It doesn’t matter if you have $500… or $5 million to invest. Here’s what I recommend you do with your money right now.

“I wish everybody knew this.”

—Billion-Dollar Wall Street Money Manager

Louis Navellier

Subscribe to our YouTube channel for more expert stock-picking tips.

ATTENTION: The following video is a serious financial warning from one of America’s richest men. He’s broken ranks from the one percent to detail a significant event he says is about take place in America’s very near future. He believes this event will make the rich even richer while financially affecting countless others and fan the flames of social protest. This content is intended for mature audiences only.

Hi, my name is Louis Navellier.

And I’m a one percenter.

I made my fortune helping the rich get richer.

“This is 83% OFF the regular price and you have a money-back guarantee… no questions asked.”

For over 40 years, I’ve shown America’s elite how to keep their wealth intact and even grow it by amazing multiples.

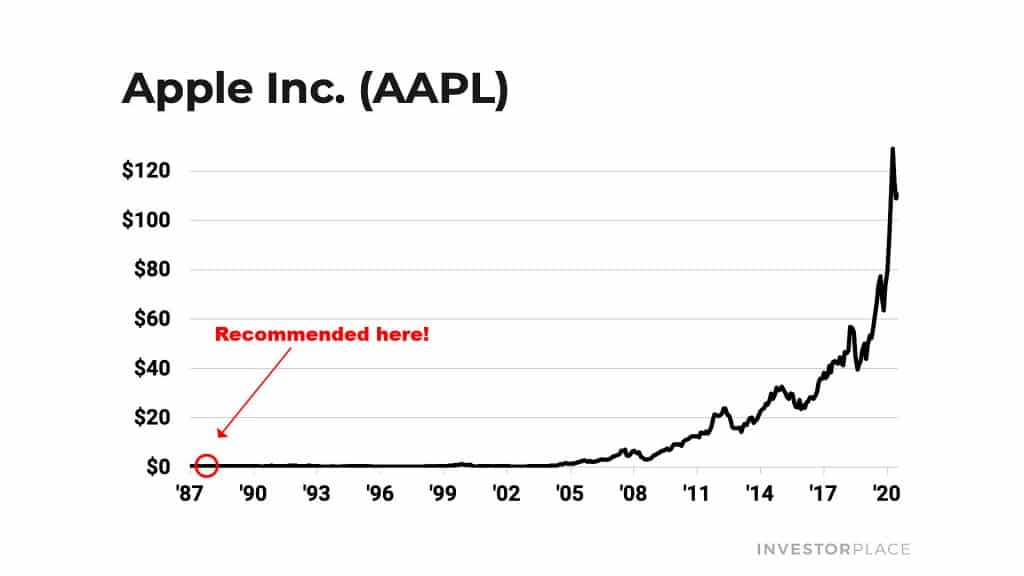

I told them to buy Apple when it was just a $1.49 stock…

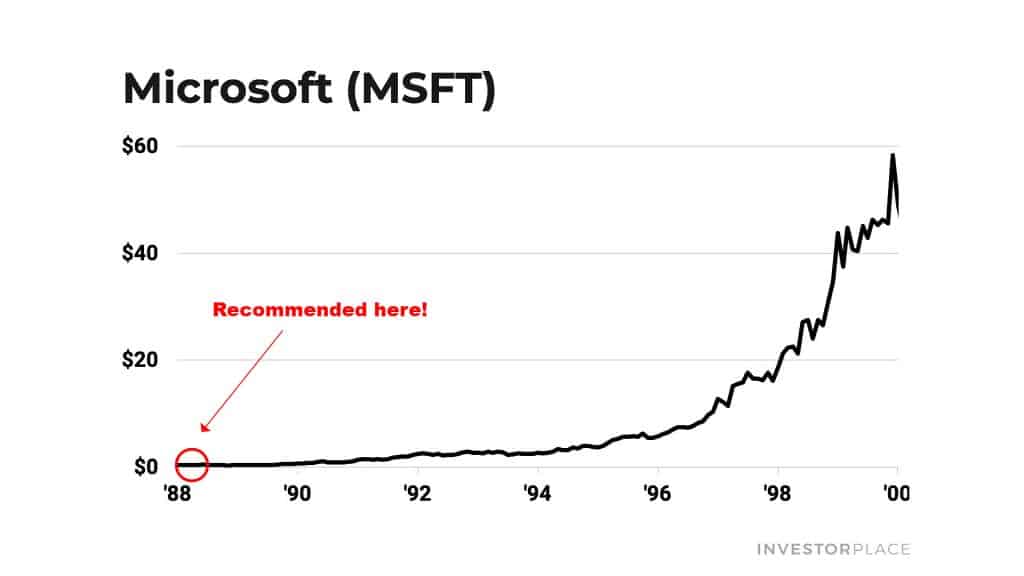

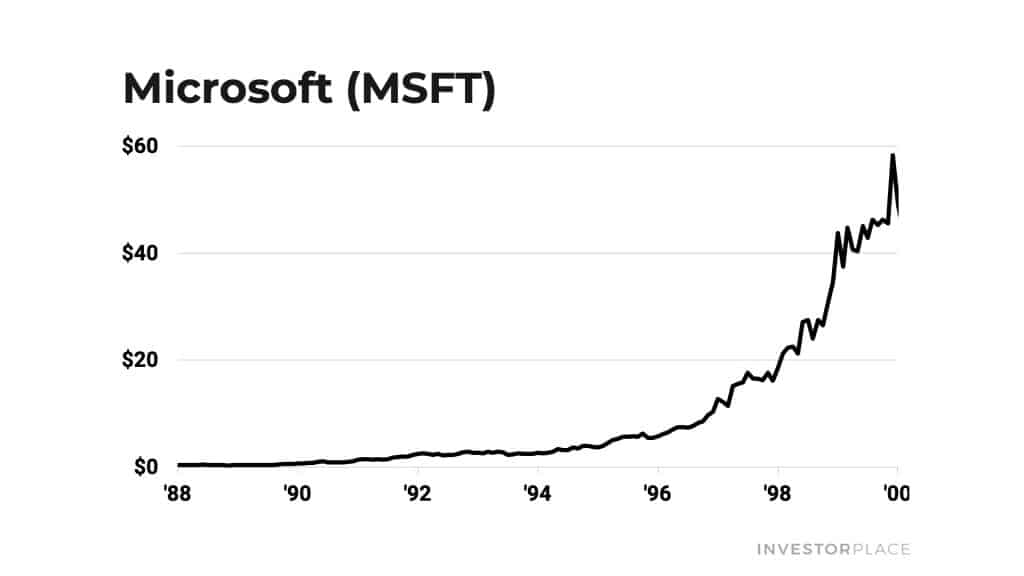

Microsoft when it was trading for just 39 cents…

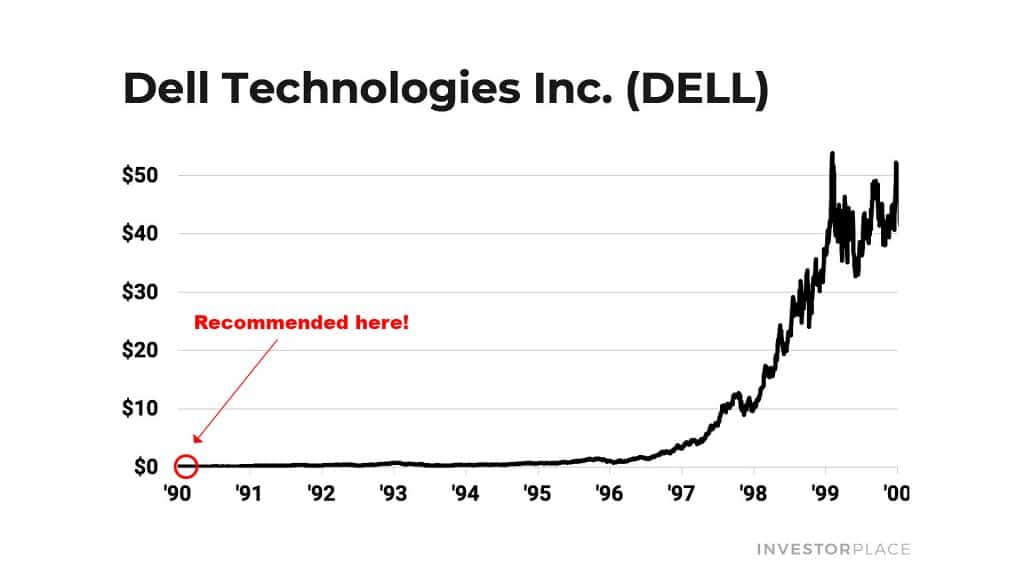

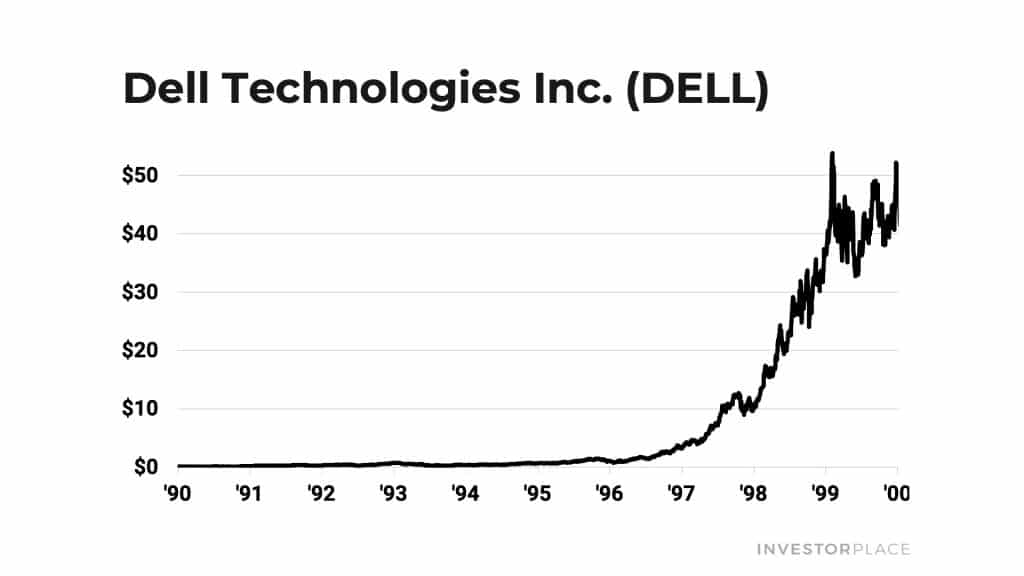

I said to buy Dell when it was trading for less than a buck.

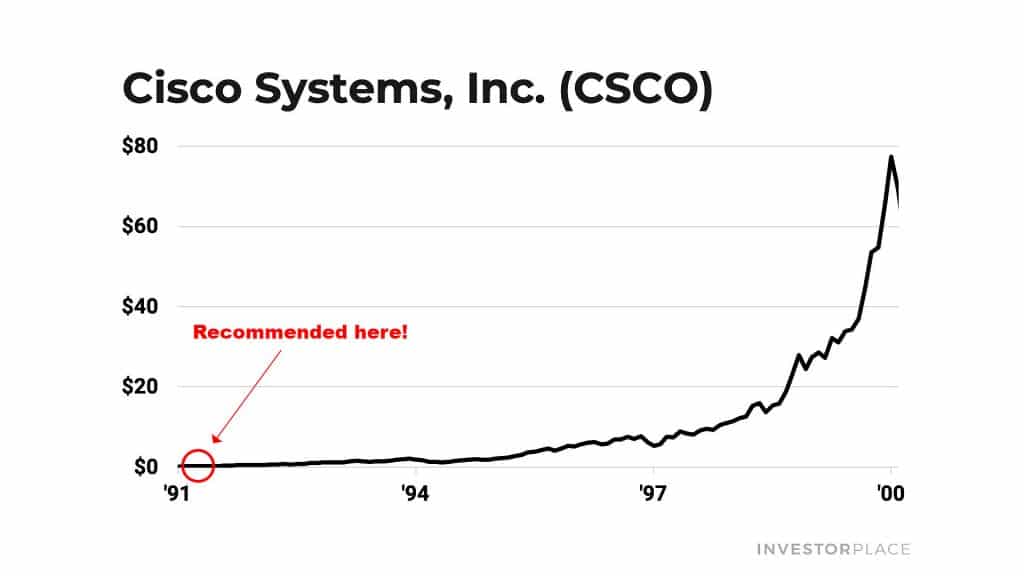

And Cisco when it was 47 cents…

MarketWatch even called me the advisor who recommended Google before anyone else.

Who is Louis Navellier? Learn more about the investing guru.

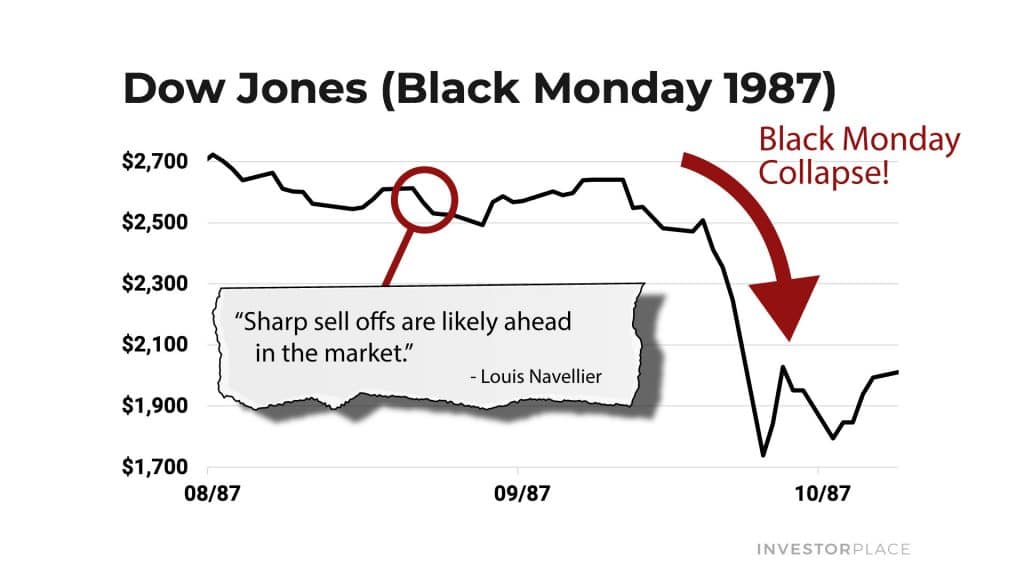

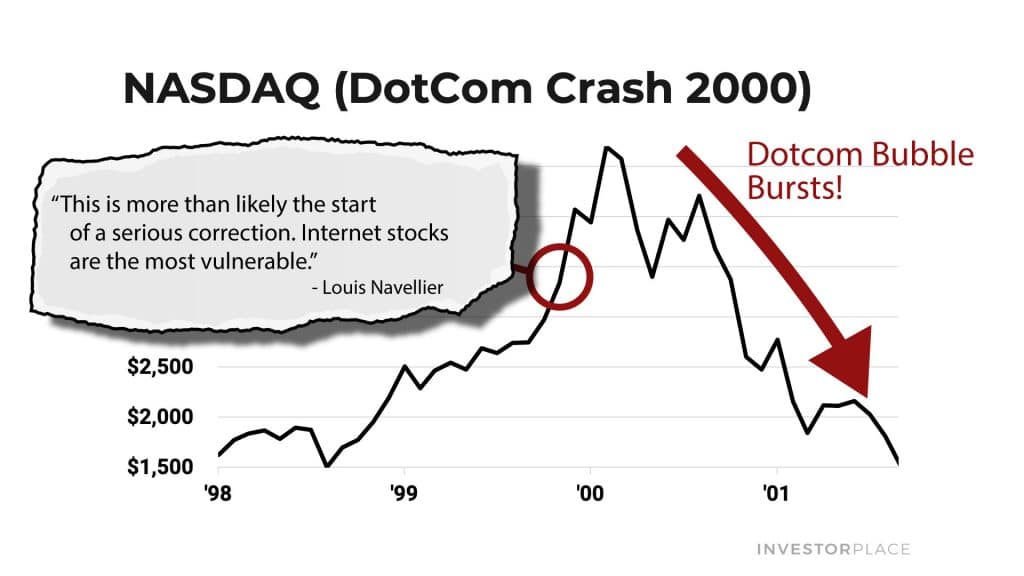

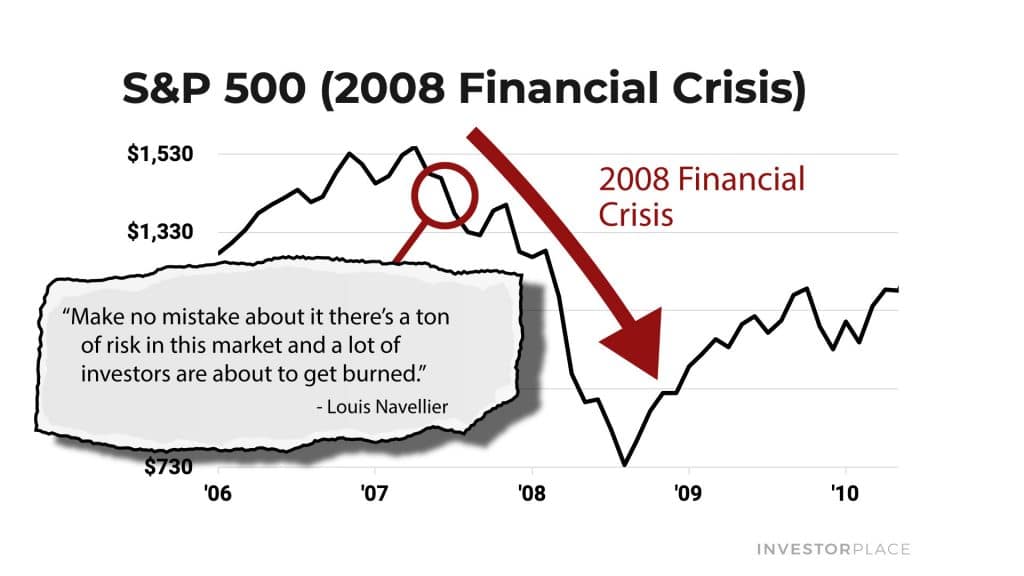

My unique market insights have helped the rich avoid some of the biggest market downturns of the past 40 years too…

Including the Black Monday crash in 1987…

The dot-com crash in 2000…

And the 2008 financial crisis…

Information like this is worth a fortune to America’s upper class.

Which is why they’ve gladly paid me as much as $30,000 per year for it.

After all, just one right call can mean a huge payday, many times greater than that… or the chance to safeguard their wealth from a market downturn.

For these reasons, I’ve been called one of the most important money managers of our time…

The New York Times called me one of America’s best-known investors…

And billionaire Steve Forbes said I have the most enviable long-term track record.

Today, I live in a multimillion-dollar estate on the South Florida coast, a thousand miles from Wall Street, in one of America’s most exclusive neighborhoods.

Now, I realize these days it’s not popular to “go public” with statements like these…

But you should know there’s a very important reason I’m doing it today.

There’s an important reason why you should know that I make a lot of money…

The reason I have all this wealth is what makes me uniquely qualified to deliver a hugely important – and urgent – message.

This is 83% OFF the regular price and you have a money-back guarantee… no questions asked.

A chasm has opened in America… a great divide.

No, not a crater in the literal sense.

I’m not talking about an earthquake or any kind of natural disaster.

This one is much worse… and infinitely more dangerous.

On one side… a new aristocracy, amassing more wealth, more quickly than any other group in American history.

People like me.

Today, the one percent makes more money in one month than most people make in a lifetime.

For people like us, life has never been better, more prosperous.

On the other side…

The opposite is happening.

Wealth is flowing out of the pockets of ordinary Americans at an unprecedented rate.

Today, nearly 80% of Americans are living paycheck to paycheck.

Most people can’t afford an unexpected $400 expense because their wages are too small, or their debts are too large to manage.

And this problem is no longer confined to the lower classes…

25% of American families earning $150,000 a year now depend on the next paycheck just to keep their heads above water.

Think about that.

Every day, more Americans are waking up to the sobering reality that they are not immune to the massive changes happening right now.

Today, the gap between the rich and poor is the widest it’s been in decades.

Although wealth inequality is one of the most important social and economic issues of our time, few people understand what is really causing it.

Despite what you hear from the mainstream press and news media…

It’s got nothing to do with tax rates… or Wall Street… or government bailouts…

It has nothing to do with your background or where you’re from.

I grew up in a small western town you’ve probably never heard of.

My father was a bricklayer who worked 60 hours a week to provide for his wife and children.

Yet, here I am.

America’s huge and widening wealth gap has nothing to do with our laws or our government or our money, either.

This unseen force is much more powerful than any of those things.

You see, unlike the news media or our politicians, I know a lot about what is really causing the huge wealth divide in America.

I know because I’ve used this force to amass more money than I’ll ever care to spend.

Believe me when I say this force is incredibly powerful…

I’ve seen it turn ordinary Americans into multimillionaires – even billionaires.

But I’ve also seen it devastate those who don’t understand it or outright ignore it, even members of my own family and close friends.

The thing is, this force is only going to gather in strength over the coming decades.

It certainly won’t weaken.

I think very few Americans even know that any of this is happening…

Those who do know don’t have a clue what to do about it, or how to prepare for what’s next.

Believe me, I don’t make this prediction lightly and I have no interest in trying to scare you.

I’m simply following my research to its logical conclusion.

If you’re worried about this situation and its implications for American society, I strongly urge you to listen to this message.

I’ve seen very few from my side of the chasm step forward to explain any of these things.

That’s why I put together this video.

In it, I’ll lay out exactly what is happening, including several key steps every American should take right now.

It doesn’t matter if you have $500 in savings…

Or $5 million.

You can benefit from the information in this video.

It’s free to watch and by doing so I believe you’ll be ahead of everyone else struggling to understand what is really going on.

Why give such valuable information away for free?

As someone who loves America down to his toes, I can tell you that it pains me to see the situation we are in today.

I believe the more people who understand what’s happening right now, and can position themselves properly, the better off we’ll all be.

The better off America will be.

I encourage – even challenge – you to listen to what I have to say.

Once you learn the story, I encourage you to structure your life to help you and your money get on the right side of the chasm.

Incredibly, you have the power to choose which side to be on.

But I urge you to take the critical steps I’ll outline in this video very soon… before the gap becomes too wide to cross.

This is 83% OFF the regular price and you have a money-back guarantee… no questions asked.

Which side will you be on?

The best way to help you understand this powerful force…

Is to listen to a story of a man named Reed.

Reed is 28 years old. He’s very bright.

Reed has an idea for a new business.

In fact, he’s already begun getting his new business off the ground – and so far, everything is working out like he’d planned.

But Reed has a problem. He doesn’t have a lot of money. He needs help growing his business.

That’s when Reed decides to approach an established business in his industry.

He figures the two can team up. His newer, younger business can help the older business reach a wider audience and, at the same time, help Reed’s small company grow.

Reed sees it as a win-win for both companies.

But when he meets with executives, he quickly realizes they don’t share his vision. They don’t think Reed’s business will help them. They’ve got it all figured out. To make things worse, they’re not very nice about it. He’s essentially laughed out of the conference room.

Reed has no choice but to go it alone.

He eventually finds other investors willing to take a chance on his business.

Turns out, Reed is on to something. His idea is not just good, it’s fantastic. His business grows like wildfire.

In fact, just a few years after that fateful meeting, Reed’s business becomes more valuable than the established business he approached.

It becomes so successful the other, bigger company can’t even compete.

Because Reed’s business leverages new technology to provide better value – and a better experience – it enables him to run his business with fewer employees.

This makes his business extremely profitable. Reed goes on to become one of the richest people in America. Investors in his business get crazy rich too. His stock soars nearly 500-fold.

Meanwhile, the other company goes bankrupt. Tens of thousands of jobs are lost. Investors who backed the business lose everything.

It’s one of the most abrupt bankruptcies in American history.

Incredibly, the story you just heard is NOT made up.

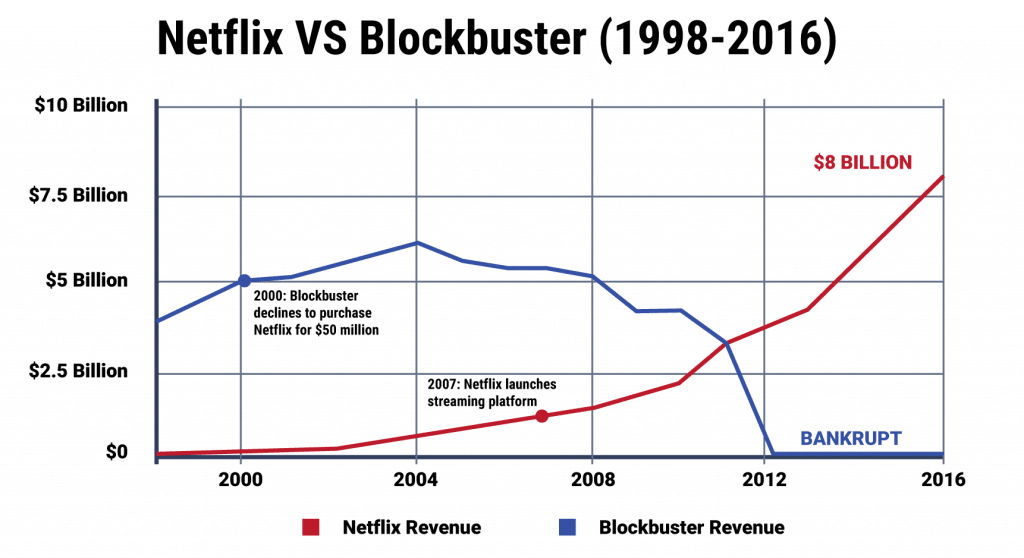

This is the real-world story of how Netflix single-handedly drove Blockbuster out of business.

Every detail you just heard is true…

Yes, Blockbuster actually had the chance to join forces with Netflix in the early days… but passed on the idea when its founder, Reed Hastings, pitched them on it.

Blockbuster went from a market value of $5 billion to bankruptcy in less than nine years. Its shareholders lost everything…

Its “pass” on Netflix is widely regarded as one of the worst decisions in modern corporate history.

Meanwhile, Netflix is one of the greatest success stories of the past 20 years.

It has taken over the $2.2 TRILLION entertainment and media industry… and it made its founders and shareholders lots of money…

What does this story have to do with America’s large and widening wealth gap…

In a word, EVERYTHING.

You see what’s probably most remarkable about this story is how it’s not a one-time… five-time… or even a ten-time thing…

But what’s probably most remarkable about this story is how it’s not a one-time… five-time… or even a ten-time thing…

This phenomenon has been repeating itself over and over again…

You’ve probably noticed in recent years how established businesses that appear sturdy and in control of their markets are suddenly getting destroyed by technological upstarts…

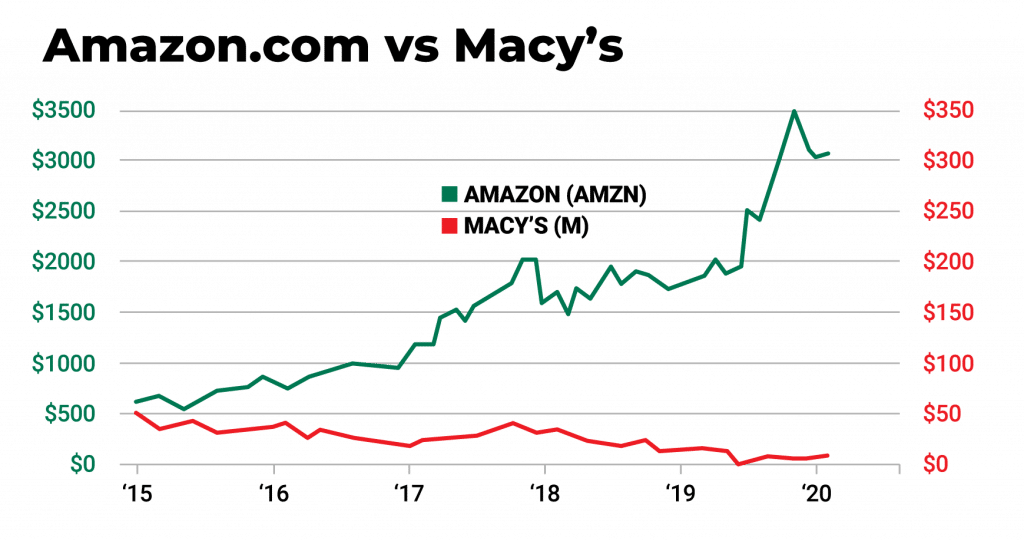

Amazon has transformed the way we shop and get our stuff.

In the process, it’s driven dozens of old-school “brick and mortar” retailers into bankruptcy. Department stores have lost 18 times more jobs than coal mining since 2001.

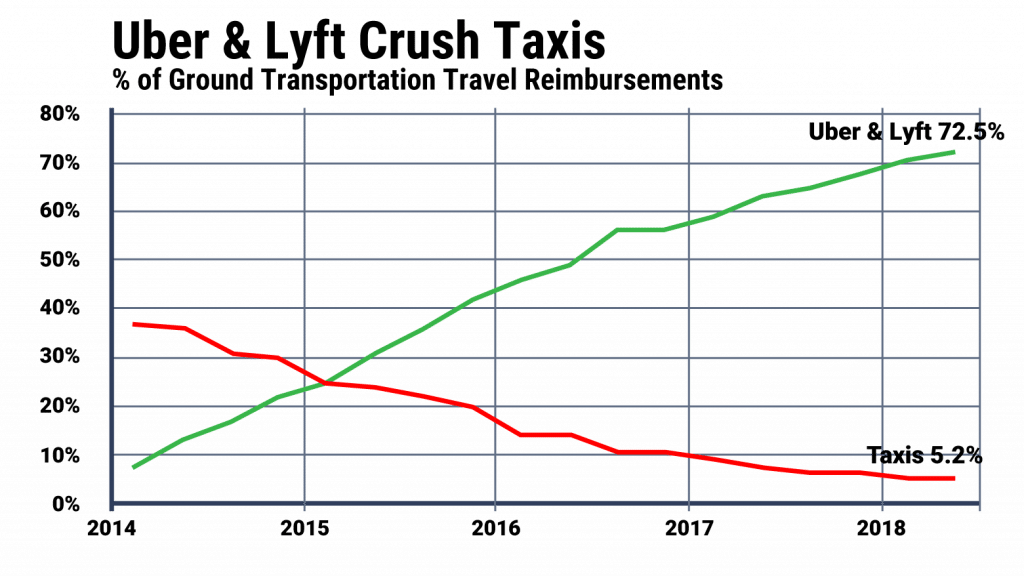

A few years ago, Uber debuted its popular “ride-sharing” technology…

In less than seven years, Uber demolished the “old” taxi industry.

Airbnb now offers more rooms than the top five hotel brands, including Hilton, Marriott and Hyatt, combined…

Wikipedia the free online encyclopedia has annihilated traditional encyclopedia companies…

By 2012, Encyclopedia Britannica published its final volumes, after 244 years of circulation.

Spotify and iTunes have turned the music world upside down.

Google has taken over information…

Facebook, YouTube, Twitter, and Instagram have disrupted traditional media outlets…

Vast amounts of cheap, online content supplied over internet connections killed many newspapers that followed the “old” business model.

Since 2004, at least 1,800 American newspapers have ceased publication. The sector has shed 47% of its jobs during this time.

And these are just the examples you’ve probably noticed in your daily life…

Behind the scenes, small tech upstarts are beginning to wreak havoc on established businesses and industries across the board…

One small startup, for instance, just developed an AI-based software program that can review and analyze legal contracts faster and with better accuracy than a human can.

It was recently pitted against 20 of the best lawyers in America—and won!

I’ll tell you more about this business in a moment, but first, think for a moment about the implications this will have on anyone in – or thinking about going into – the legal profession.

What will it do to wages?

Similar disruptions are occurring right now in real estate… human resources… transportation… customer service… finance… sales… marketing… and more.

The driver of wealth inequality – the force that has opened a large and growing chasm between the haves and the have nots — is technology.

Most people don’t realize it, but technological disruption is creating a giant shift in the way our economy works and how we build wealth.

The destruction of seemingly strong and dominant businesses by innovative technology-focused upstarts is a story we are starting to see over and over in America…

In many cases, these businesses are family-owned…

Employ tens of thousands of workers…

And are cornerstones of investment accounts.

Meanwhile, technological disruption is enriching those who own and invest in these new technologies at a pace never seen before in human history.

It explains why Steve Ballmer, Bill Gates’ No. 2 at Microsoft, became twice as rich in 2019 as he was at the beginning of 2017…

This is 83% OFF the regular price and you have a money-back guarantee… no questions asked.

Why tech titans like Elon Musk, Mark Zuckerberg and Google founder Sergey Brin each grew their net worth by multiple BILLIONS of dollars in 2020.

And Amazon founder Jeff Bezos got $87 billion richer.

While at the same time, huge swaths of America’s cities are essentially slums… filled with millions and millions of poor, desperate, angry people.

On one hand, America is a place of extraordinary wealth… a place where billionaires travel in private jets and buy $10 million condos with a week’s pay.

The system is working great for these people.

For many others, America is a land of extreme poverty.

To these folks, the system is a disaster.

America is the land of “haves” and “have nots.”

Some have absurd abundance.

Some have nothing.

And the rate at which things change in favor of the rich versus the poor is only speeding up, not slowing down.

My colleagues and I call this phenomenon – the huge and rapidly growing divide caused by technological disruptions – the Technochasm.

The Technochasm

Rich

Poor

This chasm between the rich and poor is already large… and it’s only going to get larger.

That’s why I believe it’s critical for you and your loved ones to learn about the incredible force that has created the large and expanding chasm between the Haves and the Have Nots…

Let me show you what it is…

Expect Mind-Blowing Changes

Over the next few years, I believe we’ll see the world change more rapidly than any other group of people in history.

The ways we work, travel, bank, receive health care, and entertain ourselves will look completely different than they look now.

Large new industries will be created at a pace we’ve never seen before.

These new industries will demolish old industries at a pace we’ve never seen before.

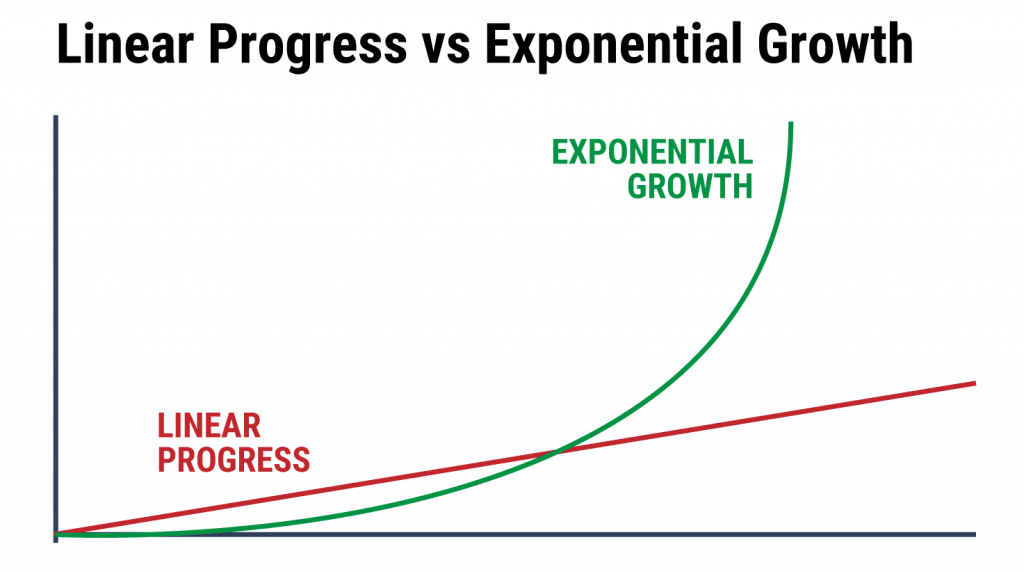

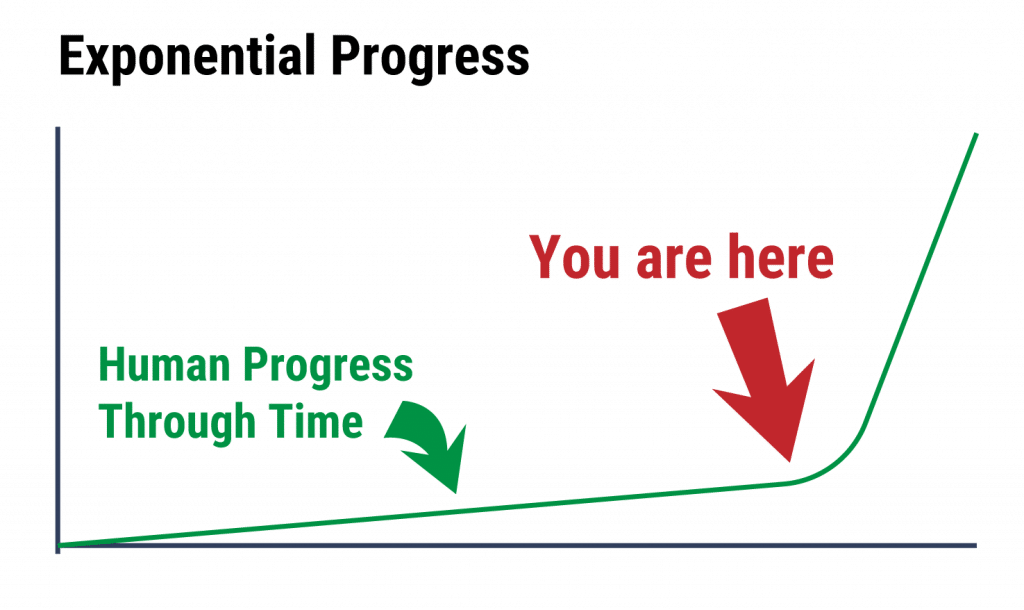

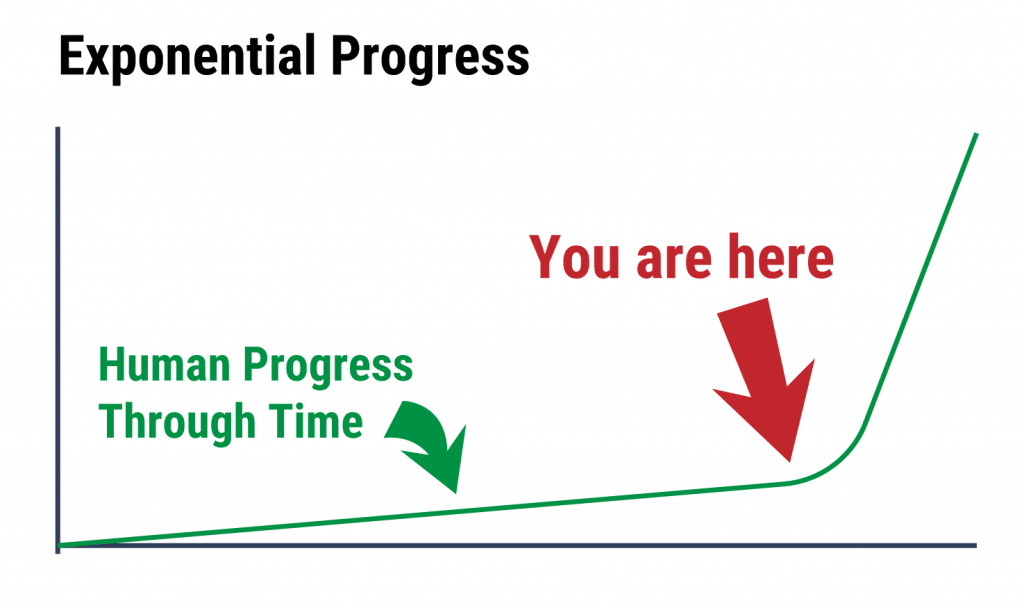

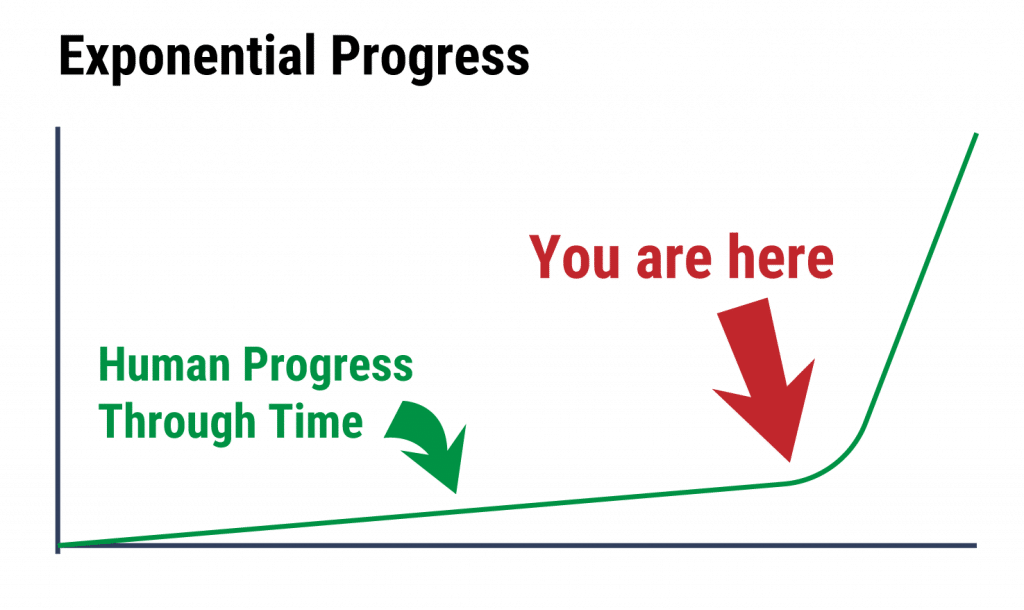

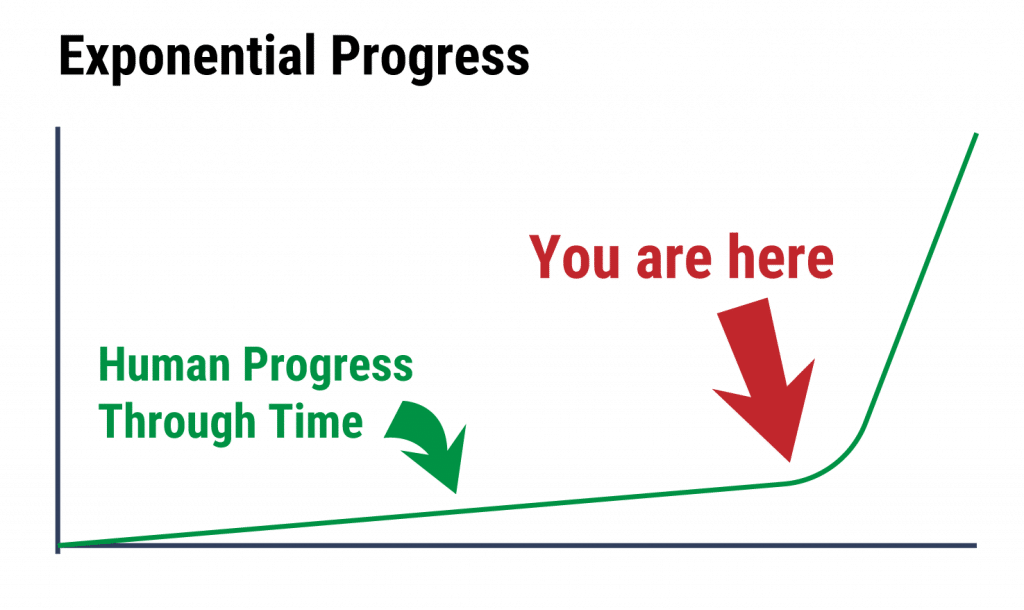

And it’s all because of the law of exponential progress.

This incredible force explains why some companies are growing so quickly, gobbling up market share… making more money faster than ever before…

And why others are getting utterly demolished – going out of business – at the same incredible rate.

What is exponential progress, exactly?

Well… most people are familiar with the concept of linear progress.

In simple terms, linear progress works like this…

Imagine earning a dollar a day for 30 days…

After day one, you have one dollar.

After ten days, you have 10 dollars.

Thirty days… 30 dollars.

This linear growth is the kind of growth ingrained in the minds of most people…

But exponential growth – the kind taking place in technology labs and businesses RIGHT NOW – radically changes the equation…

And radically accelerates the pace of change we see in the world.

Exponential progress is progress that multiplies in power and scope with each step.

Now, instead of progressing in linear fashion…

Imagine doubling that dollar every day for 30 days.

You start with a dollar on day one…

On day two, it doubles, you have two dollars…

Day three it doubles again, four dollars…

Day four, another double, eight dollars…

By the time you get to day 10, you have 512 dollars.

On the 20th day, you have 524,288 dollars…

By day 30, you have over 536 million dollars!

Do you see how powerful this is?

Yes, there are risks. There’s no guarantee every new technology or business will experience growth this way. Many simply don’t make it. But I want to explain why I believe exponential growth creates an incredible investment opportunity.

Exponential progress is progress that “snowballs” and builds on itself.

Specifically, the progress made in a step is DOUBLE the amount of progress made in the step that came before it.

The important thing to understand is that this is not a theoretical concept.

This is exactly the type of growth taking place in the real world, in technological companies right now.

That’s because technology builds off each innovation that came before it.

It ensures that each new step is larger than the previous one.

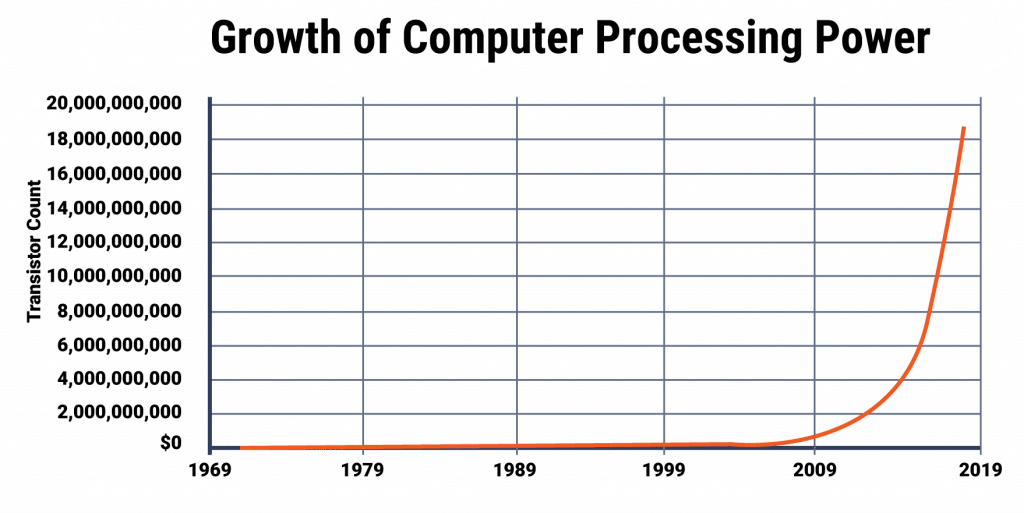

Gordon Moore, one of the founders of the tech giant Intel, first recognized this phenomenon in the 1960s when he noticed the number of transistors per square inch on integrated circuits seemed to double every 18 months.

In other words, he saw that computers DOUBLE in speed and capacity… every 18 months.

He predicted that this trend would continue well into the foreseeable future.

And that’s exactly what’s happened.

Computer power and speed is rising while cost is collapsing.

Here’s what this incredible change looks like in the real world…

In the year 2000, it cost $46 million to buy a computer that could perform one trillion operations per second.

By 2016, you could buy a computer that performed eight times that many operations per second… for just $400.

That’s exponential progress.

In 1976, a digital camera weighed four pounds, cost $10,000 and only had .01 megapixels.

Today’s digital cameras have 1,000 times the megapixels… weigh 14 grams and cost $10…

In other words, they’re a BILLION TIMES better.

The first commercial GPS unit weighed 50 pounds and cost over $100,000 back in 1981.

Today, GPS comes on a 0.3-gram chip and costs less than $5.

Exponential progress explains why the smartphone in your pocket is 1 million times faster than the computers that sent the first men to the moon.

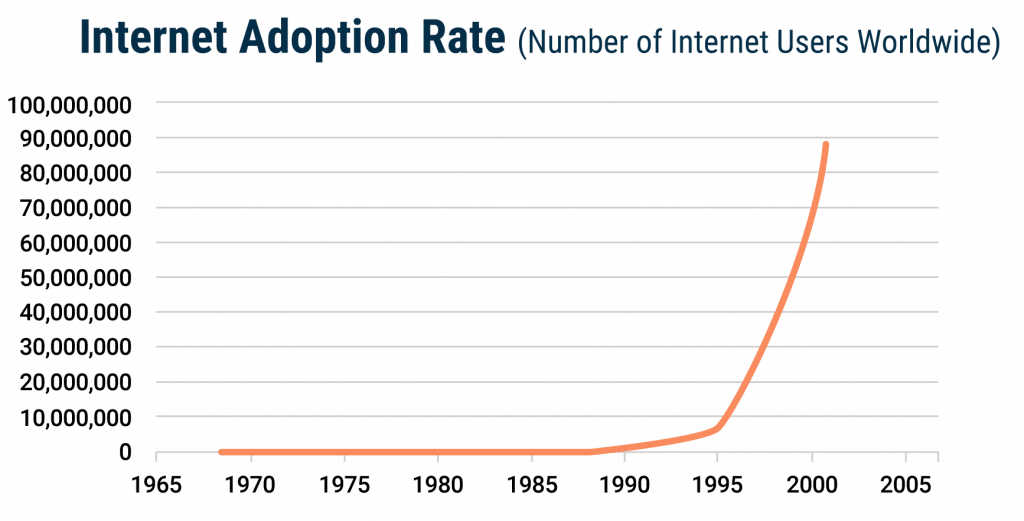

And why internet adoption followed the same exponential rate of growth…

The fascinating thing is, most folks can’t appreciate exponential growth as it’s happening.

When a small number grows at an exponential rate, the first stages of growth aren’t incredible.

It’s hard to notice.

The growth shown on a chart does not soar upward during the early stages.

That’s why this is so hard for most people to see!

It isn’t until the later stages that the big gains are noticed.

The extraordinary growth happens at an “inflection point” in time… when the exponential growth begins to snowball and makes things change at stunning rates.

This is the “liftoff” point you see on this chart:

Over the last four decades, advancements in computing power, data storage, communications gear, and other technologies have followed a trajectory like you see on the left side of the chart.

This is because they started at very low levels.

But after many years of advancing at exponential rates, the technologies I just listed are entering the

“liftoff” phase.

This rapid increase in the rate at which the world is changing has stunning business and investment ramifications.

The world around us is changing at never-before-seen speeds… the speed and capabilities of our computers are increasing at unfathomable rates…

And it’s catching many people off guard.

This is creating a gigantic shift in the way our economy works and how we build wealth.

Today, the acceleration of our technological progress allows companies to operate with just a fraction of the number of employees businesses used to require.

Forty years ago, it took the work of tens of thousands of people to build a business worth $20 billion or more.

Now, some businesses can do it with less than 2,000 people.

For example, in 2019, the workplace software company Slack achieved a market value of $23 billion. It had less than 1,700 employees.

Getting to a $23 billion valuation with just 1,700 employees never used to happen!

Back in 1989, Kodak had about 145,000 employees and was valued around $16 BILLION…

But in 2017, Snapchat achieved a $24 BILLION valuation and had just 1,800 employees.

Back in 1964, AT&T had more than 750,000 employees…

But in 2017, Google was a bigger and far richer company than AT&T with 92% fewer employees sharing the wealth.

Plus, people who invested in Google when it went public made about 17 times more in gains than those who invested in AT&T over the same time.

The best new companies of today simply don’t need many people compared to companies from a decade or two ago.

The number of great jobs is decreasing while the pay for these employees get the jobs is radically soaring!

This is why the wealth gap gets wider and wider every single year.

The incredible rise in computing power, automation and robotics makes all these things possible.

The rules of business and building wealth are being rewritten in front of our very eyes.

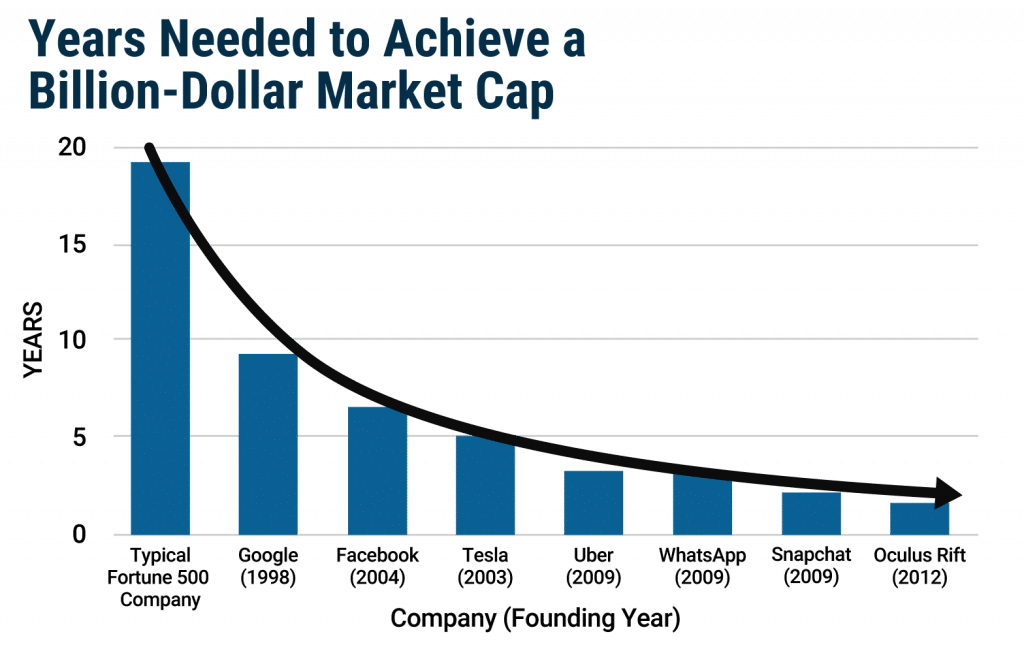

Over the last few decades, it took on average about 20 years for the typical Fortune 500 company to reach a market capitalization of $1 billion.

In 1998, Google reached $1 billion in market cap in just eight years, which was considered incredible.

By 2004, Facebook had done it in just five years.

By 2009, Uber had done it in under three years.

In 2012, virtual reality firm Oculus did it in under two years.

This chart displays the amount of time it took for companies to hit a billion-dollar market cap.

As you can see, it can take less and less time to generate incredible wealth.

To be clear, these are just some of the best examples in this space of the winners. Not every company will grow this fast.

But investors in these businesses are enjoying the benefits.

Never before have such small groups of people built such incredible wealth in such short time frames.

From 2012 to today, Facebook shareholders enjoyed as much as a 1,507% return on their investment.

From 2010 to today, Tesla investors have made as much as 9,100% gains.

Snapchat investors have made as much as 1,213% since 2018.

By now, you can see how in many cases the time it takes for massive change is getting “compressed.”

Industries are being transformed in a short time.

As a result, new industries are springing up at a rapid and ever-increasing pace… while old industries are being disrupted at a rapid and ever-increasing pace.

It will wreck family businesses, careers, and investment portfolios.

New industries are springing up at a rapid and ever-increasing pace… while old industries are being demolished at a rapid and ever-increasing pace.

As Uber and Lyft soared to billion-dollar valuations, the old taxi industry was devastated. It lost millions of dollars in revenue.

This is the Technochasm splitting apart before our very eyes.

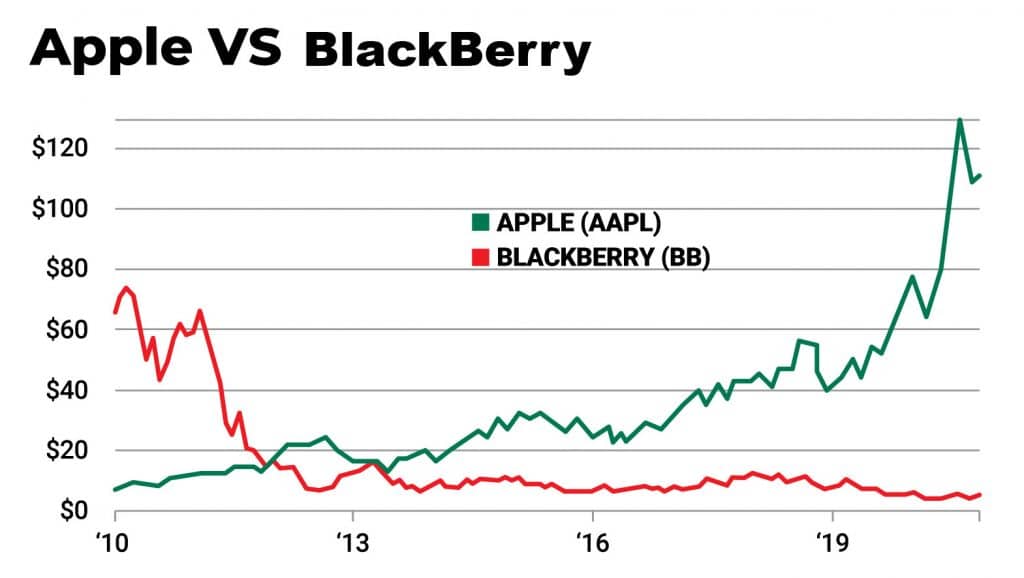

As Apple’s iPhone dominated the smartphone market, the losing competitor, BlackBerry, saw its share price plummet more than 90%.

Those on the right side saw incredible rewards. Those on the wrong side got left behind .

As Amazon’s valuation surpasses the $1.6 TRILLION mark, dozens of brick-and-mortar retailers continue to slide into bankruptcy…

Welcome to the Technochasm.

And the rate of change is speeding up every year.

The destruction of certain industries is only going to get worse. Much worse. While the money being made by a select few is only going to be more dramatic.

My hope is that some folks—you among them—seize on this opportunity to make more money, than ever before.

Why should you listen to me?

Because for the past four decades, I’ve had a front-row seat to the incredible technological change taking place in our world.

Back in the ’70s, I was working under a Wells Fargo executive, a mentor of mine, who granted me access to one of the world’s first corporate mainframe computers…

As big as a room back in those days…

Keep in mind, this was back when computers were a cutting-edge technology almost no one in the world was even using, save for government agencies like NASA and a few big corporations.

I was tasked with using a computer to analyze and find winning stocks.

The thinking was, these new supercomputers might completely change the Wall Street game.

And as a student of probability and statistics, I was certainly up to the challenge.

Now, the epiphany was not just the fact that I just found a way to beat the market as a college student – by 3-to1, no less — using a powerful computer…

Forbes would later call me the “King of Quants” for my efforts…

MarketWatch, a “Wunderkind”…

But rather, the true revelation was the speed and the ease at which I was able to do it…

That one man could singlehandedly complete a task that normally took 10, maybe even 20 market analysts.

And I did it in a fraction of the time.

One person completing the work of many.

The big picture was not lost on me.

I could see we were at the forefront of massive change…

The increasingly fast pace of technological progress – in particular, the rise of computers – would be a disruptive force in society.

Businesses who needed accounting, to process vital statistics, store information, organize files, keep inventory, and innumerable other tasks would leave the paper-based analog world behind and increasingly turn to computers and automation…

This trend would only accelerate over time.

The implications were immense.

I surmised that companies – and investors – who aligned themselves with this shift would advance at breakneck speeds.

Their revenues, profits and stock prices would soar.

I saw an opportunity.

So…

Starting with just $300,000 collected from family and friends…

I began a small investment fund that backed the technologies leading the revolution…

I began publishing research urging folks to embrace the shift to an increasingly computerized world.

I recommended people invest in the companies developing the powerful mainframe computers businesses were employing to increase efficiency and productivity…

Like IBM, when it was trading at the equivalent of just $8 per share…

I recommended the young startups bringing the computing revolution into our homes…

I was one of the first to recommend a little-known company founded by two guys working out of a garage in California, called Apple, when it was just a $1.49 stock…

And a promising young company called Dell – that was revolutionizing the PC mail order business — when it was less than a buck…

I told folks to buy the businesses developing the revolutionary software that enabled these computers to be used in our homes and by small businesses…

One such program was an integrated spreadsheet software breakthrough saving its users stupendous amounts of time by allowing them to automate calculations and financial analysis… instead of doing single calculations by hand.

Today, Excel is the world’s most popular spreadsheet software.

One person running Excel can do the work of a million accountants from days past.

I knew the company that created it, Microsoft, had the potential to create generational wealth for its investors.

I told folks to buy shares well before it was a household name, when it was a 39-cent stock…

By the way, if you’d like to fact check anything I say, please visit our disclosures and disclaimers page.

I pounded the table on the producers of computer memory – like Micron Technology. I recommended it at less than $1 per share…

Today, Micron is one of the leading providers of RAM and flash memory for computers.

The silicon microchip innovators like Intel at around $3…

Before long, my recommendations were outperforming the market by an unheard of 6-to-1…

That’s SIX TIMES better than the stock market. In the financial world, that’s a pretty rare feat.

Anyone who acted on my top recommendations and held on over the long term had the chance to see lifechanging gains…

As much as 31,000% gains on Apple…

More than 310-times your money

Or more than 500-fold gains on Dell…

500x Gains

Or 15,483% on Microsoft…

That’s 154X your Money

While it’s unlikely many people realized gains like these, my point is to illustrate the power of exponential progress and getting in on the right opportunities early.

I was the subject of bestselling books… media interviews… wealth and notoriety…

The Wall Street Journal said most money managers could only dream as having as much success as me…

But my work was far from complete… as we entered the 1990s, I knew the next phase of the digital revolution was upon us…

Our computers were becoming connected.

I recommended the internet networking firm called Cisco when it was trading for the equivalent of just 20 cents!

Database innovator Oracle at the equivalent of just 56 cents!

Not long after, I began writing about a small company radically transforming the internet space.

Few people at the time understood its business… or recognized its importance.

But I knew this company – a first mover using the disruptive power of the Internet to underprice “brick-and-mortar” stores and sell things online – was going to completely transform global commerce.

I recommended Amazon at $46…

Today, it’s a $1.5 TRILLION giant, trading for more than $3,000 per share.

And that’s the key to getting rich in the fastest, most innovative new tech stocks…

Understanding which businesses will leverage the power of exponential progress to their advantage…

And go on to mint billions, even trillions of dollars in profits…

It’s why MarketWatch called me “The adviser who recommended Google before anyone else.”

It’s why my friend and billionaire Steve Forbes said I have the most enviable long-term track record.

And why I’ve been called one of the most important money managers of our time.

Again, I say these things not to brag, but rather to show when it comes to understanding the law of exponential progress, few people are as well versed as me.

In fact, over a 15-year period, my recommendations turned every $1 invested into as much as $41, a remarkable 4,000% return.

An incredible performance that has even bested Warren Buffett.

Is every single one of my recommendations a winner?

No, of course not.

I’ve had my fair share of duds in my career.

I don’t care what anyone tells you. No one gets it right 100% of the time.

But I will say this: Understanding this very powerful force has increased the odds of success of those who’ve followed my work.

I’m proud to say that my 2020 Growth Investor portfolio of recommendations had an average gain of 36.2%. This return measures the results achieved by all of our recommendations in 2020, scaled to a one-year period.

I simply would not have been doing this for more than 40 years if I wasn’t providing folks with high-quality investment research. Feel free to fact check anything at our disclosures and disclaimers page.

And don’t worry, it’s not too late. You haven’t missed a thing.

In a moment, I’m going to show you my secrets to uncovering the next Amazons… Googles… and Microsofts…

These companies are on the launching pad as we speak.

I have a few favorites I want to tell you about, but first…

As I said before, I believe we’re about to enter the fastest, most disruptive period of the Technochasm…

The next few years could be the greatest period ever to be a technology investor. There could be more disruption in the next 20 years than in the previous 80 years combined.

Converging technologies like 5G, artificial intelligence, driverless cars, augmented reality, blockchain and more will completely reshape our world…

And with all that disruption comes incredible opportunity.

Just consider what’s happening in the automotive sector…

Autonomous vehicles – cars that can drive themselves – is just one area where I believe incredible new fortunes will be made.

This isn’t some sci-fi technology that’s going to happen sometime far off in the future.

That’s what most people don’t get.

It’s happening now.

Actually, this trend has been quietly picking up speed behind the scenes…

In 1999, GPS units began showing up in cars. The change may have been abrupt at first. But eventually we got used to the idea that our cars could tell us where to go…

Shortly after, collision detection sensors began appearing in cars to alert drivers of objects and people when backing out of the driveway…

In 2003, the first cars were introduced that could parallel park themselves…

Do you see how exponential progress works?

How change was gradual – almost imperceptible – at first?

But the changes just kept coming…

Then lane assist became standard in many cars so you don’t run off the road if you get distracted or doze off at the wheel…

In 2014, Tesla introduced autopilot, which features lane centering, traffic-aware cruise control, self-parking, automatic lane changes, and semi-autonomous navigation…

Chevy introduced Super Cruise…

Volvo has Pilot Assist…

BMW has Driving Assistant…

Subaru has “Eyesight”…

Almost all car makers have some form of semi-autonomous driving capabilities.

This is a trend that is not going to reverse itself.

All Tesla models are now built with autonomous-vehicle capabilities.

Some of the cars I own have thermal imaging to see animals, people… anything warm-blooded, and will automatically apply the brakes if something unexpectedly gets in the way.

My point is…

After years of relatively modest advancement, driverless cars are now entering the “liftoff” stage.

This is the law of exponential progress happening before our very eyes!

This is how it happens…

A long series of tiny, gradual changes alter our world, yet we barely notice them… until we wake up one day and realize a massive change has taken place.

I urge you not to miss out on this trend.

I believe the coming revolution in transportation will be massive.

The way we get to work… get groceries… go on vacation… will forever change.

Pretty soon, cars will no longer be owned… but “subscribed” to. They pick you up and drop you off as you please.

No more parking… no more insurance… no more repairs… no more oil changes!

This massive new trend is known as “Transportation as a Service” and it will be the biggest change to transportation since the birth of the automobile itself.

Think about what this will do to the insurance industry when most people don’t even own cars anymore!

Or city revenue when parking meters go away… or when they can’t issue parking tickets.

Think about what this will do to the oil and gas industry – when all of our cars go electric.

But this trend goes far beyond you and me…

You better believe that corporations who normally depend on drivers will make the switch to driverless vehicles…

As many as 25% of American jobs are at stake.

Autonomous vehicles never need a break… they don’t get paid a salary there’s no vacation time to worry about… no sick leave… no 401(k)… or pensions…

A human being simply can’t compete.

I’m not saying I agree with these changes…

But the fact of the matter is that you or I are unlikely to stop any of this from happening.

You can embrace this trend – or you can ignore it and risk getting left behind.

Look around, this is already starting to happen…

Uber just ordered up to 24,000 cars from Volvo for its driverless fleet.

Waymo — the Google-owned driverless-car company — recently ordered 62,000 driverless minivans from Fiat Chrysler and 20,000 Jaguar SUVs.

Supermarket chain Kroger is beginning to implement driverless cars to deliver groceries. Domino’s Pizza and Pizza Hut are doing the same.

Jeff Bezos, of Amazon, just placed an order for 100,000 vans that will ultimately drive themselves.

Fed Ex… Walmart… CVS… UPS… are all incorporating driverless vehicles into their daily business operations.

And numerous cities around the nation are test beds for driverless car technology.

I have no doubt this could be one of the biggest investment opportunities in world over the next decade.

Folks who are prepared for this change will have the potential to prosper…

Those who aren’t could miss out.

And it’s not just blue-collar jobs at risk…

Fifty years ago, a white-collar worker had nothing to fear from technology.

Computers simply couldn’t compete with white collar workers when it came to complex analytical tasks like tracking investments, crafting retirement portfolios, processing financial transactions, analyzing marketing data, and reviewing contracts.

But the combination of artificial intelligence and software is over 100,000 times more powerful than it was in the 1980s. Computers can do all of those tasks… and many more.

The sad part is, many people with “good” white collar jobs don’t think technology poses any risk to them.

Research firm IHS Markit says that technology-related job losses or reassignments will impact a stunning 1.3 million banking and Wall Street jobs by 2030.

Financial Times reports that in 2000, there were over 5,500 floor traders on the New York Stock Exchange. Now there are less than 400.

These high-paying Wall Street jobs – which facilitated transactions – have been replaced with electronic order routing.

Forrester Research says that 1 million people in sales and marketing will lose their jobs to marketing software programs.

If you think about it, it’s common sense.

A lot of marketing departments are staffed with people who collect and analyze marketing results.

But advanced software can do those jobs much, much more efficiently than humans can do them.

Good human resource jobs are at risk as well.

In the “old” economy, handling a company’s payroll, health insurance, and vacation required large staffs.

But now, software can do those jobs much more efficiently.

More and more companies are using software to select the best job candidates.

Companies now use software to sift through applications and assess video interviews.

Only after this automated selection is performed do human recruiters come in.

Hundreds of large firms – including Goldman Sachs, Morgan Stanley and Citigroup – already use this kind of service.

Are you a lawyer?

In 2018, a study showed that software could detect mistakes in several contracts simultaneously in just 26 seconds with 94% accuracy.

Meanwhile, it took a group of 20 lawyers 92 minutes (over 200 times as long as the software) to perform the same task… with just 85% accuracy.

When it comes to sifting through large amounts of data and cross referencing it, humans simply can’t compete with software.

Some people say that technology creates more jobs than it eliminates.

That’s often true in individual companies.

However, here in the 21st century, many of the new jobs being created don’t pay much… and offer little in the way of personal fulfillment.

New technologies will certainly make it harder to bargain for higher pay.

Why would doctors get paid more when state-of-the-art AI software can discover tumors more accurately?

Why would lawyers get paid more when incredibly powerful software can review and evaluate contracts faster and with better accuracy?

That’s why it’s critical to consider your portfolio to help ensure that you thrive.

What’s happening next

By now, I hope it’s obvious which side of the Technochasm is the right side to be on.

You want to back the businesses and industries that can’t be destroyed by the Amazons, Googles and Microsofts…

And the new disruptors coming up behind them!

You want to cut highly vulnerable “old” businesses out of your portfolio.

And most importantly…

You want to ensure the extraordinary power of exponential progress is working for you… not against you.

With what could be one of the most important financial decision you’ll make for the next 20 years in mind, here are the three key steps you should consider to help ensure you’re on the right side of the Technochasm…

Step #1 – Own the “Kings of Scalability”

If you want to learn how to capitalize on all the changes happening right now, you must understand one key concept.

Remember this word: Scalability.

The typical “old” 20th-century company had to invest massive amounts of money in real estate, heavy equipment, and workers to survive and turn a profit.

Blockbuster had to invest millions into brick-and-mortar stores, tens of thousands of employees, displays and inventory…

Same with car makers like General Motors and Ford. Same with steel makers like U.S. Steel.

Or, consider the billions of dollars an airline has to invest in planes and maintenance.

On Wall Street, these kinds of businesses are often said to be “capital intensive.”

Sure, they can make money… but the capital required to start, maintain, and grow these kinds of businesses is astronomical.

As you can imagine, having to invest billions of dollars to get a factory up and running – and then having to continually invest in the factory to keep it current – is like a lead weight on a company’s profits.

Those companies are getting wiped out.

On the other hand, you have “asset lite,” extremely scalable technology businesses like I’ve described in this presentation.

These are the businesses contributing to the massively increasing wealth gap.

Sure, it takes some money to get an “asset lite” software or social media company started, but it’s a lot less compared to an airline, car maker, or steel maker.

I like to think of scalability as “infinite costless copying.”

Companies deploying software… database technologies… streaming movies and other digital assets can reproduce these products and services for everyone, practically at no cost.

One small company – even a few people – can supply everyone on the planet on their own.

Thanks to the scalability of technology businesses, a software company like Microsoft can produce and sell additional copies of its software at minimal cost…

Netflix can stream movies digitally…

So these companies’ revenues can rise much faster than costs.

As a result, these businesses enjoy profit margins 5 to 10 times larger than “asset heavy” businesses.

That’s why in recent years, companies like Microsoft, Google and Amazon became the first companies in history to reach trillion-dollar valuations…

They made their shareholders rich… while many “old” American businesses closed their doors.

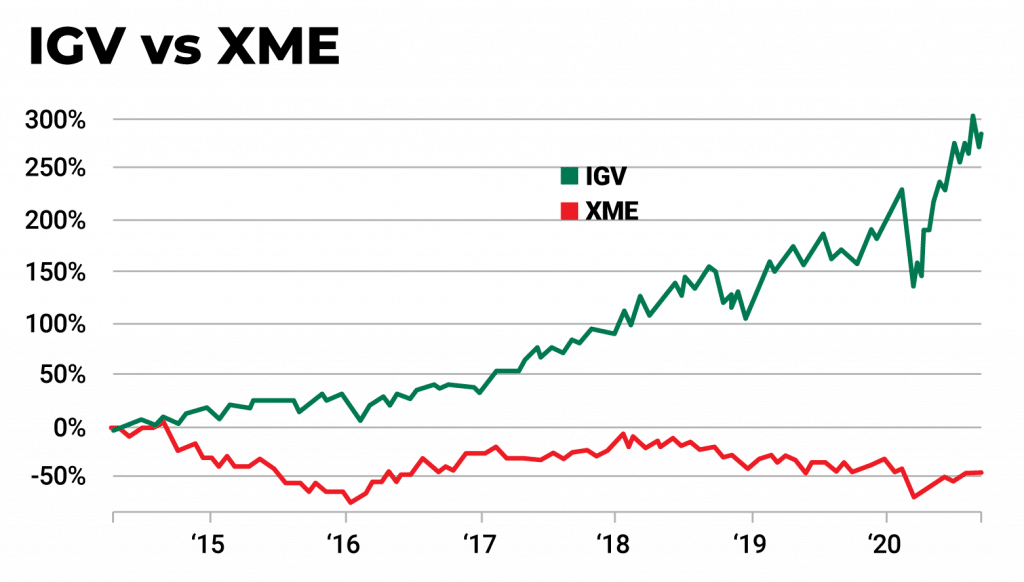

Just look at the stunning visual examples of what it means to be on the right side of scalability and the Technochasm and the wrong side.

This chart shows the performance of the iShares North American Software ETF versus the performance of the SPDR S&P Metals & Mining ETF.

As you can see, the software fund – which consists entirely of highly scalable tech stocks – is up 281% over the past few years.

Meanwhile, the mining ETF – which consists entirely of “old” mining companies – has declined 41% in value.

That’s the Technochasm happening before our very eyes.

Or let’s take the online retail technology giant Amazon versus the conventional retail giant, Walmart…

Few businesses represent their industries and generations better than these two companies. Amazon is an icon of the “new,” Walmart is an icon of the “established.”

As you can see, Amazon is up 1,045% over the past seven years. Meanwhile, Walmart is up just 66%.

Those on the right side of the Technochasm got incredibly wealthy. Those who owned Walmart got left behind.

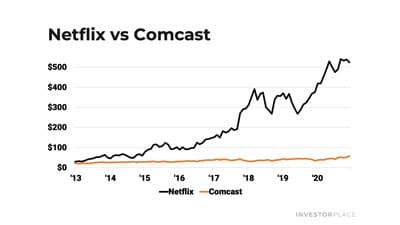

For another look at how the new is outperforming the old, let’s look at the returns generated by Netflix (representing the new tech) and Comcast (representing the old)

As you can see, Netflix is up 2,043% over the past seven years. Meanwhile, Comcast is up a mere fraction of that.

Incredible!

Investors are watching this “new crushing old” story play out year after year.

Folks with portfolios heavy in “old” industries are struggling to break even and often losing money… while investors in technology are in a much better position to see enormous returns every year.

Think about the implications of all this for a moment…

If your portfolio holds lots of slow growth, “old” stocks and grows at 6% a year… and your neighbor’s portfolio holds innovative tech firms growing at 100% or more per year, that’s the unseen force of the Technochasm at work.

That’s why a decision to add “asset lite,” extremely scalable technology businesses to your portfolio instead of “asset heavy,” nonscalable old businesses has real-world implications.

My advice is to get your portfolio on the right side of the Technochasm.

It all begins with step #1 – Owning the NEW and rising Kings of Scalability…

Yes, you want to own Amazon… Netflix… Facebook…

But you also must know who the next generation of highly scalable tech businesses are…

These companies are growing faster than ever before, and because of technological advances they don’t need many employees to do it.

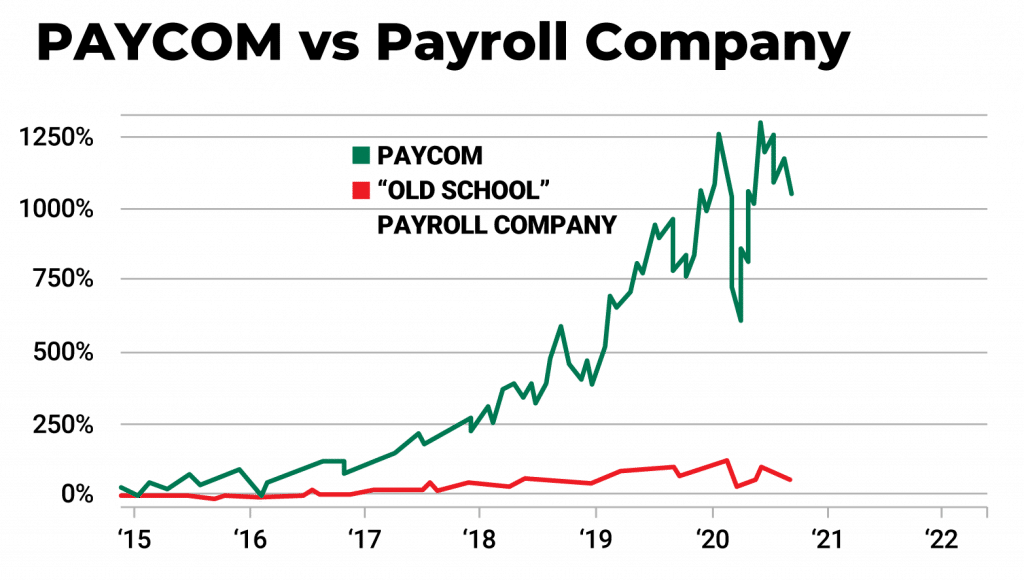

Take a company called Paycom, one of America’s leaders in human resource software. Its products help companies manage their payrolls.

And it provides these services with just one-fifteenth the employees of traditional “old school” payroll companies.

There’s amazing wealth creation happening with Paycom Software.

Thanks to incredible demand for its services, Paycom’s market value increased 1,050% since 2015.

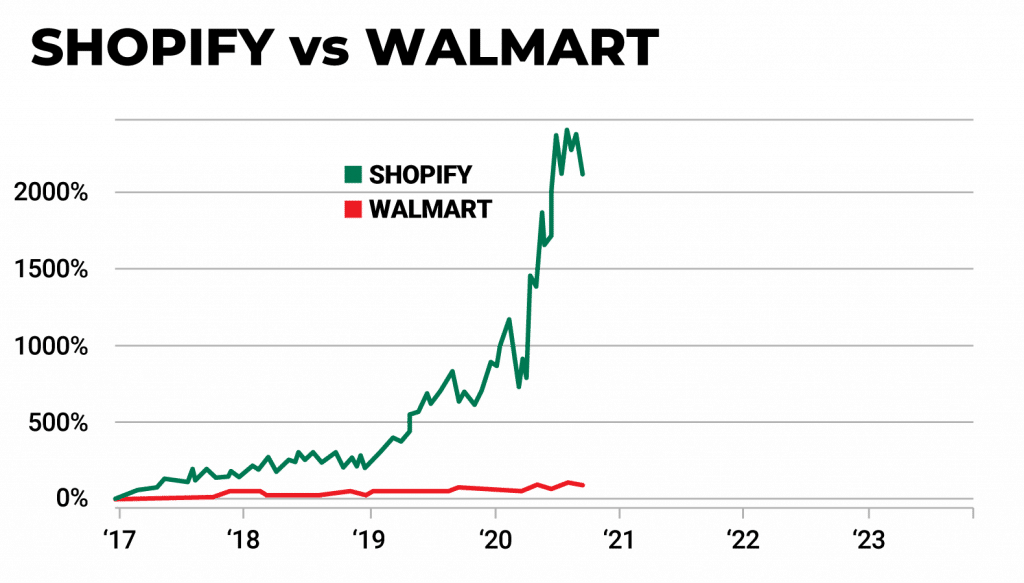

Or, consider the incredible wealth creation shareholders of Shopify have enjoyed over the past few years.

Shopify is an innovative firm that helps businesses sell their products and services online. It’s a huge hit with customers…

It has 1/1,000th the employees Walmart has… yet is TWICE as profitable.

As a result, its shares have skyrocketed 2,116% over the past three years.

This is why scalable tech firms are transforming entire industries, practically overnight, and helping to make investors rich.

And don’t worry, you haven’t missed out. The good news is that there are a dozen or more of these fast-growing tech firms emerging every year.

In fact, I’ve just identified three I recommend you BUY right now.

Now, of course all investments do carry risk. Past performance does not indicate future returns. And I would never recommend investing any amount of money you aren’t willing to lose.

That being said, I believe in these three stocks as much as I believed in any of my best recommendations in my career…

One of them has created a software platform that is revolutionizing the way businesses manage and analyze their projects.

Businesses are going crazy for it. This company claims 42% of the 2,000 largest global companies among its customer base and gaining. Which is why sales are growing at a blistering 30% per year.

Of course, a few years of incredible growth is great.

But sales mean nothing if businesses don’t renew these services year after year—a key metric most analysts fail to take into account.

A whopping 99% of customers renew this company’s software.

This business is making enormous profits. In my view, it is somewhat reminiscent of Microsoft back in the ’80s.

Because few investors know about it, I believe it’s one of the best bargains in the entire investment world—and it’s positioned to grow rapidly in the years to come.

Another company is bringing the incredible power of the blockchain – one of the most secure digital infrastructures we’ve ever known – to the world’s leading financial institutions… even everyday people like you and me.

I could go on all day about the revolutionary impact blockchain will have…

It’s already being called, “More revolutionary than the cotton gin, the steam engine, the PC, and the smartphone combined…”

Even saying it “could reverse the course of civilization and upend the world’s most powerful companies…”

But here’s my belief….

The blockchain will entirely transform our economy and financial system.

And there’s one little-known company helping to make it all happen.

I think this company could go down as one of my all-time great recommendations.

Again, few people know anything about it yet. Which makes right now the perfect time to stake a claim.

You’ll learn all about every one of these incredible businesses in my new report, The Kings of Scalability: 3 Must-Own Stocks to BUY.

Odds are, most Americans have never heard of any of these companies, but they all have THREE things in common: They are revolutionizing the way we use technology… they’re extremely scalable… and best of all, there’s plenty of room for growth.

They’re poised to make their shareholders incredibly rich in the coming years.

The way I see it, it’s crazy to own low-profit Stone Age stocks when there are dozens of companies you can own that are putting the magic of exponential progress and scalability to work… and creating hundreds of billions of dollars in wealth at rates we’ve never seen before.

That’s why I want to put this report in your hands today.

But before I show you how to claim your copy, there’s another step you can take to help get you on the right side of the Technochasm.

Step #2 – Profit From the Network Effect

To fully tilt the power of exponential progress in your favor you’ll need to know about another incredible wealth-building phenomenon…

It’s a business and communications phenomenon called the “network effect.”

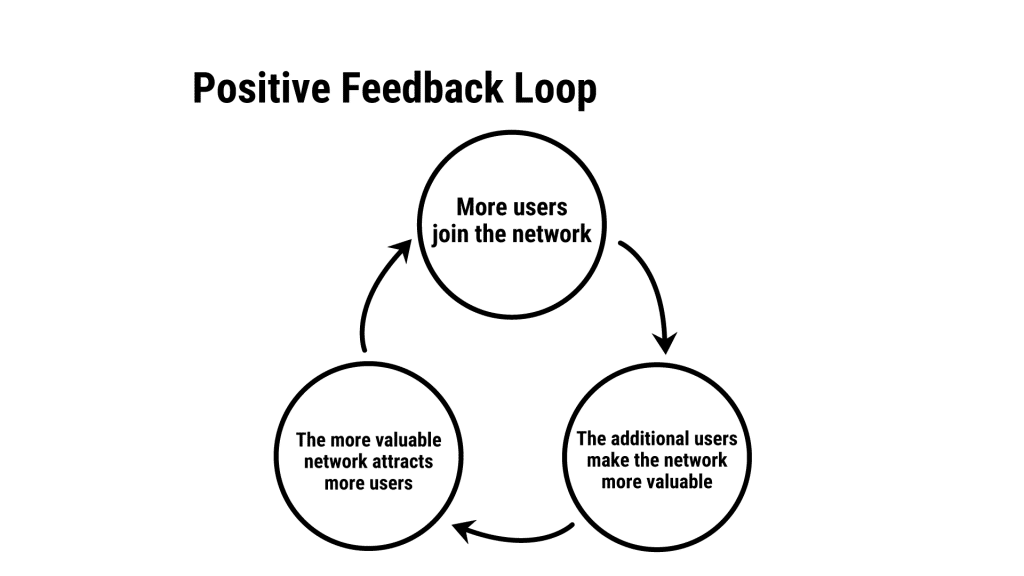

The network effect occurs when each new user of a service or a product increases the value of that service or product.

Take the telephone…

In its very early stages, the telephone wasn’t a hugely valuable invention.

That’s because only a few people had telephones.

If you had one of the early telephones, you couldn’t talk to many other people. They didn’t have them!

However, once more and more people saw the value in telephones, they started buying more and more of them.

After a while, you could talk to dozens of people who had phones instead of just two or three people with phones.

What followed was a virtuous, self-reinforcing cycle.

The more people had phones, the more valuable phones became.

The more valuable phones became, the more people bought them.

As even more people bought phones, they became even more valuable…

And so on.

This kind of virtuous, self-reinforcing cycle is called a “positive feedback loop.”

For another look at the network effect, let’s take a quick look at one of the biggest business success stories of our time: Google.

In the early 2000s, Google founders Sergey Brin and Larry Page developed the most efficient way of searching the internet. Their service was far better than other early search engines.

As a result, lots of people wanted to use Google’s search engine.

The more people used Google, the more people wanted to ensure their website was listed with Google.

The more people wanted to be listed, the better the search results got.

The better Google’s search results got, the more people wanted to use Google.

In addition to serving internet searchers, Google also developed a way to deliver targeted advertising.

For example, a person searching for vacation ideas was served with vacation-related advertising.

The more people visited Google, the more advertisers wanted to advertise on Google. The more advertisers Google had, the more targeted the advertisements became… which attracted even more users.

Google created a virtuous, self-reinforcing cycle that exploited the network effect to the tune of creating a company worth more than $1 TRILLION.

By the time he was just 37 years old, Google co-founder Sergey Brin was worth $20 billion.

Universal connectivity and the network effect are the forces behind most all of the mega-successful technology winners of the past 20 years.

Uber, which went public in 2019 at a giant $82 billion valuation, is another great case study in the network effect.

The more users Uber attracted, the more drivers it attracted. The more drivers it attracted, the better it could serve customers. The better it served customers, the more customers it attracted.

It created a virtuous, self-reinforcing cycle that made its shareholders obscenely rich.

Early Uber investors saw 1,300 times their money.

Or, take Facebook.

With every new user, Facebook became more valuable as a business.

As its social network’s value increased, its new sign ups increased. Millions upon millions of people signed up for Facebook because millions upon millions of other people were signing up for Facebook.

Facebook became popular because it was popular… leveraged universal connectivity and the network effect… and early shareholders made more than 1,000 times their money!

You can see the golden thread here. You can see the smoking gun. You can see how the dominos fell.

Of course, everyone knows about the wealth and power amassed by shareholders of tech giants like Facebook and Google.

By now, their stories are legendary… and the media obsessively focuses on those giants.

Since the giants get all the press and attention, few people know about the smaller, innovative technology companies using the power of the network effect to their advantage.

The next Ubers… the next Googles… the next Facebooks are on the launching pad.

I want to tell you all about three of them in my special report called, The Network Effect: An Incredibly Powerful Wealth Creation Force.

One of these companies, for example, is quietly gaining more users at a rate faster than Alibaba and Facebook.

Shares are rising faster than Amazon or Facebook too, and trades for just a fraction of the price!

It’s one of the hottest growth stories in the e-commerce space….

Yet I’m willing to bet 99% of Americans have never heard of this company before…

The company’s sales have already increased more than 1,000% since it began in 2012.

1,000%!

That’s because its business is spreading virally among one key demographic, over 700 million strong – who are devoutly loyal to this brand – with lots of money to spend.

That’s about all I can say about this business here except to say this business is incredibly undervalued and ready to soar.

This company illustrates the incredible power of the network effect.

In my opinion this is one of the most important moneymaking trends in the world today.

If you want the chance to be on the right side of the Technochasm you must learn about the power of the network effect.

You’ll get the full details on the leading fast-growing firms… and the specifics on what price to pay and how much to allocate to each investment..

I want to send you this report… as well as my report, The Kings of Scalability…

Here’s why…

Why I’m doing this

By now, I hope you see that there’s probably no bigger, more important, force in the world today than the Technochasm.

As I’ve shown, stunning technological growth is only widening the wealth gap in America today.

There’s nothing you or I can do about this trend, even if we wanted to.

All we can do is try to make sure we’re on the right side of it.

I didn’t come from money.

My father was a bricklayer who worked his tail off to provide for his wife and kids.

I come from humble beginnings.

But my story illustrates the incredible power of understanding this incredible force.

And the powerful change – and wealth – it can help you create.

That’s why I’ve dedicated my entire career to understanding and capitalizing on it.

It’s given me a great life…

But today my goals are much different than they were when I was younger.

I have a bigger mission these days.

And it’s not to help the rich get richer.

There’s a crisis in America today.

The Technochasm is happening.

I want to educate Americans on what is really happening… and how to help you come out on the right side.

That’s why I spent a lot of time and money bringing this message to you today.

We are at an inflection point – before the chasm becomes too wide to cross.

I believe it’s critical for you to learn about the facts that have created the large and expanding chasm we’re experiencing today.

If you’re in a crummy job that offers little in terms of pay, understanding the concepts I’ve been describing today could help you.

That’s why I want to send you my two reports on the how to survive and thrive during the Technochasm…

Especially, if you weren’t able to cash in on the incredible gains I’ve shown my readers so far…

Like Microsoft at 39 cents…

Apple at $1.49…

Or when I told folks to buy Dell and EMC Corp. – the TOP TWO performing stocks of the 1990s – before they went on historic runs.

Or being among the first to find out about Google…

And other new innovators like Nvidia, Facebook and Amazon before they were household names…

Again, past performance does not indicate future returns and all investments carry risk, but I believe the biggest risk right now is doing nothing at all.

It’s still not too late…

But the timing here is critical.

Remember… we are here.

There’s still plenty of opportunity ahead of us.

I want you to have access to all the best knowledge and research about the Technochasm in the months to come…

Which brings me to the THIRD critical step I recommend you take today…

Step #3 – Become a Master of the Technochasm!

Remember, we’ll see the world change more rapidly over the next few years than any other group of people in history.

I can’t emphasize enough the importance of staying ahead of all the big changes we’re about see…

Fortune favors the prepared.

The two reports I want to send your way are the critical FIRST STEP…

Which is why I want to make sure you stay up to date on all the new developments taking place…

And have the chance to be the first to act on them AS THEY HAPPEN.

With the new technologies changing our world as they unfold…

And most importantly, new profit opportunities that could arise, as the Technochasm kicks into high gear…

And I think there could be plenty…

It’s critical that you stay connected… to know everything about all the changes taking place…

I want you to become a master of the Technochasm.

Which is why I want you to receive my monthly advisory letter where I keep readers up to date on everything that’s going on, called Growth Investor…

Every month, in Growth Investor I’ll show you the new developments and technological breakthroughs taking place…

I’ll show you how to be prepared, stay ahead – and potentially capitalize – on all the tremendous growth happening right now.

I’ll show you some new and incredible opportunities to make money now and as the Technochasm kicks into high gear.

Again, this force is extremely powerful, and it will only grow over the coming decade.

I cannot stress enough the importance of staying ahead of the coming changes.

This is too important for you to miss.

It’s too valuable for you to sit on the sidelines.

Even if all you do is read about what’s happening… it’s worth it.

I’ve earned a reputation by helping my subscribers find incredible opportunities to profit from investigating and understanding the big technological trends that reshape our world.

Again, it’s important to know that not every stock I recommend goes up.

But I am proud to say that in my 2020 portfolio of recommendations I had an average annualized gain of 36.2%. This return measures the results achieved by all of our recommendations in 2020, scaled to a one-year period.

Over the longer term — the past 20 years — I’m even prouder to say that Growth Investor has outperformed the S&P by a phenomenal factor of nearly 3-to-1.

As far as I’m aware, no other research advisory of this kind has matched this record.

Growth Investor wouldn’t have been around for so long if we weren’t giving people good advice.

Just ask longtime subscriber Kevin Jorgenson, who works for one of the “big three” U.S. automakers.

Sadly, this business has been hammered in recent years, cutting wages and eliminating tens of thousands of jobs.

Kevin saw the writing on the wall some time ago and began following my work.

He told me he no longer worries about job security.

He works only because he wants to, not because he has to.

In fact, he wrote to tell me, “I can’t wait to get fired!”

Of course, I would never suggest anyone quit their job or aim to get fired… that’d be crazy.

I’m sharing Kevin’s letter simply to illustrate the incredible power of the opportunities I’ve been telling you today.

He even teaches these concepts to his fellow workers so they too will be prepared.

I’ve heard similar success stories from folks all across the country…

I’m confident my research can work for you too…

When you become a member to Growth Investor today, here’s everything you’ll get:

12 monthly issues of Growth Investor. This is my flagship publication where I’ll keep you to date on everything going on in new technologies and the stock market. Each month, I will email you a new edition of my Growth Investor advisory letter with at least one new investment opportunity.

SPECIAL REPORT #1: The Kings of Scalability: 3 Stocks to BUY Now

SPECIAL REPORT #2: The Network Effect: An Incredibly Powerful Wealth-Creation Force

Then every Friday, I’ll send you a Weekly Update giving you my take on events of the week, as well as a look ahead at the market and our stock news. It’s everything you need to know to stay ahead and it’s delivered directly to your email inbox.

Plus, if urgent market or stock news breaks, or it’s time to collect profits, I’ll email you to explain what’s happening and what it means for your Growth Investor recommendations.

And that’s just the start…

I’ll also send you my must-see report detailing the companies being disrupted by the new, technological innovators.

Today there are so many slow-moving stocks in so many people’s portfolios, because of bad business structures… heavy debt loads… and completely outdated business models that are being disrupted by fast-moving and creative, technological start-ups.

I urge you not to hold these stocks in your portfolio, any longer.

My research report Portfolio Destroyers: 10 Ticking Time Bombs to Sell Now will tell you about the firms I believe will underperform in the next few years… or worse, could potentially go bankrupt.

So how do you get started?

Well, before you sign up…

Along with everything I’ve mentioned so far, I’d also like to send you one more special investment report I’ve just put the finishing touches on.

It’s called The #1 Stock for the Driverless Car Revolution.

A little earlier I mentioned how we’re in the early stages of an unstoppable trend.

After years of relatively modest advancement, driverless cars are now entering the “liftoff” stage.

In this special report you’ll discover the one innovative company that I think is at the epicenter of it all.

I’ll also send you my report on how to help you try to come out on the right side of the artificial intelligence revolution, called The AI Revolution.

The combination of artificial intelligence and software is over 100,000 times more powerful than it was in the 1980s…

Businesses are harnessing this incredible power to do everything from process financial transactions, analyze marketing data, review contracts, detect tumors and more, FASTER and MORE ACCURATE than human beings ever could.

Demand for these cutting-edge technologies will surge over the next couple of years.

AI as an industry is still in its infancy.

These are just a few reasons why early investors will have a huge advantage as AI adds $30 trillion in new revenue to the global economy.

The implications are incredible…

Which is why I created a separate report dedicated solely to the new and exciting firms leading this revolution as well.

You’ll get the full details in The AI Revolution.

These reports will be among the first things you receive (in a matter of minutes), when you try a no–risk subscription to Growth Investor.

How much does it cost?

Well, I’ll be honest…

Under normal circumstances, access to me and my research isn’t cheap.

Investment firms, like the one I run, won’t take on new clients worth less than $1 million.

And I’ve charged pension and institutional money managers as much as $30,000 per year for the SAME caliber research I want to give you access to today.

And they gladly paid it.

But like I’ve been saying, these are NOT normal circumstances. America is going through serious changes.

I want to make sure that everyone – literally everyone – in America has access to this information… so that you have the information you need to make smart and safe investments as the Technochasm progresses.

Which is why, for a limited time, I’ve giving away everything mentioned here for the absurdly low rate of just $49 per year.

That’s right, for about $4 per month, or about the cost of a regular cup of coffee, you’re getting information easily worth a thousand times that…

Now of course, nothing in the market is guaranteed and past performance does not guarantee future results.

I’ve made it as easy and as inexpensive as possible to get this information out there.

I know there are a lot of people out there who find it nearly impossible to spend anything on information. They think it’s all free online.

For those folks, I have a message. If you don’t see the opportunity to earn a lot of money with Growth Investor over the next 90 days, then I don’t want you to have to pay for it at all.

That’s right. If you are not happy with your subscription for any reason, simply let us know during the next 90 days and you’ll receive a FULL REFUND for every penny you paid—and you can hang onto all the work you’ve received.

We’re not trying to “trick” anyone into paying for information. If you think there’s better information available anywhere… then don’t pay.

We’re happy to part as friends and return ALL of your subscription fees. I don’t know of another business, anywhere, that offers a better guarantee. I make it on my research because I know it’s that good.

If you are EVER not happy with our work, we’d simply like to part as friends. So, we’re not asking you to make any commitments whatsoever, but to simply TRY our work, to see if it’s right for you.

And, if you don’t agree it’s the best investment research you’ve ever read, anywhere, you can ask for (and will promptly receive) a full refund anytime during your first 90 days.

To get started—and to receive access to everything I’ve detailed here in a matter of minutes—simply click on the “Subscribe Now” button at the bottom of the screen.

This will take you to a secure order form, where you can review everything before submitting your order.

Thank you for your time. I hope you take advantage of this opportunity.

I truly believe it’s going to change the lives of millions of forward-thinking Americans over the next few years.

I hope you are one of them.

Thank you for watching today.

I’m Louis Navellier.