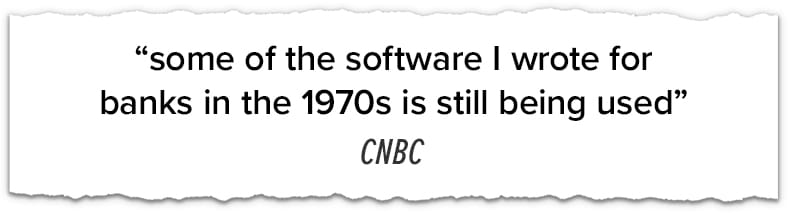

One coder who CAN fix bugs in the system is 75-year old Bill Hinshaw… who reported that “some of the software I wrote for banks in the 1970s is still being used.”

Or consider the fact that during the pandemic, the Treasury had to turn to mailing physical checks to support people.

It’s no surprise that since then, check fraud has almost doubled.

Worse, because it takes so long for checks to clear… it often takes more than a month before fraudsters are caught.

And if you want to send money somewhere, there are a whole series of “clearing” processes with your bank, the Federal Reserve and the bank you’re sending money to, which often take days to complete.

Send money in the afternoon… and you’ll likely have to wait until at least the next morning before anything happens.

And that’s if you’re lucky.

If you need to send money in the evening… on the weekend… or a public holiday… you’ll have to wait even longer.

These slow speeds have real consequences. I just met an antiques dealer who got paid via PayPal… delivered the product… then discovered the buyer had reversed the charges and disappeared.

Because the money hadn’t actually moved yet, the antique dealer got caught out. She’s lost her product… and lost the income… all because the banking system moves so slowly.

Even worse, banks are much faster to take money OUT of your account than to pay it in…

…which pushes millions of Americans into the red, simply because their bank is SO slow.

The costs of these delays – in overdraft charges, extra fees and use of payday lenders to cover the gap – are eye watering.

One study found that eliminating these delays and extra charges would put an extra $100 BILLION in ordinary Americans’ pockets.

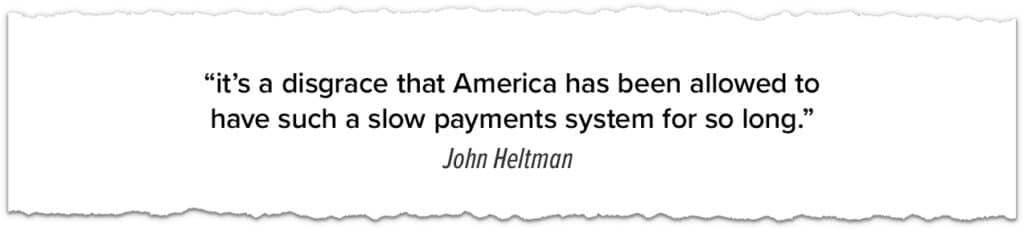

In the words of report-at-large at American Banker John Heltman, “it’s a disgrace that America has been allowed to have such a slow payments system for so long.”

Disgrace is right. Japan got real time payments in the 1960s.

Yet here in America, just less than 1% of payments cleared the same day in 2020.

In a world where we can talk to our friends instantly, anywhere on the planet… order food and groceries in a couple of taps of our smartphone… watch live sports whilst cruising at 38,000 feet on a plane…

Our money basically still moves at “Pony Express” speed.

But now – at long last – that’s all changing

That’s what FedNow represents.

The start of a shift that’ll finally bring our ancient financial system into the 21st century.

When you step back, this has been inevitable all along…

The most successful companies of the 21st century have all been built around digital technology that makes things better, faster, and cheaper for everyone.

Like Amazon, which made shopping online fast, cheap and easy… and crushed traditional stores.

In 2007 Target, Kohl’s, Best Buy, Sears, Macy’s, Staples and JCPenney were all bigger than Amazon.

Ten years later, Amazon was SIX TIMES bigger than them all… combined.

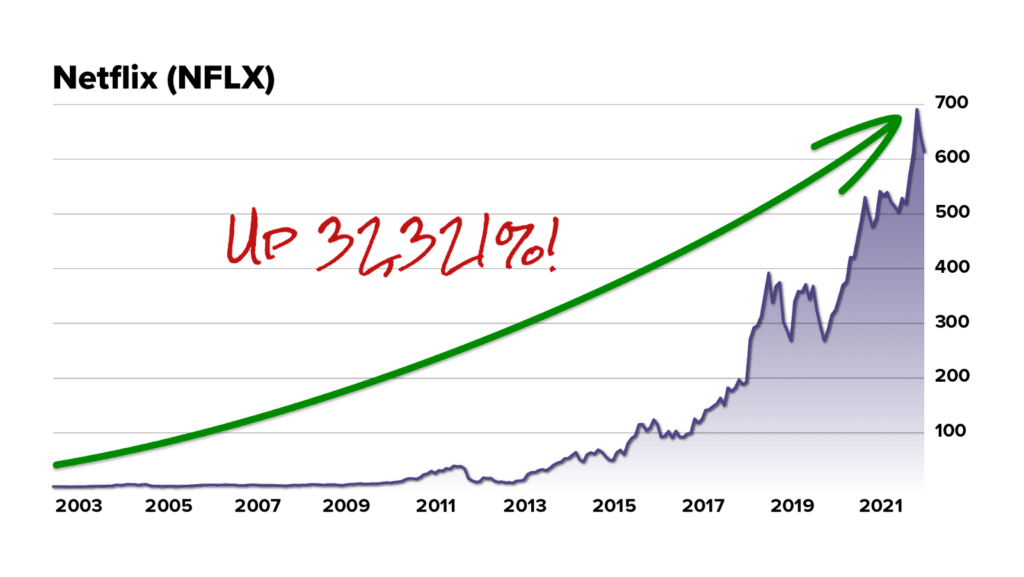

Or take Netflix…

It made it possible to watch whatever you like on-demand… from anywhere on the planet… and at a fraction of the price of its competitions.

In the process, it bankrupted Blockbuster… and rose 32,321%.

Now the same story is playing out in the biggest and most important industry of all… the $135 TRILLION financial system.

Of course, the writing has been on the wall for a long time…

- The number of people using cash has been in freefall for years

- ATMs are already going the way of the public payphone – more than 20,000 disappeared between 2019 and 2022.

- Those ATMs are being replaced by “Reverse ATMs” – places you can change cash into digital currency (you’ll already find one at most MLB or NFL stadiums).

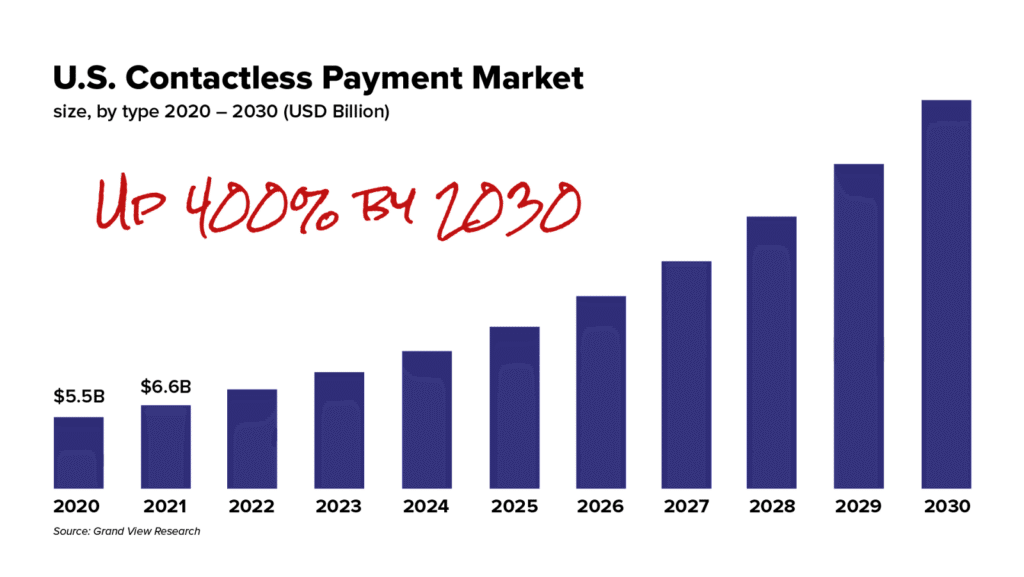

- And the contactless payments industry is exploding in value, forecast to grow 400% by 2030…

But next phase of this shift is going to change life for hundreds of millions of Americans.

Every cent in your bank account…

Every dollar you have invested in stocks, mutual funds, or gold…

Every paycheck you earn… every payment you get from Social Security or any other branch of the government… everything you owe the IRS…

I believe It’s all about to run on new technology… with new rules and processes… and with a whole new group of companies behind it all.

Of course, you’ve likely heard about some of the tech involved already…

- Like the blockchain – the distributed ledger technology cryptocurrencies like Bitcoin and Ethereum run on…

A single investment in Bitcoin 10 years ago would be worth 21,258% more today.

- Or instant payment apps like Zelle, Venmo, or the Square Cash App.

Since 2012, Venmo alone has exploded in value… increasing 146,054% in just 11 years.

- Or the sudden growth in folks using their phone or watch for contactless payments, using stuff like Apple, Samsung or Google Pay.

The number of Apple Pay users alone has grown 10-fold in the last decade… with nearly half of all Apple customers using its payment app.

- Or huge growth in asset managers like JPMorgan, BlackRock and Fidelity offering new “digital asset” trading services…

Fidelity analysts have already forecast a single bitcoin will cost a million dollars by the end of the decade… up more than 20x from today’s price.

Everywhere you look, new financial technology is emerging… catching on… and making early investors a fortune.

But what you may NOT know is this…

Right now, the Federal Reserve is in the process of integrating all of these different technologies together in one place… and making them the foundation of the entire U.S. monetary system.

The launch of FedNow was just the first phase of this.

It saw the first wave of financial institutions join the Fed’s new “instant payment” service.

But it won’t stop there.

Right now just 41 financial institutions are part of the initiative.

But that number is expected it explode 24,290%… with 10,000 banks and credit unions nationwide incorporated into FedNow.

Once that happens… it’ll be everywhere… enabled on every bank account across America.

Just look at what the authorities are doing…

FedNow wasn’t launched on a whim.

It was a direct order from the White House

On March 9, 2022, President Biden issued an Executive Order instructing federal institutions to “reinforce United States leadership… through the responsible development of payment institutions and digital assets.”

The Treasury followed that order by instructing the Fed to build an entirely new digital payment system to underpin it.

Much of the media reported this as the beginning of a “Digital Dollar” – a Central Bank Digital Currency, or CBDC.

But it’s much bigger than that.

It’s the start of the entirely new system… built on digital asset technology like blockchain… with lightning fast payment processing… and built by companies most Americans have never even heard of.

Just look at what’s happened since that initial Executive Order…

The New York Fed began testing a blockchain enabled currency for cross-border payments…

Many of America’s biggest financial institutions kickstarted the “Digital Dollar” project…

And the Federal Reserve has begun integrating cryptocurrency and blockchain companies into its FedNow service providers.

One of the companies the Fed has chosen allows you to instantly convert your money between US dollars and cryptocurrencies and other stablecoins, using the blockchain…

Another has built a superfast instant payment network that puts many of the big banks to shame…

Yet another is building a crypto-enabled app for businesses to access FedNow with…

In fact, one of the blockchain payment providers working with FedNow has already built its own cryptocurrency.

It rose more than 50% in a single month after the Fed made it a service provider.

And trading that crypto is as simple as scanning a QR code – like this one:

But it’s not just crypto and payment firms that’re working with FedNow.

The Treasury’s Bureau of the Fiscal Service is, too.

That’s the department that issues you your tax refund… Social Security benefits… and paid out “stimulus” checks to millions of Americans during the pandemic.

Can you see where all this is headed?

Blockchain technology… instant payment applications… new digital “wallets”… new ways to spend, save and trade… the growth in cryptocurrencies and digital assets…

I’ve spent my 30-year career studying these trends and technologies…

And now they’re all converging at the heart of the $135 trillion financial system, with the full backing of the federal government.

Soon, all this technology will be integrated under one application… which I predict you’ll access with a QR like this:

Most likely, it’ll be one of these “Federal QR Codes” that’ll be your portal to this new financial system.

That’s because there’s simply no other technology that can integrate and customize data like this.

Think about it…

Right now you have a username, password and pin for your bank account… you have unique logins for payment apps like Venmo or Paypal… you have one or more credit cards… possibly a smartwatch… Your IRS data is stored one place… and your Social Security IDs in another.

Soon, it could all be synchronised into one place, accessible through your own QR Code.

Just imagine…

You’d be able to pay any bill… wire money anywhere… get your tax rebate… apply for a loan… pay your credit card bill… split last night’s dinner with friends… buy cryptocurrencies… invest in the stock market…

And you’d be able to do it all whenever you like. Sunday at 6 a.m. Friday night. It doesn’t matter if the banks are open or closed… the financial system will be “always on.”

You’d just need your QR code.

And this’ll all just be the start.

It won’t be long until your federal QR code is at the heart of EVERYTHING.

That’s my prediction, anyway.

Applying for a mortgage… opening a share dealing account… trading cryptocurrencies… even accessing your Social Security payments…

You won’t need a bank account… and it won’t be long before you don’t even need a Social Security number.

Your tax rebate arrives automatically…

So does your Social Security income…

And if the government pays out “stimulus” money during a recession again – it’s not going to come in the mail.

It’ll just hit your new digital account instantly – and you could use your QR code to access it.

Whether people like it or not, we’re a lot closer to this all becoming a reality than you might realize.

The Fed and Treasury is already partnering with digital wallet firms, payment apps, crypto providers, digital ID firms…

And there’s a frenzy of new tech being rolled out in Silicon Valley and Wall Street, ready to take advantage.

They’re all working together to make this a reality.

That means you have a choice to make…

You can get angry about the idea of the new, fully digital financial system being rolled out today – and I can guarantee you, millions of ordinary folks will do exactly that…

And look, I’m not telling you not to keep money in cash or gold… I think alternative and conservative assets are critical ways to hedge risk.

But just as important is backing the companies making the update happen – and riding them as far and as fast as they’ll go.

I think just a tiny investment in these companies will be the single best financial decision of your life.

Years from now your friends and family will ask you how you saw it all happen.

What you choose to do is entirely your call, of course.

But just remember what history tells us…

- When Western Union launched its telegraph enabled “lightening lines,” it transformed itself into one of the biggest companies in America…

- When Paychex helped launch the credit card and bring plastic money to America, it rose 45,000%…

- And when Mastercard helped roll out chip and pin money across the country, it rose 8,873%…

A $5,000 investment in either of those stocks would have made you hundreds of thousands of dollars richer.

I’m here today to put my reputation on the line and say the companies at the heart of this latest shift won’t just deliver those kinds of returns…

They’ll SURPASS them

That’s a huge claim to make, I know.

But I’ve been “on the ground” exploring the companies building this new financial ecosystem for the past five years… with some eye-catching results.

Like the payments company Harmony, which cuts transaction times down to as little as two seconds…

I showed the readers of one of my services how to book a 5,166% return on that.

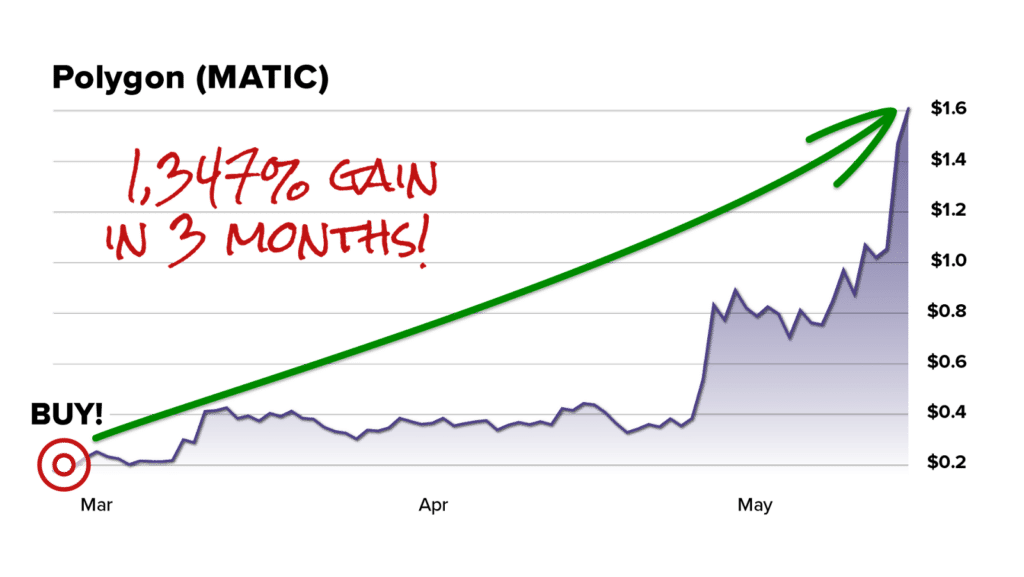

Or Polygon, which allows for 65,000 transactions in a second.

We booked a 1,347% return in just three months on that.

Or the little-known blockchain developer Secret, which is building a new, secure, and private way to transact online…

In the two years after I picked it, it rose 1,515%.

But – as crazy as it might sound – I think I’ll surpass those winners in the near future…

Because with the Federal Reserve now rolling its instant payments network out… and turning to these kinds of firms for help… I think now is the perfect time to make your move on these kinds of businesses.

That’s exactly what the Wall Street and Silicon Valley elite are already doing, by the way.

With the Fed launching its flagship FedNow policy initiative, major players are racing to launch applications to take advantage.

We’ve already seen a flurry of buyouts in the space.

- Warren Buffett was spending billions on new payments firms as long ago as 2018…

- Goldman Sachs has ploughed $3 billion of its own capital into building its own fintech division in house.

- The Depository Trust & Clearing Corp – which processes nearly every trade on the US stock market – is live testing its own blockchain.

- JPMorgan has been testing its own blockchain network for financial transactions (it’s even built a JPM “Coin”).

- Apple bought mobile payments firm Moeewave in 2020… then moved into banking, buying Credit Kudos in 2022.

- Google bought payments firm Pring… Microsoft is working with PayPal and Stripe to integrate payments into its teams network…

- Amazon is building a “pay-by-palm” system… the world’s biggest financial network SWIFT is integrating blockchain infrastructure… Elon Musk wants to build payments into the X (formerly Twitter) network.

At least 12 different people have become billionaires in recent years playing this trend.

And it’s showing no signs of slowing down…

Visa bought payments processor and banking platform Pismo for $1 billion… Robinhood just acquired X1…Nasdaq bought out financial software platform Adenza for more than $10 billion…

And that’s all BEFORE the Federal Reserve began rolling this technology out…

With the Federal Reserve building an entirely new financial system around this kind of technology, I’m expecting hundreds of billions of dollars to start flowing into the sector.

That presents a huge opportunity for you – if you’re decisive enough to take it.

That’s why I’ve spent the last 12 month researching what I call The FedNow Investor Playbook.

Put simply, it’s built around the handful of companies I expect to rise furthest and fastest as this shift gathers strength.

Take the first play I’ve found for you…

PLAY #1: FedNow’s Secret Partner

My No. #1 play is already working hand in glove with the Fed.

That’s a fact.

It’s one of the handful of technology firms the Fed has hand chosen to be a part of the fast growing FedNow ecosystem.

That puts it in a position most fintechs would pay a billion dollars to be in.

It’s right at the beating heart of the build-out of the new financial system – working alongside huge financial institutions that’re part of FedNow.

That list already reads like a “who’s who” of giant banks and credit unions:

- 1st Bank Yuma

- 1st Source Bank

- Adyen

- Alloya Corporate Federal Credit Union

- Atlantic Community Bankers Bank

- Avidia Bank

- Bankers’ Bank of the West

- BNY Mellon

- Bridge Community Bank

- Bryant Bank

- Buffalo Federal Bank

- Catalyst Corporate Federal Credit Union

- Community Bankers’ Bank

- Consumers Cooperative Credit Union

- Corporate America Credit Union

- Corporate One Federal Credit Union

- Eastern Corporate Federal Credit Union

- First Internet Bank of Indiana

- Global Innovations Bank

- HawaiiUSA Federal Credit Union

- JPMorgan Chase

- Malaga Bank

- Mediapolis Savings Bank

- Michigan Schools & Government Credit Union

- Millennium Corporate Credit Union

- Nicolet National Bank

- North American Banking Company

- PCBB

- Peoples Bank

- Pima Federal Credit Union

- Quad City Bank & Trust

- Salem Five Bank

- Star One Credit Union

- The Bankers Bank

- United Bankers’ Bank

- U.S. Bank

- U.S. Century Bank

- U.S. Department of the Treasury’s Bureau of the Fiscal Service

- Veridian Credit Union

- Vizo Financial Corporate Credit Union

- Wells Fargo Bank, N.A.

But it gets better…

Because like I said, while there are currently 41 financial institutions working as part of FedNow…

That number is expected it explode 24,290% in the very near future.

Soon, there’ll be 10,000 banks and credit unions nationwide incorporated into FedNow.

And the play I’ve found for you will be right there working alongside them.

What makes it so special?

That’s easy.

It’s built a super-secure payment network that would be a giant step forward for our current financial system.

Consider…

Right now, VISA can process around 1,700 transactions per second…

Mastercard can handle 5,000.

(For reference, bitcoin can only handle 7 transactions per second.)

But this superfast network can process TEN THOUSAND transactions per second.

That’s 600,000 per hour.

And because it’s “always on”… this network runs seamlessly, 24/7.

There are no outages at night or over the week.

Meaning it can process 14.4 million transactions a day.

And a hundred million transactions every single week.

In fact, in the first quarter of 2023, this network processed SIX BILLION transactions.

And it does it using the latest security protocols… in a completely transparent way… and with almost no latency.

So it won’t surprise you to know that this network isn’t just working with the Federal Reserve…

It’s also partnered up with $100 billion software giant ServiceNow…

Not-for-profit organizations like the Coupon Bureau…

And the second largest law firm in America.

Not only that, some seriously big corporations are directly involved in building this network out.

Companies like Google… IBM… Boeing… LG Electronics… and Deutsche Telekom.

But here’s the cool part…

You can currently buy into this network for less than a dollar.

All you need to do is grab a copy of the FedNow Investor Playbook report I’ve put together for you.

Inside you’ll find everything you need to make your move on this play.

But – as you might expect – this is much bigger than just one network…

Inside your report you’ll also get my full write up on:

PLAY #2: The “Tollbooth” of the Next Generation Financial System

The tollbooth is perhaps the best moneymaking idea in human history…

You sit by the side of the road… and collect a small charge from everyone who passes by.

There’s nothing complicated or nothing hard to understand about it…

It’s all about being in the right place at the right time.

So long as there’s plenty of traffic passing through your tollbooth, you’re making money.

And that’s exactly the principle behind the second play I want to share with you.

It’s owns a “tollbooth” on the fast-changing financial system.

In fact, it made $4.5 billion last year, simply by collecting a “toll” as investors and traders move into the market.

Even better, it passes millions of dollars of that cash back to its shareholders.

Which makes it a great way of getting paid as traffic in the new financial system picks up.

See, every investor – whether you’re a private investor or a trillion dollar sovereign wealth fund – has to route their trades through a gateway into the financial system.

And for every trade you can think of – stock, option, bond, gold, crypto – the owner of that gateway earns a fee.

And my second play is one of the best in the business at collecting these fees.

Not only that, it’s moving into the digital markets space as we speak… thanks to a huge acquisition it just made for a digital asset and derivative market.

And it’s recently partnered with asset-management giants like Fidelity, WisdomTree, VanEck and Invesco to move into the digital currency space.

That makes it a perfect way to capitalize on the shift to an all-digital financial system.

Again: if you want to move on this play right away, all you need to do is grab your copy of the FedNow Investor Playbook.

Open your copy of this research report up and you’ll also get all my research on:

PLAY #3: The unknown network building the financial “KILLER APP”

We’re in the middle of a shift not just to the way money works… but the digitisation of the entire financial system.

Ultimately it’ll disrupt the way every stock… bond… ounce of gold… or piece of real estate… gets traded.

Before long, it’ll all be traded digitally, using super-fast, super-secure networks like the blockchain. (It’s already happening – the Bank of America claim more than $1 billion in “tokenized” gold was traded in March 2023 alone.)

JPMorgan analysts claim the technology that makes this possible will be the financial world’s “killer app.”

And I think I’ve found the network that’ll make it possible.

I’m not alone.

The institutions this tiny company is working with right now is about as prestigious as it gets.

Consider… it already has partnerships with Credit Suisse and Deutsche Bank…

…the Central Bank of Italy…

…payments firm Stripe…

…Starbucks… Adobe… META… Adidas… Disney… the NFL… and DraftKings.

What makes this network so special?

And how much money could early backers realistically make?

All the answers are inside your copy of the FedNow Playbook.

To get your copy immediately, all I ask is that you take a NO-RISK trial subscription to my technology investing research letter.

It’s called Stansberry Innovations Report.

Take 30 days, see if you like it. You’ll receive instant access to your copy of the FedNow Playbook… plus our entire model portfolio of cutting-edge tech investments

You can see for yourself how our trade recommendations are performing and then decide after a month if Stansberry Innovations Report is a good fit for you.

If it’s not, just let us know and we’ll refund your subscription cost right away.

But if you decide to stick with us, every month I’ll send you a report detailing a brand-new opportunity in the tech space and how it could help you collect outsized potential profits.

I’m not just talking about the shift we’re seeing in the financial system, either.

You’ll also hear about lucrative tech trends like AI, cryptocurrencies, CRISPR, robotics, augmented reality, and so much more.

If the opportunities I’ve been telling you about today have you excited, you’ll love the work we do at Stansberry Innovations Report

Our mission is to help you understand the ways new technology is going to change the world… and help you back the companies behind it, while they’re unknown to the masses.

We’ve been able to consistently stay ahead of the world’s biggest and most important trends… and show our readers how to make money and retire comfortably – often years earlier than they ever thought possible.

How?

By delivering the best ideas by employing world-class experts in our team.

In fact, I doubt there’s anyone else in America’s retail investment research space who spends what we do on top analytical talent each year.

But just because WE pay a lot to bring you our research, doesn’t mean YOU have to pay a lot to receive it…

Normally, one year’s access to my team’s research, featuring at least 12 monthly trade recommendations, costs $199.

But today you can receive a one-year subscription toStansberry Innovations Report, with a NO-RISK 30-day trial built in, for as little as $49.

That’s up to a 75% discount off our regular retail price.

Is that a good deal?

Well, there are three big reasons I think you need to give my work a go right away.

REASON #1: All the research you’ll get immediate access to when you get started today…

The second you accept my offer, you’ll get instant access to all this:

- The FedNow Investor Playbook. Your guide to understanding – and profiting from – the biggest shift seen in the financial system for decades, including the name and ticker of the FedNow’s “secret partner.”

- 12 issues of Stansberry Innovations Report: Each new issue will be delivered to you on the third Friday of each month, just after the markets close, so that you can read and digest the trade recommendation over the weekend and be ready to move on Monday morning when the market opens, if you choose.

- EXTRA BONUS: My No. 1 AI Stock for 2024. I haven’t had time to tell you about this one yet… but as AI adoption sweeps the globe, there’s one stock I think everyone needs to own. It’s already quietly working with some of the largest global technology corporations like Amazon, Apple, and Microsoft. And it could soon be making billions of dollars by merging generative AI with automation. You’ll get my full write-up in this report.

You’ll get a full breakdown on these opportunities – including the names of my top recommendations, their ticker symbols, and how to buy them.

These reports are the first things you’ll get when you start a no-risk, trial subscription to our firm’s top-rated technology newsletter: Stansberry Innovations Report.

On the third Friday of every month, we’ll send our latest report and newest money-making recommendations. You’ll learn how to profit from the fastest-growing industries on the planet…

If it’s a new technology changing the world, you can count on me and my partner, John Engel, to pinpoint the best way to make money from it.

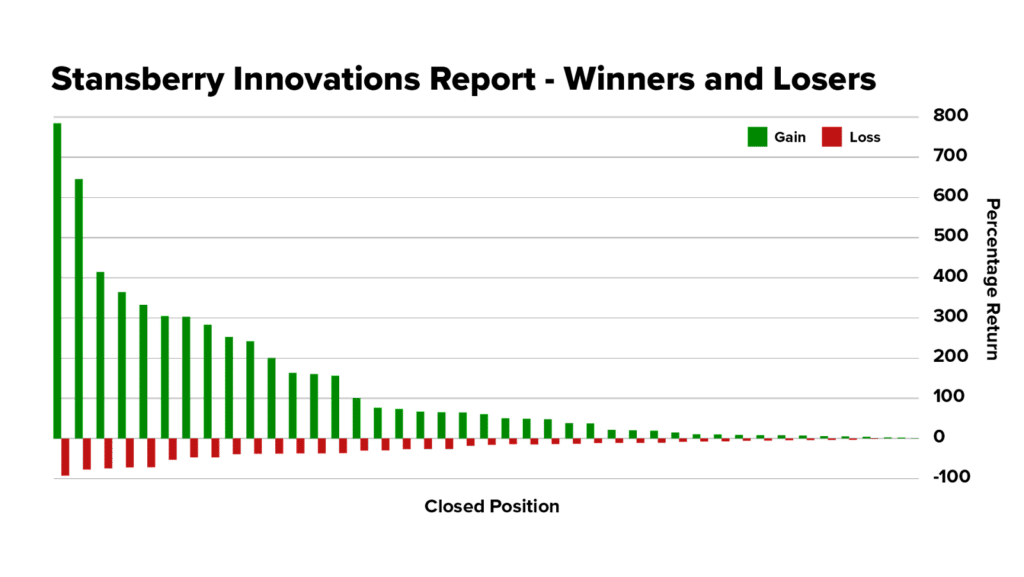

REASON #2: Our track record stacks up against the very best

The Stansberry Innovations Report model portfolio has beaten the S&P 500 since 2018 – and not just by a little bit.

Our picks have performed 71% better than the S&P return.

Delve into our closed portfolio and you see why.

Here’s how our results stacked up as of April 2023 – winners AND losers.

I won’t hide the fact that we’ve taken some losers along the way.

You can see them right there in the chart.

That’s part and parcel of investing in breakthrough new technology.

It’s the risk we take.

But look at the REWARDS when we get it right.

- Twenty of our picks would have doubled your money.

- Eight of them would have made you four times your money or more.

Of course, all investments carry risk. That’s why you should never invest more than what you are willing to lose.

But the fact remains: the average annual gain for Stansberry Innovations Report since inception is 40%.

You won’t find many experts who would share their entire track record, let alone match those kinds of results.

Which brings me to the third reason I think you need to give our work a try.

REASON #3: Thousands of investors love my work

Just consider the feedback I regularly receive from our subscribers. Like Michael from Michigan, who wrote in to say:

“Back in August you guys came onto my radar at the exact time that I was finally getting serious about beginning to invest for my retirement, but had limited assets available. All of this to say: THANK YOU! God bless you guys! Keep up the good work…”

Or Joel, who told me that with my guidance:

“I’m just an average 40 hour blue collar worker. I took $10k out of my 401k to pay for a subscription to Crypto Capital and I used the balance towards cryptos that you’ve recommended. I’m up well over $100k now. Before the pullback I was close to $200k.

I’m not worried in the least; the long play has so much potential. I could never had done this without Eric Wade. Thanks!”

The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of your investment.

Given all that, you’re probably asking yourself…

Why so cheap?

There’s never been a better time to invest in breakthrough technology.

The changes we’re seeing in the financial system… the sudden growth of AI… and a hundred other tech trends confirm that.

These new technologies present huge opportunities.

But to properly understand and profit from them, you need an expert guide.

At Stansberry Research, we’re better equipped than just about anyone to help you do it.

We’ve been in this business more than 20 years now and today we have more than 100,000 customers who have decided to become “lifetime” subscribers.

To me, that’s the best endorsement any business can ever have.

I know our firm’s work can help you – and believe me, the more people who understand these trends, the better for all of us.

That’s why I want to send you this valuable collection of special reports… plus a full year of Stansberry Innovations Report for as little as $49.

With this information in hand, you’ll understand the technological shift now taking place in America and how to take advantage of the massive wealth it’s going to create over the next few years.

Now is the time to get the facts for yourself. It’s not too late.

And we’ve made it very easy and ridiculously cheap for you to learn about the best technology investments in the world, as the Federal Reserve upgrades the entire financial system.

And when it only costs you as little as $49 to receive everything I’ve described here… honestly, what do you have to lose?

But if you don’t agree with me that this is the absolute best deal in the financial publishing industry, simply let my Baltimore-based customer service team know in the first 30 days, and they’ll refund your payment promptly.

The entire financial world is being digitized… and your life is going to change in hundreds of ways as a result.

The only question is, will you be ready?

If you are, just click the “Get Started”’ button below.

You’ll be taken to a secure order form where you can review the details of this special offer once more and claim your up-to-75% discount off Stansberry Innovations Report, as well as secure your two crypto reports quickly and easily.

Sincerely,

Eric Wade

Stansberry Research

October 2023