Joel Litman is far from your typical accountant. To truly understand why Litman’s insights captivate 10 of the world’s biggest money managers and over half of the world’s 300 largest financial firms—with some clients reportedly paying up to $100,000 monthly for his services—follow Joel Litman on Twitter.

As the respected Chief Investment Strategist and President of Valens Research, Litman is an investing trailblazer. With his innovative forensic accounting and Uniform Accounting methods, he uncovers hidden insights in financial statements often missed by traditional approaches.

Litman’s skill enables precise market trend forecasts and stock valuation. In addition, his Hidden Alpha newsletter and promos cover topics like profiting from natural gas, financial disasters, and Steve Jobs’s final prophecy, sharing valuable insights with investors for just $4 a month.

In this article, we’ll examine the latest activity from Joel Litman on Twitter, explore recent Joel Litman predictions, and see how his insights can outpace the market and help make intelligent investment decisions.

1- Debunking Fears: Why the Next U.S. Recession Won’t Be So Bad

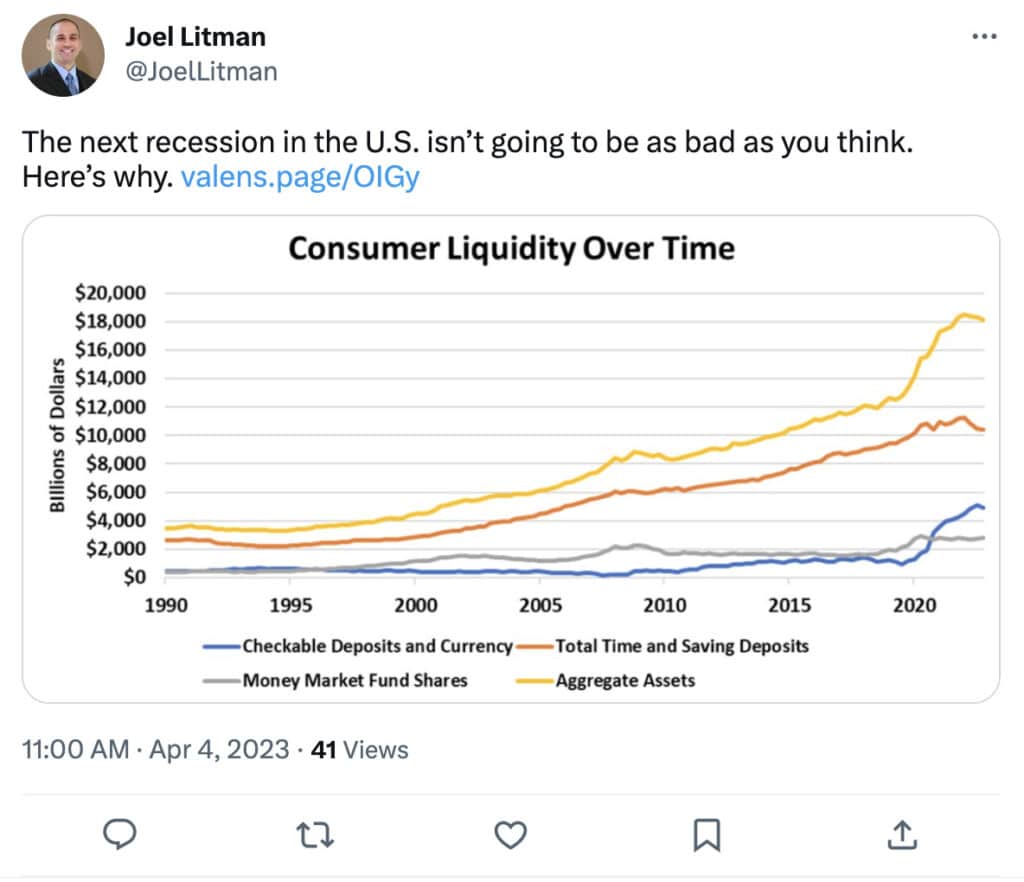

Joel Litman tweeted on April 4, 2023, that the upcoming U.S. recession might be milder than many think. He points out that the substantial cash reserves consumers accumulated during the pandemic and thanks to government stimulus should help them stay strong amid an economic slowdown. In just four years, consumer cash balances have soared from $1 trillion to $5 trillion.

Furthermore, consumer net worth has substantially grown, experiencing a 30% increase in total equity since 2020. Given such solid financial standing, U.S. consumers are likely to withstand the impact of a moderate recession caused by the Federal Reserve’s rate hikes. As Litman highlights, these rate hikes will curb spending and temper the economy but won’t trigger a disastrous collapse.

2- Mortgage-Backed Securities: This Time Is Different

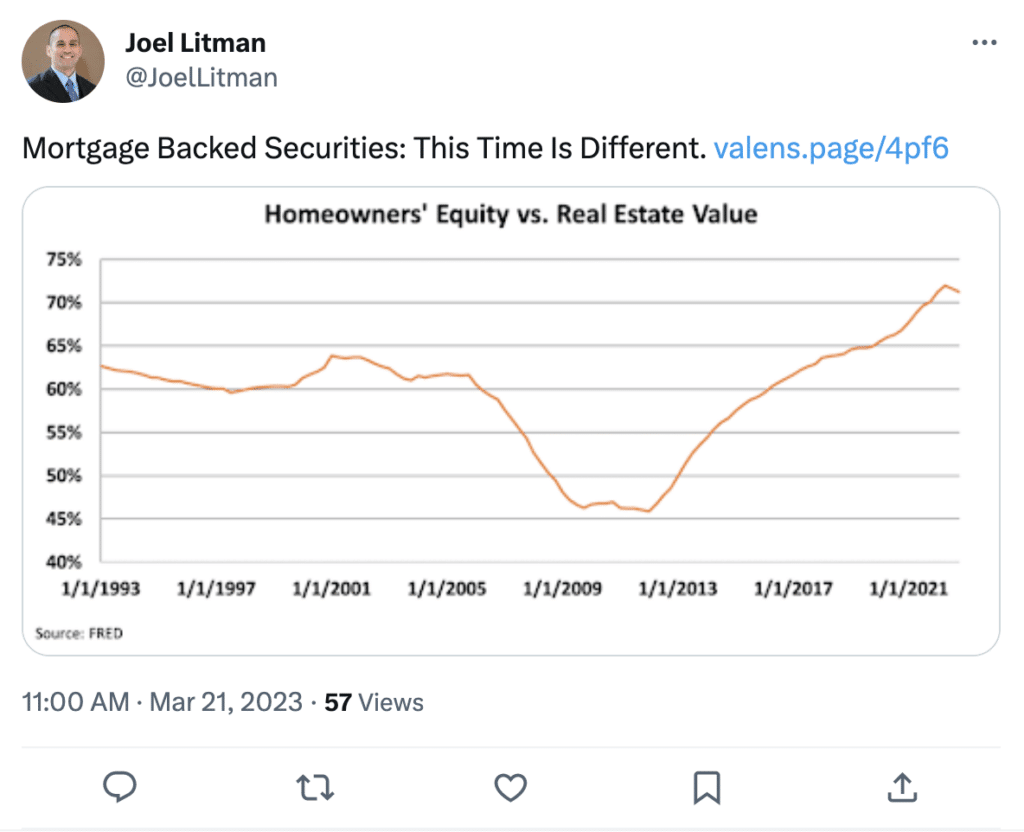

On March 21, 2023, Joel Litman on Twitter posted insights on mortgage-backed securities (MBS), addressing recent bank failures like Silicon Valley Bank. He emphasized the distinctions between today’s MBS climate and the 2008 crisis, reassuring investors that we’re not reliving history.

Today’s MBS scenario varies as homeowners possess greater equity and secure, fixed-rate mortgages, lowering default risks. The primary concern lies in MBS valuation, not poor loans.

Banks don’t foresee MBS failures, but declining values necessitate capital base adjustments. In addition, the Federal Reserve’s interest rate hikes aim to temper the economy and manage inflation, potentially causing a recession but avoiding a financial meltdown.

Joel Litman’s Twitter predictions provide valuable guidance during uncertain times, as demonstrated by his achievements in the 2009 crisis and the COVID-19 recovery.

Learn more about profiting amid financial turmoil in 2023 here.

3- “Unscalable Means Impossible? Think Again”

On March 10, 2023, Joel Litman on Twitter shared the intriguing investment approach by Dave Daglio, former CIO of Mellon Investments. Daglio created BC-GUMPS to pursue “unscalable” opportunities, similar to elusive yet rewarding gold mines. Inspired by an aviation acronym, Daglio’s unique strategy emphasizes focusing on hard-to-scale ideas.

In collaboration with Litman’s Valens Research, BC-GUMPS developed a systematic, repeatable method for identifying market dislocations or notable mispricings. Their first fund, set to launch this spring, targets credit default swaps (CDS) for companies grappling with debt repayment challenges. The firm’s flexibility enables them to close the fund amid a recession and return capital to investors.

Joel Litman’s predictions on Twitter reveal unconventional yet profitable strategies like these. This informative report showcases a similarly unconventional and potentially rewarding investment approach focused on natural gas investments.

4- Don’t Look at the Banks to Understand the Next Recession

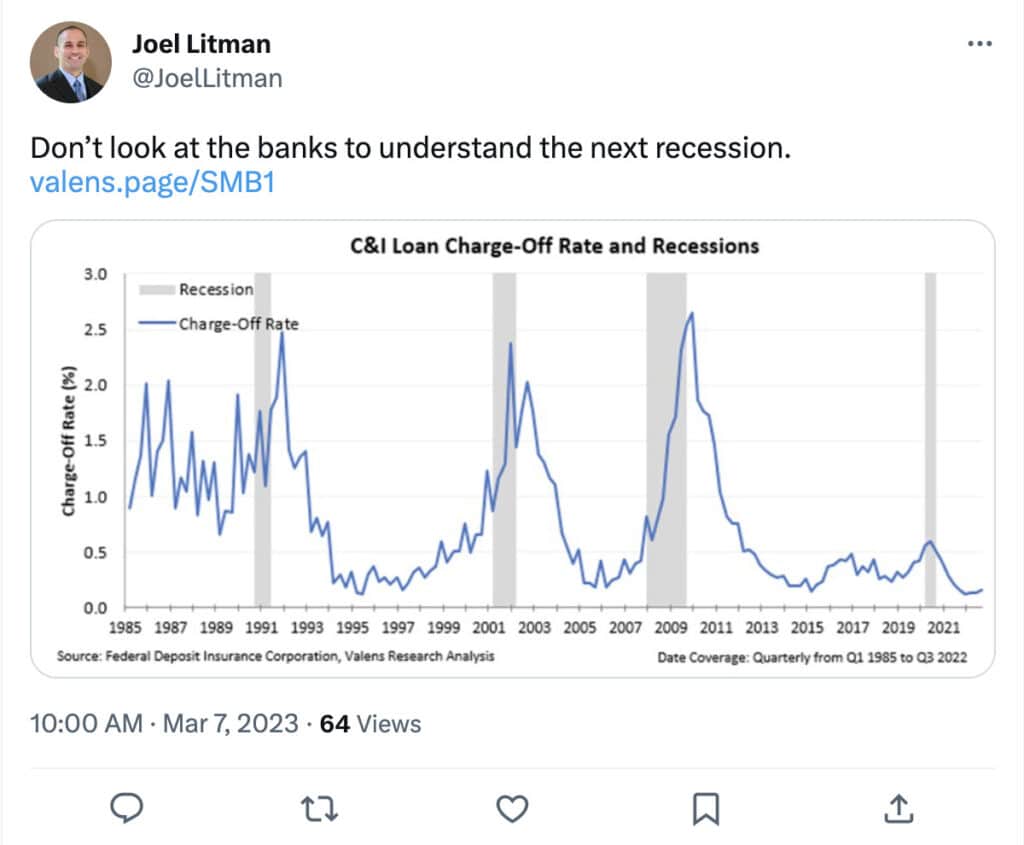

On March 7, 2023, Joel Litman tweeted a prediction, warning investors not to depend on banks for insight into the next recession. He argued that bank earnings, often seen as economic indicators, might be misleading this time.

Major banks are swiftly raising their loan loss reserves, a trend unseen since the pandemic began. For instance, Bank of America and JPMorgan Chase added $403 million and $1.4 billion to their reserves in the fourth quarter, suggesting they’re preparing for tough times.

However, Litman thinks banks might overestimate reserve requirements as corporate and consumer credit trends remain strong. For example, consumer credit delinquencies are historically low despite rising interest rates, indicating financial stability. Similarly, commercial and industrial (C&I) loan charge-offs, which usually increase during recessions, stay low.

In this insightful Joel Litman prediction on Twitter, he shares concrete data once again drilling down the point that the forthcoming recession might not be as harsh as some expect.

After all, almost exactly a month after he tweeted this, Goldman Sachs came out and said that fear of a bank crisis has faded.

5- Doubling Down on ‘Pax Americana’

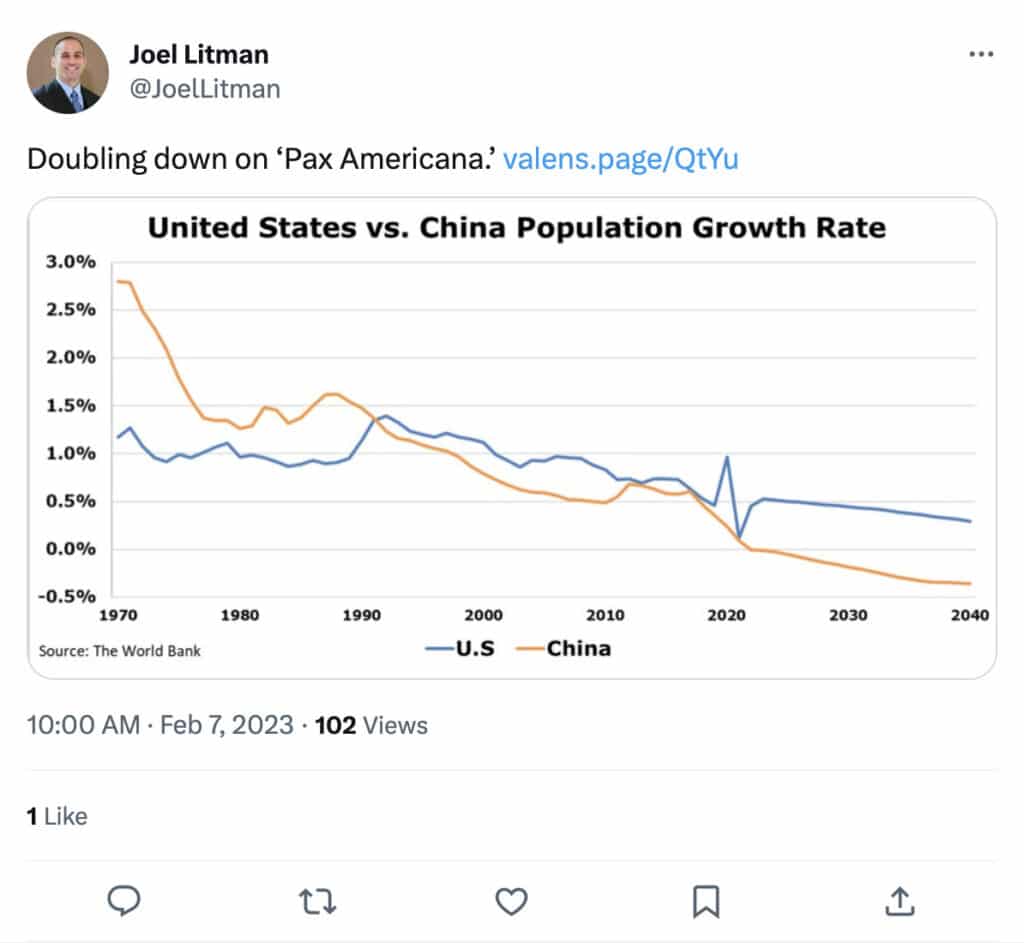

On February 7, 2023, Joel Litman on Twitter linked to a Valens article titled “Doubling Down on ‘Pax Americana.’ The piece highlights the resilience of the U.S. economy and a shift away from China’s once-dominant growth model.

China once seemed to challenge America’s economic dominance with rapid growth, a vast population, and rising trade influence. However, recent trends reveal a resurgence in U.S. economic strength and cracks in China’s foundation. The aging and shrinking Chinese population, driven by death rates surpassing birth rates for the first time in over 50 years, results from the outdated one-child policy and an inadequate social safety net.

Today, China’s higher median age negatively impacts its economy. At the same time, the US enjoys strong population growth, abundant resources, and corporate innovation. Furthermore, the U.S. invests heavily in research and development, laying the groundwork for long-term economic prosperity.

Litman’s tweet highlights the importance of the supply-chain supercycle, a resurgence in U.S. manufacturing and industrial jobs that will transform the nation’s economy. Although tech industries encounter obstacles, Litman has confidence in their enduring potential, mainly focusing on SynBio—the marriage of computer science, genetics, and gene editing. He dives deeper into it with this report on “Steve Jobs’ Final Prophecy.”

The Key Takeaway: Lessons from Joel Litman’s Tweets and Predictions

Joel Litman’s predictions and insights on Twitter provide valuable guidance for investors navigating today’s complex and ever-changing market. His expertise in forensic accounting and Uniform Accounting allows for uncovering hidden opportunities and making more informed decisions. Stay up-to-date with Litman’s expert insights by following him on Twitter and signing up for his Hidden Alpha newsletter for just $4 a month through one of these informative reports:

Embracing Litman’s profound analysis and distinctive viewpoints will enable you to understand the financial landscape better and equip you to navigate the investing world more efficiently.